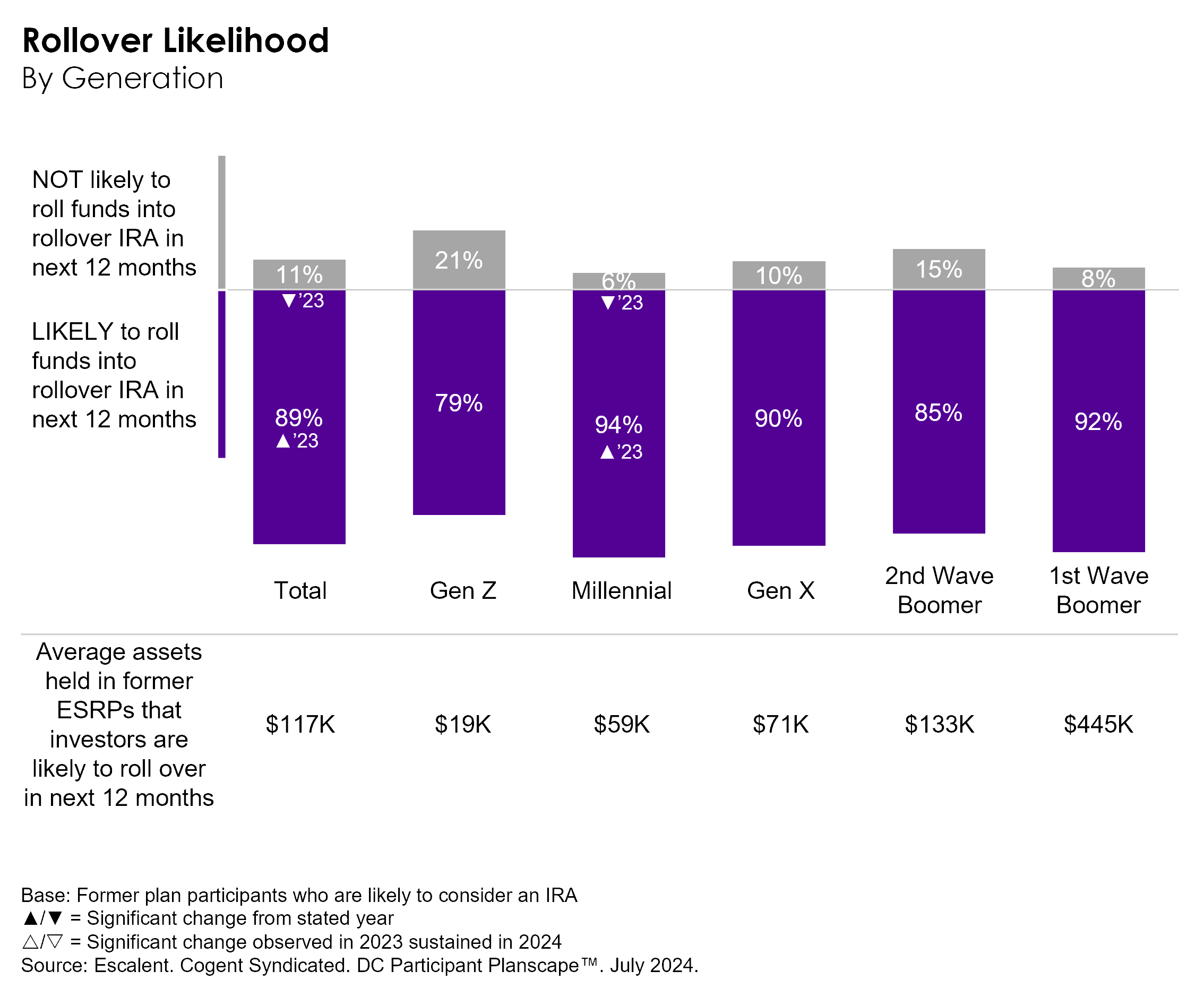

LIVONIA, Mich., Sept. 04, 2024 (GLOBE NEWSWIRE) -- Nearly nine in ten (89%) former defined contribution (DC) plan participants who are likely to consider an IRA intend to initiate a rollover this year, a notable uptick from 82% last year. Millennials are leading the charge, citing significantly higher intent at 94% versus 82% in 2023. First and Second Wave Boomers are the most lucrative cohorts to target, respectively holding $445K and $133K in former employer-sponsored retirement plans (ESRPs). That is according to the latest DC Participant Planscape™ report from Cogent Syndicated by Escalent, which is designed to help DC plan providers maximize participant contributions, enhance engagement, leverage cross-sell opportunities and attract rollover dollars.

Findings from the study further reveal former plan assets are becoming more fluid. Fewer participants report holding former ESRP assets in-plan for six or more years (61% vs. 67% in 2023), stemming from declines among First Wave Boomers and participants who have investable assets of at least $100K.

“That said, we are also observing a trend in which participants are content leaving their assets in former employer plans. In fact, investment performance, range of investment options and advisor recommendations have become even bigger motivators for keeping plan assets parked,” said Sonia Davis, lead report author and senior product director in Escalent’s Cogent Syndicated division. “In addition, mentions of participant inertia are declining, reflecting a more intentional management of retirement funds.”

Meanwhile, rollover candidates are more likely to be working with traditional advisors and are trending wealthier. Nearly six in ten likely rollover candidates are working with traditional advisors, up from 44% last year. The average investable assets within this cohort is up from $620K in 2023 to $950K this year.

“We’re seeing increased engagement and a lot more reliance on financial advisors from younger generations especially. Gen Zers, Millennials and Gen Xers are generally more receptive to advisor outreach and eager for knowledge and guidance,” continued Davis.

Participants are increasingly citing job changes, the desire to consolidate, lower fees and former plan provider outreach as key catalysts for initiating rollover activity. In addition, financial advisors play a significant role in influencing decisions across all generational cohorts, highlighting their involvement in the rollover education and consideration process.

“Financial advisors are participants’ go-to resource for rollover guidance and play an instrumental role in the decision-making process,” added Davis. “In the years ahead, there is a clear opportunity for advisors and providers to capitalize on participants’ heightened interest and engagement levels.”

To learn more about DC Participant Planscape findings, visit Escalent.co.

About DC Participant Planscape™

Cogent Syndicated, a division of Escalent, conducted an online survey of a representative cross-section of 3,452 DC plan participants from June 3 to June 18, 2024. Survey participants were required to be 18 years or older and contribute at least 1% to a current plan and/or have $5,000 or more in at least one former plan. Targets were set to investor gender, region, age, education and household income using US census data filtered by the screening criteria (a market-sizing flyover survey was used to filter the US census data). The data have a margin of error of ±1.67% at the 95% confidence level. Escalent will supply the exact wording of any survey question upon request.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 1,800 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the US and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

CONTACT: Kim Eberhardt

248.417.2460

keberhardt@identitypr.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/15f6d3c7-58c9-49a2-a33e-42744b83f594