Dublin, April 26, 2024 (GLOBE NEWSWIRE) -- The "Electric Vehicles & Charging Infrastructure" report has been added to ResearchAndMarkets.com's offering.

This flagship report into the EV industry and associated charging landscape analyses the key trends and developments in this critical sector aligned to 5-year market forecasts.

Zero Carbon Academy’s new research into the EV vehicle and charging landscape has found that globally 40 million new EV charging connections will be in place by 2028, with more than two thirds of these designated as household chargers.

This deep-dive research analyses government policy, EV roll-out targets and deadlines, consumer demand, technological developments, charging types and battery technologies. The report assesses the current market opportunities alongside key recommendations and prospects for both the public and private sector.

Furthermore, the research considers EV charging adoption, such as public charging, home charging, and workplace charging, providing critical insight into how deployments are evolving and the opportunities these offer. Additionally, the research includes the analyst's new Leaderboard product, offering analysis of 10 EV vendors, and 10 EV charging providers.

Industry Impacts: Fragmented charging market risks an increase in societal inequality

The report finds that global EV sales will surpass $1 trillion per annum by 2025, with an additional 100 million EVs on roads by 2028, yet less than 16 million publicly available chargers will be in operation.

Analyst Perspective

Whilst EV sales will continue to grow, we recognise a slowing of adoption rates in many major economies by the end of the period. A lack of public EV charging infrastructure is hampering adoption, and risks isolating communities where public charging is sparse, or residential chargers are not viable- such as in remote rural communities, or in city centres where many live in flats or apartments.

Key Takeaways & Recommendations

EVs & EV charging market forecasts: A proprietary top-down forecast that projects the number of on-road LCVs split by BEV, PHEV, ICE and 'other'. It includes annual sales by vehicle type, as well as average price by country of BEV and PHEV LCVs, leading to total revenue projections for both segments. The EV charging forecasts culminate in the cumulative number of EV chargers on both a regional and country-level basis. These are also divided between public chargers and by household chargers.

Total number of ICE (Internal Combustion Engine) vehicles as annual LCV sales split by vehicle type

- Executive summary: Overview of the key trends and research findings, alongside a summary infographic.

- Sector focus & analysis: review and insight into both the EV and the EV charging landscapes, looking at technology, major trends, opportunities and developments.

- Government policy and roll-out targets: EV targets and phase out dates for ICE vehicles for selected geographies, as well as analysis of emissions levels from the transport sector.

- Vendor profiles and leaderboards: assessment of the key players in both the EV sector and the EV charging infrastructure space. Includes company profiles, vendor scoring & heatmaps, and the analyst's new Leaderboard product, for:

- EV vehicle vendors

- BMW Group

- BYD

- Ford

- Hyundai Motor

- Tesla

- Toyota Motor Corporation

- Volkswagen Group

- Renault-Nissan-Mitsubishi Alliance

- SAIC Motor

- Stellantis

- EV charging infrastructure vendors

- ABB

- Allego

- BP Pulse

- Charge+

- ChargePoint

- Gridserve

- Ionity

- Osprey

- Shell Recharge

- Starcharge

- Tesla

- EV vehicle vendors

Key Questions Answered

- How is EV adoption progressing and what are the major barriers to this?

- What can governments and businesses do to encourage faster EV adoption?

- When are major economies set to phase out ICE vehicles? Are these countries currently on track to do so?

- How is the roll-out of EV charging infrastructure progressing? What are the challenges and opportunities?

- Which countries are leading in terms of both EV adoption and EV charger roll-out? What lessons can be learned?

Data and Forecast

- Total LCVs on the road (in use)

- Total LCV sales per annum - split by ICE, PHEV, BEV, and Other

- Total LCVs in use by type - ICE, PHEV, BEV, and Other

- Average vehicle price - PHEV, BEV

- Annual revenue - PHEV, BEV

- Total EV chargers (public and household)

- Number of households

- Number of households with an EV

- Number of Households with an EV charger installed

- Number of public chargers

- Total public chargers split by slow and by fast

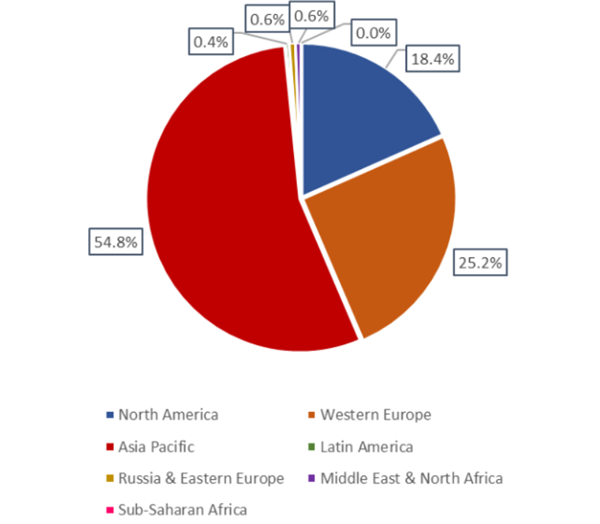

Each data set includes regional level data equating to 93% of the LCV market

- North America

- Western Europe

- Asia-Pacific

- Latin America

- Russia & Eastern Europe

- Middle East & North Africa

- Sub-Saharan Africa

For more information about this report visit https://www.researchandmarkets.com/r/lkwzib

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment