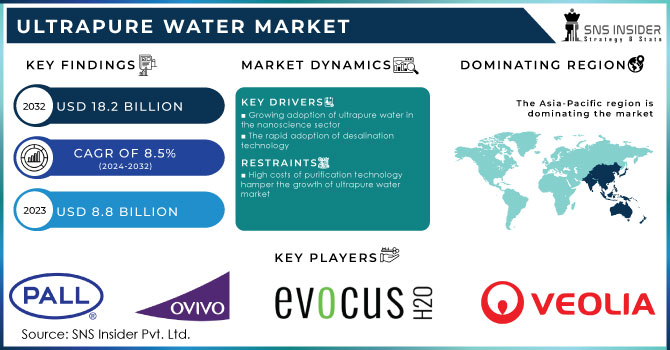

Austin, Aug. 05, 2024 (GLOBE NEWSWIRE) -- The Ultrapure Water Market Size was valued at USD 8.8 billion in 2023, and is expected to reach USD 18.2 billion by 2032, and grow at a CAGR of 8.5% over the forecast period 2024-2032.

Get a Sample Report of Ultrapure Water Market @ https://www.snsinsider.com/sample-request/2766

Key Players

- Pall Corporation

- Veolia

- Evocus

- Osmoflo

- Ovivo

- MANN+HUMMEL Water & Fluid Solutions

- Pentair

- Memstar USA

- Kurita Water Industries Ltd.

- Synder Filtration, Inc.

- DuPont

- Koch Separation Solutions

- NX Filtration BV

- Evoqua Water Technologies LLC.

The demand from the semiconductor, pharmaceutical, and power generation industries is one of the key growth drivers of the Ultrapure Water Market. As of May 2024, major players in the market, such as Veolia Water Technologies and Ecolab, were highly involved in operational and product-line expansion initiatives. Veolia had similarly announced its plans for setting a new plant within the circuits of Singapore for the manufacture of ultrapure water, as the demand for its pure water had been briskly increasing from customers based in the Asia-Pacific region. In September 2022, Ecolab introduced its advanced treatment system for ultrapure water to enhance the purity standards for its application in pharmaceutical manufacturing.

A number of forces played an active role in the market dynamics. These processes of advancements in semiconductor manufacturing thus call for ultrapure water, free of impurities that may cause damage to sensitive electronic parts. Again, strict regulatory standards in the pharmaceuticals industry stipulate the presence of ultrapure water for product safety and efficiency. Another growth driver has been environmental concern and the need for sustainable water management practices, wherein companies invest heavily in research and development to come up with more efficient technologies in water purification.

Although the ultrapure water market has emerged as a positive growth curve, high initial investment and complex maintenance measures can prove to be major restraints in the market. However, industry players are making inventions by technological advancement and strategic collaboration. For instance, the collaboration of SUEZ Water Technologies and Solutions with Intel during November 2023 to develop next-generation ultrapure water systems for semiconductor fabrication clearly explained their serious commitment towards innovation in the industry.

Ultrapure Water Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 8.8 billion |

| Market Size in 2032 | USD 18.2 billion |

| CAGR (2024-2032) | 8.5% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Ultrapure Water Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/2766

Segment Analysis

The semiconductor segment dominated the ultrapure water market in 2023, with a share of approximately 50%. It finds the remarkable growth in this sector due to the fact that ultrapure water is an extremely important component of semiconductor manufacturing processes. Water has to be used for cleaning purposes, to rinse silicon wafers; at the same time, impurities will affect chip performance. Huge investment in fabrication plants across the world also fosters this segment's growth. For instance, Taiwan Semiconductor Manufacturing Co. recently announced a new investment of US$10 billion in a new semiconductor fabrication plant in the state of Arizona, USA, which may drive demand for ultrapure water systems. Accordingly, further extensions to semiconductor facilities by Samsung in South Korea and Texas definitely deepen the need for high-purity water, noting that in advanced manufacturing processes the semiconductor industry does depend on ultrapure water.

By Equipment and Services

- Filtration

- Consumables/Aftermarket

- Others

By Technology

- Reverse Osmosis (RO)

- Ion Exchange

- Ultrafiltration

- Tank Vent filtration

- Resin Trap filtration

- Degasification

- Electrode ionization

- Others

By Treatment Process

- Pre-Treatment

- Roughening

- Polishing

By Application

- Washing Fluid

- Process Feed

By End-use Industry

- Semiconductor

- Pharmaceuticals

- Power Generation

- Others

Rising Chip Industry Drives Escalating Demand for Ultrapure Wate

The precision required for manufacturing semiconductor chips necessitates the use of ultrapure water, which the industry uses in vast volumes. Every silicon wafer used during chip production must be washed with ultrapure water to avoid contamination; even a slight impurity might spoil an entire chip. An average-sized 30cm wafer chip requires around 2200 gallons of ultrapure water to be manufactured. Companies like Thermax Ltd. underline the increasing demand for UPW, therefore underlining the role that ultrapure water systems would play in sustaining the stringent purity levels needed for semiconductor fabrication. Resulting wastewater management and treatment are other challenges the industry has to face.

Regional Analysis

In 2023, the ultrapure water market was dominated by the Asia-Pacific region, which held an enormous market share of 45%. This is attributed to rapid industrialization and growing semiconductor manufacturing industries in the region, coupled with investments in high-tech industries. Again, countries like China, Japan, and South Korea are leading the sector due to huge production capacities and technological advancements. For instance, strong electronics and semiconductor industries in China that require ultrapure water for precision manufacturing have very much boosted this regional market dominance. Furthermore, advanced manufacturing processes in the sectors of electronics and pharmaceuticals, which have a lot of emphasis put on by Japan, have added to the leading position of this region.

Recent Developments

March 2024: Novo Nordisk announced a $556 million investment in sterile preparation expansion at its Tianjin facility, with an expected completion date of 2027 and further increasing its capacity and local drug production.

January 2023: Envirogen Group launched LabPure—an energy-efficient water purification system for labs that require ultrapure water type 1—using RO-EDI technology for low-cost continuous operation.

March 2023: PureTech Systems Ltd. has announced a new advanced ultrapure water monitoring system with real-time analytics for better management of water quality and proactive maintenance of systems.

Buy an Enterprise User PDF of Ultrapure Water Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/2766

Key Takeaways:

- Impelled by the enormous investments made in the semiconductor and pharmaceutical industries, Asia-Pacific continues to dominate the Ultrapure Water Market.

- Advances in technology are making filtration and purification systems better, ultimately leading to improvements in water purity and operation efficiency.

- Increased penetration of digital technologies such as the Internet of Things and data analytics is changing traditional water treatment processes.

- Industry players need to develop strategic collaborations and partnerships that go a long way in addressing the predicaments in the market by providing room for innovation.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Ultrapure Water Market Segmentation, By Equipment and Services

8. Ultrapure Water Market Segmentation, By Technology

9. Ultrapure Water Market Segmentation, By Treatment Process

10. Ultrapure Water Market Segmentation, By Application

11. Ultrapure Water Market Segmentation, By End-use Industry

12. Regional Analysis

13. Company Profiles

14. Competitive Landscape

15. Use Case and Best Practices

16. Conclusion

Access Complete Report Details @ https://www.snsinsider.com/reports/ultrapure-water-market-2766

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.