Dublin, March 18, 2024 (GLOBE NEWSWIRE) -- The "Europe Laboratory Developed Tests Market Size, Share & Trends Analysis Report By Technology (Immunoassay, Molecular Diagnostics), By Application (Oncology, Immunology, Cardiology), And Segment Forecasts, 2024 - 2030" report has been added to ResearchAndMarkets.com's offering.

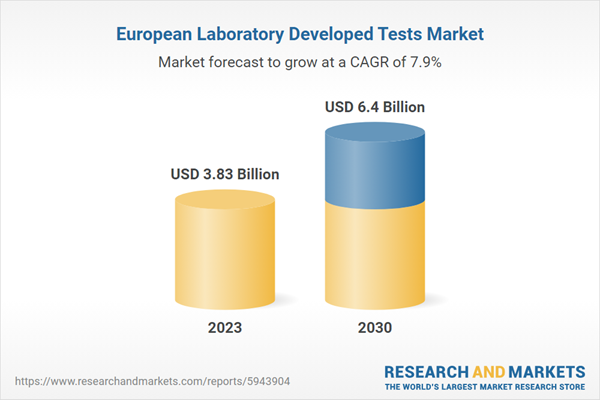

The Europe laboratory developed tests market size is anticipated to reach USD 6.4 billion by 2030 and is projected to grow at a CAGR of 7.9% from 2024 to 2030

The increasing demand for personalized medication, rising prevalence of cancer, and the growing demand for IVD tests currently unavailable in the market are the major factors contributing to the market growth. The 2.3% rise in a number of cancer cases in Europe in 2022, as compared to 2020, to reach a number of around 2.74 million is a major healthcare concern.

The increasing number of deaths caused by non-communicable diseases such as ischemic heart disease, stroke, Alzheimer's disease and other dementia highlights the need for early disease detection. Moreover, diabetes, one more type of non-communicable disease, is a global threat and has also affected Europe, with around 60 million cases across the region. Furthermore, the rising healthcare costs and common medicines not being effective in treating large numbers of patients have led to opting for the option of personalized medication.

Government-sponsored initiatives, such as the European PANCAID and PANCAIM projects, are aiding in the diagnosis and treatment of cancer. The amendments in European in-vitro medical devices regulations in 2022 have relaxed the conditions to be met by health institutions making laboratory developed tests, also known as in-house devices placing on the market and put into service.

The launch of the European Partnership for Personalised Medicine (EP PerMed) in 2023 is anticipated to boost research in European precision medicine, increasing the demand for R&D and adoption of laboratory developed tests, driving the market growth in Europe.

Europe Laboratory Developed Tests Market Report Highlights

- Based on technology, the molecular diagnostics segment led the market with a largest revenue share of 26% in 2023, owing to its prominent applications in disease diagnosis at gene level

- Based on application, the nutritional and metabolic disease application segment is expected to grow at the fastest CAGR over the forecast period

- Based on application, the oncology segment held the market with the largest revenue share of 21% in 2023, owing to the rising incidence in the region. Factors such as sedentary lifestyle, increasing incidences of smoking, and lack of exercise are contributing to the growing prevalence of cancer and metabolic diseases

- In November 2023, F. Hoffmann-La Roche Ltd launched its next generation qPCR system LightCycler PRO. This system is expected to help testing patients for cancer, infectious diseases, and other public health challenges

Company Profiles

- Abbott

- Guardant Health

- Siemens Healthineers AG

- Quest Diagnostics

- Qiagen

- Eurofins Scientific

- Illumina, Inc.

- F.Hoffmann-La Roche Ltd

- SVAR life sciences

- Biomerieux

- BD

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 80 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $3.83 Billion |

| Forecasted Market Value (USD) by 2030 | $6.4 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Europe |

Key Topics Covered:

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.3. Research Methodology

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Europe Laboratory Developed Tests Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.3. Europe Laboratory Developed Tests Market Analysis Tools

3.3.1. Industry Analysis - Porter's

3.3.2. PESTEL Analysis

Chapter 4. Europe Laboratory Developed Tests Market: Technology Estimates & Trend Analysis

4.1. Technology Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Europe Laboratory Developed Tests Market by Technology Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Immunoassays

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Hematology and coagulation

4.4.3. Molecular diagnostics

4.4.4. Microbiology

4.4.5. Clinical Chemistry

4.4.6. Histology/cytology

4.4.7. Flow cytometry

4.4.8. Mass spectrometry

Chapter 5. Europe Laboratory Developed Tests Market: Application Estimates & Trend Analysis

5.1. Application Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Europe Laboratory Developed Tests Market by Application Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Oncology

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.1.2. Companion diagnostics

5.4.1.3. Genomics sequencing and others

5.4.2. Genetic disorders/inherited disease

5.4.3. Infectious and parasitic diseases

5.4.4. Immunology

5.4.5. Endocrine

5.4.6. Nutritional and metabolic diseases

5.4.7. Cardiology

5.4.8. Mental/behavioural disorders

5.4.9. Pediatrics-specific testing

5.4.10. Hematology/general blood testing

5.4.11. Body fluids analysis

5.4.12. Toxicology

Chapter 6. Europe Laboratory Developed Tests Market: Country Estimates & Trend Analysis

6.1. Europe Market Share Analysis, 2023 & 2030

6.2. Europe Market Dashboard

6.3. Europe Market Snapshot

6.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

6.5. Europe

6.5.1. UK

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

6.5.2. Germany

6.5.3. France

6.5.4. Italy

6.5.5. Spain

6.5.6. Norway

6.5.7. Sweden

6.5.8. Denmark

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of key distributors and channel partners

7.3.2. Key customers

7.3.3. Key company heat map analysis, 2023

7.4. Company Profiles

7.4.1. Company overview

7.4.2. Financial performance

7.4.3. Product benchmarking

7.4.4. Strategic initiatives

For more information about this report visit https://www.researchandmarkets.com/r/5b8nhl

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment