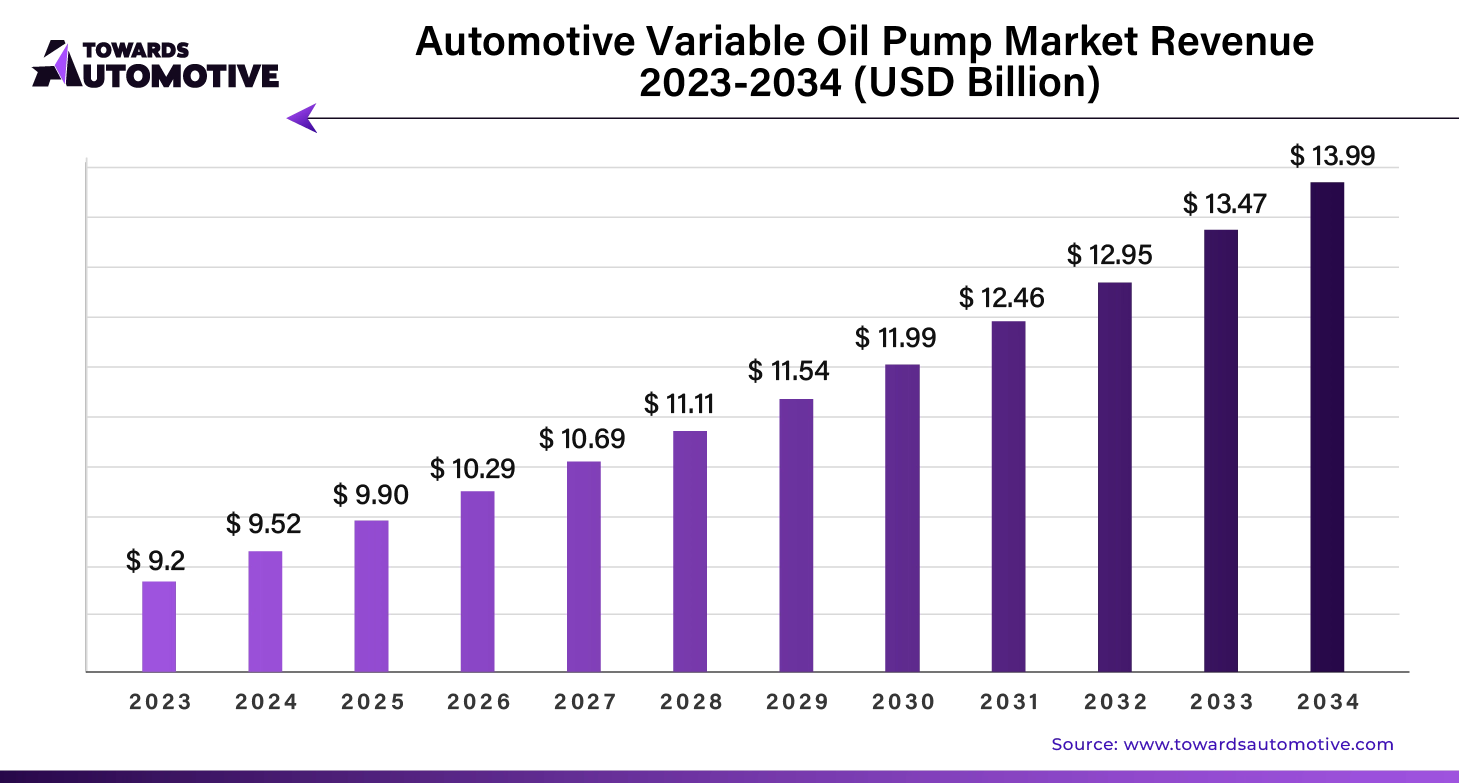

Ottawa, Aug. 21, 2024 (GLOBE NEWSWIRE) -- The global automotive variable oil pump market size crossed USD 9.20 billion in 2023 and is predicted to touch around USD 13.47 billion by 2033, according to a study published by Towards Automotive a sister firm of Precedence Research.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1320

Key Takeaways

- Asia Pacific dominated the market with the largest market share in 2023.

- North America is estimated to grow at the fastest rate during the forecast period.

- By sales channels, the OEMs segment held the largest share of the automotive variable oil pump market in 2023.

- By vehicle type, the passenger car segment dominated the market In 2023.

The Future of Variable Oil Pumps: Driving Efficiency and Performance in the Automotive Industry

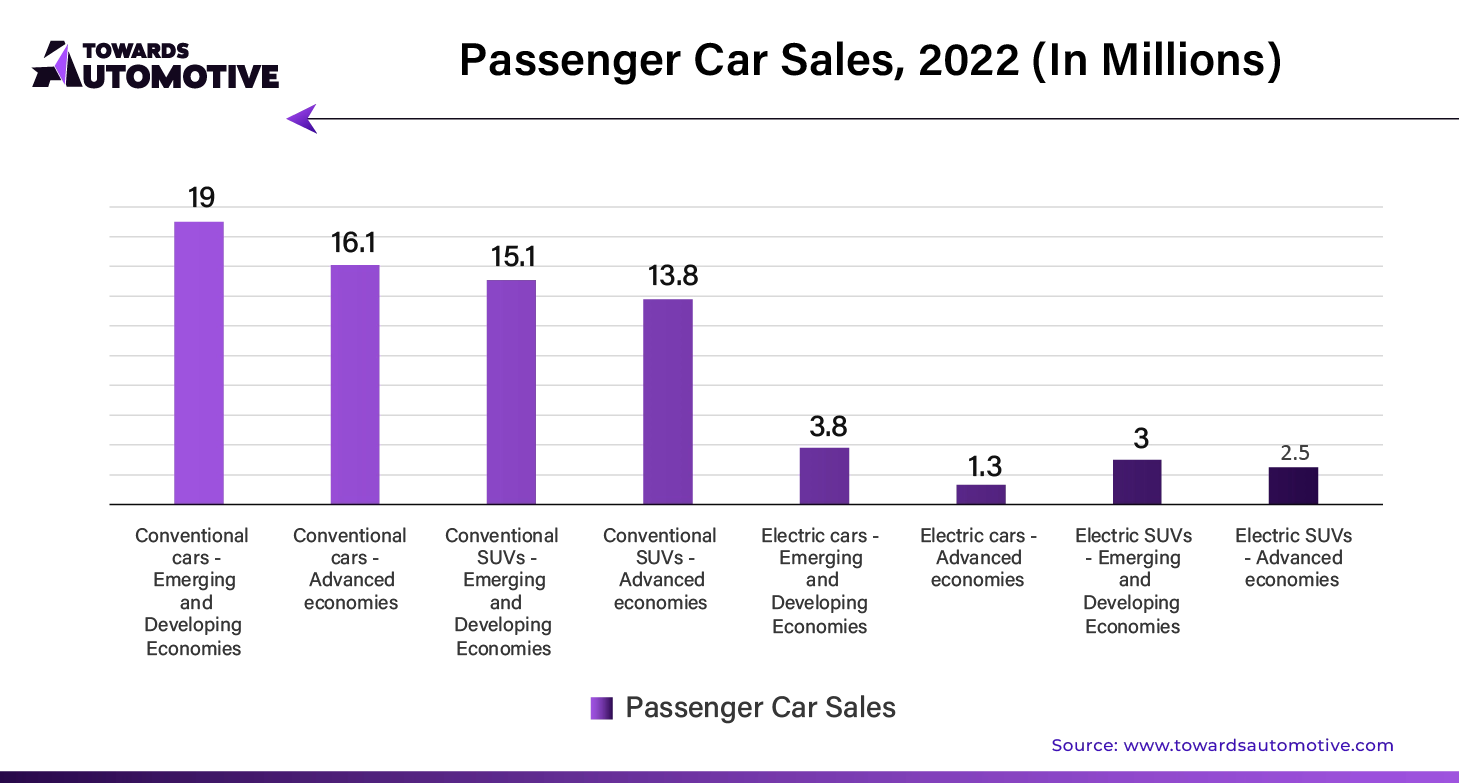

Variable oil pumps are becoming a standard feature across various vehicle categories, with passenger cars leading the charge. As per the International Organization of Motor Vehicle Manufacturers (OICA), global production of passenger cars reached over 65 million units in 2023, accounting for approximately 65 to 75% of total automotive production. This substantial figure underscores the prominence of passenger cars and highlights the growing importance of advanced components like variable oil pumps. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Challenges and Regulations

The automotive variable oil pump market faces several challenges, including stringent regulations on vehicular emissions, performance, fuel efficiency, and cost-effectiveness. Regulations such as the Corporate Average Fuel Economy (CAFE) standards are designed to mitigate environmental impact by curbing emissions. To comply with these regulations, manufacturers are compelled to innovate and develop advanced technologies.

For example, the Indian Government's introduction of BS6 emission norms in April 2020 has set new benchmarks for automotive manufacturers, emphasizing the need for efficient and high-performance components. Variable oil pumps play a crucial role in meeting these standards by enhancing the efficiency of lubrication systems, which directly impacts vehicle performance.

Growth in Gasoline-Driven Automobiles

The automotive industry's shift towards alternative fuels is accompanied by a notable growth opportunity in the gasoline-driven segment. Despite the rise in electric vehicles and the push to reduce diesel usage, gasoline remains a popular choice due to its relatively lower service intervals and cost-effectiveness. As gasoline-powered vehicles continue to be a significant part of the market, the demand for variable oil pumps in this segment is expected to rise.

Market Dynamics

In terms of sales channels, the Original Equipment Manufacturer (OEM) segment is projected to dominate the market for automotive variable oil pumps. OEMs are known for their ability to produce high-quality, reliable components that meet rigorous standards. This capability positions them well to cater to the growing demand for variable displacement oil pumps.

Customization and Innovation

Manufacturers are increasingly focusing on customization to meet evolving customer preferences. The development of specialized variable flow oil pumps, such as those that are compact, low-vibration, and brushless, is driving growth in the market. These innovations are essential for automotive manufacturers seeking to offer high-performance and efficient vehicles.

Pump manufacturers are also engaging in strategic efforts to integrate customization into their operations. By providing tailored solutions and securing long-term supply contracts with automakers, they are positioning themselves for sustained growth. The ongoing advancement of compact and high-performance motors and engines further supports the expansion of variable oil pump sales.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

AI Integration for Automotive Variable Oil Pumps: Boosting Industry Development

The integration of Artificial Intelligence (AI) in the Automotive Variable Oil Pump market is poised to significantly enhance market growth. AI-driven technologies can optimize the performance of variable oil pumps by enabling real-time data analysis and predictive maintenance. By processing vast amounts of data from sensors, AI algorithms can adjust the pump’s operation to match engine requirements, thereby improving fuel efficiency and reducing emissions. This adaptability not only enhances the pump’s lifespan but also lowers maintenance costs, making it an attractive option for automotive manufacturers.

Furthermore, AI can facilitate the development of more efficient and environmentally friendly pumps by simulating different operational scenarios and materials, leading to innovative designs that align with evolving regulatory standards. As the automotive industry shifts towards more sustainable and intelligent systems, the demand for AI-integrated variable oil pumps is expected to grow. This technological advancement will likely drive market expansion by offering superior performance and cost-effectiveness, addressing both consumer demands and industry requirements.

Managing the Automotive Variable Oil Pump Market's Supply Chain Dynamics

The supply chain for the automotive variable oil pump market is a complex network involving multiple stages, from raw material procurement to end-user delivery. It begins with the sourcing of essential raw materials, such as high-quality metals and polymers, which are vital for manufacturing durable and efficient pumps. Suppliers of these raw materials often work closely with manufacturers to ensure consistent quality and timely delivery.

Manufacturers then use these materials to produce variable oil pumps, incorporating advanced technologies to meet stringent automotive standards. The production process involves several stages, including precision machining, assembly, and quality testing. Manufacturers often rely on just-in-time inventory systems to minimize holding costs and optimize production schedules.

Once produced, the pumps are distributed through a network of wholesalers and distributors who supply them to automotive OEMs (Original Equipment Manufacturers) and aftermarket service providers. Effective logistics management is crucial at this stage to ensure timely delivery and reduce downtime.

The final step in the supply chain involves the installation of these pumps in vehicles and their maintenance, ensuring smooth operations and customer satisfaction. Coordination and communication among all supply chain participants are essential to address challenges and maintain a seamless flow of products from manufacturers to end-users.

Important Players and Elements of the Automotive Variable Oil Pump Industry Ecosystem

The automotive variable oil pump market is shaped by a range of components and key industry players. At its core, a variable oil pump system includes several main components: the pump housing, control valves, rotor, and stator. The pump housing contains the internal components and directs oil flow. Control valves manage the oil pressure, while the rotor and stator work together to adjust the pump’s displacement, optimizing engine performance and efficiency.

Major automotive manufacturers, such as Bosch, Denso, and ZF Friedrichshafen, play crucial roles in this ecosystem. Bosch is known for its advanced variable oil pump technology, which enhances engine efficiency and reduces emissions. Denso provides high-quality pumps that contribute to improved vehicle performance and fuel economy. ZF Friedrichshafen offers innovative solutions that integrate seamlessly with modern engine systems, promoting better drivability and reduced fuel consumption.

In addition, tier-one suppliers and automotive component specialists contribute to the market by developing specialized VOP components and providing maintenance services. Their innovations and expertise ensure that variable oil pumps meet evolving industry standards and performance requirements. Together, these players drive the growth and advancement of the automotive variable oil pump market.

Top Companies in Automotive Variable Oil Pump Market

- Aisin Seiki Co., Ltd.

- Concentric AB

- Continental AG

- Delphi Automotive LLP

- DENSO Corporation

- HELLA KGaA Hueck & Co.

- Hitachi Automotive Systems, Ltd.

- Johnson Electric Holdings Limited

- JTEKT Corporation; KSPG AG

- Magna International Inc.

- Magneti Marelli S.p.A

- Robert Bosch GmbH

- Pricol Ltd.

- SHW Group

- TI Automotive Ltd.

- ZF TRW Automotive Holdings Corp.

- BorgWarner Inc.

- FTE Automotive

Competitive Landscape

The global automotive variable oil pump market is characterized by significant fragmentation. Leading companies collectively hold around 40% to 45% of the market share, indicating a competitive and diverse industry landscape. Key players dominating this sector include:

- Robert Bosch GmbH: Known for its innovation and robust portfolio in automotive components, Bosch remains a pivotal player in the variable oil pump market.

- Denso Corporation: A major supplier with a strong emphasis on technology-driven solutions for enhancing vehicle performance.

- Hella KGaA Hueck & Co.: Renowned for its advanced automotive lighting and electronics, Hella also plays a critical role in the oil pump sector.

- Aisin Seiki Co., Ltd.: A leading manufacturer with extensive expertise in automotive parts, including variable oil pumps.

- Concentric AB: Specializes in hydraulic solutions and continues to expand its footprint in the variable oil pump market.

These companies are actively working to maintain their competitive edge through substantial investments in research and development. They are focused on innovating new types of vehicles equipped with advanced oil pumps. Additionally, many firms are showcasing their latest products at industry exhibitions and trade fairs to enhance product visibility and attract a broader customer base.

Recent Developments:

- In June 2024, Volvo Trucks North America made headlines with the introduction of the Volvo VNL, a new truck designed to improve fuel efficiency. The latest model features enhancements to the I-Shift transmission and Volvo D13 engine, incorporating a variable vane oil pump, a long connecting rod, and a short piston height to optimize performance.

- In 2023, Nidec Power Train Systems Corporation, based in Japan, announced the development of a new electric oil pump specifically for automotive continuously variable transmission (CVT) systems. This innovative product is designed to support the mechanical oil pump driven by the vehicle’s engine, providing essential oil pressure to the CVT system and enhancing overall vehicle efficiency. These developments reflect ongoing advancements and competitive strategies within the automotive variable oil pump market, underscoring the industry's focus on innovation and efficiency.

Key Industry Highlights

Advancements in Pump Technologies to Reduce Vehicular Emissions

Automobile manufacturers are under increasing pressure to meet stringent global emission standards, leading to a focus on innovative solutions to cut carbon emissions. High-pressure and electric fuel pumps have emerged as effective tools in this effort, potentially reducing emissions by 1.5 to 2 grams per kilometer for 1.8-liter diesel or gasoline engines.

Among the latest innovations are advanced automotive variable oil pumps, which adjust pressure and oil flow based on the engine's needs. This not only enhances lubrication but also minimizes parasitic losses and energy consumption. By improving fuel efficiency and reducing emissions, these pumps help manufacturers comply with environmental regulations, driving their adoption in modern vehicles.

Impact of Rising Automotive Production and Vehicle Parc

The growth in automotive production is directly linked to the increased demand for variable oil pumps. Despite economic fluctuations, global automotive production is projected to grow at a modest annual rate of 3% to 3.5%, with more pronounced growth in emerging markets compared to developed regions. This growth is driven by urbanization and economic stability in these areas.

As the vehicle fleet expands, there will be a growing demand for advanced pump technologies, enhancing vehicle longevity and lubrication systems. This rising production and vehicle parc are expected to spur significant growth in the automotive variable oil pump market.

Growing Demand for Premium Features in Mid-Size Cars

The increasing affluence of the middle class, particularly in countries like India and China, is shifting automotive trends. Consumers now seek premium features in mid-size and compact cars, which were previously exclusive to luxury vehicles. Features such as advanced cabin comfort, anti-lock braking systems, and power steering are becoming standard in these segments.

Mid-size and compact cars, which represent 55% to 65% of global car sales, are prime markets for automotive variable oil pumps. This segment's demand for customized and advanced pumps presents lucrative opportunities for manufacturers.

Challenges: Low Replacement Rates and Aftermarket Potential

Automotive variable oil pumps are integral to transmission, driveline, and auxiliary systems and are infrequently replaced. The replacement rate globally ranges between 0.1% and 1% of the vehicle parc, and technological advancements may further reduce this rate.

This low replacement rate limits aftermarket potential, impacting revenue streams for manufacturers. Additionally, the complexity and specialized nature of these pumps may lead consumers to opt for cheaper alternatives or delay replacements, further constraining growth in the aftermarket segment.

The Shift Towards Electric Motors

Electric motors are increasingly being used as substitutes for traditional mechanical pumps in the automotive industry. Functions typically performed by hydraulic or power steering pumps can now be achieved with electric motors, driven by the broader trend of electrification in vehicles.

Electric motors offer several advantages, including enhanced efficiency, reduced maintenance, and improved control. As electric and hybrid vehicles become more common, electric coolant pumps and electric power steering systems are becoming standard, showcasing the potential for electric motors to replace conventional pumps.

Market Concentration: An In-Depth Analysis of Industry Tiers

In the global market, companies are typically classified into different tiers based on their market share, production capacity, and geographical reach. This classification helps in understanding the competitive landscape and the dynamics driving market growth. Here’s a detailed breakdown of the different tiers:

Tier 1: Industry Leaders

Tier 1 companies are the dominant players in the global sector, capturing a substantial market share ranging from 40% to 45%. These industry leaders are characterized by their high production capacities, extensive product portfolios, and robust global presence.

Key Characteristics:

- High Production Capacity: Tier 1 companies are known for their large-scale manufacturing capabilities.

- Broad Product Portfolio: They offer a wide range of products catering to various market segments.

- Extensive Expertise: They possess deep expertise in manufacturing and reconditioning across multiple packaging formats.

- Global Reach: Their operations span across numerous regions, ensuring a significant consumer base.

Examples of Tier 1 Companies:

- Robert Bosch GmbH: Renowned for its diverse product offerings and global operations.

- Denso Corporation: A key player with a broad range of automotive components and a strong international footprint.

- Hella KGaA Hueck & Co.: A leading company in automotive lighting and electronics with a comprehensive market presence.

Tier 2: Regional Influencers

Tier 2 companies are mid-sized players that, while not as globally dominant as Tier 1, hold significant influence within specific regions. These companies account for approximately 55% to 60% of the overall industry revenue during the forecast period.

Key Characteristics:

- Regional Presence: These companies have a strong influence in particular geographic areas.

- Specialized Manufacturing: They focus on manufacturing essential components, such as plastic and metal parts.

- Technological Proficiency: They possess advanced technology and ensure regulatory compliance.

- Regional Knowledge: Their expertise is often centered around local market needs and regulatory requirements.

Examples of Tier 2 Companies:

- Concentric AB: Specializes in hydraulic and engine components with a notable regional impact.

- SHW Group: Known for its expertise in automotive and industrial components, primarily serving local markets.

- Pricol Ltd.: Offers a range of automotive components and has a strong regional presence.

Global Outlook on Automotive Variable Oil Pump Sales: Key Country Insights

The automotive variable oil pump market is experiencing dynamic growth across various global regions, driven by increasing vehicle sales, rising purchasing power, and significant investments in sustainable production processes. This report provides a detailed analysis of market trends in leading countries, highlighting growth rates and factors influencing demand.

Asia Pacific held the largest share of the automotive variable oil pump market in 2023.

India: A Leader in Growth

India is leading the automotive variable oil pump market with a notable growth rate. The market in India is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% from 2024 to 2034. This growth is largely driven by a surge in vehicle sales and improving purchasing power among the Indian population. With a burgeoning middle class and increasing disposable income, the demand for advanced automotive components, including variable oil pumps, is expected to continue rising.

Japan: Steady Advancement

Japan is set to experience a steady growth rate of around 3.9% CAGR during the same period. The country’s well-established automotive industry and technological advancements are key factors contributing to this growth. Japan’s focus on innovation and high-quality manufacturing processes supports the demand for advanced automotive components.

For instance,

- In March 2024, Volume deliveries of gate driver integrated circuits (ICs) with embedded microcontrollers (MCUs) in the SmartMCDTM Series began, according to Toshiba Electronic Devices & Storage Corporation ("Toshiba"). "TB9M003FG," the initial product, is appropriate for sensorless control of three-phase brushless DC motors used in automotive applications, such as blowers, fans, and water and oil pumps.

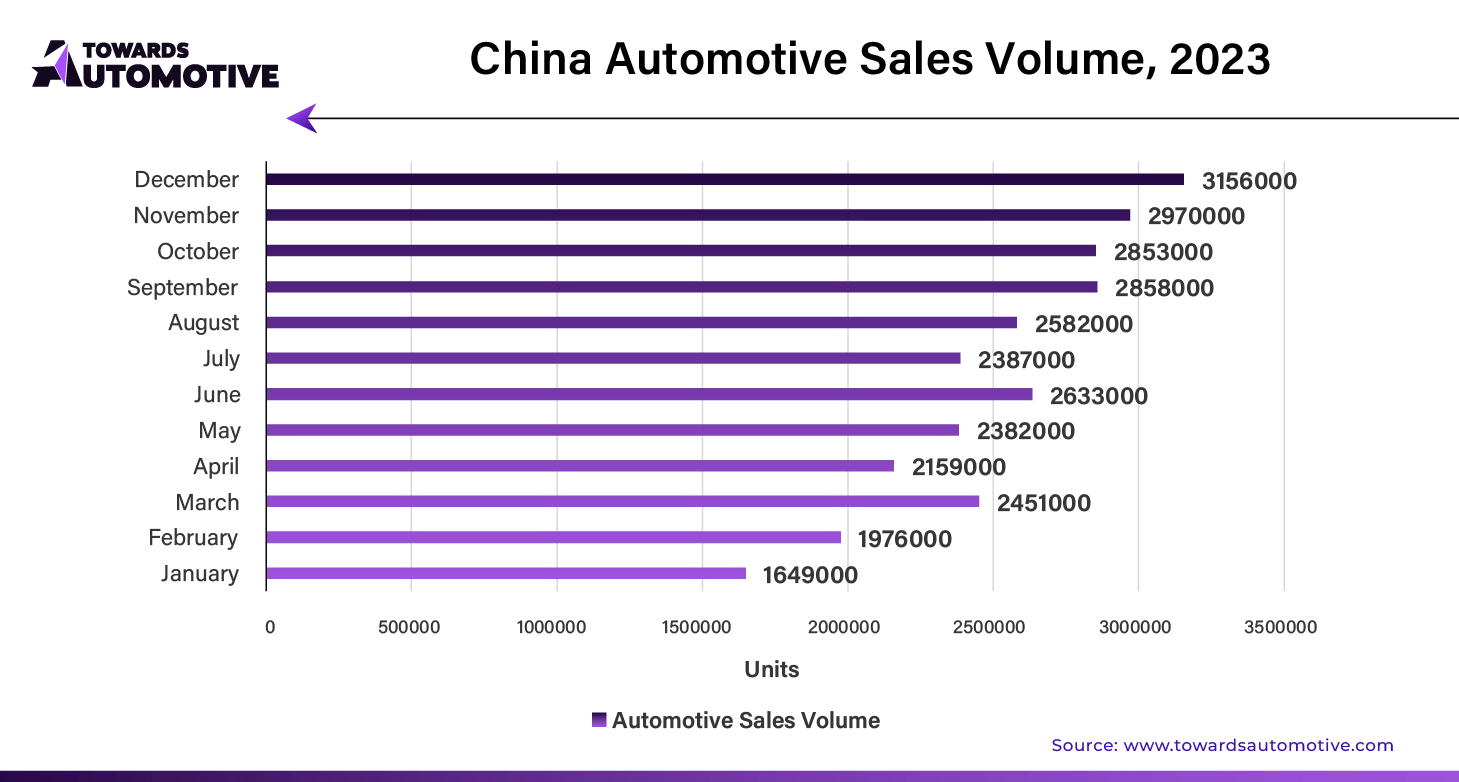

China: Robust Expansion

China, one of the largest automotive markets globally, is anticipated to grow at a CAGR of 3.9% through 2034. The growth is fueled by increasing vehicle sales and substantial investments in clean energy initiatives by automobile manufacturers. Companies like Audi are investing heavily in sustainable production processes in China, which is expected to boost the demand for automotive variable oil pumps. The market value in China is projected to reach approximately USD 2,900 million by 2034.

Germany: Consistent Growth

Germany’s automotive variable oil pump market is forecasted to grow at a CAGR of 3.3% over the next decade. As Europe’s automotive hub, Germany benefits from its strong automotive industry and focus on technological advancements, driving demand for high-performance automotive components.

United States: Significant Market Presence

The United States automotive variable oil pump market is projected to grow at a CAGR of 2.9%, reaching an estimated USD 2,100 million by 2034. Recent acquisitions, such as BorgWarner Inc.’s purchase of Delphi Technologies for USD 3.5 billion, are expected to enhance market dynamics. These acquisitions are poised to strengthen product capabilities and flexibility across various propulsion systems, further boosting demand.

United Kingdom: Growing Demand

In the United Kingdom, the market for automotive variable oil pumps is set to grow at a CAGR of 2.8%, with the total value reaching approximately USD 420 million by 2034. The presence of prominent sports and luxury car manufacturers, including Rolls-Royce, Jaguar, and Aston Martin, along with high registration rates of private vehicles, is expected to drive the demand for automotive components. In January 2022, the UK saw a registration of about 64,000 private vehicles, up from 38,000 in the previous year.

OEMs Lead the Way in Automotive Variable Oil Pumps with Emphasis on Lightweight Components

The dominance of OEMs in the Automotive Variable Oil Pump Market

The Original Equipment Manufacturers (OEMs) segment is poised to dominate the automotive variable oil pump market, with a projected market share of approximately 72.5% in 2024. This dominance is driven by OEMs' capability to deliver high-quality, innovative variable displacement oil pumps that adhere to stringent industry standards. The automotive industry is experiencing increasing pressure to comply with strict regulations aimed at reducing vehicle emissions and enhancing fuel efficiency. In response, OEMs are focusing on producing lightweight and fuel-efficient components. This shift is helping meet regulatory requirements and catering to the growing demand for advanced OEM parts in hybrid and luxury vehicles.

Benefits for Passenger Car Manufacturers from Easy Loan Availability

In the passenger car segment, which is expected to capture around 66.8% of the market share in 2024, the availability of automobile financing is proving to be a significant growth driver. The rise in private vehicle ownership, fueled by increasing disposable incomes and the ease of obtaining vehicle loans, is positively impacting this segment. Automobile financing companies are offering attractive loan options that make it easier for individuals to purchase vehicles quickly. In developing nations, where owning a car is often a symbol of high social status, this accessibility to financing is expected to drive up the demand for automotive variable oil pumps in passenger cars. Overall, the market for automotive variable oil pumps is experiencing growth due to technological advancements by OEMs and the increased accessibility of vehicle financing for consumers.

Browse More Insights of Towards Automotive:

- The global passenger ferries market size is estimated to reach USD 15.75 billion by 2033, up from USD 11.35 billion in 2023, at a compound annual growth rate (CAGR) of 3.41%.

- The global specialty commercial vehicle market size is estimated to reach USD 150.73 billion by 2033, up from USD 105.23 billion in 2023, at a compound annual growth rate (CAGR) of 3.74%.

- The global motorcycle accessories market size is estimated to reach USD 31.84 billion by 2033, up from USD 19.08 billion in 2023, at a compound annual growth rate (CAGR) of 5.35%.

- The global on-board connectivity market size is estimated to reach USD 40.48 billion by 2033, up from USD 11.21 billion in 2023, at a compound annual growth rate (CAGR) of 13.81%.

- The global in-vehicle apps market size is estimated to reach USD 157.02 billion by 2033, up from USD 60.47 billion in 2023, at a compound annual growth rate (CAGR) of 10.12% from 2024 to 2033.

- The global heat treating market size is estimated to reach USD 125.89 billion by 2032, up from USD 94.19 billion in 2023, at a compound annual growth rate (CAGR) of 3.36%.

- The global cellular vehicle-to-everything (C-V2X) market size is estimated to reach USD 39.54 billion by 2033, up from USD 1.21 billion in 2023, at a compound annual growth rate (CAGR) of 41.81% between 2023 and 2033.

- The global electric lift truck market size is estimated to reach USD 164.92 billion by 2033, up from USD 43.61 billion in 2023, at a compound annual growth rate (CAGR) of 14.35%.

- The global car accessories market is estimated to reach USD 355.94 billion by 2033, up from USD 198.67 billion in 2023, at a compound annual growth rate (CAGR) of 6.11% from 2024 to 2033.

- The global biometric vehicle access systems market size is estimated to reach USD 2540.79 million by 2033, up from USD 1082.53 million in 2023, at a compound annual growth rate (CAGR) of 9.05%.

Automotive Variable Oil Pump Market TOC | Table of Content

Executive Summary

- Market Overview

- Key Findings

- Market Trends

- Market Opportunities

- Competitive Landscape Overview

- Global Market Outlook

Introduction

- Market Definition and Scope

- Research Methodology

- Data Collection Techniques

- Data Sources

- Market Estimation Methodology

- Assumptions & Limitations

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- Industry Trends

Automotive Variable Oil Pump Market Analysis

- Market Size and Forecast

- Value Chain Analysis

- Porter's Five Forces Analysis

- PESTLE Analysis

Market Segmentation

- By Fuel Type

- Gasoline

- Diesel

- Hybrid

- By Vehicle Type

- Passenger Cars

- Compact

- Mid-Size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Passenger Cars

- By Sale Channels

- OEMs (Original Equipment Manufacturers)

- Aftermarkets

Regional Market Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Cross Segmentations (Region Selection)

- By Fuel Type

- Gasoline

- Passenger Cars

- Compact

- Mid-Size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Passenger Cars

- Diesel

- Passenger Cars

- Compact

- Mid-Size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Passenger Cars

- Hybrid

- Passenger Cars

- Compact

- Mid-Size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Passenger Cars

- Gasoline

- By Vehicle Type

- Passenger Cars

- Gasoline

- Compact

- Mid-Size

- Luxury

- SUVs

- Diesel

- Compact

- Mid-Size

- Luxury

- SUVs

- Hybrid

- Compact

- Mid-Size

- Luxury

- SUVs

- Gasoline

- Light Commercial Vehicles

- Gasoline

- Diesel

- Hybrid

- Heavy Commercial Vehicles

- Gasoline

- Diesel

- Hybrid

- Passenger Cars

- By Sale Channels

- OEMs (Original Equipment Manufacturers)

- Gasoline

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Diesel

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Hybrid

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Gasoline

- Aftermarkets

- Gasoline

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Diesel

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Hybrid

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Gasoline

- OEMs (Original Equipment Manufacturers)

- By Region

- North America

- U.S.

- Gasoline

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Diesel

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Hybrid

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Gasoline

- Canada

- Gasoline

- Diesel

- Hybrid

- U.S.

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Gasoline

- Diesel

- Hybrid

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Gasoline

- Diesel

- Hybrid

- Latin America

- Brazil

- Mexico

- Argentina

- Gasoline

- Diesel

- Hybrid

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

- Gasoline

- Diesel

- Hybrid

- North America

Go-to-Market Strategies

- Market Penetration Strategy

- Identifying Key Markets for Initial Entry

- Target Customer Segmentation

- Pricing Strategy

- Sales Channel Optimization

- Marketing and Advertising Tactics

- Product Differentiation Strategy

- Value Proposition Development

- Product Innovation and Customization

- Branding and Positioning

- Competitive Differentiation

- Distribution and Sales Strategy

- Direct vs. Indirect Sales Channels

- OEM Partnerships and Alliances

- Aftermarket Distribution Networks

- Regional Distribution Strategies

- Partnerships and Alliances

- Strategic Alliances with Key Industry Players

- Joint Ventures and Collaborations

- Supplier and Vendor Relationships

- Customer Acquisition and Retention

- Customer Relationship Management (CRM) Implementation

- Loyalty Programs and Incentives

- Customer Support and Service Strategies

- Feedback and Continuous Improvement Processes

- Digital and E-commerce Strategy

- Leveraging Online Sales Platforms

- Digital Marketing and Social Media Campaigns

- E-commerce Integration with Traditional Sales Channels

- Regulatory and Compliance Strategy

- Understanding Global and Regional Regulatory Requirements

- Compliance with Environmental Standards

- Navigating Trade Policies and Tariffs

- Localization Strategy

- Adapting Products for Regional Preferences

- Local Manufacturing and Sourcing

- Regional Marketing Campaigns

- Risk Management Strategy

- Identifying Potential Market Risks

- Developing Contingency Plans

- Mitigation Strategies for Supply Chain Disruptions

- Performance Monitoring and KPIs

- Setting Key Performance Indicators (KPIs)

- Monitoring Market Penetration Success

- Adjusting Strategies Based on Performance Data

Integration of AI in Automotive Variable Oil Pump Market

- Predictive Maintenance

- AI-driven algorithms for predicting and preventing pump failures

- Real-time performance monitoring for optimized maintenance schedules

- Smart Calibration

- AI-enabled calibration for precise oil flow control

- Adaptive learning systems for continuous efficiency improvements

- Energy Efficiency Optimization

- AI analysis of vehicle data for fuel efficiency optimization

- Dynamic oil pressure adjustment based on real-time engine needs

- Advanced Diagnostics

- AI-powered diagnostics for quick issue identification and troubleshooting

- Automated alerts and notifications for potential faults

- Supply Chain Optimization

- AI integration for streamlined supply chain management

- Predictive analytics for inventory management and demand forecasting

- Customizable Pump Performance

- AI algorithms for tailoring oil pump performance to vehicle specifications

- Integration with vehicle AI systems for seamless operation

- Enhanced Product Development

- AI-driven simulations for testing and refining oil pump designs

- Accelerated R&D through AI insights and data analysis

- AI-Driven Market Analysis

- Utilizing AI to analyze market trends and customer preferences

- Predictive modeling for market demand and pricing strategies

Production and Consumption Data

- Global Production Data

- Overview of Global Production Volumes by Region

- Production Trends by Year

- Major Producing Countries and Their Output

- Production Capacity Utilization Rates

- Key Factors Influencing Production Levels

- Regional Production Analysis

- North America

- Production Volumes by Country (U.S., Canada)

- Key Manufacturers and Their Production Capacities

- Europe

- Production Volumes by Country (Germany, UK, France, Italy, Spain)

- Major Production Hubs and Their Contributions

- Asia Pacific

- Production Volumes by Country (China, Japan, India, South Korea)

- Analysis of Regional Production Growth

- Latin America

- Production Volumes by Country (Brazil, Mexico, Argentina)

- Emerging Production Centers

- Middle East and Africa (MEA)

- Production Volumes by Country (South Africa, UAE, Saudi Arabia)

- Key Drivers of Regional Production

- North America

- Global Consumption Data

- Overview of Global Consumption Volumes by Region

- Consumption Trends by Year

- Major Consuming Countries and Their Demand

- Per Capita Consumption Analysis

- Key Factors Influencing Consumption Patterns

- Regional Consumption Analysis

- North America

- Consumption Volumes by Country (U.S., Canada)

- End-Use Industries Driving Demand

- Europe

- Consumption Volumes by Country (Germany, UK, France, Italy, Spain)

- Sector-Specific Consumption Insights

- Asia Pacific

- Consumption Volumes by Country (China, Japan, India, South Korea)

- Analysis of Regional Demand Growth

- Latin America

- Consumption Volumes by Country (Brazil, Mexico, Argentina)

- Emerging Consumption Trends

- Middle East and Africa (MEA)

- Consumption Volumes by Country (South Africa, UAE, Saudi Arabia)

- Key Drivers of Regional Consumption

- North America

- Production vs. Consumption Analysis

- Global Production vs. Consumption Balances

- Regional Disparities in Production and Consumption

- Trade Flows and Their Impact on Production and Consumption Patterns

- Supply Chain Dynamics and Their Influence on Global Balances

- Future Outlook

- Forecasted Production and Consumption Trends

- Emerging Markets and Their Potential Impact on Production and Consumption

- Anticipated Technological Advancements Affecting Production Efficiency

- Predicted Changes in Consumption Behavior and Preferences

Strategic Planning

- Opportunity Assessment

- Market Gap Analysis

- Identification of High-Growth Segments

- Competitive Opportunity Mapping

- Regional Opportunity Analysis

- Customer Needs and Preference Trends

- New Product Development

- Ideation and Concept Development

- Product Design and Prototyping

- R&D and Innovation Strategies

- Market Testing and Validation

- Time-to-Market Strategies

- Plan Finances/ROI Analysis

- Budgeting and Cost Estimation

- Break-Even Analysis

- Return on Investment (ROI) Forecasting

- Financial Risk Assessment

- Long-term Financial Planning

- Supply Chain Intelligence/Streamline Operations

- Supply Chain Optimization Strategies

- Inventory Management and Demand Forecasting

- Supplier Relationship Management

- Logistics and Distribution Efficiency

- Technology Integration in Supply Chain

- Cross-Border Intelligence

- Regulatory Compliance in International Markets

- Cross-Border Trade Analysis

- Global Market Entry Strategies

- Tariff and Non-Tariff Barriers

- Cultural and Economic Considerations

- Business Model Innovation

- Analysis of Existing Business Models

- Disruptive Innovation Strategies

- Value Proposition Enhancement

- Digital Transformation and Business Model Adaptation

- Sustainability and Circular Economy Models

- Blue Ocean vs. Red Ocean Strategies

- Overview of Blue Ocean Strategy

- Identifying Uncontested Market Spaces

- Differentiation and Low-Cost Strategies

- Red Ocean Strategy and Competitive Positioning

- Case Studies and Success Stories

Competitive Landscape

- Market Share Analysis

- Key Player Profiles

- Aisin Seiki Co., Ltd.

- Concentric AB

- Continental AG

- Delphi Automotive LLP

- DENSO Corporation

- HELLA KGaA Hueck & Co.

- Hitachi Automotive Systems, Ltd.

- Johnson Electric Holdings Limited

- JTEKT Corporation

- KSPG AG

- Magna International Inc.

- Magneti Marelli S.p.A

- Robert Bosch GmbH

- Pricol Ltd.

- SHW Group

- TI Automotive Ltd.

- ZF TRW Automotive Holdings Corp.

- BorgWarner Inc.

- FTE Automotive

Strategic Recommendations

- Key Strategies for Market Entry

- Investment Opportunities

- Strategic Partnerships & Collaborations

Conclusion

- Summary of Key Findings

- Future Outlook

Appendix

- List of Abbreviations

- Glossary of Terms

- Research Methodology

- Bibliography

- Disclaimer

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1320

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive