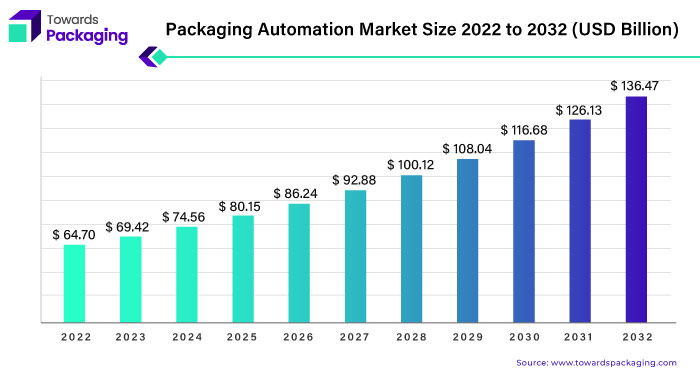

Ottawa, Sept. 04, 2024 (GLOBE NEWSWIRE) -- The global packaging automation market size is predicted to increase from USD 64.70 billion in 2022 to approximately USD 136.47 billion by 2032, according to a study published by Towards Packaging a sister firm of Precedence Statistics.

Get a comprehensive free sample: https://www.towardspackaging.com/personalized-scope/5135

Packaging automation refers to the use of various technologies and machinery to handle packaging processes without human intervention. This includes activities such as filling, sealing, labeling, and palletizing products. By automating these tasks, companies can increase efficiency, reduce labor costs, and ensure consistent quality in their packaging. It’s especially useful in industries like food and beverage, pharmaceuticals, and consumer goods where high volume and precision are crucial.

The packaging automation market encompasses all the businesses and technologies involved in developing, producing, and selling automated packaging solutions. This market is growing rapidly due to the increasing need for efficient and cost-effective packaging processes. Companies are investing in advanced machinery and robotics to enhance productivity and meet the rising consumer demand for quickly and safely packaged products. Additionally, the push for sustainability and reducing packaging waste is driving innovation in this field, making it a dynamic and evolving market.

Get the latest insights on packaging industry segmentation with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Packaging Automation Market at a Glance

The packaging automation market is experiencing robust growth, driven by the increasing need for efficiency and cost-effectiveness in packaging processes across various industries. Packaging automation involves using advanced technologies such as robotics, machine learning, and artificial intelligence to streamline packaging processes like filling, labeling, sealing, and palletizing.

These technologies offer numerous benefits, including faster production rates, reduced labor costs, improved accuracy, and consistent product quality. Industries such as food and beverages, healthcare, personal care, and industrial manufacturing are particularly investing in these solutions to meet the rising consumer demand and maintain a competitive edge.

The packaging automation market is set for significant growth, driven by technological advancements, regional developments, and a strong focus on sustainability. As industries continue to prioritize efficiency and innovation, the adoption of automated packaging solutions is expected to rise, further propelling the market forward.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Driver for the Packaging Automation Market, Increasing Efficiency and Productivity

One of the key goals of packaging automation is to significantly increase efficiency and productivity in packaging operations. Automation systems promote faster throughput, minimize downtime, and enhance output, allowing manufacturers to meet the growing market demand while effectively lowering labor costs.

For instance,

- Consider the case of Coca-Cola. In recent years, Coca-Cola has invested heavily in automated packaging lines to boost its production capabilities. These automated systems enable the company to handle high volumes of beverage cans and bottles efficiently, ensuring a consistent supply to meet consumer demand. By automating processes such as filling, labeling, and palletizing, Coca-Cola has managed to reduce manual labor requirements and speed up its production lines, leading to significant cost savings and improved product availability.

Recent developments in the sector also highlight the growing adoption of advanced automation technologies. For example, in 2023, Nestlé announced the implementation of a new automated packaging system at one of its key production facilities. This system integrates robotics and advanced sensors to streamline packaging processes, significantly reducing downtime and increasing the facility's overall productivity. The automation technology employed by Nestlé not only enhances operational efficiency but also ensures higher precision and consistency in packaging, which is crucial for maintaining product quality.

Get a customized report designed according to your preferences: https://www.towardspackaging.com/customization/5135

Supply Chain Resilience, Driver for the Packaging Automation Market

Frequent supply chain disruptions have emphasized the need for flexible and adaptable packaging processes, which automation can effectively address. In recent years, global supply chains have faced numerous challenges, including natural disasters, geopolitical tensions, and, most notably, the COVID-19 pandemic. These disruptions have highlighted the importance of having resilient supply chains that can quickly adapt to changing circumstances.

Automation plays a crucial role in enhancing supply chain resilience by offering the flexibility and adaptability needed to respond to unexpected disruptions. For example, during the COVID-19 pandemic, many companies faced labor shortages and operational challenges due to lockdowns and health protocols. Companies like Procter & Gamble (P&G) turned to automation to maintain their packaging operations. P&G implemented advanced robotics and automated systems in their packaging lines, allowing them to continue production with minimal human intervention. This not only ensured continuous product supply but also protected the health and safety of their workforce.

High Initial Investment, Restraint for the Packaging Automation Market

One of the major restraints for the packaging automation market is the high initial investment required for equipment, installation, and integration. These systems often involve advanced technologies such as robotics, sensors, and software, which come with significant costs. This financial barrier can be particularly challenging for small and medium-sized enterprises (SMEs), who may not have the necessary capital to invest in such sophisticated systems.

Despite these challenges, some solutions are emerging to help mitigate the high initial costs. Leasing options and financing programs are becoming more prevalent, allowing SMEs to spread the cost over time. Additionally, some technology providers are developing modular automation systems that can be scaled up gradually, reducing the need for a massive one-time investment.

- For instance, in 2023, a startup in Germany introduced a modular packaging automation system designed specifically for SMEs. This system allows businesses to start with basic automation and add more components as they grow and can afford further investment. This approach lowers the initial cost barrier and makes automation more accessible to smaller companies.

Focus on Sustainability, Upcoming Opportunity for the Packaging Automation Market

The increasing focus on sustainability is creating significant opportunities for the packaging automation market. As consumers and governments alike push for greener practices, companies are seeking ways to efficiently handle recyclable and biodegradable materials in their packaging processes. Automation systems are well-positioned to meet these demands, offering solutions that enhance both efficiency and sustainability.

For instance, the use of automated sorting systems can significantly improve the handling of recyclable materials. These systems are designed to identify and separate different types of recyclable packaging, such as plastics, paper, and glass, more efficiently than manual processes. By integrating advanced sensors and AI technology, automated sorting can ensure that materials are correctly sorted and sent to the appropriate recycling streams, reducing contamination and increasing the overall recycling rate.

- In 2023, a leading packaging automation company launched a new line of robotic systems specifically designed for handling biodegradable materials. These robots can adjust their handling techniques to accommodate the unique properties of biodegradable packaging, which often requires more delicate and precise manipulation. This innovation not only improves the efficiency of packaging processes but also supports the broader shift towards environmentally friendly materials.

North America Leading the Packaging Automation Market

North America leads the packaging automation market due to its advanced technological infrastructure and widespread adoption of automation across diverse industries. The presence of major manufacturers in sectors like food and beverage, pharmaceuticals, consumer goods, and e-commerce has created a robust demand for packaging automation solutions. Companies in this region are keen on improving productivity, reducing costs, and meeting the growing consumer expectations for swift delivery and high-quality products.

- For instance, Ranpak Holdings Corp., a notable player in sustainable packaging solutions, introduced the AutoFill system in August 2021, showcasing the region’s continuous innovation in automation technologies.

Europe to Grow Rapidly During the Forecast Period

Europe is another key player in the packaging automation market, with countries like Germany, France, and the UK leading the charge. The region’s strong emphasis on sustainability and regulatory compliance drives the adoption of eco-friendly automation solutions. European manufacturers are integrating advanced technologies such as AI and machine learning to enhance packaging processes, improve decision-making, and ensure quality control. In January 2024, ABB announced the acquisition of a controlling stake in Meshmind, a move aimed at bolstering their capabilities in AI, Industrial IoT, and machine vision, further solidifying Europe’s position in the market.

Asia Pacific on to Grow at a Rapid Rate

The Asia Pacific region is rapidly emerging as a powerhouse in the packaging automation industry, thanks to the booming manufacturing sectors in countries like China, India, Japan, and South Korea. The rapid industrialization and economic growth in these nations are driving the demand for packaging automation systems to stay competitive in the global market. China, for example, had 290,258 units of industrial robots installed by 2022, reflecting its massive investment in automation. Similarly, Japan remains a global leader in robot manufacturing, contributing 46% of the world's robot production.

- In January 2022, SIG’s acquisition of Pactiv Evergreen Inc.'s Asia Pacific Fresh business for $335 million highlighted the region's expanding footprint in packaging automation.

India stands out in the Asia Pacific region with its burgeoning manufacturing sector and increasing emphasis on automation to boost productivity and quality. The country is seeing a surge in investments in packaging automation, particularly in the food and beverage, pharmaceuticals, and consumer goods industries. Companies are integrating advanced technologies to streamline operations, reduce labor costs, and enhance product quality. For example, TurboFil Packaging Machines introduced an automated system using TipFil syringe filling technology in December 2023, showcasing India's growing inclination towards sophisticated packaging solutions. This trend aligns with India's broader goal of becoming a global manufacturing hub by leveraging cutting-edge automation technologies.

By Product Type, the Filling Machines Segment to Lead the Market

Filling machines dominate the packaging automation market due to their versatility and efficiency in handling various types of products. These machines are essential in industries like food and beverages, pharmaceuticals, and personal care, where they ensure accurate and consistent filling of liquids, powders, and granules. The demand for precise, contamination-free filling processes has made filling machines a critical component in maintaining product quality and meeting stringent regulatory standards.

By End Use, the Food & Beverages Segment to Hold a Significant Share

The food and beverages industry is the leading end-use segment in the packaging automation market. Automation in this sector helps maintain hygiene standards, increases production speed, and minimizes human error, which is crucial for handling consumable products. With the rising global demand for packaged foods and beverages, companies are increasingly investing in automated packaging solutions to enhance efficiency, reduce costs, and meet consumer expectations for product safety and quality.

By Distribution, the Retail Segment to Grow Rapidly

Retail is the primary distribution channel driving the growth of packaging automation. The shift towards e-commerce and the increasing demand for fast and reliable delivery have led retailers to adopt automated packaging solutions. These solutions help streamline the packing process, reduce labor costs, and ensure that products are securely packaged for transportation. Automation in retail packaging also enables personalization and branding, which are important for customer satisfaction and loyalty.

Recent Developments

- In March 2024, Martin Automatic, based in Rockford, Illinois, unveiled new automated converting machinery designed to tackle challenges related to workforce shortages and stringent quality requirements. This equipment aims to minimize manual labor, cut down on production errors, and enhance operational flexibility.

- In March 2024, Videojet introduced its 9560 PL pallet labeling system, engineered to streamline warehouse operations, minimize errors, and ensure robust management of palletized goods. Capable of labeling up to three sides of a pallet and processing 120 pallets per hour, this system is set to improve efficiency in logistics.

- In March 2024, Tension Packaging and Automation announced in March 2024 its plans to debut the fitPACK 500 right-sized packaging system at MODEX 2024. This new system is expected to enhance operational efficiency, reduce waste, and lower costs for e-commerce and pharmacy order fulfillment processes.

- In March 2024, CMC Packaging Automation North America launched its new Tech Center in Atlanta, Georgia. This facility marks a significant development in the U.S. packaging and automation sector and is anticipated to become a central venue for innovation, experimentation, and collaboration with clients and technology partners.

- In February 2024, Kirin Holdings’ Bell's Brewery announced a substantial investment exceeding US$ 2 million to enhance its packaging automation capabilities. This investment aims to increase the production capacity of its variety packs, reflecting a commitment to boosting operational efficiency and meeting growing demand.

More Insights in Towards Packaging:

- The global non-corrugated boxes market size reached USD 67.22 billion in 2024 and is projected to hit around USD 137.79 billion by 2034, expanding at a CAGR of 7.5% during the forecast period from 2024 to 2034.

- The global airless packaging market size is estimated to reach USD 15.91 billion by 2033, up from USD 8.38 billion in 2023, at a compound annual growth rate (CAGR) of 6.79% from 2024 to 2033.

- The global transit packaging market size reached US$ 231.25 billion in 2023 and is projected to hit around US$ 454.48 billion by 2033, expanding at a CAGR of 6.99% during the forecast period from 2024 to 2033.

- The global semiconductor packaging market size reached US$ 41.05 billion in 2023 and is projected to hit around US$ 108.82 billion by 2033, expanding at a CAGR of 10.24% during the forecast period from 2024 to 2033.

- The global polystyrene packaging market size reached USD 24.58 billion in 2023 and is projected to hit around USD 37.92 billion by 2033, expanding at a CAGR of 4.43% during the forecast period from 2024 to 2033.

- The global adherence packaging market size reached US$ 1.1 billion in 2023 and is projected to hit around US$ 2.05 billion by 2033, expanding at a CAGR of 6.43% during the forecast period from 2024 to 2033.

- The global corrugated boxes market size reached USD 163.07 billion in 2023 and is projected to hit around USD 269.19 billion by 2033, expanding at a CAGR of 5.14% during the forecast period from 2024 to 2033.

- The global bioplastic packaging market size reached US$ 17.99 billion in 2023 and is projected to hit around US$ 87.98 billion by 2033, expanding at a CAGR of 17.2% during the forecast period from 2024 to 2033.

- The global packaging services market size forecasted to secure USD 48.37 billion by 2033, increase from USD 116.25 billion in 2023, at a compound annual growth rate (CAGR) of 9.34% from 2023 to 2033.

- The global healthcare packaging market size envisioned to advance from USD 137.13 billion in 2023 predicted to conclude USD 229.91 billion by 2032, growing at a 5.9% CAGR between 2023 and 2032.

Packaging Automation Market TOC

Introduction

- Research Objective

- Scope of the Study

- Definition and Taxonomy

Research Methodology

- Research Approach

- Data Sources

- Assumptions

Executive Summary

- Synopsis

- Analyst Recommendations

Market Overview

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Value chain analysis

- Raw Material Sourcing

- Manufacturing Process

- Logistics & Transportation

- Buyer Preferences

- Trends

- Market Trends

- Technological Trends

- Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute

- Threat of New Entrants

- Degree of Competition

- PESTLE Analysis for 5 Leading Countries

- Regulatory Framework for Leading Countries/Regions

- Supply Demand Analysis

- Production & Consumption Statistics

- Export Import Statistics

- Price Trend Analysis

View Full TOC: https://www.towardspackaging.com/table-of-content/packaging-automation-market-sizing

Act Now and Get Your Packaging Automation Market Size, Companies and Insight 2032 @ https://www.towardspackaging.com/price/5135

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/