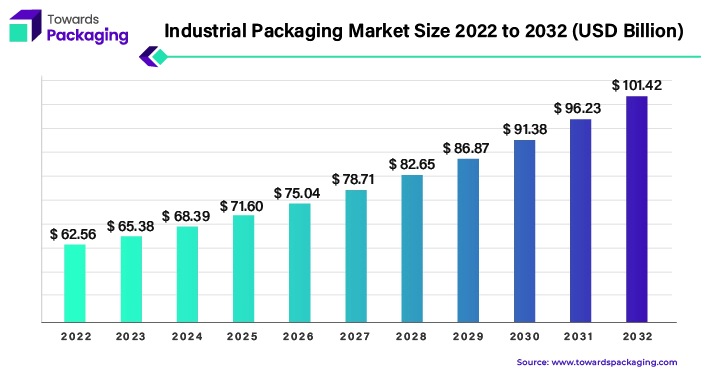

Ottawa, April 25, 2024 (GLOBE NEWSWIRE) -- The global industrial packaging market size was valued at USD 65.38 billion in 2023 and is predicted to hit around USD 96.23 billion by 2031, according to a study published by Towards Packaging a sister firm of Precedence Research.

Report Highlights: Important Revelations

- Advancements influencing industrial packaging in the Asia-Pacific region.

- Exploring the vital role of industrial packaging in North American sectors.

- Dominance of industrial packaging in today's era unveiled by plastic innovations.

- Progress of industrial storage through intermediate bulk containers.

- Ensuring chemical safety during transit and storage with industrial packaging.

For the short version of this report @ https://www.towardspackaging.com/personalized-scope/5152

Industrial packaging is essential to companies that ship or deliver items to clients. Whether it's a retail shop, product manufacturer, distributor, wholesaler, or an e-commerce portal selling products around the globe, relying on industrial packaging solutions is essential for ensuring the protection and security of goods while in transit. Over the last few decades, the use of industrial packaging for direct delivery to customers' doorsteps has steadily grown. Distribution systems that involved multiple interactions and storage periods presented difficulties, significantly reducing a product's shelf life. The use of industrial packing has enabled for faster and less destructive transit, consequently abolishing these time restrictions. This benefit has reduced manufacturing cycles and improved possible amounts for companies.

Industrial packaging has enabled manufacturers and merchants save costs on inventories. Significantly the potential to transfer products more quickly and with less damage, firms are increasingly choosing for purchasing on a daily basis opposed to periodic or weekly purchases, significantly eliminating inventory holding expenses. An important part of industrial package design is ensuring that items be transported safely and with little damage from point A to point B. Palletization stacking patterns and pallet material choices are among the design factors. The global market for industrial packaging market is expanding rapidly due to the extensive usage of packaging to protect goods or materials during transit. This development indicates the vital role that industrial packaging plays in modern supply chains, allowing items to travel efficiently and securely across sectors.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

In February 2024, Antalis, a paper and industrial packaging firm, has entered into a formal agreement to buy Pakella, another packaging company.

Industrial Packaging Market Trends

- Industrial packaging solutions are getting more customized and specialized to satisfy the specific needs of various industries and applications.

- Developments in materials science and packaging technology are driving industrial packaging innovation.

- Sustainability has become an important priority in the industrial packaging sector, as demand to decrease environmental impact and promote circular economy concepts grows.

- The development of e-commerce and digitization trends is changing the industrial packaging market. Industrial packaging solutions are evolving to meet the special needs of online retail, omnichannel distribution, and last-mile delivery.

Innovations Shaping Industrial Packaging in Asia-Pacific

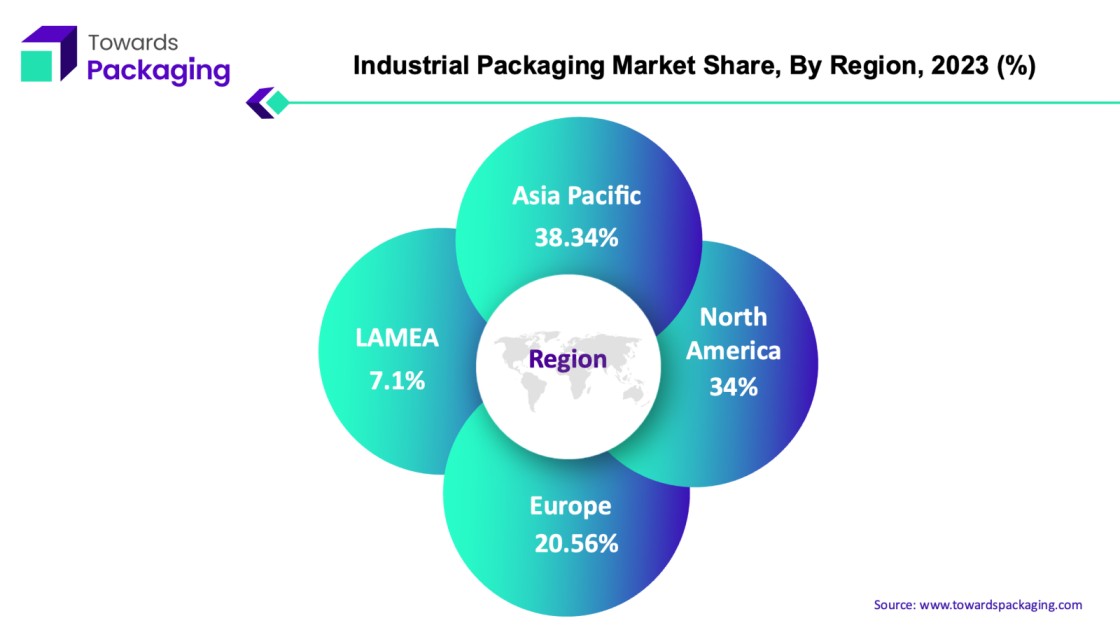

Industrial packaging offers an essential part in supply chain management in the Asia-Pacific region, ensuring the secure and effective movement of goods across a range of sectors. The need for effective and dependable packaging solutions has increased dramatically due to the region's quick industrialization, increasing urbanisation, and growing trade networks.

The Asia-Pacific region's industrial packaging incorporates an extensive variety of materials and technologies that are customised to satisfy the unique requirements of different industries, such as manufacturing, electronics, automotive, food and beverage, pharmaceuticals, and retail. Packaging is essential to these sectors as it helps to protect goods during transportation, reduce damage, and meet legal requirements.

The Asia-Pacific region is the centre for packaging design and material innovation due to its extensive geographic scope and varied market dynamics. Manufacturers in Southeast Asian, Chinese, Japanese, Indian, South Korean, and other countries constantly invest in R&D to improve packaging's cost-effectiveness, sustainability, and efficiency. The expansion of online shopping and e-commerce has increased demand for package delivery-optimized packaging solutions, which contributed to the development of durable yet lightweight packaging materials and designs.

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5152

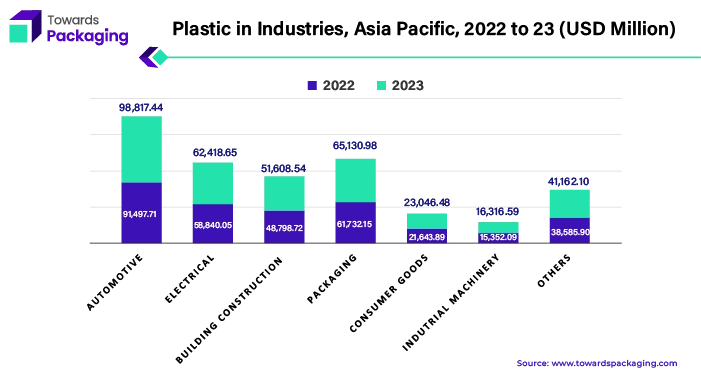

Asia Pacific region have largest share plastic applications in industrial packaging of various sectors such as automotive, electrical, building and constructions and others. In the Asia-Pacific region, industrial packaging has become more sustainable due to legislative restrictions and increasing environmental awareness. To mitigate the environmental impact of packaging processes, businesses are investigating circular economy concepts, introducing recycling programmes, and utilising eco-friendly materials. The Asia-Pacific region's industrial packaging is defined by its ingenuity flexibility, and commitment to resolving environmental issues while satisfying the changing demands of a changing market environment.

Perstorp declared its acquisition by PETRONAS Chemicals Group Berhad (PCG), a division of PETRONAS Group and the top integrated chemicals supplier in Malaysia.

Backbone of North American Industries Exploring the Power of Industrial Packaging

North America's strong manufacturing and distribution industries are built on the backs of industrial packaging. It includes a wide range of materials and solutions that meet the demanding needs of many industries, such as consumer goods, automotive, aerospace, medicines, and food & beverage. In North America, industrial packaging is essential to the safe and effective movement of commodities across long distances. Smart packaging techniques are used by businesses to reduce waste, safeguard goods from harm during transportation, and enhance handling and storage procedures. Packaging technologies are consistently advanced in the region due to the significant emphasis on quality control, regulatory compliance, and customer satisfaction.

Manufacturers and suppliers in the US, Canada, and Mexico conduct research and development investments to improve the strength, sustainability, and affordability of packaging materials. One of the world's top manufacturers of chemical goods is the United States. The Department of Transportation, the International Air Transport Association, and the Environmental Protection Agency monitor chemical exports within the United States. Chemicals are transported by any means of transportation under the control of the Pipeline and Hazardous Materials Safety Administration and the U.S. Department of Transportation. the products' transit while protected in premium packaging.

The growing e-commerce industry in North America has increased demand for specialised packaging solutions made for online retail fulfilment. Industrial packaging in the area is constantly developing to match the changing demands of contemporary supply chains and transportation networks, from corrugated boxes to protective cushioning materials. North American industrial packaging supports the secure transit of goods throughout the continent's vast production and distribution networks by demonstrating a dedication to innovation, efficiency, and sustainability.

In November 2023, Complete Packaging, a portfolio firm of the Spell Family Office and located in Monroe, Michigan, has been acquired by Specialised Packaging Group (SPG), a prominent vertically integrated manufacturer of protective packaging goods. automotive, aerospace, energy, industrial truck, defence, heavy equipment, and general industrial are just a few of the end areas for which Complete offers custom-designed packaging solutions.

Industrial Packaging Market, DRO

Demand:

- Increasing demand for product protection of Industrial products and supplies are frequently heavy, bulky, and susceptible to environmental conditions such as moisture, stress, vibration, and corrosion.

Restraint:

- Industrial packaging must adhere to several rules and standards controlling packaging materials, labelling, transportation, and hazardous material management.

Opportunity:

- Embracing digital technology like the Internet of Things (IoT), sensors, and RFID allows for smart features in industrial packaging.

Plastic Power Unveiling the Dominance of Industrial Packaging in the Modern Era

Plastic's cost-effectiveness, durability, and adaptability contribute to it being a major player in the industrial packaging companies. For the transportation and protection of goods, industrial packaging composed of plastic materials including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS) offers a number of advantages. Packaging made of plastic is essential to the safe and secure transportation of hazardous products. Plastics are an essential raw material used to make the packaging that is utilised to ship dangerous goods across international borders. Drums, jerricans, composite intermediate bulk containers (IBCs), non-bulk composite packaging, and some inner packaging’s used in combination packaging’s are all composed of plastic.

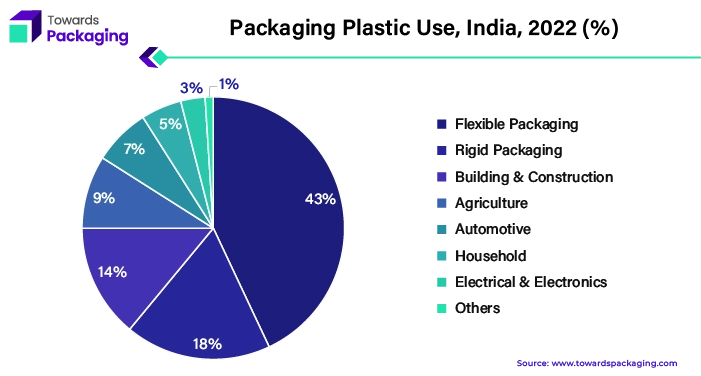

The Central Pollution Control Board estimates that India produces over 25,940 tonnes of plastic garbage every day, despite the fact that plastic is a common material in most Indian homes. Every year, over 9.46 million tonnes of plastic garbage are produced. Plastic packaging is extremely adaptable when it involves automated packaging procedures, which increases production and efficiency in manufacturing and distribution facilities. Plastic packaging can be recycled, and developments in recycling technology keep raising the sustainability level of plastic packaging solutions.

For Instance,

- In January 2024, Apex Plastics, a US-based producer, has been bought by plastic blow moulder Container Services Inc (CSI). Apex specialises in extruded high-density polyethylene and unique single-stage packaging solutions for polyethylene terephthalate.

Evolution of Industrial Storage with Intermediate Bulk Containers

IBCs, or intermediate-capacity bulk containers, are industrial containers used for bulk and liquid product storage and transportation. Three frequently utilised forms of IBC are used today: flexible, foldable, and stiff. 600 litres and 1000 litres are the capacities of the two most popular rigid IBC tanks. Bulk items can be stored in medium-capacity containers for several uses. Containers can be reused after being cleaned and dried. This is dependent on multiple factors, such as whether the IBC will be recycled, if it has to be durable, and if there are any regulatory restrictions. Rigid containers in the shape of cubes are frequently composed of plastic, namely polyethylene or high-density polyethylene (HDPE). A strong external container, often in the form of a cage, constructed mostly of iron or galvanised tubular steel.

The foldable IBC is composed of extremely robust polyethylene that is empty inside and does not form a stiff outside cage. Various heavy materials, such as woven polypropylene or polyethylene, are used to make flexible IBC or wholesale bags.

IBCs are made to be portable and easy to handle. Their uniform measurements enable a smooth connection with current forklift and pallet systems. Pallet tanks, also called pallecons, allow IBCs to be safely and stacked during transit, reducing the possibility of damage. This effectiveness lowers expenses related to human handling and optimises logistics.

The Intermediate Bulk Container (IBC) industry leads the way in technical developments as the need for effective packaging and transportation solutions keeps rising. To improve IBC technology and make it even more efficient and flexible to the changing demands of global enterprises and industries, manufacturers are constantly investing in R&D.

In October 2023, A new production line for Form-Fit intermediate bulk container (IBC) liners has been launched by DF Corporation.

Industrial Packaging Safeguards Chemicals in Transit and Storage

The chemical industry is the most significant consumers of industrial packaging due to the extensive variety of chemicals it makes and distributes, many of which require specialised packaging solutions for safe handling, transportation, and storage. Chemical compounds differ widely in their qualities, ranging from caustic acids to delicate powders, necessitating packaging that can efficiently contain, preserve, and identify them.

Global chemical companies are upgrading the industrial packaging for better environmental aspects and consumer preferences. Chemical industries rely on industrial packaging to maintain compliance with stringent safety rules and to reduce the dangers connected with dangerous products. Drums, intermediate bulk containers (IBCs), totes, and specialised containers are popular packaging materials for transporting chemicals in bulk. These containers are frequently made of strong materials like as high-density polyethylene (HDPE) or steel, which are designed to withstand the corrosive nature of many chemicals while also providing containment in the event of a spill or leakage.

For Instance,

- In November 2023, Amcor, a leader in the development and production of environmentally friendly packaging solutions worldwide, and NOVA Chemicals Corporation (NOVA Chemicals), a top manufacturer of sustainable polyethylene, have signed an MOU for the purchase of mechanically recycled polyethylene resin (rPE), which will be used in flexible packaging films. Amcor is committed to supporting packaging circularity, and one key component of that commitment is the increased usage of rPE in flexible packaging applications.

Exploring the Key Competencies of Industrial Packaging Leaders

The competitive landscape of the industrial packaging market is dominated by established industry giants such as DS Smith (U.K.), Mondi (U.K.), Sonoco Products Company (U.S.), Sealed Air (U.S.), Huhtamäki Oyj (Finland), Smurfit Kappa (Ireland), WestRock Company (U.S.), UFP Technologies, Inc. (U.S.), Stora Enso (Finland), Pregis LLC (U.S.), Shenzhen Hoichow Packing Manufacturing Ltd. (China), International Paper (U.S.), Dordan Manufacturing Company (U.S.), Hangzhou Xunda Packaging Co. (China), Mosburger GmbH (Austria), Universal Protective Packaging Inc. (U.S.), Parksons Packaging Ltd. (India), Neenah Paper and Packaging (U.S.), Plastic Ingenuity (U.S.), and JJX-Packaging (U.S.). These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Mondi produces lightweight, recyclable packaging that is simple to use and has several advantages over conventional non-paper-based packaging methods. Examine the advantages of our industrial solutions to get a new perspective on heavy-duty packaging like cartons and boxes.

For Instance,

- In February 2024, The Hinton Pulp mill in Alberta, Canada, was acquired by Mondi plc (Mondi), a leading worldwide producer of sustainable packaging and paper, from West Fraser Timber Co. Ltd (West Fraser) for a sum of USD 5 million.

The industrial markets have high standards. Durability, accuracy, adaptability, and ingenuity are all qualities that industrial goods must possess. Since Sonoco was founded to cater to the industrial sectors, we have a solid understanding of the challenges that our clients face and the resources they require to succeed. Using that information, a variety of solutions were created to assist them in achieving their objectives.

For Instance,

- In September 2022, Leading global packaging company Sonoco announced that it has finalised an acquisition deal to buy S.P. Holding, Skjern A/S (Skjern), a privately held paper mill with headquarters in Skjern, Denmark.

Sustainable packaging options from Smurfit Kappa are made to showcase and safeguard your goods, no matter how big or little. All of our packaging is made to guarantee that items reach their destination in the best possible shape because supply chains can be difficult.

For Instance,

- In September 2023, Smurfit Kappa (SKG. I) of Ireland has opened a new tab for the agreed-upon $11 billion purchase of WestRock (WRK. N), a rival in the United States, to become the largest paper and packaging firm globally and attempt to better navigate the sluggish economy on both sides of the Atlantic.

UFP Packaging offers OEM components and packaging solutions to small and big organisations in a variety of sectors as a full-service supplier. From wood pallets and boxes to highly customised packing solutions with integrated tracking systems, we develop and produce the widest range of custom packaging solutions on the market.

For Instance,

- In November 2021, for about $13.5 million, UFP Global Holdings, a subsidiary of US-based UFP Industries (UFPI), acquired a 70% share in Ficus Pax, a manufacturer of industrial packaging. With this transaction, UFP is entering the Indian industrial packaging market for the first time.

Industrial Packaging Market Player

Industrial packaging leading market players are DS Smith (U.K.), Mondi (U.K.), Sonoco Products Company (U.S.), Sealed Air (U.S.), Huhtamäki Oyj (Finland), Smurfit Kappa (Ireland), WestRock Company (U.S.), UFP Technologies, Inc. (U.S.), Stora Enso (Finland), Pregis LLC (U.S.), Shenzhen Hoichow Packing Manufacturing Ltd. (China), International Paper (U.S.), Dordan Manufacturing Company (U.S.), Hangzhou Xunda Packaging Co. (China), Mosburger GmbH (Austria), Universal Protective Packaging Inc. (U.S.), Parksons Packaging Ltd. (India), Neenah Paper and Packaging (U.S.), Plastic Ingenuity (U.S.), and JJX-Packaging (U.S.).

Browse More Insights of Towards Packaging:

- The global footwear packaging market size expected to increase from USD 5.45 billion in 2022 to achieve an approximation USD 8.26 billion by 2032, growing at a 4.3% CAGR between 2023 and 2032.

- The global flexible plastic packaging market size to expand from USD 178.60 billion in 2022 to secure USD 289.52 billion by 2032, growing at a 5.0% CAGR between 2023 and 2032.

- The industry 5.0 in packaging recognizes of the increasing consumer demand for personalized products. To meet this demand, packaging technologies that combine big data and artificial intelligence are being implemented.

- The global secondary packaging market size presumed to grow from USD 232.85 billion in 2022 to reach a conjectured USD 366.81 billion by 2032, growing at a 4.7% CAGR between 2023 and 2032.

- The global dunnage packaging market size envisioned to advance from USD 3.8 billion in 2022 to reach a conjectured USD 6.52 billion by 2032 at a growing CAGR of 5.6% CAGR between 2023 and 2032.

- The global bakery packaging market size envisaged to surge from USD 3.40 billion in 2022 to secure a forecasted USD 5.40 billion by 2032, growing at a 4.8% CAGR between 2023 and 2032.

- The global lip powder packaging market size prognosticated to elevate from USD 1,798.20 million in 2022 to hit a presumed USD 3,328.10 million by 2032, expanding at a 6.4% CAGR between 2023 and 2032.

- The global packaging automation market size predicted to climb from USD 64.70 billion in 2022 to obtain a projected USD 136.47 billion by 2032, growing at a 7.8% CAGR between 2023 and 2032.

- The global returnable transport packaging market size expected to increase from USD 8,786.68 million in 2022 to attain a calculated USD 16,570.80 million by 2032, increasing at 6.6% CAGR between 2023 and 2032.

- The global aerosol packaging market size anticipated to rise from USD 6.74 billion in 2022 to achieve an approximation USD 10.58 billion by 2032, growing at a 4.62% CAGR between 2023 and 2032.

Market Segments

By Material

- Plastic

- Wood

- Metal

- Steel

- Cardboard

- Others

By Product Type

- Intermediate Bulk Containers

- Drums

- Corrugated boxes

- Sacks

- Crates

- Pails

- Wrappers

- Others

By End User

- Chemical

- Automotive

- Building & Construction

- Pharmaceutical

- Food & Beverage

- Personal Care

- Cosmetics

- Electronics

- Textile

By Region

- Asia Pacific

- North America

- Europe

- LAMEA

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5152

Explore the statistics and insights concerning the packaging industry and its segmentation: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Web: https://www.precedenceresearch.com/

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/