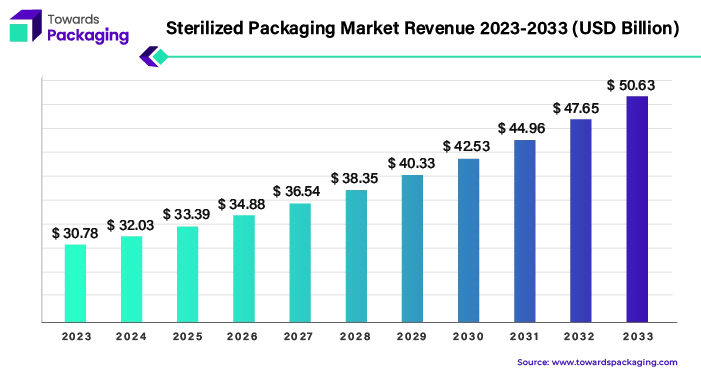

Ottawa, Aug. 22, 2024 (GLOBE NEWSWIRE) -- The global sterilized packaging market size is predicted to increase from USD 30.78 billion in 2023 to approximately USD 50.63 billion by 2033. The sector is registering a solid CAGR of 5.22% between 2024 and 2033, a study published by Towards Packaging a sister firm of Precedence Statistics.

Get a comprehensive Sterilized Packaging Market Size, Companies, Share free sample: https://www.towardspackaging.com/personalized-scope/5197

- Sustainable and eco-friendly packaging solutions in the North American region.

- Increasing healthcare expenditure due to rise in chronic disease is the major factor that drives the market.

- Aside from pharmaceutical and biological industry, food and beverages industry is anticipating growth in upcoming years.

- Rising environmental concerns pose a challenge for the sterilized packaging market.

Sterilized Packaging: Hemp for Healthcare Industry

The sterilized packaging market is utilized in protection of products due to its autoclaving, radiation and ethylene methods. Along with these qualities, ensuring safe transportation and preserving the integrity and sterility of the product are the leading objectives of the market. The growing concerns about infections provoked strict regulations and the consequence demands sterilization, that is, preventing contamination of products. Each sector has its own unique way of packaging, given the reason they want to prevent infection and contamination of their product, ensure its hygiene and present it as high-end premium product.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Increase in Healthcare Expenditure and Chronic Diseases Drive the Sterilized Packaging Market

The healthcare industry and pharmaceutical industry, food and beverage industry, and personal care and cosmetics industry, focus on these factors which are safety, hygiene and product integrity. All the industries ensure the protection of their product through sterilization, which, fulfils the three factors mentioned by the consumer market.

The awareness among consumers has increased the demand for sterilized materials due to concerns regarding food safety and hygiene. E-commerce is also another driving factor for the demand of grocery shopping and other sterilized packaging market. Here, e-commerce is the result of rising incomes of the middle class which heightens the consumption of packaged products.

Get a customized Sterilized Packaging Market report designed according to your preferences: https://www.towardspackaging.com/customization/5197

Strict Government Regulations and Material Compatibility Hinder the Market Growth

The sterilized packaging uses plastic-based, glass-based, metal-based material and restrictions on these materials due to environmental consciousness can impact their utilization in sterilized packaging. An additional factor, material compatibility, wherein the sterilization process should be withstood by a suitable material and also not compromise the product integrity, will be challenging point.

The packaging material and sterilization process, along with complex manufacturing processes will affect the cost and profit margin of the product due to high-production costs. Apart from this, limited awareness among the consumers and the premiumization of products leading to increased costs can be a hindrance for the sterilized packaging market. Government regulations, being time-consuming, can maximize the costs and can interrupt production process.

North America, Asia and Europe: Leaders to Sustain in Market

The utilization of AI in sterilized packaging includes inspection of packages with defects with the help of image analysis and it also helps to reduce human error. The algorithms can prevent failures with its prediction prototype and can ensure flow of production. The prototype can also predict growth of different industries. Apart from this, AI can analyse the supply chain and predict the outcomes of leading consumers and leading regions as well.

Major factors like analyzation of material properties and sustainability of packaging material can be analysed with the help of AI technology. The technologically innovative tools can generate packaging designs based on the market’s product, consumer preference. Automated packaging machine will be cost-effective for the manufacturers and the optimization of machine settings for different industry and different product with AI innovation is the additional factor.

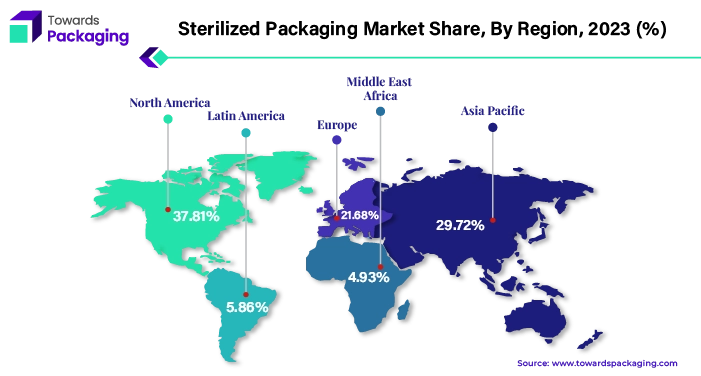

North America is the leading region for the sterilization packaging market. The market in this region is driven by developed healthcare infrastructure, utilization of advanced technologies and strict government regulations. The major factors like focus on innovation and sustainable packaging are contributing to the market.

- In May 2023, PCI Pharma Services, a manufacturing organization, discussed the need of development in on-going industry trends like potent oral solid dose, sterile injectable process, robotic technologies, increasing pipeline of biologics, supply chain risk mitigation, packaging abilities, and investments in new facilities.

Europe has established itself as the matured market with its focus on quality and regulatory compliance. In addition, increased growth rate of customized packaging solutions and recyclable packaging materials are the driving factors of the sterilized packaging market. Pharmaceutical and biotechnology companies are the highest contributors of the market.

- In March 2023, Aenova Group, an international contract manufacturer, has launched a program for its Sterile Manufacturing business, which is approved by the Italian Authorities and investments of approximately 15 million euros are underway and it was expanded further. The program was aimed at increasing capacity of prefilled syringes and also at fast-growing sterile dosage form.

Asia-Pacific is remarked as the fastest growing region. The rapid economic growth and rising population which increases the spending on healthcare expenditure is what drives the market. The potential in untapped market and a focus on cost-effective packaging is the goal for the region. Countries like China and India are the leading contributors in sterilized packaging market.

In December 2022, ESL, developed a processing plant, which prevents microorganisms from entering the package. With the help of the process, sterilized food product is filled in sterilized package and sealed in a hygienic environment. The processing plant became a part of DFA Dairy Brands division and was operated as Richmond Beverage Solutions and Pacific Dairy Solutions.

Major Breakthroughs in the Sterilized Packaging Market

- In May 2024, Coveris, a German company, had launched a statement stating that they will expand their production capacity for medical products with an investment over 8 million euros. The company aimed to rise the demand for medical packaging solutions.

- In February 2024, Syntegon’s Ampack launched a machine to fill bottles using the FBL filling machine with neck-handling capabilities. The bottles, made of all three plastics are checked for leaks and were operated with a range of bottle types, for example, bottles with eternal nutrition. The company also stated that the machine can fill up to 36,000 every hour.

Clamshells and Plastic: To be Widely Used in the Period

Clamshells dominate the sterilized packaging market. It is the dominating material due to its properties which are product visibility and protection and in result makes its utilization ideal for medical devices and pharmaceutical products. The next line is pouches which is used due to its packaging format and properties like high barriers for various products.

The bottles are in demand because of its child-resistant feature and providence of material, which is plastic and glass based on product characteristics. Apart from this, blister and ampoules are utilized in pharmaceutical and medical services due to their strong barrier properties. Vitals are in demand due to their storing and transporting capabilities and emphasis on material compatibility. Food and other industries use trays, tubs and other packaging format.

The plastic segment dominates the sterilized packaging market. Plastic is known for its versality and cost-effectiveness, although, its focus is on recycling and developing biodegradable plastics. The glass segment is used food and beverages sector, pharmaceutical sector, and cosmetics sector, given the reason it can provide inertness and protective packaging to the product due to its strong barrier properties. The metal segment is specially used for components like aerosol cans and rigid containers due to its barrier properties and durability, in addition, providing light weight assistance to the product.

More Insights in Towards Packaging

Corrugated Mailers Market Size, Growth, Development and Insight

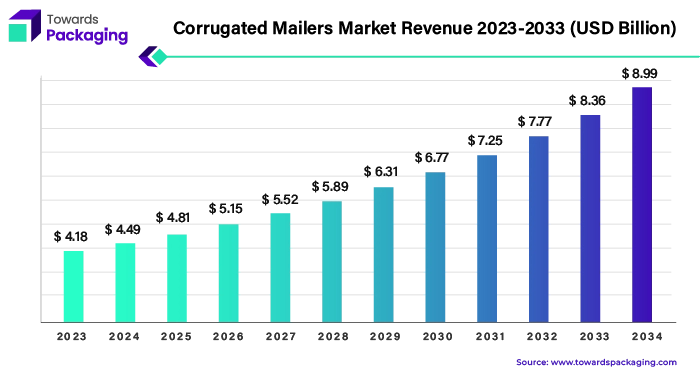

The global corrugated mailers market size reached US$ 4.18 billion in 2023 and is projected to hit around US$ 8.99 billion by 2034, expanding at a CAGR of 7.30% during the forecast period from 2024 to 2033.

Green Packaging Film Market Size, Trends, Growth Rate

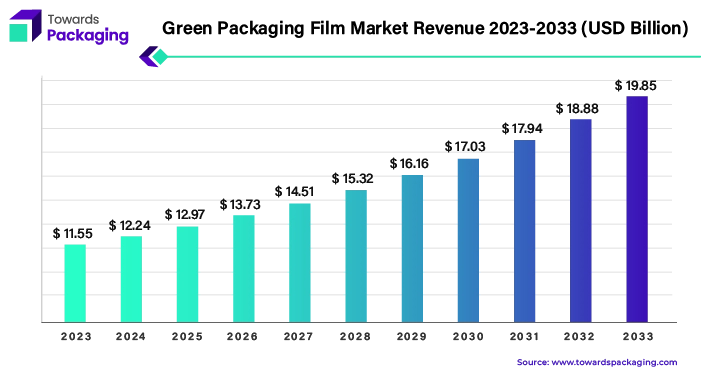

The global green packaging film market size reached US$ 11.55 billion in 2023 and is projected to hit around US$ 19.85 billion by 2033, expanding at a CAGR of 5.93% during the forecast period from 2024 to 2033.

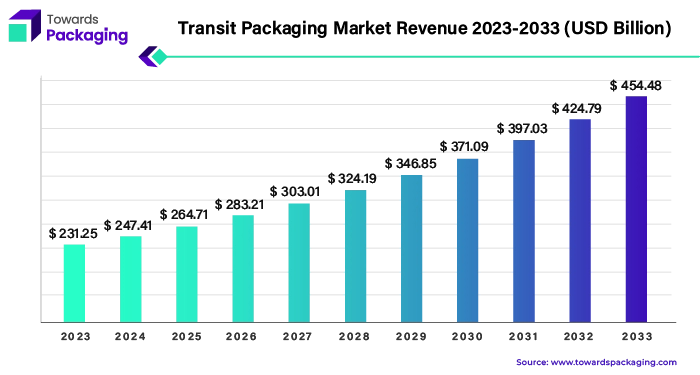

Transit Packaging Market Size, Companies Report 2023 - 2033

The global transit packaging market size reached US$ 231.25 billion in 2023 and is projected to hit around US$ 454.48 billion by 2033, expanding at a CAGR of 6.99% during the forecast period from 2024 to 2033.

- The global paper machinery market size reached US$ 3.83 billion in 2023 and is projected to hit around US$ 5.41 billion by 2033, expanding at a CAGR of 4.43% during the forecast period from 2024 to 2033.

- The global semiconductor packaging market size reached US$ 41.05 billion in 2023 and is projected to hit around US$ 108.82 billion by 2033, expanding at a CAGR of 10.24% during the forecast period from 2024 to 2033.

- The global adherence packaging market size reached US$ 1.1 billion in 2023 and is projected to hit around US$ 2.05 billion by 2033, expanding at a CAGR of 6.43% during the forecast period from 2024 to 2033.

- The global polystyrene packaging market size reached USD 24.58 billion in 2023 and is projected to hit around USD 37.92 billion by 2033, expanding at a CAGR of 4.43% during the forecast period from 2024 to 2033.

- The global ethical label market size is estimated to reach USD 1815.34 billion by 2033, up from USD 948.65 billion in 2023, at a compound annual growth rate (CAGR) of 6.83% from 2024 to 2033.

- The global wine packaging market size is estimated to reach USD 10.99 billion by 2033, up from USD 6.11 billion in 2023, at a compound annual growth rate (CAGR) of 6.19% from 2024 to 2033.

- The global corrugated boxes market size reached USD 163.07 billion in 2023 and is projected to hit around USD 269.19 billion by 2033, expanding at a CAGR of 5.14% during the forecast period from 2024 to 2033.

Top Companies in the Sterilized Packaging Market

- Amcor plc

- Berry Global Inc

- DuPont

- 3M Company

- West Pharmaceutical Services Inc

- Bemis Company, Inc

- Placon Corporation

- Coveris Holdings S.A.

- SteriPack Group Ltd

- Sealed Air Corporation

- Sonoco Products Company

- AptarGroup Inc

- Nelipak Healthcare Packaging

- Wipak Group

- Printpack

Sterilized Packaging Market TOC

Executive Summary

- Market Overview

- Key Findings

- Market Size and Growth Prospects

- Trends and Opportunities

- Competitive Landscape

Introduction

- Market Definition

- Scope of the Study

- Research Methodology

- Assumptions and Limitations

Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Market Challenges

- Impact Analysis of Drivers and Restraints

Sterilized Packaging Market Segment Analysis

By Product

- Clamshells

- Market Size and Forecast

- Trends and Opportunities

- Pouches

- Market Size and Forecast

- Trends and Opportunities

- Bottles

- Market Size and Forecast

- Trends and Opportunities

- Blisters and Ampoules

- Market Size and Forecast

- Trends and Opportunities

- Vials

- Market Size and Forecast

- Trends and Opportunities

- Others

- Market Size and Forecast

- Trends and Opportunities

By Material

- Plastic

- Market Size and Forecast

- Trends and Opportunities

- Glass

- Market Size and Forecast

- Trends and Opportunities

- Metal

- Market Size and Forecast

- Trends and Opportunities

- Others

- Market Size and Forecast

- Trends and Opportunities

By Sterilization Method

- Chemical

- Market Size and Forecast

- Trends and Opportunities

- Radiation

- Market Size and Forecast

- Trends and Opportunities

- High Temperature/Pressure

- Market Size and Forecast

- Trends and Opportunities

By End-user Industry

- Medical And Surgical

- Market Size and Forecast

- Trends and Opportunities

- Pharmaceutical and Biological

- Market Size and Forecast

- Trends and Opportunities

- Food and Beverage

- Market Size and Forecast

- Trends and Opportunities

- Others

- Market Size and Forecast

- Trends and Opportunities

Regional Analysis

North America

- U.S.

- Market Size and Forecast

- Trends and Opportunities

- Canada

- Market Size and Forecast

- Trends and Opportunities

- Mexico

- Market Size and Forecast

- Trends and Opportunities

Europe

- U.K.

- Market Size and Forecast

- Trends and Opportunities

- France

- Market Size and Forecast

- Trends and Opportunities

- Germany

- Market Size and Forecast

- Trends and Opportunities

- Italy

- Market Size and Forecast

- Trends and Opportunities

- Spain

- Market Size and Forecast

- Trends and Opportunities

- Rest of Europe

- Market Size and Forecast

- Trends and Opportunities

Asia Pacific

- China

- Market Size and Forecast

- Trends and Opportunities

- Japan

- Market Size and Forecast

- Trends and Opportunities

- India

- Market Size and Forecast

- Trends and Opportunities

- South Korea

- Market Size and Forecast

- Trends and Opportunities

- South-East Asia

- Market Size and Forecast

- Trends and Opportunities

- Rest of Asia Pacific

- Market Size and Forecast

- Trends and Opportunities

Latin America

- Brazil

- Market Size and Forecast

- Trends and Opportunities

- Argentina

- Market Size and Forecast

- Trends and Opportunities

- Rest of Latin America

- Market Size and Forecast

- Trends and Opportunities

Middle East & Africa

- GCC Countries

- Market Size and Forecast

- Trends and Opportunities

- South Africa

- Market Size and Forecast

- Trends and Opportunities

- Rest of Middle East & Africa

- Market Size and Forecast

- Trends and Opportunities

Competitive Landscape

- Market Share Analysis

- Competitive Strategies

- Key Developments

Competition Analysis

- Competitive Benchmarking

- Market Positioning of Key Players

- Product Offerings

- R&D Investment

- Business Strategies

- Company Profiles

- Overview

- Financial Performance

- Product Portfolio

- Recent Developments

- SWOT Analysis

- Market Share Analysis

- Market Share by Key Players

- Market Share by Region

- Strategic Initiatives

- Mergers and Acquisitions

- Partnerships and Collaborations

- New Product Launches

- Expansions

- Competitor Analysis by Segment

- Analysis of Top Competitors in Each Market Segment

- Competitive Landscape in Each Region

- Emerging Players

- Profiles of Emerging Companies

- Innovations and Technological Advancements

- Impact of Major Events

- Analysis of Key Market Events (e.g., regulatory changes, economic impacts)

- Analysis of Key Market Events (e.g., regulatory changes, economic impacts)

Opportunity Assessment

Market Opportunity Analysis

- Identification of Market Opportunities

- Opportunity Analysis by Product

- Opportunity Analysis by Material

- Opportunity Analysis by Sterilization Method

- Opportunity Analysis by End-user Industry

Regional Opportunity Analysis

- North America

- Market Opportunities

- Growth Drivers

- Key Trends

- Europe

- Market Opportunities

- Growth Drivers

- Key Trends

- Asia Pacific

- Market Opportunities

- Growth Drivers

- Key Trends

- Latin America

- Market Opportunities

- Growth Drivers

- Key Trends

- Middle East & Africa

- Market Opportunities

- Growth Drivers

- Key Trends

Emerging Trends and Innovations

- Technological Advancements

- Sustainability Trends

- Consumer Preferences

Investment Analysis

- Key Investment Opportunities

- ROI Analysis

- Risk Factors

Strategic Recommendations

- Market Entry Strategies

- Product Development

- Expansion Strategies

- Partnerships and Collaborations

Go-to-Market Strategies (Region Selection)

- Market Entry Strategy

- Market Assessment and Opportunity Identification

- Regulatory and Compliance Requirements

- Product Launch Strategy

- Product Development and Innovation

- Packaging and Branding

- Pricing Strategy

- Distribution Strategy

- Distribution Channels and Network

- Partnership and Collaboration

- E-commerce and Digital Presence

- Marketing and Promotion Strategy

- Target Audience Identification

- Advertising and Promotion Campaigns

- Content Marketing and Thought Leadership

- Trade Shows and Industry Events

- Sales Strategy

- Sales Force Training and Development

- Key Account Management

- Customer Relationship Management (CRM)

- Sales Performance Metrics and KPIs

New Product Development

- Concept Development and Ideation

- Market Research and Consumer Insights

- Concept Testing and Feasibility Analysis

- Design and Prototyping

- Design Thinking Approach

- Prototyping and Iteration

- Material Selection

- Product Testing and Validation

- Performance Testing

- Safety and Compliance Testing

- Feedback and Improvement

- Development and Manufacturing

- Pilot Production

- Scaling Up Manufacturing

- Quality Control and Assurance

- Launch and Commercialization

- Go-to-Market Strategy

- Marketing and Promotion

- Distribution and Sales Channels

- Post-Launch Evaluation

- Market Feedback and Analysis

- Continuous Improvement and Innovation

- Product Lifecycle Management

Plan Finances/ROI Analysis

- Financial Planning

- Budgeting and Cost Estimation

- Financial Projections

- Break-even Analysis

- ROI Analysis

- Return on Investment (ROI) Calculation

- Payback Period Analysis

- Profit Margin Analysis

- Cost-Benefit Analysis

- Initial Investment Costs

- Ongoing Operational Costs

- Benefits and Revenue Projections

- Funding and Investment

- Sources of Funding

- Investment Strategies

- Risk Management

- Financial Performance Metrics

- Key Financial Indicators

- Performance Monitoring

- Reporting and Analytics

Supply Chain Intelligence/Streamline Operations

- Supply Chain Overview

- Supply Chain Structure

- Key Stakeholders

- Roles and Responsibilities

- Procurement Strategies

- Sourcing and Supplier Selection

- Supplier Relationship Management

- Cost Management

- Risk Mitigation

- Manufacturing and Production

- Production Planning and Scheduling

- Lean Manufacturing Principles

- Quality Control and Assurance

- Technology and Automation

- Inventory Management

- Inventory Control Techniques

- Demand Forecasting

- Safety Stock Management

- Inventory Optimization

- Logistics and Distribution

- Transportation and Warehousing

- Distribution Network Design

- Logistics Management

- Last Mile Delivery

- Supply Chain Visibility and Transparency

- Real-time Tracking and Monitoring

- Data Integration and Analytics

- Transparency and Accountability

- Sustainable Supply Chain Practices

- Environmental Impact Reduction

- Ethical Sourcing and Fair Trade

- Circular Economy Principles

- Supply Chain Risk Management

- Risk Identification and Assessment

- Contingency Planning

- Crisis Management

- Performance Measurement and KPIs

- Key Performance Indicators (KPIs)

- Performance Analysis

- Continuous Improvement

- Technology and Innovation

- Supply Chain Technology Trends

- Digital Transformation

- Blockchain and IoT in Supply Chain

- Strategic Partnerships and Collaborations

- Collaboration with Suppliers and Partners

- Joint Ventures and Alliances

- Industry Collaborations

- Case Studies and Best Practices

- Successful Supply Chain Strategies

- Lessons Learned

- Industry Benchmarks

Cross-Sectional Analysis

Regional Comparison

Market Trends and Dynamics by Region

- North America

- Market Size and Growth Trends

- Key Drivers: Regulatory requirements, advanced healthcare infrastructure

- Market Challenges: High competition, cost pressures

- Europe

- Market Size and Growth Trends

- Key Drivers: Stringent regulations, innovation in packaging technologies

- Market Challenges: Market saturation, economic fluctuations

- Asia Pacific

- Market Size and Growth Trends

- Key Drivers: Rapid industrialization, growing healthcare and pharmaceutical sectors

- Market Challenges: Diverse regulatory landscapes, logistical issues

- Latin America

- Market Size and Growth Trends

- Key Drivers: Emerging markets, increasing demand for healthcare products

- Market Challenges: Economic instability, regulatory hurdles

- Middle East & Africa

- Market Size and Growth Trends

- Key Drivers: Expanding healthcare infrastructure, rising awareness of sterilized packaging

- Market Challenges: Limited technological advancements, political instability

Growth Drivers and Constraints

- Regional regulatory requirements

- Economic conditions and investment climate

- Technological advancements and innovation adoption

Regional Opportunities and Challenges

- Opportunities for growth in emerging markets

- Challenges related to regulatory compliance and economic fluctuations

Product Segmentation Analysis

- Market Performance of Different Products

- Clamshells

- Market Share and Growth Trends

- Popularity in specific sectors (e.g., food and beverage, medical)

- Pouches

- Market Share and Growth Trends

- Usage in pharmaceutical and biological applications

- Bottles

- Market Share and Growth Trends

- Demand in medical and personal care industries

- Blisters and Ampoules

- Market Share and Growth Trends

- Key applications in pharmaceuticals

- Vials

- Market Share and Growth Trends

- Usage in vaccines and injectable drugs

- Others

- Emerging products and niche applications

- Clamshells

- Product Innovations and Trends

- New product developments

- Technological advancements in packaging materials and design

- Comparative Analysis by Product Type

- Comparative performance in different end-user industries

- Market share and growth potential of each product type

Material-Based Analysis

- Market Performance by Material Type

- Plastic

- Market Size and Growth Trends

- Innovations in plastic materials for sterilized packaging

- Glass

- Market Size and Growth Trends

- Advantages and limitations of glass in sterilized packaging

- Metal

- Market Size and Growth Trends

- Applications and trends in metal packaging

- Others

- Emerging materials and their impact on the market

- Plastic

- Material-Specific Trends and Innovations

- Development of new materials with enhanced properties

- Sustainability trends and recyclable materials

- Comparative Analysis by Material Type

- Performance comparison of different materials

- Cost, durability, and application suitability

Sterilization Method Analysis

- Market Dynamics by Sterilization Method

- Chemical Sterilization

- Market Size and Growth Trends

- Common chemicals used and their effectiveness

- Radiation Sterilization

- Market Size and Growth Trends

- Advantages in terms of efficacy and safety

- High Temperature/Pressure Sterilization

- Market Size and Growth Trends

- Applications and effectiveness in different industries

- Chemical Sterilization

- Technological Advancements and Trends

- Innovations in sterilization technologies

- Emerging methods and their potential impact

- Comparative Analysis by Sterilization Method

- Efficiency, cost, and suitability of each method for different products

- Regulatory and safety considerations

End-User Industry Analysis

- Market Performance in Various End-User Industries

- Medical and Surgical

- Market Size and Growth Trends

- Specific requirements and applications

- Pharmaceutical and Biological

- Market Size and Growth Trends

- Demand for sterilized packaging in drug manufacturing

- Food and Beverage

- Market Size and Growth Trends

- Impact of sterilized packaging on food safety and shelf life

- Others

- Applications in personal care, cosmetics, and other sectors

- Medical and Surgical

- Trends and Opportunities by End-User Industry

- Emerging trends and demands in each industry

- Opportunities for growth and innovation

- Comparative Analysis by End-User Industry

- Market dynamics and growth potential across different industries

- Analysis of how industry-specific needs influence packaging choices

Business Model Innovation in Sterilized Packaging Market

Value Proposition Innovation

- Enhanced Product Features

- Advanced Materials: Develop and offer sterilized packaging solutions using innovative materials that improve product safety, extend shelf life, or enhance usability.

- Sustainability: Introduce eco-friendly packaging options that use recyclable or biodegradable materials to meet growing environmental concerns and regulatory pressures.

- Customization: Provide tailored packaging solutions designed to meet specific needs of different industries, such as custom sizes, shapes, or sterilization methods.

- Technology Integration

- Smart Packaging: Implement technologies such as QR codes, NFC tags, or sensors that provide real-time information on product integrity, traceability, and compliance.

- Digital Integration: Offer digital platforms for tracking and managing inventory, orders, and supply chain logistics to streamline operations for customers.

- Enhanced Sterilization Methods

- Innovative Sterilization Techniques: Develop new or improved sterilization methods that offer superior efficacy, lower costs, or faster processing times compared to traditional methods.

- Innovative Sterilization Techniques: Develop new or improved sterilization methods that offer superior efficacy, lower costs, or faster processing times compared to traditional methods.

Revenue Model Innovation

- Subscription-Based Services

- Recurring Revenue Streams: Offer subscription models for packaging supplies where customers receive regular deliveries of sterilized packaging materials, ensuring consistent revenue and customer retention.

- Value-Added Services

- Consulting and Support: Provide additional services such as regulatory compliance consulting, packaging design, and supply chain optimization, creating new revenue streams and increasing customer loyalty.

- Training and Certification: Offer training programs and certification for proper handling and use of sterilized packaging materials, adding value for customers and creating new revenue opportunities.

- Flexible Pricing Models

- Pay-Per-Use: Implement flexible pricing structures based on usage, volume, or performance metrics rather than fixed pricing, aligning costs with the actual value delivered to customers.

- Pay-Per-Use: Implement flexible pricing structures based on usage, volume, or performance metrics rather than fixed pricing, aligning costs with the actual value delivered to customers.

Distribution and Channel Innovation

- Direct-to-Consumer Models

- Online Platforms: Launch e-commerce platforms or digital marketplaces where customers can directly purchase sterilized packaging solutions, bypassing traditional distribution channels.

- Partnerships and Alliances

- Strategic Partnerships: Form alliances with industry players, such as healthcare providers, pharmaceutical companies, or food manufacturers, to co-develop and distribute specialized sterilized packaging solutions.

- Collaborative Logistics: Partner with logistics companies to offer integrated packaging and delivery solutions, improving efficiency and reducing costs.

- Omni-Channel Distribution

- Multi-Channel Strategy: Utilize a combination of direct sales, distributors, and online channels to reach a broader customer base and enhance market penetration.

- Multi-Channel Strategy: Utilize a combination of direct sales, distributors, and online channels to reach a broader customer base and enhance market penetration.

Operational Model Innovation

- Lean Manufacturing

- Efficiency Improvements: Implement lean manufacturing techniques to reduce waste, optimize production processes, and lower costs while maintaining high quality in sterilized packaging products.

- Agile Supply Chain

- Flexibility and Responsiveness: Develop a more agile supply chain capable of quickly adapting to changing market demands, regulatory changes, and customer requirements.

- Automation and Technology

- Advanced Manufacturing Technologies: Invest in automation and robotics to enhance production efficiency, accuracy, and scalability in the manufacturing of sterilized packaging.

Customer Relationship Management

- Customer Experience Enhancement

- Personalized Service: Offer tailored solutions and dedicated account management to address specific customer needs and preferences, enhancing overall customer satisfaction and loyalty.

- Feedback and Improvement

- Customer Feedback Mechanisms: Implement systems for gathering and analyzing customer feedback to continuously improve product offerings and service quality.

- Engagement and Education

- Customer Education: Provide resources, workshops, and webinars to educate customers on the benefits and proper use of sterilized packaging solutions, fostering a deeper relationship and higher value perception.

Market Expansion Strategies

- New Market Penetration

- Geographical Expansion: Explore opportunities to enter emerging markets with high growth potential for sterilized packaging solutions, leveraging localized strategies to address specific regional needs.

- Industry Diversification

- Cross-Industry Solutions: Develop packaging solutions for new industries or applications beyond the traditional sectors, broadening the market scope and creating new revenue opportunities.

Conclusion

- Key Findings and Insights

- Strategic Recommendations

- Future Outlook

Appendix

- Abbreviations

- Methodology

- References

- List of Tables and Figures

Act Now and Get Your Sterilized Packaging Market Size, Companies and Insight 2033 @ https://www.towardspackaging.com/price/5197

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/