New York, USA, July 23, 2024 (GLOBE NEWSWIRE) -- GLP Agonist Clinical Trial Pipeline Appears Robust With 20+ Key Pharma Companies Actively Working in the Therapeutics Segment | DelveInsight

The GLP-1 receptor agonist market is experiencing significant growth, driven by the increasing prevalence of type 2 diabetes and obesity, and the high efficacy of these drugs in managing such conditions. Key market drivers include advancements in GLP-1 receptor agonist formulations, a robust product pipeline, and the ability of these drugs to modify cardiovascular risk factors, such as reducing body weight, lowering blood pressure, improving lipid profiles, and enhancing glycemic control. As chronic diseases rise globally, pharmaceutical companies are aligning their research and development initiatives with the World Health Organization's recommendations to combat non-communicable diseases.

DelveInsight’s 'GLP Agonist Pipeline Insight 2024' report provides comprehensive global coverage of pipeline GLP agonists in various stages of clinical development, major pharmaceutical companies are working to advance the pipeline space and future growth potential of the GLP agonist pipeline domain.

Key Takeaways from the GLP Agonist Pipeline Report

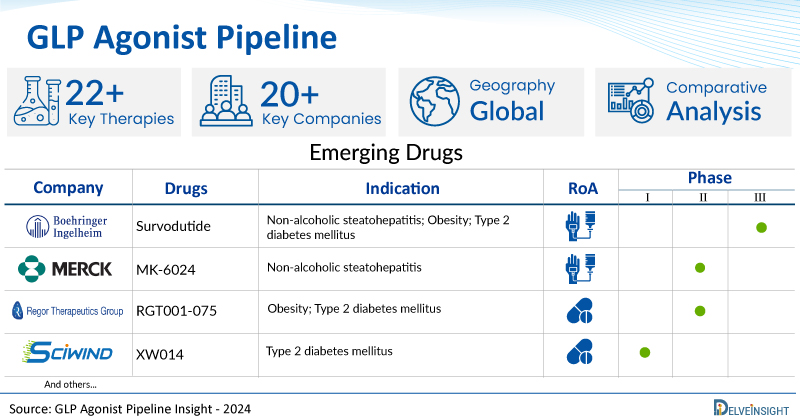

- DelveInsight’s GLP agonist pipeline report depicts a robust space with 20+ active players working to develop 22+ pipeline GLP agonists.

- Key GLP agonist companies such as Sciwind, Boehringer Ingelheim, Merck, Eccogene, Suzhou, Regor Pharmaceuticals, Eli Lilly and Company, Neuraly, Carmot Therapeutics, Viking Therapeutics, Biolexis Therapeutics and others are evaluating new GLP agonist drugs to improve the treatment landscape.

- Promising pipeline GLP agonists such as XW014, Survodutide, MK-6024, ECC5004, RGT001-075, Tirzepatide, CT 388, Pegylated exenatide, VK2735, MLX 7000 and others are under different phases of GLP agonist clinical trials.

- In July 2024, Pfizer announced that based on results from the ongoing pharmacokinetic study (NCT06153758), the company selected its preferred once-daily modified release formulation for danuglipron, an oral glucagon-like peptide-1 (GLP-1) receptor agonist.

- In July 2024, Amylyx Pharmaceuticals announced the acquisition of avexitide from Eiger BioPharmaceuticals. Avexitide has been studied for the potential treatment of first-in-class GLP-1 receptor antagonists to treat hyperinsulinemic hypoglycemia to date.

- In July 2024, Genentech, a member of the Roche Group announced positive topline results from two arms of an ongoing multi-part Phase I clinical trial for CT-996, an investigational, once-daily, oral small molecule GLP-1 receptor agonist being developed for the treatment of both type 2 diabetes and obesity.

- In May 2024, Roche’s dual GLP-1/GIP receptor agonist CT-388 produced positive findings treating obesity and type 2 diabetes in a Phase Ib clinical trial. The company announced results from the trial show that a once-weekly subcutaneous (SC) injection of CT-388 produced significant weight loss in healthy adults with obesity compared with placebo across 24 weeks.

- In March 2024, Viking Therapeutics announced positive results from the company's Phase I multiple ascending dose (MAD) clinical trial of an oral tablet formulation of VK2735, a dual agonist of the glucagon-like peptide 1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) receptors, in development for the potential treatment of metabolic disorders such as obesity.

- In January 2024, Sciwind Biosciences announced positive interim results from the first four cohorts of a Phase I clinical trial of oral ecnoglutide (XW004). Ecnoglutide is a long-acting, cAMP signaling biased, glucagon-like peptide-1 (GLP-1) analog that is being developed for the treatment of type 2 diabetes and obesity.

Request a sample and discover the recent advances in GLP agonist drugs @ GLP Agonist Pipeline Report

The GLP agonist pipeline report provides detailed profiles of pipeline assets, a comparative analysis of clinical and non-clinical stage GLP agonist drugs, inactive and dormant assets, a comprehensive assessment of driving and restraining factors, and an assessment of opportunities and risks in the GLP agonist clinical trial landscape.

GLP Agonist Overview

Glucagon-like peptide (GLP) agonists are medications mainly used to treat type 2 diabetes mellitus. They imitate the action of the natural hormone GLP-1, which is released by the intestines after eating. GLP-1 is vital for regulating blood sugar levels by promoting insulin secretion and suppressing glucagon release, both of which help to lower blood glucose.

There are several GLP-1 receptor agonists available, each with its own formulation and dosing schedule. Commonly prescribed ones include exenatide, liraglutide, dulaglutide, semaglutide, and lixisenatide. These medications are usually given by subcutaneous injection, with dosing frequencies ranging from daily to weekly. This convenient dosing can enhance patient adherence and lead to better treatment outcomes.

GLP-1 receptor agonists are crucial in managing type 2 diabetes and obesity due to their diverse effects. They boost insulin secretion in response to glucose while inhibiting glucagon release, aiding in blood sugar control without causing hypoglycemia. Additionally, they reduce appetite, support weight loss, and offer cardiovascular benefits, such as lowering the risk of major adverse cardiovascular events (MACE). These agents may also help preserve pancreatic beta cell function, improve liver health in conditions like non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH), and potentially provide neuroprotective and renoprotective effects. With convenient dosing options and potential for combination therapies, GLP-1 agonists are promising treatments for various metabolic and neurological conditions, highlighting their significant clinical importance.

Find out more about GLP agonist drugs @ GLP Agonist Analysis

A snapshot of the Pipeline GLP Agonist Drugs mentioned in the report:

| Drugs | Company | Phase | Indication | RoA |

| Survodutide | Boehringer Ingelheim | Phase III | Non-alcoholic steatohepatitis; Obesity; Type 2 diabetes mellitus | Subcutaneous |

| MK-6024 | Merck | Phase II | Non-alcoholic steatohepatitis | Subcutaneous |

| RGT001-075 | Regor Therapeutics | Phase II | Obesity; Type 2 diabetes mellitus | Oral |

| XW014 | Sciwind | Phase I | Type 2 diabetes mellitus | Oral |

| ECC5004 | Eccogene | Phase I | Non-alcoholic steatohepatitis; Obesity; Type 2 diabetes mellitus | Oral |

| KN056 | Alphamab Oncology | Phase I | Type 2 diabetes mellitus | Subcutaneous |

Learn more about the emerging GLP agonist @ GLP Agonist Clinical Trials

GLP Agonist Therapeutics Assessment

The GLP agonist pipeline report proffers an integral view of the emerging GLP agonist segmented by stage, product type, molecule type, and route of administration.

Scope of the GLP Agonist Pipeline Report

- Coverage: Global

- Therapeutic Assessment By Product Type: Mono, Combination, Mono/Combination

- Therapeutic Assessment By Clinical Stages: Discovery, Pre-clinical, Phase I, Phase II, Phase III

- Therapeutics Assessment By Route of Administration: Oral, Intravenous, Subcutaneous, Parenteral, Topical

- Therapeutics Assessment By Molecule Type: Recombinant fusion proteins, Small molecule, Monoclonal antibody, Peptide, Polymer, Gene therapy

- Key GLP Agonist Companies: Sciwind, Boehringer Ingelheim, Merck, Eccogene, Suzhou, Regor Pharmaceuticals, Eli Lilly and Company, Neuraly, Carmot Therapeutics, Viking Therapeutics, Biolexis Therapeutics, and others

- Key GLP Agonist Pipeline Therapies: XW014, Survodutide, MK-6024, ECC5004, RGT001-075, Tirzepatide, CT 388, Pegylated exenatide, VK2735, MLX 7000, and others

Dive deep into rich insights for new GLP agonists, visit @ GLP Agonist Drugs

Table of Contents

| 1. | GLP Agonist Pipeline Report Introduction |

| 2. | GLP Agonist Pipeline Report Executive Summary |

| 3. | GLP Agonist Pipeline: Overview |

| 4. | Analytical Perspective In-depth Commercial Assessment |

| 5. | GLP Agonist Clinical Trial Therapeutics |

| 6. | GLP Agonist Pipeline: Late-Stage Products (Pre-registration) |

| 7. | GLP Agonist Pipeline: Late-Stage Products (Phase III) |

| 8. | GLP Agonist Pipeline: Mid-Stage Products (Phase II) |

| 9. | GLP Agonist Pipeline: Early-Stage Products (Phase I) |

| 10. | GLP Agonist Pipeline Therapeutics Assessment |

| 11. | Inactive Products in the GLP Agonist Pipeline |

| 12. | Company-University Collaborations (Licensing/Partnering) Analysis |

| 13. | Key Companies |

| 14. | Key Products in the GLP Agonist Pipeline |

| 15. | Unmet Needs |

| 16. | Market Drivers and Barriers |

| 17. | Future Perspectives and Conclusion |

| 18. | Analyst Views |

| 19. | Appendix |

For further information on the GLP agonist pipeline therapeutics, reach out @ GLP Agonist Therapeutics

Related Reports

Obesity Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, including clinical and non-clinical stage products, and the key obesity companies, including 180 Life Sciences, 9 meters, Aardvark Therapeutics, Adocia, Agentix, AgeX Therapeutics, Altimmune, Amgen, Antag Therapeutics, Aphaia Pharma, Aptorum Group, AstraZeneca, Bukwang Pharmaceutical, Caliway Biopharmaceutics Co Ltd, Can Fite Biopharma, Carmot Therapeutics, Inc., Cellivery Therapeutics Inc, CinFina Pharma, Clayton Biotech, Click Therapeutics, Corbus Pharma, DiscoveryBiomed Inc, Dong-A ST, Dongkook Pharmaceuticals, Eccogene, Elevian, Eli Lilly and Company, Empros Pharma, Enterin Inc., EraCal Therapeutics AG, ERX Pharmaceuticals, ERX Pharmaceuticals, Eternygen GmbH, Eurofarma, Gannex Pharma, Glaceum, Gmax Biopharm, GPER G-1 Development Group, LLC, Gubra Therapeutics, Hanmi Pharmaceutical, Hanmi Pharmaceuticals, Innovent Biologics, Jenrin Discovery, Jiangsu Hansoh Pharmaceutical, Kallyope, Kintai Therapeutics, Kriya Therapeutics, LG Life Sciences, Lipidio Pharmaceuticals, MakScientific, Nano Precision Medical, NeonMind Biosciences, Novartis, Novo Nordisk, NuSirt Biopharma, Otsuka Pharmaceutical Factory Inc, Pfizer, Raziel Therapeutics, Reata Pharmaceuticals, Regeneron Pharmaceuticals, Reviva Pharmaceuticals, Rivus Pharmaceuticals, Shionogi, SHIONOGI & Co., Ltd., Sigrid Therapeutics, SJT Molecular Research SL, Structure Therapeutics, Sun Pharmaceutical Industries, Techfields Pharma, Terns Pharmaceuticals, Tonix Pharmaceuticals, UGISense AG, Versanis Bio, Viking Therapeutics, YSOPIA Bioscience, Yuhan, Zealand Pharma, among others.

Obesity Market Insights, Epidemiology, and Market Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, market share of the individual therapies, and key obesity companies, including Novo Nordisk, Eli Lilly and Company, CSPC Baike (Shandong) Biopharmaceutical, Jiangsu Hengrui Medicine, Carmot Therapeutics, MedImmune, Boehringer Ingelheim, Raziel Therapeutics, Pfizer, Sciwind Biosciences, Empros Pharma, Amgen, Epitomee Medical, ERX Pharmaceuticals, Altimmune, Saniona, YSOPIA Bioscience, Innovent Biologics, Glaceum, Shionogi, Aardvark Therapeutics, NuSirt Biopharma, Novartis, among others.

Diabetes Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key diabetes companies, including Daewoong Pharmaceutical, Janssen Biotech, Zealand Pharma, BioRestorative Therapies, Elevian, Oramed Pharmaceuticals, ImCyse, Novo Nordisk, Enthera, Precigen, Inc., Japan Tobacco, Avotres, AstraZeneca, Landos Biopharma, Vertex Pharmaceuticals, REMD Biotherapeutics, Inc., Eledon Pharmaceuticals, Eli Lilly and Company, Novo Nordisk A/S, Diamyd Medical, NextCell Pharma, ViaCyte, Op-T LLC, Dompé Farmaceutici S.p.A, ILTOO Pharma, Throne Biotechnologies, Oramed Pharmaceuticals, Janssen Research & Development, LLC, Jaguar Gene Therapy, SQZ Biotechnologies, Genprex, Inc., CRISPR Therapeutics, Biora Therapeutics, Genprex, Inc., among others.

Type 2 Diabetes Market Insights, Epidemiology, and Market Forecast – 2032 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key type 2 diabetes companies, including Sanofi, Eli Lilly and Company, AstraZeneca, Novartis, among others.

Type 1 Diabetes Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key type 1 diabetes companies, including Histogen, Novo Nordisk, Prevention Bio, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences.

Connect with us at LinkedIn