Pune, Sept. 06, 2024 (GLOBE NEWSWIRE) -- Insurtech Market Size Analysis:

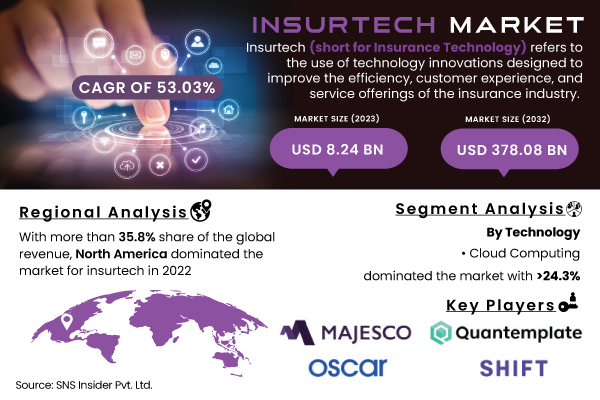

“The Insurtech Market, valued at USD 8.24 billion in 2023, is projected to skyrocket to USD 378.08 billion by 2032, achieving an impressive CAGR of 53.03% from 2024 to 2032.”

This remarkable growth is fueled by the rising demand for digital insurance platforms and the need for more efficient, personalized insurance services. The market is benefiting from ongoing innovations, such as AI-driven underwriting and blockchain-based claims management, which are enhancing operational efficiency and customer experience. As insurance companies strive to reduce costs and improve service delivery, investments in cutting-edge technologies and digital platforms are surging. The expansion of insurtech solutions is also supported by the growing acceptance of these technologies among both traditional insurers and startups.

Get a Sample Report of Insurtech Market@ https://www.snsinsider.com/sample-request/2800

Major Players Analysis Listed in this Report are:

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco

- Oscar Insurance

- Quantemplate

- Shift Technology

- Policy Bazaar

- Wipro Limited

- Clover Health Insurance

- ZhongAn Insurance

- Acko General Insurance Limited

Insurtech Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.24 Bn |

| Market Size by 2032 | US$ 378.08 Bn |

| CAGR | CAGR of 53.03% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Key Growth Drivers | • Insurtech solutions help to reduce operational costs and streamline processes, increasing insurance companies' profitability. • Growing venture capital and investment in insurtech startups are driving innovation and market growth. |

Do you have any specific queries or need any customization research on Insurtech Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/2800

Segment Analysis:

By Type: The Health Insurance segment led the Insurtech Market with over 23.5% of global revenue in 2023. This segment’s dominance is due to the increasing adoption of digital platforms that streamline interactions between insurers, brokers, and providers. The integration of mobility features into health insurance services is boosting convenience and driving demand.

By Service: In 2023, the Managed Services segment captured the largest revenue share, exceeding 43.2%. Managed services offer insurers a strategic path to transformation by combining expertise with advanced technologies, optimizing processes, and navigating regulatory challenges.

By Technology: Cloud Computing dominated the Insurtech Market with a revenue share of over 24.3% in 2023. Its versatility, ease of implementation, and capacity to handle growing data volumes are driving growth. Collaborations between cloud providers and insurers, such as Amazon Web Services Inc.’s partnership with American International Group, are further propelling market expansion.

By End-User: The BFSI sector led the market with over 20.5% of global revenue in 2023. Insurtech solutions enhance efficiency and provide valuable insights through data generated by connected devices. The Healthcare segment is expected to register the fastest growth due to increasing digitization and the need for efficient data management and monitoring.

Key Segments:

By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

By Service

- Consulting

- Support & Maintenance

- Managed Services

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

By End-use

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

Regional Analysis:

North America: In 2023, North America held the largest share of the Insurtech Market, driven by its advanced technological infrastructure and high demand for innovative insurance solutions. The U.S. remains a leader, with major companies like Lemonade and Root Insurance driving advancements in digital insurance. The region benefits from significant R&D investments and a favorable regulatory environment, solidifying its dominant market position.

Asia-Pacific: Asia-Pacific is the fastest-growing region, experiencing rapid expansion due to increased healthcare spending, rising awareness of insurtech solutions, and government initiatives to enhance digital infrastructure. Key players such as ZhongAn Online P&C Insurance and Ping An Insurance are leading the market in countries like China and India. The region’s growth is further supported by efforts to improve insurance accessibility and integrate advanced technologies into the insurance ecosystem.

Buy an Enterprise-User PDF of Insurtech Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/2800

Recent Developments:

- January 2024: Lemonade launched a new AI-driven claims management system, enhancing efficiency and accuracy in claims processing.

- February 2024: Root Insurance introduced a blockchain-based fraud prevention solution, aiming to reduce operational costs and improve security.

- April 2024: ZhongAn Online P&C Insurance expanded its digital platform with new telematics features for personalized auto insurance policies.

- June 2024: Ping An Insurance unveiled an advanced AI-powered underwriting tool to streamline policy issuance and risk assessment.

- July 2024: Metromile launched an innovative pay-per-mile insurance product, leveraging data analytics to offer customized premiums.

- August 2024: Hippo Insurance introduced a new home insurance product with integrated IoT technology for real-time risk management and claims processing.

Key Takeaways:

- The Insurtech Market is rapidly growing, driven by technological advancements and increased demand for digital insurance solutions.

- Segment analysis highlights the dominance of health insurance and the anticipated rapid growth of home insurance, alongside the significant roles of managed services and cloud computing.

- Regional analysis underscores North America's leading position and Asia-Pacific's emerging growth potential, supported by major players and government initiatives.

- Recent developments showcase the ongoing innovation and strategic advancements within the insurtech sector.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Insurtech Market Segmentation, by Type

8. Insurtech Market Segmentation, by Service

9. Insurtech Market Segmentation, by Technology

10. Insurtech Market Segmentation, by End-User

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Insurtech Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/insurtech-market-2800

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.