Pune, July 03, 2024 (GLOBE NEWSWIRE) -- The Flame Retardants Market is growing due to new guidelines, increasing fire safety regulations, and developing advanced technology. These materials play a crucial part in different industries like electronics, building and construction, and automotive industry. Worldwide market patterns are affected by the Restriction of Hazardous Substances (RoHS) Order, which was presented by the European Association in 2023 and requires the utilization of eco-accommodating and successful fire retardants.

Get a Sample Report of Flame Retardants Market @ https://www.snsinsider.com/sample-request/1702

China's Belt and Road projects are boosting rapid growth in the development area across underdeveloped countries, particularly in the Asia Pacific region, which is driving up the demand for fire-resistant materials. Besides, the consumer shift towards E-vehicles, which require safety guidelines, is further accelerating the development of the fire retardants market. Likewise, Birla SaFR was sent off at ITMA 2023 in Milan by Birla Cellulose, an auxiliary of Grasim Undertakings and the Aditya Birla Get-together. This advanced phosphate-based heat proof began in India, particularly for specialized materials, and is perfect for protective apparel in industries like oil and gas, salvage tasks, and safeguard on account of its exceptional performance, sustainability, and eco-friendly characteristics. Birla SaFR poses an Oxygen Limiting Part (OLF) of more than 28 and holds its heat-proof characteristics even after more than 50 washes. The presentation of Birla SaFR at a huge industry event like ITMA 2023 in Milan includes its normal impact on the worldwide market. This product can set new rules for heat-proof materials, driving interest in India as well as worldwide as numerous enterprises search for reliable and possible fire security solutions.

Albemarle is a prominent leader in vehicle fire security solutions, offering a large number of flame retardant materials applicable to various parts of a vehicle. These are included in a number of vehicle components, including electrical systems, battery casings, powertrain components, and interior textiles and foams. Albemarle works together with partners to continuously develop in response to changing market demands for transportation materials that are stronger, lighter, and more efficient.

In October 2023, Clariant, a manufacturer of specialty synthetic chemicals with an focus on sustainability, announced another manufacturing plant in Daya Straight, Huizhou, marking a key achievement. With an initial investment of CHF 60 million, the workplace's most memorable creation line, which produces imaginative Exolit Over controlled fire retardants, works on neighborhood availability of eco-accommodating items. These headways accelerate the use of planning plastics, especially in electrical hardware and e-versatility ventures. By 2024, a resulting creation line will add an extra CHF 40 million to the association's capacity.

In the industry for flame retardants, there are still concerns about the effects that some types of flame retardants, particularly halogenated compounds like polybrominated diphenyl ethers (PBDEs), have on health and the environment. Stricter regulations and a move towards more secure substitutes were achieved by a CNN Wellbeing report that circulated in April 2024 and highlighted examinations interfacing these substances to higher disease risk. As a result of their better well-being profiles and more modest ecological effects, non-halogenated choices are turning out to be more famous in spite of being utilized broadly.

Key Players Listed in the Report:

- Albemarle Corporation (US)

- Clariant AG (Switzerland)

- LANXESS AG (Germany)

- BASF SE (Germany)

- ICL Group Ltd. (Israel)

- Nabaltec AG (Germany)

- Huber Engineered Materials (US)

- ADEKA Corporation (Japan)

- Italmatch Chemicals S.p.A. (Italy)

- Avient Corporation (US)

Segment Analysis

The polyolefins segment dominated the flame retardants market with a market share of more than 26% in 2023 and a significant CAGR. The factors driving the dominance of polyolefins are because it contain flame retardants that prevent the spread of flames, stop polymer dripping, and reduce smoke production. Examples include Carpet backing, automobile textiles, mattress covers, roofing and siding materials, construction fabrics, and parts used in trains and airplanes.

Flame Retardants Market Report Scope & Overview:

| Report Attributes | Details |

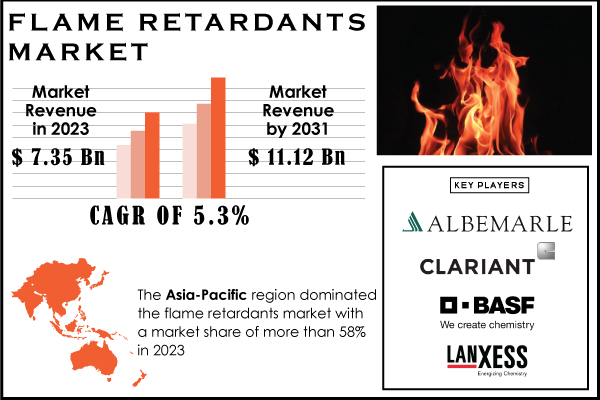

| Market Size in 2023 | USD 7.35 billion |

| Market Size in 2031 | USD 11.12 billion |

| CAGR (2024-2031) | 5.3% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Flame Retardants Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/1702

Recent Developments

June 2024: UB Forest Industry Green Growth Fund and ALTANA had an investment in NORDTREAT, specializing in eco-friendly flame retardants derived from bio-based materials. NORDTREAT's NORFLAM products safeguard over 2,000 global buildings, meeting the latest fire safety regulations.

April 2024: Finolex Cables introduced FinoGreen, an eco-safe wire brand targeting 5% of their wire business. These halogen-free, flame-retardant industrial cables helped in the enhancement of safety in electrical installations, mitigating fire risks.

April 2024: Trinseo launched PFAS-free flame-retardant resins called EMERG PC 8600PV, 8600PR, and EMERGE PC/ABS 7360E65 which comply with regulatory requirements in the Asia-Pacific market. These products cater to applications in IT equipment and electronics, addressing environmental concerns.

Regional Analysis

In 2023, the Asia-Pacific region dominated the flame retardants market due to rigid fire safety guidelines, a swift surge in construction activities, and increased electronics consumption by consumers. Urbanization, modern development, and the rising consumer electronics are key factors driving the demand for flame retardants. In the automotive industry, the demand for electric and hybrid vehicles is further boosting up the market growth. Future investments in regional R&D, progressions in innovation, and a shift towards eco-friendly solutions are supposed to promote sustained adoption of flame retardants in the long term.

SNS View on Flame Retardants Market

The flame retardants market is projected to rise consistently across worldwide businesses because of the developing requirement for compound arrangements that are more secure and more natural agreeable. Due to their compatibility with stringent fire safety regulations and environmental friendliness, non-halogenated flame retardants are in high demand. Regardless, moves persevere due to contending government approaches, complicated regulations, and the continuous interest for development.

Key Takeaways:

- Legal requirements and growing awareness of safety concerns are driving the requirement for non-halogenated flame retardants.

- The Asia-Pacific region is driving the market because of its quick industrialization and foundation development.

- A competitive advantage is maintained through constant technological advancements and innovative systems.

- Establishing and maintaining market leadership requires adapting strategies to these shifts and sustainability trends.

Buy an Enterprise User PDF of Flame Retardants Market Outlook Report 2024-2031@ https://www.snsinsider.com/checkout/1702

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Flame Retardants Market Segmentation, By Type

8. Flame Retardants Market Segmentation, By Application

9. Flame Retardants Market Segmentation, By End-User Industry

10. Regional Analysis

11. Company Profiles

12. Competitive Landscape

13. Use Case and Best Practices

14. Conclusion

Access Complete Flame Retardants Market Report @ https://www.snsinsider.com/reports/flame-retardants-market-1702

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.