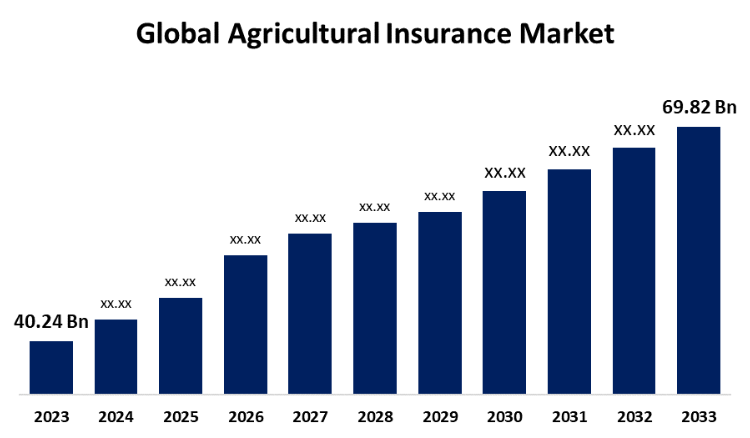

New York, United States , Aug. 05, 2024 (GLOBE NEWSWIRE) -- The Global Agricultural Insurance Market Size is to Grow from USD 40.24 Billion in 2023 to USD 69.82 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 5.6% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5396

Agricultural insurance is a kind of policy that shields farmers from weather-related occurrences that could harm their crops as well as other disasters. Government initiatives provide incentives, but insurance companies also provide agricultural insurance. The scope of coverage will be decided by the chosen insurance provider. Insurance frequently covers extreme rain, fire, lightning, waterspouts, high winds, cold winds, hail, drought, and frost in addition to non-germination and floods. Furthermore, the commercialization of farming and the amount of money involved in it are steadily rising. Farmers, investors, and their banks may think about using a financial product like insurance to reduce some of the risk involved in their financial venture. Contract farming arrangements, wherein farms get supplies and other services, including insurance, are growing more prevalent in step with the trend toward commercialization. Furthermore, the commercial insurance industry claims that governments are now in greater need of providing crop insurance information. The nature of these questions makes it clear that knowledge of this seemingly approved avenue of support for the farming community acts as a stimulus for them. However, the demand for these goods is expected to be restricted due to the high cost of crop insurance programs. The service's penetration may be constrained by farm owners' incapacity to make crop insurance premiums because of their poor farm area profits.

Browse key industry insights spread across 236 pages with 110 Market data tables and figures & charts from the report on the "Global Agricultural Insurance Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Crop-Hail Insurance, Livestock Insurance, Multi-Peril Crop Insurance (MPCL), and Others), By Distribution Channel (Insurance Companies, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/5396

The multi-peril crop insurance (MPCI) segment is anticipated to hold the greatest share of the global agricultural insurance market during the projected timeframe.

Based on the product type, the global agricultural insurance market is divided into crop-hail insurance, livestock insurance, multi-peril crop insurance (MPCI), and others. Among these, the multi-peril crop insurance (MPCI) segment is anticipated to hold the greatest share of the global agricultural insurance market during the projected timeframe. It protects standing crops from additional risks including delayed planting and non-emergence of seedlings due to top-soil slaking, as well as all weather-related concerns like pests and diseases. For annual crops, coverage starts soon after planting and continues until harvest. More and more premium subsidies and government incentives are being used to close the gap between the amount most farmers can afford to pay for MPCI insurance and the premium required for the high exposure and high anti-selection risk.

The 155mm segment is anticipated to grow at the fastest pace in the global agricultural insurance market during the projected timeframe.

Based on the distribution channel, the global agricultural insurance market is divided into insurance companies, banks, and others. Among these, the Banks play a key role in the agriculture insurance sector as go-betweens for insurance firms and farmers. These financial organizations can insure a broad spectrum of farmers because of their vast networks that span both rural and urban locations. Due to banks' wide reach, even rural and underdeveloped areas can get essential insurance coverage, increasing the market's overall inclusivity for agriculture insurance.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/5396

North America is expected to hold the largest share of the global agricultural insurance market over the forecast period.

North America is expected to hold the largest share of the global agricultural insurance market over the forecast period. A few of the elements driving the growth of the regional market are the better economic conditions in the area and the initiatives taken by the government to develop the infrastructure needed by the insurance business. The agricultural sector in North America faces a range of risks due to its different crop and farming practices, such as weather variations, pests, and market volatility. The United States, which has around 250 million acres of cropland, provides federal crop insurance through a private insurance firm that is under USDA regulation.

Asia Pacific is predicted to grow at the fastest pace in the global agricultural insurance market during the projected timeframe. Natural disasters often affect it because of typhoons, floods, landslides, droughts, earthquakes, volcanic eruptions, and tsunamis. The region's agricultural output, earnings, assets, and the security of individuals in vulnerable groups are all impacted by weather-related threats. In Asia and the Pacific, agricultural insurance programs range from large-scale, state-run programs in the Philippines and India to partnerships between the public and private sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Agricultural Insurance Market include Zurich Insurance Group, Swiss Re, XL Catlin, Munich Re, Tokio Marine Holdings, Hannover Re, Arch Capital Group, Chubb Limited, American International Group (AIG), Aon plc, QBE Insurance Group, Willis Towers Watson, Farmers Insurance Group, Allianz SE, and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/5396

Recent Developments

- In February 2024, the SARATHI portal was introduced by the government to help insurance companies get in touch with farmers. They established a platform called SARATHI to let insurance companies connect with farmers and the rural community by offering tailored products and government-subsidized insurance programs like Pradhan Mantri Fasal Bima Yojana (PMFBY).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Agricultural Insurance Market based on the below-mentioned segments:

Global Agricultural Insurance Market, By Product Type

- Crop-Hail Insurance

- Livestock Insurance

- Multi-Peril Crop Insurance (MPCI)

- Other

Global Agricultural Insurance Market, By Distribution Chanel

- Insurance Companies

- Banks

- Others

Global Agricultural Insurance Market, By Application

- Siege Warfare

- Counter-Battery Fire

- Artillery Support

- Strategic Bombardment

- Others

Global Agricultural Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Blood Meal Market Size, Share, and COVID-19 Impact Analysis, By Source (Porcine Blood, Poultry Blood, and Ruminant Blood), By Application (Poultry Feed, Porcine Feed, Ruminant Feed, and Aquafeed), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Global Agrochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Pesticides and Fertilizers), By Crop Type (Food Grains, Cash Crops, Plantation Crops, and Horticulture Crops), By Pesticide Type (Fungicides, Herbicides, Insecticides, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Global Blockchain In Agriculture Market Size, Share, and COVID-19 Impact Analysis, By Application (Product Traceability, Tracking, & Visibility, Payment & Settlement, Smart Contracts, Governance Risk & Compliance Management, and Smart Contracts), By Provider (Infrastructure & Protocol Provider, Middleware Provider Application, and Solution Provider), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Global Agriculture Biologicals Testing Market Size, Share, and COVID-19 Impact Analysis, By Application (Analytical, Regulatory, and Field Support), By Product Type (Bio-Pesticides, Bio-Fertilizers, and Bio-Stimulants), By End User (Government Agencies, Biological Product Manufacturers, Outsourced Contracts, Plant Breeders, and Research Organizations), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter