LIVONIA, Mich., June 25, 2024 (GLOBE NEWSWIRE) -- A new Cogent Syndicated report from Escalent reveals that mergers and acquisitions (M&A) and healthy business growth have emerged as top catalysts for recent plan provider changes among 401(k) plan sponsors who have switched recordkeepers in the past two years, accentuating some of the newer challenges in today’s marketplace.

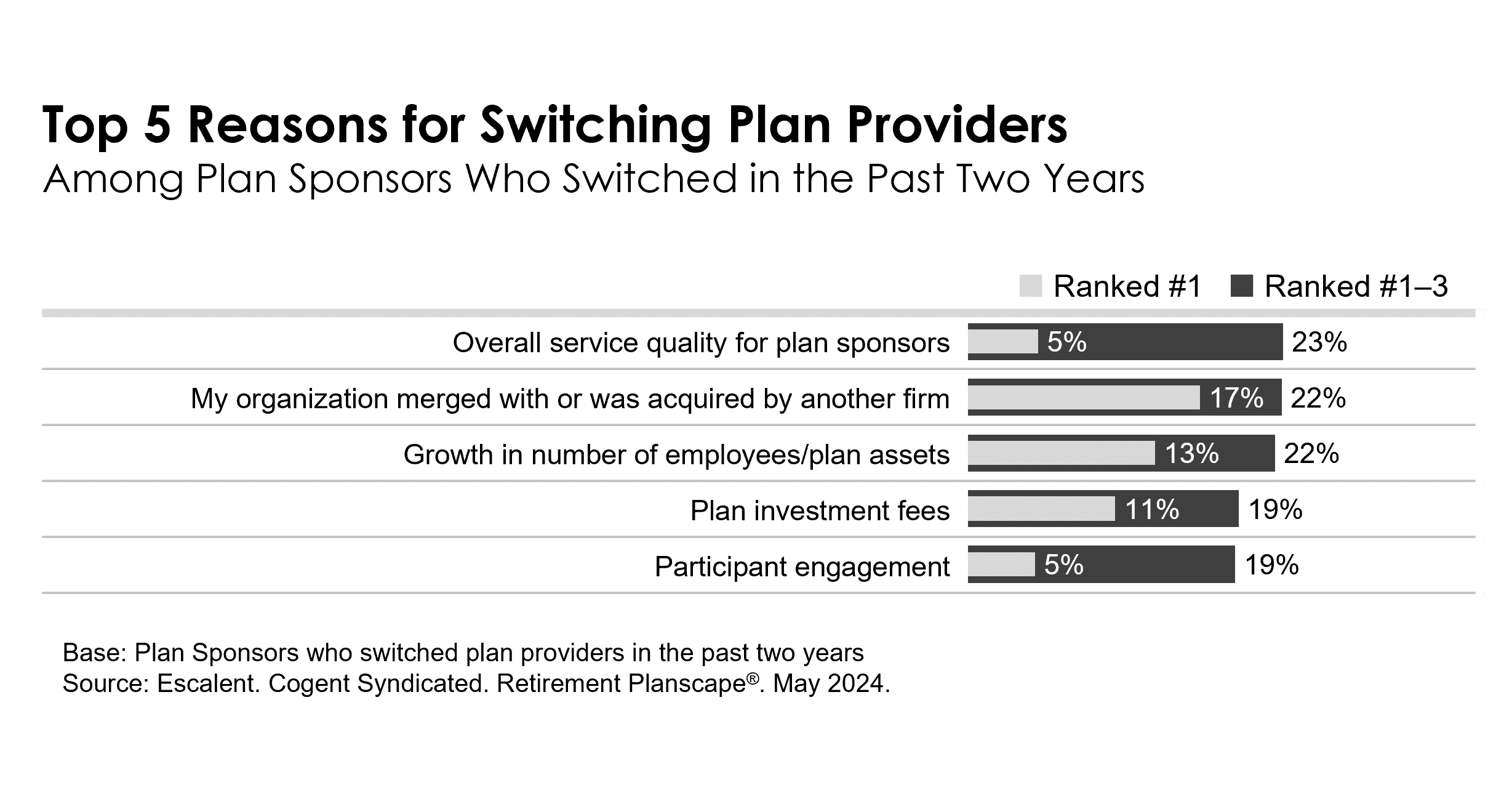

In a sharp divergence from last year, when overall service quality for participants was the most dominant trigger for switching plan providers, recordkeepers now must heed multiple factors: overall service quality for plan sponsors, organizational mergers and acquisitions, and growth in the number of employees and/or plan assets. These are among the key findings from Escalent’s 2024 Retirement Planscape® report.

“Incumbent plan providers may be tempted to believe that corporate growth is purely positive given the potential for increased plan assets and participants, but they must be vigilant,” said Sonia Davis, lead report author and senior product director at Cogent Syndicated. “Healthy growth and M&A activity can prompt plan sponsors to reevaluate and enhance their retirement plan benefit offerings in the spirit of being equitable to all parties.”

In fact, average plan provider tenure is trending lower among Large-Mega plans, which are defined as plans holding at least $100 million in assets—a sign challenger firms are starting to have greater success unseating incumbents within this cohort. The average recordkeeper tenure is 7.5 years among Large-Mega plans, down from 8.4 years in 2022.

Meanwhile, for the first time in the history of this study, cybersecurity threats/data breaches eclipse underperformance of plan investment options as plan sponsors’ biggest fear with respect to managing their organization’s 401(k) plan. Cybersecurity concerns are up significantly from 40% in 2022 to 47% in 2024. In turn, anxieties around underperformance have softened to an extent, from 57% in 2022 to 45% this year.

“Cybersecurity threats previously served as a top concern among Large-Mega plans but now serve as the most dominant fear across all plan-size cohorts. Providers must be very explicit in showcasing their data security and cyber-risk management practices,” said Davis. “As mergers, acquisitions and cybersecurity concerns take center stage, it is imperative for recordkeepers to clearly communicate their offerings. By maintaining high-quality service and security standards, recordkeepers will be poised to win new opportunities and maintain relationships with their existing clients.”

About Retirement Planscape®

Cogent Syndicated, a division of Escalent, conducted an online survey of a representative cross section of 1,391 401(k) plan sponsors from February 14 to March 12, 2024. Survey participants were required to have shared or sole responsibility for plan design, administration or selection and evaluation of plan providers, or for evaluating and/or selecting investment managers/investment options for 401(k) plans. In determining the sampling frame for this study, Cogent relied upon recent Form 5500 filings as maintained by ALM’s Judy Diamond Associates. To ensure the population for this research is representative of the universe of 401(k) plan sponsors, quotas were set during the data collection phase around key firmographic variables including total plan assets, number of plan participants, industry and geography. Minimal weighting was applied to adjust for purposeful deviations from the actual marketplace distribution. The data have a margin of error of ±2.63% at the 95% confidence level. Escalent will supply the exact wording of any survey question upon request.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 2,000 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the US and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE, and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/040c5971-c0e2-4c99-b374-eae7fd203b4d