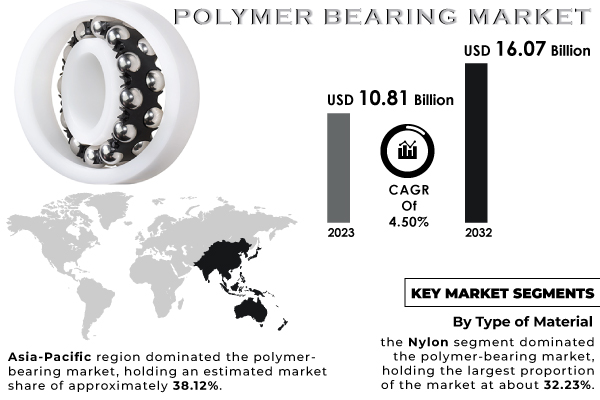

Austin, Aug. 27, 2024 (GLOBE NEWSWIRE) -- As per the SNS Insider research, The Polymer Bearing Market size is projected to reach USD 16.07 billion by 2032 and grow at a CAGR of 4.50% over the forecast period of 2024-2032.

Customization and Specialized Products in Polymer Bearing Drive Market Growth.

The increasing demand for custom and specialized polymer bearings is stimulated by the necessity of bespoke solutions for multiple industries. Market developments and key player activities showcase the growing interest in such bearings and the attempt by the sector to meet the demand. According to the U.S. Department of Commerce 2023 report, the polymer bearings market exhibited an annual growth rate of 7% which can serve as a reflection of the increasing interest in requirements-specific solutions.

Request Sample Report of Polymer Bearing Market 2023 @ https://www.snsinsider.com/sample-request/2485

Key Players

- ISB Industries (Italy)

- Waukesha Bearings (US)

- SKF (Sweden)

- OILES CORPORATION (Japan)

- Xinzhou Bearing Industrial Inc. (China)

- Synnovia (UK), Igus (Germany)

- Dotmar Engineering Plastics (Australia)

- Kashima Bearings, Inc. (Japan)

- OILES CORPORATION (Japan)

- KMS Bearings, Inc. (US)

- TOK, inc. (Japan)

Moreover, among the recent developments in the sector are new technologies of polymer bearings launched by key players. For example, SKF started offering a range of custom polymer bearings in 2023 to meet the requirements of their clients working in the aerospace and automotive industries and looking for high-performance applications. In 2024, Igus expanded its selection of high-performance polymer bearings focused on its use in industrial automation and custom assemblies. Finally, further investment in research and development in the sector also supports the statement.

Furthermore, technological advancements in polymer materials and manufacturing techniques have significantly enhanced the performance and durability of polymer bearings. Recent innovations have focused on developing high-performance polymers and composites that can withstand extreme conditions. For example, in 2023, the introduction of PEEK composites by DuPont revolutionized the sector with their superior heat resistance and mechanical strength, making them ideal for demanding applications in the aerospace and automotive industries.

Additionally, in early 2024, SKF unveiled a new generation of polymer bearings incorporating advanced tribological coatings that improve wear resistance and reduce friction, extending the bearings' lifespan in harsh environments. These developments reflect a broader trend towards creating more robust and versatile polymer bearings, driven by the increasing demands for high-performance materials in various high-stress applications.

Polymer Bearing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.81 Billion |

| Market Size by 2032 | US$ 16.07 Billion |

| CAGR | CAGR of 4.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Material (Phenolics, Nylon, Teflon, Acetal, UHMWPE (Ultra High Molecular Weight Polyethylene),Others) • By End-Use Industry (Automobile, Textile, Medical & Pharmaceutical, Packaging, Elevators, Food Processing, Office Products, Chemical Industry, Photography, Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| DRIVERS | • Expanding demand across industries for polymer bearings. • Investing more in sophisticated materials for the automobile industry. • Lower cost of maintenance. |

If You Need Any Customization on Polymer Bearing Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/2485

Segmentation Analysis

By Type of Material

The nylon segment held the largest market share at around 68.35% in 2023. Nylon, recognized for its strength, durability, and resistance to wear and tear, is increasingly favored in applications requiring high performance and reliability. Recent advancements have enhanced its suitability for demanding environments by improving its heat resistance and reducing friction. For example, in 2023, advancements in nylon formulations and processing techniques led to the development of new grades with enhanced mechanical properties and lower moisture absorption. This has expanded its use in automotive, aerospace, and industrial applications, where traditional materials might falter under stress. Additionally, nylon’s cost-effectiveness compared to metals and its ease of processing contribute to its growing adoption.

By End-Use Industry

The automobile industry is leading in the polymer-bearing market. Due to its substantial demand for high-performance, lightweight components that enhance vehicle efficiency and durability. Polymer bearings offer advantages such as reduced friction, lower weight, and corrosion resistance, which are crucial for improving fuel efficiency and extending the lifespan of automotive parts. Recent advancements in polymer materials have further fueled this growth, with innovations in composites and engineered polymers providing enhanced strength and thermal stability suitable for demanding automotive environments.

Regional Landscape:

Asia Pacific held the highest market share in the polymer bearing market around 38.12% in 2023. China’s automotive sector alone accounted for a considerable portion of global polymer bearing consumption, fueled by the country’s growing vehicle production and emphasis on technological advancements. Additionally, Asia-Pacific’s extensive manufacturing base, which includes industries such as machinery, electronics, and consumer goods, further propels the demand for polymer bearings due to their benefits in reducing friction and maintenance costs. The region's competitive manufacturing environment and increasing adoption of advanced polymer technologies, coupled with supportive government policies and investments, have solidified Asia-Pacific's leading position in the global polymer bearing market.

Buy Full Research Report on Polymer Bearing Market 2024-2032 @ https://www.snsinsider.com/checkout/2485

Recent Developments

- In 2023, SKF introduced a new line of polymer bearings with enhanced tribological properties. These bearings feature advanced coatings that improve wear resistance and reduce friction, addressing the growing demands for high-performance components in automotive and industrial applications.

- In 2024, Igus launched a series of custom polymer bearings designed for specific industrial automation needs. The new product line includes bearings made from high-performance materials that offer superior durability and resistance to extreme temperatures, catering to the needs of high-precision machinery.

Key Takeaways:

- The Asia-Pacific region holds the largest market share, driven by rapid industrialization, a strong automotive sector, and significant investments in infrastructure development.

- Rising demand for customized and specialized polymer bearings tailored to specific application requirements is shaping market growth

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

7. Polymer Bearing Market Segmentation, by Type of Material

8. Polymer Bearing Market Segmentation, by End-Use Industry

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Description of Polymer Bearing Market Report 2024-2032 @ https://www.snsinsider.com/reports/polymer-bearing-market-2485

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.