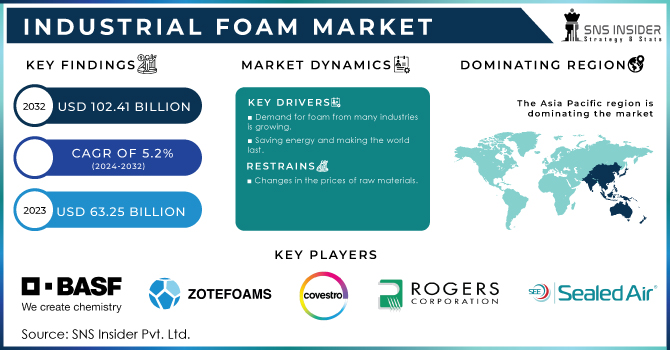

Austin, Aug. 07, 2024 (GLOBE NEWSWIRE) -- The Industrial Foam Market Share is projected to reach USD 102.41 billion by 2032 and grow at a CAGR of 5.50% over the forecast period of 2024-2032.

Get a Sample Report of Industrial Foam Market @ https://www.snsinsider.com/sample-request/1906

Key Players:

- Zotefoams Plc.

- BASF SE

- Covestro AG

- Rogers Corporation

- Recticel NV/SA

- Sealed Air Corporation

- Bayer Material Science

- The Woodbridge Group

- UBE Industries Ltd

- The Dow Chemical Company

- Huntsman International LLC

- Wanhua Chemical Group Co. Ltd.

Expanding end-use applications drive market growth.

The industrial foam market is expanding because of its many uses and the rising need for specific qualities across a range of industries. Foams are essential in construction because they effectively insulate buildings from heat and increase their energy efficiency. Stricter laws and a global movement toward greener, more energy-efficient building techniques are the driving forces behind this. Foams are crucial to the automobile industry's efforts to enhance vehicle performance, comfort, and safety, especially in areas like interior cushioning and seating. Foams are advantageous to the packaging industry because of their cushioning and protecting qualities, which are essential for minimizing damage during shipping, especially with the growth of e-commerce.

For instance, the U.S. Department of Energy’s Building Energy Codes Program supports the adoption of energy-efficient building materials. The 2021 International Energy Conservation Code requires enhanced insulation standards, contributing to increased demand for industrial foams.

Moreover, foams are becoming more useful in a variety of applications as a result of emerging technologies adding smart qualities to them, such as temperature-sensitive or self-healing capabilities.

In 2023, Armacell, invested in expanding its European production facilities to cater to the increasing demand for high-quality insulation solutions driven by new building projects and renovation activities.

Industrial Foam Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 63.25 billion |

| Market Size in 2032 | USD 102.41 billion |

| CAGR (2024-2032) | 5.50% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Industrial Foam Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/1906

Segmentation Analysis

By Foam Type

By Foam Type, the rigid foam segment dominated the industrial foam market with the highest revenue share of more than 68.23% in 2023. The need for rigid foam is further driven by the construction sector's growth, which is propelled by the fast development of infrastructure and urbanization, especially in emerging economies. Modern safety and environmental regulations are in line with the improved qualities of rigid foam brought about by technological improvements, which also include low-VOC formulations and increased fire resistance. These elements, along with the growing focus on environmentally friendly and energy-efficient building materials, support the rigid foam market's strong expansion.

By Resin Type

Polyurethane type held the largest market share of more than 38% in 2023. Ongoing advancements in foam technology, such as the creation of low-VOC and ecologically friendly formulations that meet growing sustainability requirements, also contribute to the expansion of the PU resin type. Moreover, PU foam's wide range of uses and well-established manufacturing methods support its market-dominating status. Overall, polyurethane resin is a top option in the industrial foam market due to its blend of performance, flexibility, and versatility.

By End-Use Industry

The building & construction segment held the largest, market share in the application segment around 31.23% in 2023. The global trend towards green and sustainable building methods is another factor propelling the sector's growth. Higher criteria for sustainability and energy efficiency in the building are now required by regulatory frameworks in many places, which is encouraging the use of high-performance and environmentally friendly materials. Further driving demand for foam products are developments in foam that provide better fire safety, moisture control, and thermal resistance, which are the result of advancements in building technology and materials.

Regional Landscape:

In 2023, Asia Pacific held the largest market share of about 39.20% of the total industrial foam market. The expansion of the economy in the area has also attracted investments in several industries, including consumer goods, construction, and automotive, all of which employ industrial foams for packaging, insulation, and cushioning. Furthermore, the Asia-Pacific area is witnessing a growing emphasis from both the public and commercial sectors on energy-efficient and sustainable building methods, which is creating a demand for sophisticated foam products that provide enhanced functionality and reduced environmental effects.

Recent Developments

- In 2024, BASF invested significantly in expanding its production facilities in Europe to increase the output of its polyurethane and polystyrene foams, addressing the rising need for energy-efficient building materials.

- In 2024, Dow expanded its production capabilities in North America to meet the growing demand for polyurethane foams in the construction and automotive sectors.

Buy an Enterprise User PDF of Industrial Foam Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/1906

Key Takeaways:

- Asia-Pacific holds the largest market share.

- The key players focused on the partnership to enhance product offerings and expand the market reach.

- Building & Construction segment hold the largest market share.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Industrial Foam Market Segmentation, By Foam Type

- Flexible

- Rigid

8. Industrial Foam Market Segmentation, By Resin Type

- Polyurethane

- Polystyrene

- Polyolefin

- Phenolic

- PET

- Others

9. Industrial Foam Market Segmentation, By End-use Industry

- Building & Construction

- HVAC

- Industrial pipe insulation

- Marine

- Aerospace

- Industrial cold storage

- Others

10. Regional Analysis

11. Company Profiles

12. Competitive Landscape

13. Use Case and Best Practices

14. Conclusion

Access Complete Report Details @ https://www.snsinsider.com/reports/industrial-foam-market-1906

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.