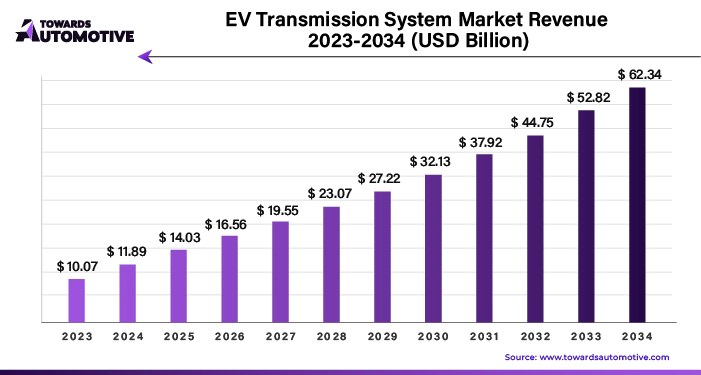

Ottawa, Sept. 02, 2024 (GLOBE NEWSWIRE) -- The global EV transmission system market size was is predicted to increase from USD 10.07 billion in 2023 to approximately USD 52.82 billion by 2033, a study published by Towards Automotive a sister firm of Precedence Research.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1328

Key Takeaways

- Asia-Pacific led the EV transmission system market in 2023.

- By region, Europe is expected to grow with the highest CAGR during the forecast period.

- By vehicle type, the battery electric vehicles segment dominated the market in 2023.

- By vehicle type, the hybrid electric vehicles segment is estimated to exhibit the fastest growth rate during the forecast period.

- By transmission type, single-speed transmission segment held a dominant share of the market in 2023.

- By transmission type, the multi-speed transmission segment is expected to grow with the highest CAGR during the forecast period.

- By transmission system, the AMT transmission segment dominated the market in 2023.

- By transmission system, the CVT transmission segment is expected to grow with the fastest rate during the forecast period.

Recent Developments

- Hyundai and Kia's Uni Wheel (November 2023): South Korean automotive giants Hyundai and Kia have introduced a groundbreaking EV drivetrain system called the “Uni Wheel.” This innovative system, designed to be used directly on wheels, represents a significant leap in drivetrain technology, offering new possibilities for vehicle design and performance.

- Toyota's Stimulated Manual EV Transmission (December 2023): Toyota, the Japanese automotive leader, has unveiled a revolutionary manual EV transmission featuring up to 14 gears. This system aims to replicate the driving experience of traditional manual transmissions, providing a unique blend of modern electric powertrains with classic driving dynamics.

- BMW's Consideration of Stimulated Gearbox and Vibration Feedback (July 2023): BMW, headquartered in Munich, has announced plans to explore a stimulated gearbox and vibration feedback system for its future mechanic electric vehicles (MEVs). This innovation is designed to enhance driver engagement by simulating the tactile feedback and shifting experience found in conventional vehicles.

Top Companies in EV Transmission System Market

- Allison Transmission Inc.

- Aisin Seiki Co., Ltd.

- AVL List GmbH

- Continental AG

- BorgWarner Inc.

- Dana Incorporated

- EATON Corporation

- Denso Corporation

- GKN Automotive Limited

- Hitachi Automotive Systems Ltd.

Get the latest insights on automotive industry segmentation with our Annual Membership: Get a Subscription

The Rapid Expansion and Future of EV Transmission Systems

The electric vehicle (EV) transmission system sector is rapidly expanding and innovating, driven by the automotive industry's shift towards electric mobility. As the demand for electric vehicles grows, so does the need for high-performance, reliable, and efficient transmission systems that are specifically designed for electric drivetrains. This shift is fueled by global trends, such as stringent emission regulations, increased environmental awareness, and advancements in EV technology.

With the automotive market valued at USD 4,070.19 billion in 2023 and projected to exceed USD 6,678.28 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of over 5.66%, the sector is poised for significant transformation.

Several factors are driving this growth. Technological advancements play a pivotal role, as innovations in energy storage systems, motor designs, and power electronics lead to more compact and efficient transmission solutions. Automakers are focused on improving transmission efficiency, reducing weight and size, and enhancing overall system performance. These developments are essential for creating transmission systems that cater to the unique requirements of electric vehicles.

Strategic partnerships and collaborations are also crucial to advancing the EV transmission system market. By forming alliances between automakers and transmission system suppliers, companies can pool their expertise to develop and integrate technologies. These collaborations are vital for driving innovation and improving the performance of EV transmission systems.

Moreover, the rise of autonomous driving technologies is reshaping the requirements for transmission systems. Future systems will need to support features such as adaptive cruise control, predictive powertrain management, and regenerative braking. As these technologies become more integrated into vehicles, there will be a greater need for intelligent transmission solutions that can seamlessly interface with autonomous driving systems. This evolving landscape is expected to spur significant innovation in the EV transmission system market.

The Transformative Influence of Charging Infrastructure, Autonomous Driving, and Global Standards on Electric Vehicle Transmission Systems

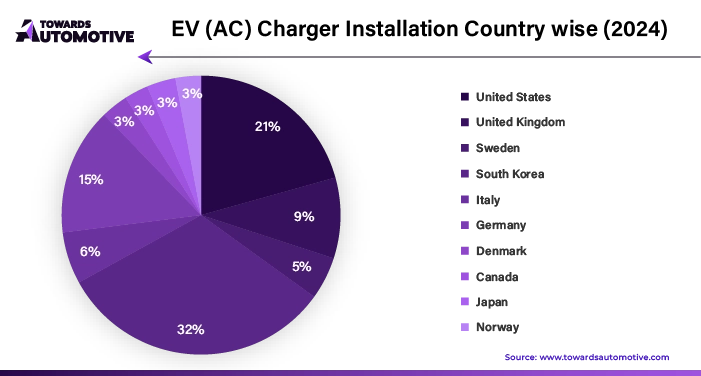

The advancement of charging infrastructure is dramatically reshaping electric vehicle (EV) transmission systems. As new charging technologies, such as fast-charging solutions and various charging standards, become more prevalent, EV transmission systems are required to evolve. These systems must improve efficiency, compatibility, and range to keep pace with emerging technologies.

Charging infrastructure impacts EV charging behaviors, which in turn influences transmission system design. Modern transmission systems must accommodate different charging scenarios, including rapid public charging, which demands handling high power inputs, overnight home charging with prolonged, lower power inputs, and opportunistic charging, where vehicles charge intermittently as they encounter charging stations. To manage these diverse charging conditions effectively, transmission systems need to handle power from multiple sources without compromising vehicle performance.

Safety and reliability are critical aspects of EV transmission systems, particularly due to the power fluctuations and potential voltage spikes associated with charging. To address these challenges, transmission systems require robust components designed to withstand high power levels and advanced safety features to minimize the risk of malfunctions, ensuring reliable operation during charging sessions.

The rise of autonomous driving technologies is also influencing EV transmission systems. These technologies demand that transmission systems integrate seamlessly with advanced driving components, facilitating coordinated control for smooth vehicle operation. Autonomous driving increases the need for transmission systems to handle higher torque and maintain consistent performance under varying conditions, thereby enhancing the overall safety and efficiency of autonomous vehicles.

The global electric vehicles market size was USD 1,150.77 billion in 2023, calculated at USD 1,542.24 billion in 2024 and is expected to reach around USD 20,879.44 billion by 2033, expanding at a CAGR of 34.21% from 2024 to 2033. Rising environmental concerns lead to adopting electric vehicles, fueling the market growth.

Global standardization and regulations play a vital role in the development of EV transmission systems. By establishing uniform technical and performance specifications, standardization promotes compatibility among various components and systems, builds consumer trust, and supports safety. It also fosters innovation by providing a structured framework for research and development, leading to more efficient and advanced transmission technologies. Moreover, standardization simplifies technical requirements and certification processes, facilitating global trade and market expansion for companies.

Overall, the evolution of charging infrastructure, advancements in autonomous driving, and global standardization efforts are collectively driving significant changes in electric vehicle transmission systems, pushing the industry toward greater efficiency, safety, and technological advancement.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Global EV Transmission Systems Market: Country-Specific Insights and Growth Dynamics

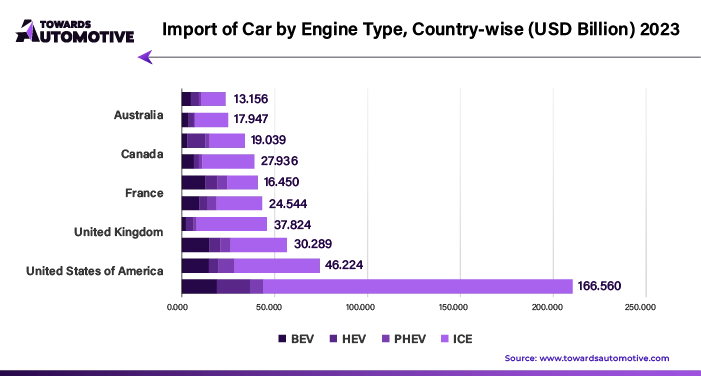

The global market for electric vehicle (EV) transmission systems is experiencing remarkable growth, with several countries emerging as key players. This analysis explores the country-wise dynamics, including consumer behavior, competitive landscape, regulatory environment, industry sizes, and growth prospects in various regions.

India: A Rising Hub for EV Transmission Systems

India is projected to lead the global EV transmission systems market, boasting an impressive compound annual growth rate (CAGR) of 28.2% over the forecast period. The Indian government's proactive support for electric vehicles (EVs) is a major factor driving this growth. This includes incentives for setting up EV component manufacturing, tax breaks, and subsidies, which collectively nurture a thriving ecosystem for EV transmission systems.

India's potential as a cost-effective producer is bolstered by its low labor costs, making its EV transmissions appealing to global manufacturers. Moreover, the country has a substantial pool of skilled engineers and technicians, poised to support the evolving EV sector. With strong government backing, India is set to play a pivotal role in the global market.

China: Leading the Charge in EV Transmission Systems

China is emerging as a dominant force in the EV transmission systems market, with a projected CAGR of 21.3% through 2034. The country's well-established automotive industry and swift adoption of electric vehicles are fueling the demand for EV components.

Chinese government initiatives, including tax incentives and subsidies for both manufacturers and consumers, are instrumental in this growth. Additionally, China's focus on developing EV infrastructure and localizing components to reduce foreign dependence is driving substantial market expansion in the EV transmission sector.

Spain: Clean Energy Driving EV Growth

Spain is set to become a significant player in the EV transmission systems market, with a forecasted CAGR of 14.1% from 2024 to 2034. Spain's commitment to renewable energy is expected to boost electric vehicle adoption, thereby increasing the demand for EV components.

While Spain's focus on clean energy presents a strong case for EV growth, it faces competition from more established markets. Success will depend on how well Spain can leverage its renewable energy strengths to sustain its growth trajectory in the EV sector.

Key Insights into the Electric Vehicle Transmission System Market

Understanding the future outlook and investment potential of the EV transmission system market requires a look into the leading categories and trends:

Battery Electric Vehicles: Dominating the Market

Battery Electric Vehicles (BEVs) are projected to hold a substantial value share of 45.0% in 2024. This dominance is attributed to BEVs' efficient electric motors, which deliver high torque and operate effectively with simplified transmissions. Unlike traditional internal combustion engines that need complex multi-speed transmissions, BEVs benefit from a streamlined approach that enhances performance and efficiency.

The electric vehicle battery market size is estimated at USD 43.68 billion in 2022, and is expected to reach USD 252.02 billion by 2033, growing at a CAGR of 21.50% during the forecast period (2022-2032).

Single-Speed Transmissions: The Preferred Choice

Single-speed transmissions are expected to dominate the transmission type segment, with a projected value share of 68.0% in 2024. These transmissions are favored for their ability to deliver strong acceleration and efficiency across various speeds, thanks to their simplicity. Single-speed transmissions are easy to manufacture and install, leading to lower production costs for EVs. Their design also reduces maintenance needs and ensures a smoother driving experience by eliminating the need for constant gear changes.

Browse More Insights of Towards Automotive:

- The global EV charging panelboard market size is calculated at USD 6.13 billion in 2024 and is expected to be worth USD 29.53 billion by 2034, expanding at a CAGR of 17.13% from 2023 to 2034.

- The global EV charger converter module market size is calculated at USD 5.23 billion in 2024 and is expected to be worth USD 46.43 billion by 2034, expanding at a CAGR of 25.47% from 2023 to 2034.

- The global plug-in hybrid electric vehicle market size is calculated at USD 36.62 billion in 2024 and is expected to be worth USD 193.80 billion by 2034, expanding at a CAGR of 18.3% from 2023 to 2034.

- The global EV charging cable market size is calculated at USD 2.43 billion in 2024 and is expected to be worth USD 19.57 billion by 2034, expanding at a CAGR of 23.10% from 2023 to 2034.

- The vehicle tracking device market was valued at USD 22.1 billion in 2023 and is expected to grow by USD 139.5 billion at a CAGR of around 16.55% from 2024 to 2032.

- The global on-board connectivity market size is estimated to reach USD 40.48 billion by 2033, up from USD 11.21 billion in 2023, at a compound annual growth rate (CAGR) of 13.81%.

- The EV charger operations and maintenance services market was valued at USD 0.72 billion in 2023 and is expected to grow by USD 3.66 billion at a CAGR of around 14.92% from 2024 to 2032.

- The electric vehicle (EV) charging management software platform market was valued at USD 0.91 billion in 2023 and is expected to grow by USD 15.6 billion at a CAGR of around 22.33% from 2024 to 2032.

- The global cellular vehicle-to-everything (C-V2X) market size is estimated to reach USD 39.54 billion by 2033, up from USD 1.21 billion in 2023, at a compound annual growth rate (CAGR) of 41.81% between 2023 and 2033.

- The electric vehicle (EV) charger cellular connectivity market, valued at USD 1.43 billion in 2023, is experiencing rapid growth, projected to exceed USD 7.59 billion by 2032, with a remarkable CAGR of 20.38% during the forecast period.

EV Transmission System Market TOC | Table of Content

Introduction

- Overview of EV Transmission Systems

- Importance and Functionality in Electric Vehicles

- Market Dynamics and Trends

Leading EV Transmission System Brands

- Allison Transmission Inc.

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- Aisin Seiki Co., Ltd.

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- AVL List GmbH

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- Continental AG

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- BorgWarner Inc.

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- Dana Incorporated

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- EATON Corporation

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- Denso Corporation

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- GKN Automotive Limited

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

- Hitachi Automotive Systems Ltd.

- Company Overview

- Key Products and Technologies

- Market Position and Strategy

Market Segmentation

- By Vehicle Type

- Battery Electric Vehicles (BEVs)

- Market Overview

- Key Trends and Innovations

- Leading Players and Market Share

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Market Overview

- Key Trends and Innovations

- Leading Players and Market Share

- Hybrid Electric Vehicles (HEVs)

- Market Overview

- Key Trends and Innovations

- Leading Players and Market Share

- Battery Electric Vehicles (BEVs)

- By Transmission Type

- Single-speed

- Market Overview

- Advantages and Challenges

- Key Players and Market Trends

- Multi-speed

- Market Overview

- Advantages and Challenges

- Key Players and Market Trends

- Single-speed

- By Transmission System

- AMT (Automated Manual Transmission)

- Market Overview

- Technological Developments

- Key Players and Market Trends

- CVT (Continuously Variable Transmission)

- Market Overview

- Technological Developments

- Key Players and Market Trends

- AT (Automatic Transmission)

- Market Overview

- Technological Developments

- Key Players and Market Trends

- AMT (Automated Manual Transmission)

Cross Segment Analysis

Vehicle Type Combined with Transmission Type

- Battery Electric Vehicles (BEVs)

- Single-speed Transmission

- Multi-speed Transmission

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Single-speed Transmission

- Multi-speed Transmission

- Hybrid Electric Vehicles (HEVs)

- Single-speed Transmission

- Multi-speed Transmission

Vehicle Type Combined with Transmission System

- Battery Electric Vehicles (BEVs)

- AMT (Automated Manual Transmission)

- CVT (Continuously Variable Transmission)

- AT (Automatic Transmission)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- AMT (Automated Manual Transmission)

- CVT (Continuously Variable Transmission)

- AT (Automatic Transmission)

- Hybrid Electric Vehicles (HEVs)

- AMT (Automated Manual Transmission)

- CVT (Continuously Variable Transmission)

- AT (Automatic Transmission)

Transmission Type Combined with Transmission System

- Single-speed Transmission

- AMT (Automated Manual Transmission)

- CVT (Continuously Variable Transmission)

- AT (Automatic Transmission)

- Multi-speed Transmission

- AMT (Automated Manual Transmission)

- CVT (Continuously Variable Transmission)

- AT (Automatic Transmission)

Market Trends and Forecast

- Technological Advancements

- Regulatory and Policy Impact

- Market Growth and Opportunities

- Regional Insights and Analysis

Competitive Landscape

- Market Share Analysis

- Strategic Initiatives by Leading Companies

- SWOT Analysis of Major Players

Case Studies and Industry Insights

- Case Study 1: Innovation in BEV Transmission Systems

- Case Study 2: Market Penetration Strategies by Leading Brands

- Industry Insights and Expert Opinions

Go-to-Market Strategies (Region Selection)

- Europe

- Market Segmentation and Targeting

- Regulatory Compliance and Standards

- Distribution Channels and Partnerships

- Consumer Adoption and Market Penetration

- Asia Pacific

- Market Entry Barriers and Opportunities

- Strategic Alliances and Joint Ventures

- Pricing Strategies and Value Proposition

- Regional Regulatory and Technological Challenges

- North America

- Market Penetration Strategies

- Technological Innovations and Adoption

- Competitive Landscape and Market Analysis

- Consumer Awareness and Education

- Latin America

- Market Expansion Tactics

- Localized Marketing and Sales Strategies

- Distribution and Logistics Considerations

- Economic and Political Factors Affecting Market Entry

- Middle East

- Market Entry Strategies

- Cultural and Socio-Economic Factors

- Strategic Partnerships and Alliances

- Market Regulation and Compliance

Integration of AI in EV Transmission Systems

- Overview of AI Technologies in EV Transmission Systems

- Introduction to AI Technologies

- Key AI Technologies and Trends in Transmission Systems

- Applications and Use Cases in Electric Vehicles

- Applications of AI

- Smart Transmission Control and Management

- Real-Time Transmission Monitoring and Control

- Adaptive Transmission System Optimization

- Enhanced Performance and Efficiency

- Predictive Maintenance and Fault Detection

- AI-Driven Predictive Maintenance Solutions

- Fault Detection and Diagnostic Tools

- Reducing System Downtime and Maintenance Costs

- Optimization of Energy Efficiency

- AI-Enhanced Energy Management

- Optimization of Power Distribution

- Improving Overall Vehicle Efficiency

- Smart Transmission Control and Management

- Benefits of AI Integration

- Enhanced Efficiency and Performance

- Improved Transmission Performance

- Optimized Energy Usage

- Cost Savings and Maintenance Reduction

- Lower Maintenance Costs

- Extended Equipment Lifespan

- Improved Reliability and Safety

- Increased System Reliability

- Enhanced Safety Features and Mechanisms

- Enhanced Efficiency and Performance

Production and Consumption Data

- Global Production Volumes

- Current Production Statistics and Trends

- Key Production Hubs and Facilities

- Historical Production Trends and Forecasts

- Regional Production Analysis

- Europe

- Major Producers and Production Output

- Regional Production Trends and Developments

- Asia Pacific

- Leading Production Countries and Facilities

- Growth and Development Analysis

- North America

- Production Capacity and Expansion Plans

- Regional Production Dynamics

- Latin America

- Production Trends and Insights

- Emerging Markets and Opportunities

- Middle East

- Production Volumes and Key Players

- Market Growth Prospects

- Europe

- Consumption Patterns by Region

- Europe

- Consumption Trends and Preferences

- Key Market Drivers and Influencers

- Asia Pacific

- Consumer Behavior and Demand

- Regional Consumption Insights

- North America

- Consumption Trends and Market Dynamics

- Influencing Factors

- Latin America

- Regional Consumption Patterns and Growth Factors

- Middle East

- Consumption Trends and Opportunities

- Key Market Drivers

- Europe

- Key Trends in Production and Consumption

- Emerging Trends and Innovations in Production

- Market Drivers and Challenges

- Future Projections and Growth Opportunities

Opportunity Assessment

- New Product Development

- Identifying Market Needs and Opportunities

- Innovation Trends and Technological Developments

- Strategies for Product Development

- Plan Finances/ROI Analysis

- Financial Planning and Budgeting

- ROI Calculation and Analysis

- Investment Opportunities and Risks

- Supply Chain Intelligence/Streamline Operations

- Supply Chain Analytics and Optimization

- Operational Efficiency Improvements

- Integration of Technology in Supply Chain

- Cross-Border Intelligence

- International Market Insights and Analysis

- Trade Regulations and Barriers

- Opportunities for Cross-Border Collaboration

- Business Model Innovation

- Innovative Business Models in the EV Transmission Market

- Market Disruption and Transformation

- Successful Case Studies and Innovations

- Blue Ocean vs. Red Ocean Strategies

- Blue Ocean Strategy: Creating Uncontested Market Space

- Red Ocean Strategy: Competing in Existing Market Space

- Strategic Implications and Case Studies

Case Studies and Examples

- Successful Implementations of AI in Transmission Systems

- Case Study: Company A’s AI Integration in EV Transmissions

- Case Study: Company B’s AI-Driven Transmission Solutions

- Market Innovations and Trends

- Example: Innovative EV Transmission Technologies

- Example: Emerging Market Trends and Insights

- Challenges and Solutions

- Common Challenges in AI Integration for Transmission Systems

- Solutions and Best Practices

Future Prospects and Innovations

- Technological Advancements

- Future AI Technologies and Innovations in EV Transmission Systems

- Emerging Trends and Technological Developments

- Market Outlook and Forecast

- Long-Term Market Projections

- Potential Growth Areas and Opportunities

- Strategic Recommendations

- Strategic Planning and Recommendations

- Future Market Trends and Business Strategies

Conclusion

- Summary of Key Findings

- Strategic Recommendations for Stakeholders

Appendices

- Glossary of Terms

- List of Abbreviations

- Research Methodology

- Sources and References

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1328

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing automotive world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive