TORONTO, Aug. 01, 2024 (GLOBE NEWSWIRE) -- Giyani Metals Corp. (TSXV:EMM, GR:A2DUU8) ("Giyani" or the "Company") developer of the K.Hill battery-grade manganese project in Botswana ("K.Hill" or the "Project") is pleased to announce that it has completed the field work for the infill drilling programme at the Project. The information gathered from this programme is expected to provide the basis for an updated Mineral Resource Estimate (“MRE”) to be included in the 2025 Definitive Feasibility Study (“DFS”).

Highlights:

- Giyani has completed a 3,185m (61 hole) infill drilling programme at K.Hill. The aim of the programme was to define sufficient Measured Mineral Resource for the initial five years of mining operations covering the typical tenure of project finance debt facilities. This drill programme will supplement the 10,710m of previous drill results used in the 2023 MRE.

- The results of the infill drilling programme will also be integrated with the Demonstration Plant (“Demo Plant”) processing and operating output data to optimize the mine schedule and plant feed grades within the DFS.

- Giyani has now commenced the mining geotechnical field investigations to inform the mine design parameters for the DFS. Groundwater monitoring holes will also be drilled to allow on-going water sampling to confirm baseline water quality data and future monitoring during the construction and operating phases.

- Concurrent with these drilling programs, Giyani will launch the civil geotechnical field investigations. These investigations will comprise both drilling and pitting programmes, and inform the geotechnical design criteria of all plant, support infrastructure, access roads, waste rock dumps and the tailings storage facility, all important steps in the DFS process.

Danny Keating, President and CEO of the Company, commented:

“We have initiated a comprehensive fieldwork programme aimed at upgrading significant portions of the Indicated Mineral Resource into the Measured Mineral Resource category, providing geotechnical data for detailed designs of the plant and related infrastructure, and installing a water monitoring system to ensure our compliance with the highest international environmental standards.

This continues our approach of systematically de-risking the Project in advance of securing construction financing. Meeting lender requirements that the debt repayment period is covered by Measured Mineral Resource, that the project execution plan is supported by detailed designs and underpinned by sound geotechnical data are all part of a comprehensive de-risking approach with the aim of further increasing the Project’s attractiveness to lenders and investors.”

2024 Drilling Programme

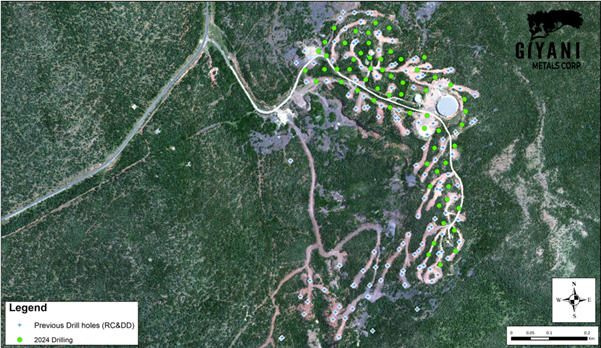

Giyani has completed a resource drilling programme which commenced in Q1 2024 (see Figure 1 below) and included 3,185m of drilling over 61 holes. A combination of reverse-circulation (“RC”) and diamond drilling (“DD”) was used to optimise core recoveries as well as minimise costs. RC is more cost effective than DD for collaring the holes and initial casing, while DD provided superior core sample recovery for analysis and density testwork.

The programme builds on the 2023 MRE (see Table 1 below), which was prepared using data from 187 RC and DD holes from all drilling campaigns conducted over the Project since 2018, totalling 10,710m.

The goal of the current programme is to upgrade and reclassify a portion of the current 8.6Mt Indicated Mineral Resource into Measured Mineral Resources, to ensure the Project has sufficient Measured Mineral Resources for the initial five years of mine production that typically covers the project finance debt repayment period.

The addition of this data will increase Giyani’s knowledge of its K.Hill deposit, enabling more accurate modelling of the ore grade and the elemental profile of the ore going to the plant, in turn allowing more accurate forecasting of the production profile.

Some 100t of mineralised material from K.Hill was shipped to Johannesburg in 2023 and is expected to be processed into HPMSM at the Demo Plant in H2 2024. The same ore from K.Hill will be used as feedstock in the Commercial Plant which is planned to be built in Botswana and start ramping up to full commercial scale production from 2027.

Figure 1: 2024 K.Hill Drill Programme

Mineral Resource Estimate1

The Mineral Resource Estimate completed by CSA Global in July 2023 is presented for ease of reference.

| Mineral Resource Classification | Tonnage (Mt) | Grade (% MnO) | Contained MnO (Mt) | HPMSM Equivalent (Mt)2 |

| Indicated | 8.6 | 15.2 | 1.3 | 3.1 |

| Inferred | 6.1 | 14.1 | 0.9 | 2.1 |

Table 1: K.Hill Project CSA Global MRE Statement as of July 2023 (at a cut-off grade of 7.3% MnO)

- Source: K.Hill Battery-Grade Manganese Project Preliminary Economic Assessment, National Instrument 43-101 Technical Report, with an effective date of 31st July 2023, was prepared on behalf of Giyani Corp. by CSA Global South Africa (Pty) Ltd, an ERM Group company, Tetra Tech Europe, Knight Piésold Ltd. and Axe Valley Mining Consultants Ltd. and was filed under the Company's profile on SEDAR+ on August 25, 2023.

- Before processing recoveries are applied.

MRE Notes:

a) The Mineral Resource has been classified and reported under the guidelines defined by the Canadian Institute of Mining, Metallurgy and Petroleum in their document “CIM Definition Standards for Mineral Resources and Mineral Reserves” of May 2014.

b) Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

c) Mineral Resources are stated as in situ dry tonnes; figures are reported in metric tonnes.

d) Figures have been rounded to the appropriate level of precision for the reporting of Mineral Resources.

e) Estimation has been completed within 6 different mineralization domains.

f) Mineral Resources are reported assuming open pit mining methods.

g) The Mineral Resource is reported within a conceptual pit shell determined using a price of US$3,800/t HPMSM (equivalent to US$9,054/t MnO), conceptual parameters and costs to support assumptions relating to reasonable prospects for eventual economic extraction.

h) The Mineral Resource is reported at a cut-off grade of 7.3% MnO.

i) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. CSA Global is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other any other relevant factors affecting the MRE.

j) HPMSM price quoted is based on 2022 market data, which was available at the time of reporting the Mineral Resource. Additional pricing information will be available for input into subsequent technical studies, and this may impact on the Mineral Resource reported.

Qualified Person and Data Verification

Mr. Luhann Theron, MSc., Pr.Sci.Nat. 400184/15, of Lambda Tau is registered with the South African Council for Natural Scientific Professions, membership number 400184/15, and last visited the K.Hill Project site in July 2024 and is a QP, as defined by NI 43-101. Mr. Theron is the Chief Geologist for the Company and has reviewed and approved the scientific and technical content contained in this announcement but is not independent for the purposes of NI 43-101.

About Giyani

Giyani is focussed on becoming the dominant western-world producer of sustainable, low carbon high purity battery grade manganese for the electric vehicle (“EV”) industry. The Company has developed a proprietary hydrometallurgical process to produce High Purity Manganese Sulphate Monohydrate (“HPMSM”), a lithium-ion battery (“LIB”) cathode precursor material critical for EVs.

The Company has secured US$26m in financing from two strategic partners, ARCH Sustainable Resources Fund LP and the Industrial Development Corporation of South Africa, as it aims to progress the K.Hill battery-grade manganese project in Botswana to construction by building and operating the Demo Plant and completing a Definitive Feasibility Study by H1 2025.

Additional information and corporate documents may be found on www.sedarplus.ca and on Giyani Metals Corp. website at https://giyanimetals.com/.

On behalf of the Board of Directors of Giyani Metals Corp.

Danny Keating, President and CEO

Contact:

Danny Keating

President & Chief Executive Officer

Tel: +1 289 291 7632

dkeating@giyanimetals.com

Charles FitzRoy

Head of Corporate Development & Strategy

cfitzroy@giyanimetals.com

Neither the TSX Venture Exchange (the "TSXV") nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

The securities described herein have not been registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and accordingly, may not be offered or sold to, or for the account or benefit of, persons in the United States or "U.S. persons," as such term is defined in Regulation S promulgated under the U.S. Securities Act ("U.S. Persons"), except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the Company's securities to, or for the account of benefit of, persons in the United States or U.S. Persons.

Forward Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements in this news release, other than statements of historical fact, that address events or developments that Giyani expects to occur, are "forward-looking statements". Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "does not expect", "plans", "anticipates", "does not anticipate", "believes", "intends", "estimates", "projects", "potential", "scheduled", "forecast", "budget" and similar expressions, or that events or conditions "will", "would", "may", "could", "should" or "might" occur.

All such forward-looking statements are based on the opinions and estimates of the relevant management as of the date such statements are made and are subject to certain assumptions, important risk factors and uncertainties, many of which are beyond Giyani's ability to control or predict. Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. In the case of Giyani, these facts include their anticipated operations in future periods, planned exploration and development of its properties, and plans related to its business and other matters that may occur in the future. This information relates to analyses and other information that is based on expectations of future performance and planned work programs.

Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking information, including, without limitation: inherent exploration hazards and risks; risks related to exploration and development of natural resource properties; uncertainty in Giyani's ability to obtain funding; commodity price fluctuations; recent market events and conditions; risks related to the uncertainty of mineral resource calculations and the inclusion of Inferred Mineral Resources in economic estimation; risks related to governmental regulations; risks related to obtaining necessary licences and permits; risks related to their business being subject to environmental laws and regulations; risks related to their mineral properties being subject to prior unregistered agreements, transfers, or claims and other defects in title; risks relating to competition from larger companies with greater financial and technical resources; risks relating to the inability to meet financial obligations under agreements to which they are a party; ability to recruit and retain qualified personnel; and risks related to their directors and officers becoming associated with other natural resource companies which may give rise to conflicts of interests. This list is not exhaustive of the factors that may affect Giyani's forward-looking information. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information or statements.

Giyani's forward-looking information is based on the reasonable beliefs, expectations and opinions of their respective management on the date the statements are made, and Giyani does not assume any obligation to update forward looking information if circumstances or management's beliefs, expectations or opinions change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking information. For a complete discussion with respect to Giyani and risks associated with forward-looking information and forward-looking statements, please refer to Giyani's Annual Information Form, all of which are filed on SEDAR+ at www.sedarplus.ca.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/025b2733-45d8-486a-8972-ec49be0719b6