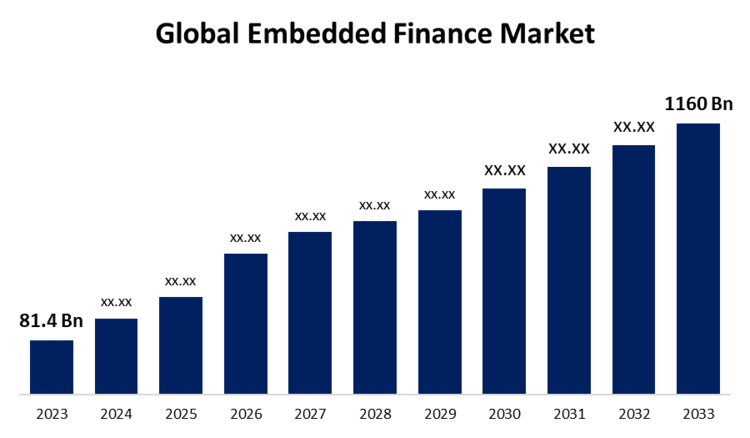

New York, United States , Aug. 14, 2024 (GLOBE NEWSWIRE) -- The Global Embedded Finance Market Size is to Grow from USD 81.4 Billion in 2023 to USD 1160 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 30.43% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5602

Embedded finance is the integration of financial services with non-financial products or services. Embedded finance is creating substantial opportunities for both financial as well as non-banking financial businesses. It enables businesses with non-financial services to offer services like credit at point of sale, digital wallet, and buy now pay later (BNPL). Companies that have implemented embedded finance reported an increase in customer engagement and higher customer acquisition. Embedded finance and payment solutions offer various financial services to their customers like a loan, payment program like EMI, insurance plan, or any other easier way to complete purchases. The increase in the number of digital payments, combined with technological advancements, online banking, and customized financial management applications is expected to boost market growth globally. However, the market faces challenges such as managing sensitive customer data including personal and financial details, cyber-attacks, and the lack of consistent regulations across different regions.

Browse key industry insights spread across 240 pages with 110 Market data tables and figures & charts from the report on the "Global Embedded Finance Market Size, Share, and COVID-19 Impact Analysis, By Finance Type (Embedded Payment, Embedded Insurance, Embedded Investment, Embedded Lending, Embedded Banking), Business Model(B2B, B2C, B2B2B, B2B2C), End-Use (Retail, Healthcare, Logistics, Manufacturing, Travel & Entertainment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/5602

The embedded payment segment is anticipated to hold the greatest share of the global embedded finance market during the projected timeframe.

Based on the finance type, the global embedded finance market is divided into embedded payment, embedded insurance, embedded investment, embedded lending, and embedded banking. Among these, the embedded payment segment is anticipated to hold the largest share of the global embedded finance market during the forecast period. This is due to the rising demand of consumers for seamless transactions and improved security.

The B2C segment is anticipated to grow at the fastest pace in the global embedded finance market during the projected timeframe.

Based on the business model, the global embedded finance market is divided into B2B, B2C, B2B2B, and B2B2C. Among these, the business-to-consumer (B2C) segment is anticipated to grow at the fastest CAGR in the global embedded finance market during the forecast period. The availability of financial services on B2C platforms, and the convenience to consumers for performing transactions by in their familiar apps are the factors driving the segment's growth in the forecasted years.

The retail segment is anticipated to hold the greatest share of the global embedded finance market during the projected timeframe.

Based on the end-use, the global embedded finance market is divided into retail, healthcare, logistics, manufacturing, travel & entertainment. Among these, the retail segment is anticipated to hold the largest share of the global embedded finance market during the forecast period. The cost-effective and convenient credit solutions, cashback offers, coupons, and credit & debit card payments help retailers to attract more repeat customers, which is driving the sector’s growth.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/5602

North America is expected to hold the largest share of the global embedded finance market over the forecast period.

North America is expected to hold the largest share of the global embedded finance market over the forecast period. The presence of global leaders in the BFSI sector, a well-established and strong financial infrastructure, a deep-rooted banking system, and a wide range of financial organizations are the primary reasons for the region’s market growth. Additionally, high income levels, spending capacity, and standard of living will help the market grow faster in North America.

Asia Pacific is predicted to grow at the fastest pace in the global embedded finance market during the projected timeframe. The swift growth of the industry across the continent can be attributed to high number of smartphone and internet users in the region, especially in India, China Indonesia, and Vietnam. The rapid economic and GDP growth in the region in recent years is another reason for rising demand for embedded finance in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Embedded Finance Market include Zopa Bank Limited, Additiv AG, Plaid, Inc., Fortis Payment Systems, Wise Payments Limited, Stripe, Inc., Alipay+, PayPal Holdings, Inc., Fluenccy Pty Limited, Walnut Insurance Inc., Transcard Payments, Galileo Financial Technologies, Cross River Bank, Tint Technologies Inc., JPMorgan Chase & Co., Amazon.com, Inc., Finastra, Zeta Services Inc., PAYRIX, Parafin, Inc., Goldman Sachs, and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/5602

Recent Developments

- In July 2024, Fortis to boost its embedded payment solutions division with the acquisition of NetSuite payments division of MerchantE.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Embedded Finance Market based on the below-mentioned segments:

Global Embedded Finance Market, By Type

- Embedded Payment

- Embedded Insurance

- Embedded Investment

- Embedded Lending

- Embedded Banking

Global Embedded Finance Market, By Business Model

- B2B

- B2C

- B2B2B

- B2B2C

Global Embedded Finance Market, By End-Use

- Retail

- Healthcare

- Logistics

- Manufacturing

- Travel & Entertainment

Global Solar PV Fuse Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Residential Battery Market Size By Type (Lithium-ion battery, Lead-Acid battery, Others), By Power Rating (3-6 kW, 6-10 kW), By Operation (Standalone, Solar); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

Global Axial Flow Pump Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Product Type (Horizontal and Vertical), Application (Water Treatment, Irrigation, Evaporators, and Others) and End-Use (Chemical, Municipal, Pulp & Paper, Food & Beverage, Agriculture, and Others): By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

Global CNG Dispenser Market Size, Share & Trends Analysis Report Market by Type (Fast Fill and Time Fill), Flow Rate (Up to 15, Up to 50, and Up to 100 Kg/Min), Distribution (Company Owned & Company Run, Company Owned & Dealer Run, and Dealer Owned & Dealer Run), By Region (APAC, North America), And Segment Forecasts, 2021 – 2030

Global Nuclear Power Plant Market Size, Share, Statistics & Facts, By Equipment Type (Island Equipment & Auxiliary Equipment); By Reactor Type (Pressurized Water Reactors (PWR), Boiling Water Reactors (BWR), Pressurized Heavy Water Reactors (PHWR) & Others); By Region (U.S., Canada, Mexico, Rest Of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest Of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest Of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest Of Middle East & Africa, Brazil, Argentina, Rest Of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends And Forecast, 2021-2030

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter