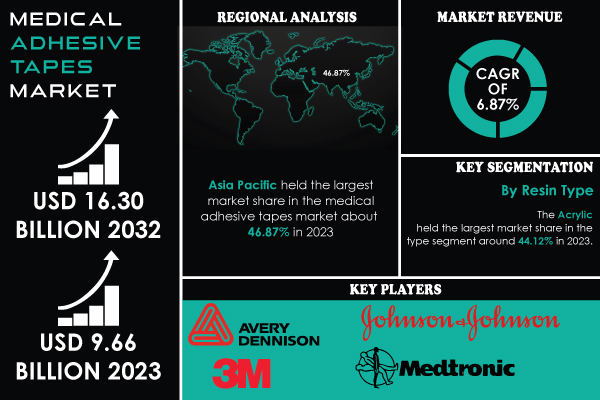

Austin, Aug. 09, 2024 (GLOBE NEWSWIRE) -- The Medical Adhesive Tapes Market Share is projected to reach USD 16.30 billion by 2032 and grow at a CAGR of 6.87% over the forecast period of 2024-2032.

Get a Sample Report of Medical Adhesive Tapes Market @ https://www.snsinsider.com/sample-request/2007

Key Players:

- Avery Dennison Corporation

- 3M Company

- Johnson & Johnson

- Medtronic PLC

- Scapa Group PLC

- Nichiban Co., Ltd.

- Paul Hartmann AG

- Nitto Denko Corporation

- Medline Industries, Inc.

- Smith & Nephew PLC

- Mactac Mexico

- Lohmann GmbH & Co.KG

Advancements in Wound Care drive market growth.

The innovation in wound care technology significantly drives market growth. Advanced wound dressings now incorporate materials and features designed to promote faster healing and improve patient comfort. These are usually combined with dressing retention adhesive tapes that require specific enhanced adhesion management properties to secure these in place correctly. Moreover, tools used today for securement are imperative in wound care that requires strong adhesive tapes to ensure stability and prevent any future complications. The increased awareness about wound care and the blossoming technological environment have fuelled demand for medical adhesive tapes that help in faster healing promoting patient comfort.

For instance, in 2024 Smart Wound Ltd. launched the smart equipment with sensors and monitoring capabilities that has enhanced the ability to track wound conditions and healing progress. These advanced dressings often require specialized adhesive tapes that can securely anchor the dressings while accommodating the embedded sensors.

The increase in long-term illnesses like diabetes and heart conditions is having a major effect on the need for medical adhesive tapes. Chronic illnesses often demand continuous medical care, such as frequent treatments and surgeries, which call for the application of diverse medical adhesive tapes. For instance, individuals with diabetes might require specific adhesive tapes for wound treatment and bandaging to effectively address ulcers and other skin problems.

Likewise, people with heart problems may need routine procedures and surgeries that involve securing devices, monitoring equipment, or dressings. As the number of chronic conditions grows, the demand for dependable and efficient adhesive solutions rises due to increased medical interventions. These tapes are essential for upholding wound cleanliness, ensuring medical devices are safely attached, and enhancing patient comfort to meet the increasing need for advanced medical adhesive tapes in treating chronic illnesses.

Medical Adhesive Tapes Market Report Scope & Overview:

| Report Attributes | Details |

| Market Size in 2023 | USD 9.66 Billion |

| Market Size in 2032 | USD 16.30 billion |

| CAGR (2024-2032) | 6.87% |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Market Driver |

|

Do you need any customization research on Medical Adhesive Tapes Market, Speak to Our Analyst @ https://www.snsinsider.com/enquiry/2007

Segmentation Analysis

By Resin Type

Acrylic held the largest market share in the type segment around 44.12% in 2023. The advantages that acrylic medical adhesive tape provides are the reason for its widespread use. In particular, this tape leaves no residue on the skin after removal, has a strong initial tack, and is not overly sensitive to the skin. It also exhibits heat and humidity resistance, is free of latex, and can be laminated onto a variety of surfaces, such as foams and film dressings. Interestingly, the tape holds up well during the dressing procedure.

With the highest CAGR, the silicone segment is the second largest segment in resin type. Several important factors have contributed to the increase in demand for silicone medical adhesive tapes. Their ability to be repositioned allows for wound monitoring and evaluation without requiring the dressing to be changed, which contributes to their extended wear period.

By Backing Material

In the backing material segment paper type held the largest market share around 41.63% in 2023. Paper-based tapes offer a wonderful combination of strength, flexibility, and breathability, which makes them popular in medical applications. Paper's porosity makes it ideal for applications involving skin contact because it improves aeration and moisture absorption. Paper tapes are also readily customizable, which enables producers to create a range of widths and lengths to satisfy various medical needs. This helps to drive the segment's overall growth.

By Application

In the application segment surgery segment held the highest market share around 45.63% in 2023. The need for surgical adhesives has grown dramatically as a result of an aging population, improvements in surgical procedures, and an increase in both elective and emergency surgeries. These tapes are necessary for stabilizing medical devices both during and after procedures, treating wounds following surgery, and fastening dressings.

Regional Landscape:

Asia Pacific held the largest market share in the medical adhesive tapes market about 46.87% in 2023. The rising need for medical adhesive tapes can be linked to the region's rising diabetes prevalence. The growing number of diabetics increases the risk of developing diabetic foot ulcers, which calls for the application of wound dressings. Throughout the forecast period, a rise in surgical cases is anticipated to fuel demand for medical adhesive tapes and propel regional market expansion. Being one of the largest economies in the world, the nation enables significant investment in the manufacturing of medical adhesive tapes. Additionally, China attracts foreign investments due to its easy access to affordable raw materials, which supports the expansion of the healthcare adhesive tape industry.

Recent Developments

- In 2024, 3M expanded its manufacturing capabilities for medical adhesive products by opening a new production facility in Asia-Pacific. This expansion aims to meet the growing demand for medical adhesive tapes in the region, enhancing their ability to provide advanced wound care and surgical solutions.

- In 2023, ConvaTec invested in research and development for its portfolio of wound care and adhesive products. The investment focuses on developing next-generation adhesive technologies and enhancing the efficacy of their medical adhesive tapes.

Buy an Enterprise User PDF of Medical Adhesive Tapes Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/2007

Key Takeaways:

- Asia Pacific holds the largest market share and is projected to be growing in the forecast period.

- The trend towards home healthcare and self-care drives the need for adhesive tapes.

- Key players and Governments are investing in new technologies and expanding facilities growing market demands.

Table of Contents – Major Key Points

1. Introduction

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Medical Adhesive Tapes Market Segmentation, By Resin Type

- Acrylic

- Silicone

- Rubber

- Others

8. Medical Adhesive Tapes Market Segmentation, By Backing Material

- Paper

- Fabric

- Plastic

- Other

9. Medical Adhesive Tapes Market Segmentation, By Application

- Surgery

- Wound Dressing

- Splints

- Secure IV lines

- Ostomy Seals

- Others

10. Regional Analysis

11. Company Profiles

12. Competitive Landscape

13. Use Case and Best Practices

14. Conclusion

Access Complete Report Details @ https://www.snsinsider.com/reports/medical-adhesive-tapes-market-2007

About SNS Insider

At SNS Insider, we believe that businesses should have access to the best market intelligence and insights, regardless of their size or industry. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to big corporations. With a passion for our work and an unwavering commitment to delivering value, we are dedicated to helping our clients achieve their full potential.