Pune, Sept. 03, 2024 (GLOBE NEWSWIRE) -- Fleet Management Software Market Size Analysis:

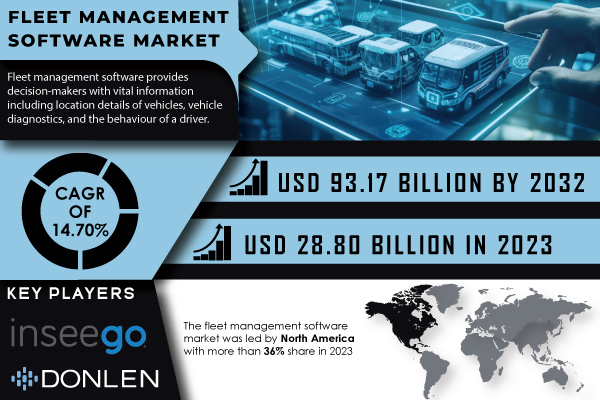

“According to the SNS Insider report, the Fleet Management Software Market was valued at USD 28.80 billion in 2023 and is projected to reach USD 93.17 billion by 2032, growing at a robust CAGR of 14.70% during the forecast period of 2024-2032.”

Market analysis

The fleet management software market has experienced significant growth in recent years, supported by several influential factors changing the face of transportation and logistics. From a growing emphasis on efficient fleet operations within companies, the demand for software that instantly shows vehicle locations, driver behavior, and diagnostics has gone up.

The increasing adoption of electric vehicles into corporate fleets, owing to strict environmental regulations and a worldwide movement toward sustainable mobility, acts as a driver for this market. The market is also driven by government incentives, particularly in regions such as the EU, where regulations require a 37.5% reduction in CO2 emissions by 2030, thereby accelerating the adoption of EVs. This, in turn, accelerates EV adoption. Growing demand for fleet management software is also being driven by the growth of mobility-as-a-service due to rapid urbanization and increased city investments in smart transportation infrastructure. Advanced technologies in IoT and 5G have revitalized the sector by creating predictive maintenance and real-time communication across dispersed areas. In addition to this, cloud-based solutions are in demand, owing to scalability, flexibility, and cost-effectiveness. The cloud-based solutions are gaining traction due to their scalability, flexibility, and cost-efficiency, with over 40% of managers already deploying cloud platforms as an ideal remedy to improve operational efficiency.

Get a Sample Report of Fleet Management Software Market@ https://www.snsinsider.com/sample-request/3109

Major Players Analysis Listed in this Report are:

- Donlen

- Samsara

- Inseego

- Fleetonomy

- Teletrac Navman

- Verizon Connect

- Holman

- Azuga

- GPS Insight

- Orbcomm

- Gurtam

- Titan GPS

- ClearPathGPS

- Chevin

- Zebra Technologies

- Trimble

- Masternaut

- Omnitracs

- MiX Telematics

- Geotab

- TomTom

- Zonar Systems

- Motive

- Fleet Complete

- Automile

- Fleetio

- Fleetroot

- Freeway Fleet

- Avrios

Fleet Management Software Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 28.80 Bn |

| Market Size by 2032 | US$ 93.17 Bn |

| CAGR | CAGR of 14.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Utilizing Fleet Management and Advanced Technologies to Increase Product Demand • fleet owners' increased attention to operational effectiveness |

Do you have any specific queries or need any customization research on Fleet Management Software Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3109

Segment Analysis

- On the basis of deployment, the market was led by the on-premises segment, accounting for over 65% of the market share in 2023. On-premises deployment offers reduced overall cost based on the upfront investment and greater control on data storage and security services. Companies that have strong data security concerns prefer on-premises deployment so that they can have access to all the data at any time. Cloud-based segment is expected grow with significant CAGR during forecast period. The adoption of cloud deployment is due to enhanced integration with other fleet management services, high scalability, and cost efficiency. For instance, in March 2023, Pro-Vision released CloudConnect, a cloud-based fleet video management software that offers easy accessibility, management, storage, and sharing of video data.

- Based on industry, the manufacturing segment was the major driver of the fleet management software market with a revenue share of over 22% in 2023. There is a critical need for the timely delivery of materials and components to manufacturing facilities to prevent production delays has driven the adoption of fleet management software in this sector. The software solution has been effectively used to plan certain routes over which transportation can be kept to a minimum and relocation costs reduced. Moreover, the software helps in delivering the material on time by monitoring the fleet in real time. The logistics industry is also a major user of the software owing to the substantial transport of merchandise.

Key Segments:

By Type

Operations Management

- Fleet Tracking and Geo-fencing

- Routing and Scheduling

Vehicle Maintenance and Diagnostics

Performance Management

- Driver Management

- Fuel Management

Fleet Analytics & Reporting

Others

By Deployment

- Cloud

- On-premises

By fleet type

- Commercial fleets

- Light commercial vehicles

- Medium and Heavy commercial vehicles

- Passenger Vehicles

- Internal combustion engine

- Electric Vehicles

By Vertical

- Manufacturing

- Transportation & logistics

- Healthcare & pharmaceuticals

- Construction

- Utilities

- Oil, gas and mining

- Government

- Others

Recent Developments

- In March 2024, Verizon Connect introduced the fleet management platform with improved analytics and real-time vehicle monitoring. It provides tailored solutions to the evolving demands of operators of commercial fleets through gadgets that may help enhance their operations and overall productivity.

- In December 2023, it was announced that Traxall International sister company of Fleet Operations completed the acquisition of Fleet Logistics Group. This purchase was made to form one of the most extensive mobility and fleet management providers in Europe. One of the focuses of the company is to provide independent, comprehensive fleet management services. The combined entity now manages over 400,000 contracts, thus solidifying its position among the leaders in the European market.

- Webfleet- Bridgestone's fleet management software launched a new trailer management solution in June 2023 called Webfleet Trailer. Designed to equip companies that have fleets of trailers operating on long-haul routes with timely, actionable information about status, location, and performance, this may be seen as a response to the increased demand for industry-specific fleet management tools.

Regional Analysis

North America held over 36% of the market share for the global fleet management software market in 2023. Due to the increasing adoption of real-time tracking solutions by industries in various regions. The United States’ largest automobile firms, General Motors, Ford, and Fiat-Chrysler, have provided vehicle tracking systems to help companies interact with different industry fields and ensure smooth business operations. The region is also witnessing a spike of up to 30% in investments for flexible fleet management software across North America, including significant capital in smart transportation infrastructure.

Buy an Enterprise-User PDF of Fleet Management Software Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/3109

Key Takeaways

- The report provides comprehensive insights into the factors driving the fleet management software market, including technological advancements, regulatory mandates, and the growing adoption of electric vehicles.

- The objective of the study is to offer a detailed analysis of market trends, opportunities, and challenges, enabling stakeholders to make informed decisions.

- The report provides Key market segments, which are analyzed to identify the dominant segments and their growth prospects.

- Regional developments are highlighted to showcase the global reach of the fleet management software market and the factors contributing to its growth in key regions.

Table of Contents – Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

4. Impact Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Fleet Management Software Market Segmentation, By Component

9. Fleet Management Software Market Segmentation, By Deployment

10. Fleet Management Software Market Segmentation, By Vehicle Type

11. Fleet Management Software Market Segmentation, By Fleet Type

12. Fleet Management Software Market Segmentation, By Vertical

13. Regional Analysis

14 Company Profile

15. Competitive Landscape

16. USE Cases and Best Practices

17. Conclusion

Access Complete Report Details of Fleet Management Software Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/fleet-management-software-market-3109

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.