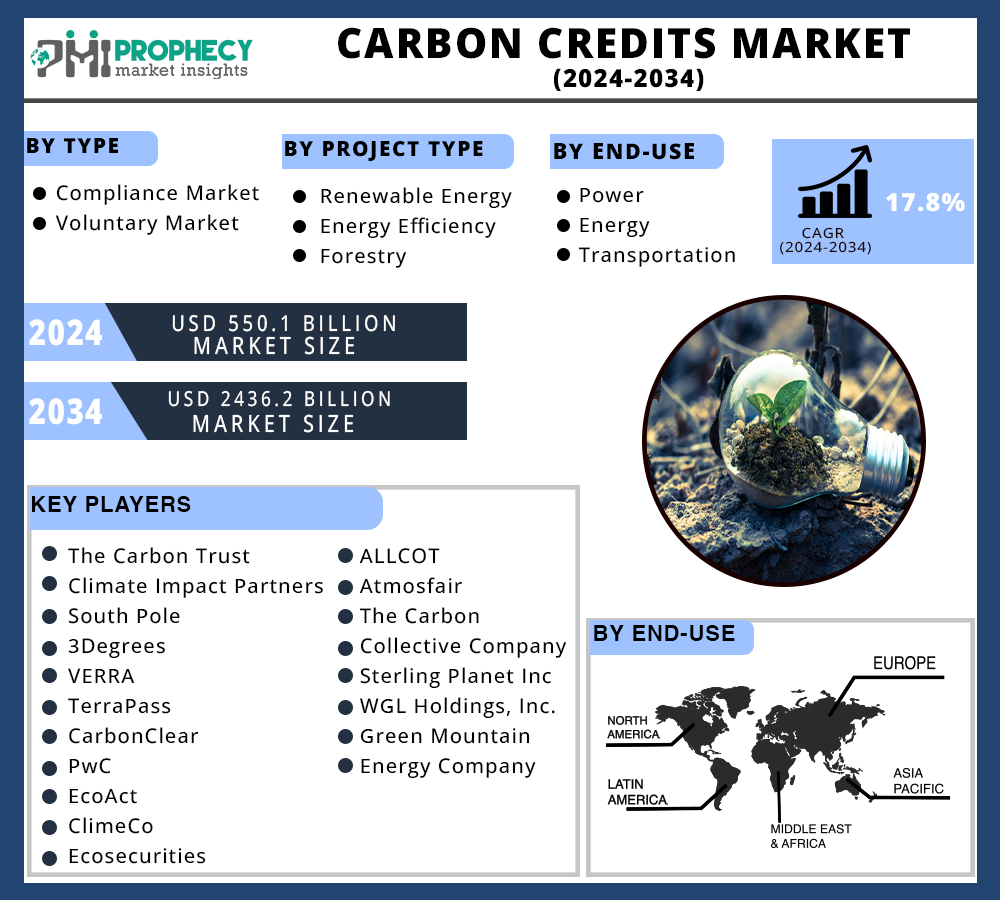

Covina, Aug. 25, 2024 (GLOBE NEWSWIRE) -- According to Prophecy Market Insights, the global carbon credits market size and share value is projected to grow from USD 550.1 Billion in 2024 and is forecasted to reach USD 2436.2 Billion by 2034, exhibiting a compound annual growth rate (CAGR) of 17.8% during the forecast period (2024 - 2034).

Carbon Credit Market Report Overview

Carbon credits are a crucial mechanism in the global effort to combat climate change. They represent a tradable certificate or permit that allows the holder to emit a certain amount of carbon dioxide (CO2) or other greenhouse gases. The concept of carbon credits is rooted in cap-and-trade systems, where a cap is set on the total level of greenhouse gas emissions and entities are allowed to trade emission allowances within this cap.

Projects that reduce prevent, or sequester greenhouse gas emissions produce carbon credits. Reforestation and afforestation, energy efficiency upgrades, renewable energy projects, and methane capture from landfills and agricultural activities are some of these projects.

Download a Free Sample Research Report with Latest Industry Insights: https://www.prophecymarketinsights.com/market_insight/Insight/request-sample/5517

Our Free Sample Report includes:

- Overview & introduction of market study

- Revenue and CAGR of the market

- Drivers & Restrains factors of the market

- Major key players in the market

- Regional analysis of the market with a detailed graph

- Detailed segmentation in tabular form of market

- Recent developments/news of the market

- Opportunities & Challenges of the Market

Competitive Landscape:

The Carbon Credit Market is characterized by rapid growth, technological innovation, and fierce competition. Companies are expanding their global presence, focusing on sustainability, and diversifying their service offerings to stay competitive.

Some of the Key Market Players:

- The Carbon Trust

- Climate Impact Partners

- South Pole

- 3Degrees

- VERRA

- TerraPass

- CarbonClear

- PwC

- EcoAct

- ClimeCo

- Ecosecurities

- ALLCOT

- Atmosfair

- The Carbon Collective Company

- Sterling Planet Inc.

- WGL Holdings, Inc.

- Green Mountain Energy Company

To Know More on Additional Market Players, Download a Free Sample Report Here: https://www.prophecymarketinsights.com/market_insight/Insight/request-pdf/5517

Analyst View:

International agreements and governmental laws have a major role in the market expansion for carbon credits. There is a strong market for carbon credits as a result of the Paris Agreement and national laws designed to cut greenhouse gas emissions. High carbon neutrality targets are being set by governments and businesses, which is driving up demand for carbon credits as a way to achieve these objectives.

Market Dynamics:

Drivers:

Growing Focus on High-Quality Credits

- The quality of carbon credits is becoming more and more important, with an emphasis on making sure that credits reflect real, additional, and long-term reductions in emissions. Verified Carbon Standard (VCS) and Gold Standard certifications are two examples of standards and certifications that are becoming more and more well-known because they give market participants confidence and certainty.

Request for FLAT 30% Discount on this Report @ https://www.prophecymarketinsights.com/market_insight/Insight/request-discount/5517

Market Trends:

Expanding Market Participation

- A wider range of stakeholders, such as governments, corporations, and non-governmental organizations (NGOs), are participating in the carbon credits market at an increasing rate.

Segmentation:

Carbon Credit Market is segmented based on Type, Project Type, End-User, and Region.

Type Insights

- This sector includes the Compliance Market and the Voluntary Market. The compliance market segment is expected to dominate the target market growth as it operates under established regulatory frameworks that mandate emissions reduction targets for industries and organizations.

Project Type Insights

- This sector includes Renewable Energy, Energy Efficiency, Forestry, and Others. Renewable energy segment is expected to dominate the target market growth as there is a strong and growing demand for carbon credits from renewable energy projects due to global commitments to reduce carbon emissions. Governments, corporations, and other organizations are increasingly investing in renewable energy projects to meet their sustainability goals and offset their carbon footprints.

End-User Insights

- This sector includes Power, Energy, Transportation, and Others. Power segment is expected to dominate the target market growth as many power companies have set ambitious sustainability and carbon neutrality goals.

Request FREE Unlimited Customization on this Report @ https://www.prophecymarketinsights.com/market_insight/Insight/request-customization/5517

Recent Development:

- In March 2024, According to managing director and chief executive Satyajit Ganguly of Power Exchange India Ltd. (PXIL), which is supported by the NSE and NCDEX, plans to introduce its carbon-credit trading platform by the second quarter of the upcoming fiscal year (FY25). The company is now developing the necessary technology for the product. The company is looking at onboarding more companies and businesses as members in order to achieve higher penetration, as carbon trading starts in the country.

Regional Insights

- North America: This region invests heavily in clean technologies and innovative solutions to reduce emissions. This includes advancements in renewable energy, energy efficiency, and carbon capture technologies.

- Asia Pacific: The establishment and expansion of carbon markets in Asia-Pacific countries are expected to enhance market liquidity and create new opportunities for carbon trading.

Browse Detail Report on "Carbon Credit Market Size, Share, By Type (Compliance Market, Voluntary Market), By Project Type (Renewable Energy, Energy Efficiency, Forestry, Others), By End-Use (Power, Energy, Transportation, Others), and By Region - Trends, Analysis, and Forecast till 2034" with complete TOC @ https://www.prophecymarketinsights.com/market_insight/carbon-credits-market-5517

About Us:

Prophecy Market Insights is a specialized market research, analytics, marketing and business strategy, and solutions company that offer strategic and tactical support to clients for making well-informed business decisions and to identify and achieve high value opportunities in the target business area. Also, we help our client to address business challenges and provide best possible solutions to overcome them and transform their business.

Prophecy’s expertize area covers products, services, latest trends, developments, market growth factors, and challenges along with market forecast in various business areas such as Healthcare, Pharmaceutical, Biotechnology, Information Technology (IT), Automotive, Industrial, Chemical, Agriculture, Food and Beverage, Energy, and Oil and Gas. We also offer various other services such as, data mining, information management, and revenue enhancement suggestions.

Contact Us:

Prophecy Market Insights

US: 964 E. Badillo Street

#2042 Covina,

CA 91724

US toll free: +1 860 531 2574

Rest of world: + 91 7775049802

Follow us on: LinkedIn | Twitter