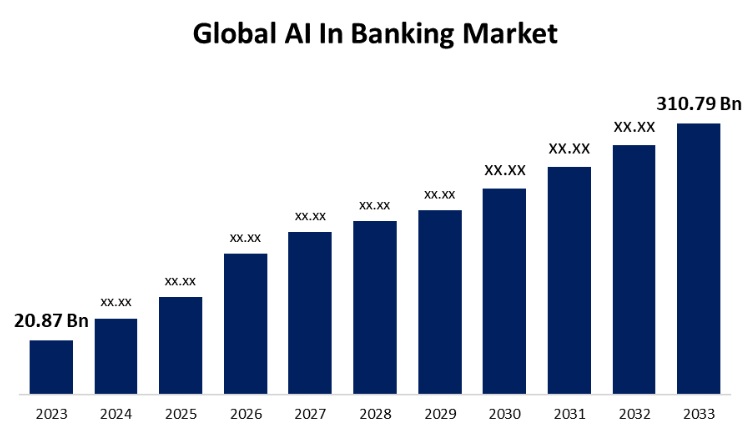

New York, United States , July 08, 2024 (GLOBE NEWSWIRE) -- The Global AI In Banking Market Size is to Grow from USD 20.87 Billion in 2023 to USD 310.79 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 31.01% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4810

AI is used in banking to enhance customer satisfaction, security, and productivity. Operating costs are reduced by automating repetitive tasks like data entry and fraud detection. AI-driven chatbots provide customer support around the clock. Machine learning algorithms analyze customer data and search for unusual transactions to enhance security and personalize services. AI is used by credit scoring algorithms to provide a more precise evaluation of creditworthiness. Furthermore, to enhance customer experience and revolutionize the FinTech management process, banks are increasing their investments in artificial intelligence technologies. As the banking industry becomes more sophisticated and competitive, there is an increasing demand for customized solutions that meet its goals. The growth of AI in the banking sector is thus being driven by the numerous financial institutions and FinTech companies that are investing in AI solutions to meet customer needs. Furthermore, the success of financial institutions in all aspects of risk management, such as impact assessment, measurement, quantification, and risk identification, depends on artificial intelligence (AI). Growing investment from banks and FinTech companies is propelling the artificial intelligence sector in banking to new heights. However, financial institutions implement AI platforms and solutions to analyze vast volumes of consumer data and extract important insights for operational efficiency and well-informed decision-making, which makes them more vulnerable to cyber threats.

Browse key industry insights spread across 240 pages with 110 Market data tables and figures & charts from the report on the "Global AI In Banking Market Size, Share, and COVID-19 Impact Analysis, By Component (Service and Solution), By Application (Risk Management, Customer Service, Virtual Assistant, Financial Advisory, and Others), By Technology (Machine Learning, Natural Learning Processing, Generative AI, and Computer Vision), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4810

The solution segment is anticipated to hold the greatest share of the global AI in banking market during the projected timeframe.

Based on the component, the global AI in banking market is divided into service and solution. Among these, the solution segment is anticipated to hold the greatest share of the global AI in banking market during the projected timeframe. Due to the market's increasing demand for tools with AI capabilities. These technologies include automated client care, customized financial advice, and fraud detection. More precise and effective solutions that are tailored to specific financial needs are being created as AI technology advances.

The customer service segment is predicted to grow at the fastest CAGR in the global AI in banking market during the projected timeframe.

Based on the application, the global AI in banking market is divided into risk management, customer service, virtual assistant, financial advisory, and others. Among these, the customer service segment is predicted to grow at the fastest CAGR in the global AI in banking market during the projected timeframe. The increased need from customers for a personalized banking experience is driving growth in the AI customer services market. Artificial intelligence saves hours of work by enabling rapid customer service. the development of AI chatbots and additional customer care solutions to improve client assistance. Chatbots with artificial intelligence can automatically generate relevant answers, summarize queries from customers, and provide support.

The natural learning processing segment is predicted for the largest revenue share in the AI in banking market during the estimated period.

Based on the technology, the global AI in banking market is divided into machine learning, natural learning processing, generative AI, and computer vision. Among these, the natural learning processing segment is predicted for the largest revenue share in the AI in banking market during the estimated period. Natural language processing is being used more and more by the banking sector to understand and extract relevant information from unstructured data, customer inquiries, and social media activity. This aids in satisfying the needs and desires of customers. Natural language processing helps with several banking operations activities, such as performance prediction, task simplification, sentiment analysis, and error reduction.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4810

North America is expected to hold the largest share of the global AI in banking market over the forecast period.

North America is expected to hold the largest share of the global AI in banking market over the forecast period. A greater number of people in the area having more reliable and substantial sources of income are driving the growth of the banking sector, which in turn is driving regional market expansion. In addition to early technology adoption in all end-use industries, including banking, the region's banking sector is going through a period of growing digitalization and technical evaluation.

Asia Pacific is predicted to grow at the fastest pace in the global AI in banking market during the projected timeframe. Artificial intelligence (AI) in the banking sector is growing in the Asia Pacific region as a result of the fintech sector's expansion, the speed at which digital transformation is occurring, and the growing number of people who have access to digital banking services. Growth in the economies of Asia Pacific, particularly China and India, is being driven by substantial investments from the current economy and the creation of new fintech companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global AI In Banking Market include IBM, Microsoft, Google Cloud, AWS Inc., NVIDIA, H2O.ai, DataRobot, Kabbage, Upstart, Zest AI, Ayasdi, Darktrace, Feedzai and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4810

Recent Developments

- In May 2024, Setu introduced "Sesame," a Large Language Model (LLM). The digital infrastructure in India enables Sesame to power services like improved fraud detection, credit underwriting, loan monitoring, cross-selling and upselling, and personal finance consulting.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global AI In Banking Market based on the below-mentioned segments:

Global AI In Banking Market, By Component

- Service

- Solution

Global AI In Banking Market, By Application

- Risk Management

- Customer Service

- Virtual Assistant

- Financial Advisory

- Others

Global AI In Banking Market, By Technology

- Machine Learning

- Natural Learning Processing

- Generative AI

- Computer Vision

Global AI In Banking Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global Revenue Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Solution (Billing & Payment, Price Management, Revenue Assurance & Fraud Management, Channel Management, Others), By Deployment Mode (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Vertical (Telecom, Hospitality, Transportation, Healthcare, Retail & eCommerce, BFSI, Utilities, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter