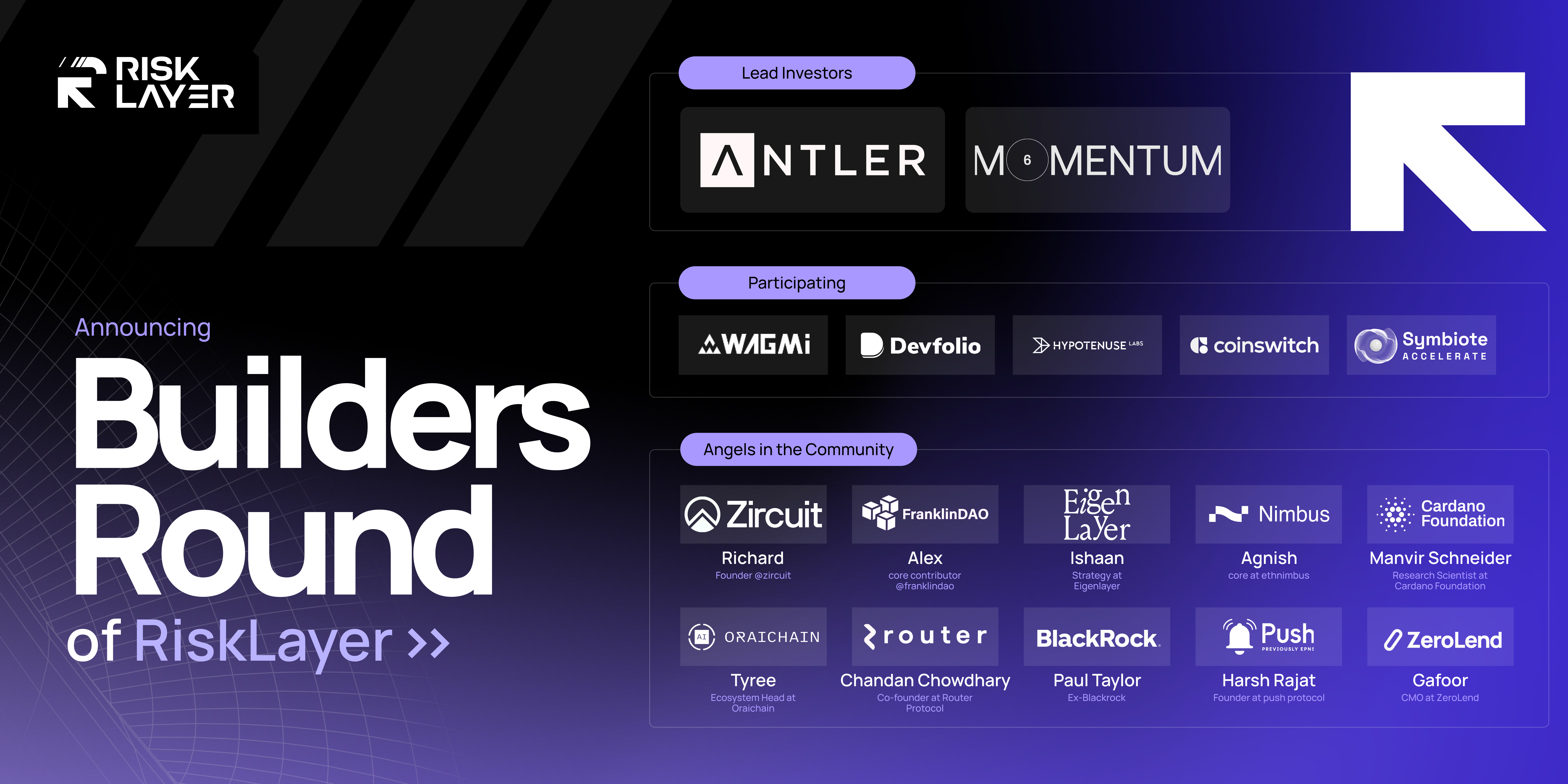

NEW YORK, July 25, 2024 (GLOBE NEWSWIRE) -- RiskLayer, the DeFi Economic Security AVS on Eigenlayer, has secured its ‘Builders round’ co-led by Antler and Momentum6 with participation from Wagmi Ventures, Hypotenuse ventures, and notable angels, including Richard Ma (Founder, Zircuit), Ishaan 0x (Strategy, Eigenlayer), Agnish Ghosh (Core, EthNimbus), Alex (Core Contributor, FranklinDAO) and Paul Taylor (Ex-Blackrock) among others. RiskLayer proposes two separate Actively Validates Services (AVSs) on EigenLayer as a solution to key DeFi economic security concerns. Chainrisk Labs, the developers behind RiskLayer, has secured over $10B in assets under management to date, serving protocols like Compound, Angle Labs, Gyroscope, Ebisu Finance and entire ecosystems from Arbitrum to Fuel Network with their end-to-end Economic Risk Management solution.

Accelerated by Symbiote, a leading Web3 accelerator, RiskLayer strives to scale the internet’s shared security and commercialise risk as a metric for DeFi, institutions, and users to deploy capital with risk-optimised capital efficiency per market per asset, thereby unlocking the potential to spearhead the Total Value Locked (TVL) within the decentralised financial market to achieve new heights in the upcoming years.

According to Nitin Sharma, Partner and Global Co-lead for Web3 at Antler, “We are very excited about the momentum Chainrisk Labs has built quickly, to emerge as one of the most promising Web3 projects globally, when it comes to economic security. Having seen their journey from Day Zero as part of the Antler Fellowship, Sudipan, Arka and the team have shown real depth of research and thought leadership towards protecting DeFi protocols and investors with a robust simulation-based approach. Projects like Chainrisk are critical to the vision of taking DeFi mainstream”

“The team has been razor-focused on navigating the complex space and solving the multi-billion dollar problem in Web3, economic security, with their deep association with the Eigen ecosystem. Being associated with the team so closely since the start, I can confidently claim that their maturity, understanding and clarity of the space is unparalleled and wish the team all the luck for their future milestones,” said Nilotpal Mukherjee, Founder of Symbiote & General Partner Momentum6

The RiskLayer team is commercialising risk as a metric, previously siloed between risk managers and protocols. This is akin to what Moody’s Analytics did in Web2. RiskLayer proposes two AVS - Risk Oracle AVS, the data provider of DeFi risk, and the Risk Rollup AVS to serve application-specific needs on EigenLayer. Risk Oracle AVS utilises a “proof of risk” consensus to index the risk of a user per market per asset. Thereby, allowing any investor to access this data and deploy capital efficiently. Risk Rollup AVS economically secures app-specific rollups created on RiskLayer to build a new set of structured financial products. These product rollups now have the potential to be risk-intelligent.

Sudipan Sinha, Core Contributor at RiskLayer and CEO at Chainrisk Labs, said, “Economic security is being solved at the network level by EigenLayer. Gauntlet, Chaos Labs, Chainrisk Labs and other risk managers that solved it at the DeFi level. At RiskLayer, we abstract economic security from the protocol layer and scale it to the application layer. Institutions and users in DeFi have always had a hard time figuring out risk-optimised strategies. RiskLayer is taking one step at a time to make that onboarding experience trustless and hyper-efficient.”

According to Ishaan Hiranandani, Strategy Lead at EigenLayer :

“RiskLayer is building the risk infrastructure necessary to onboard institutions into crypto. By building on Eigenlayer, they are commercialising risk, which has always been a social data. Super excited to see a risk-intelligent DeFi coming ahead powered by the EigenLayer AVS stack.”

The company intends to use the funds to accelerate the development of the AVS infrastructure and to prepare for its upcoming pre-staking launch.

About RiskLayer

RiskLayer is an economic security middleware for DeFi built on the shared security primitives of Eigenlayer. RiskLayer not only broadcasts risk data across markets but also helps build risk-intelligent DeFi on top. The promise is to build an ecosystem where investors and users can trust deploying their capital into DeFi. RiskLayer is backed by Antler, Momentum6 and renowned angels like Richard Ma (Founder, Zircuit), Alex (Core Contributor, FranklinDAO), Ishaan 0x (Strategy, Eigenlayer), Agnish Ghosh (Core, EthNimbus), and Paul Taylor (Ex-Blackrock). For more information, please visit https://risklayer.xyz

About Chainrisk Labs

Chainrisk Labs, the visionary developers behind RiskLayer, have been instrumental in advancing economic risk management in the Web3 space. They are actively managing over $10 billion in assets, catering to prominent protocols such as Compound, Angle Labs, Gyroscope, Ebisu Finance, and entire ecosystems from Arbitrum to Fuel Network. Chainrisk Labs has built a full-stack economic security platform that helps in economic audits and parameter recommendations for DeFi protocols. The company’s innovative solutions have set a new standard for economic security in decentralised finance (DeFi). For more information, please visit https://www.chainrisk.cloud/

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/258a3cf1-e7ed-4f62-a89a-479291ac23b1