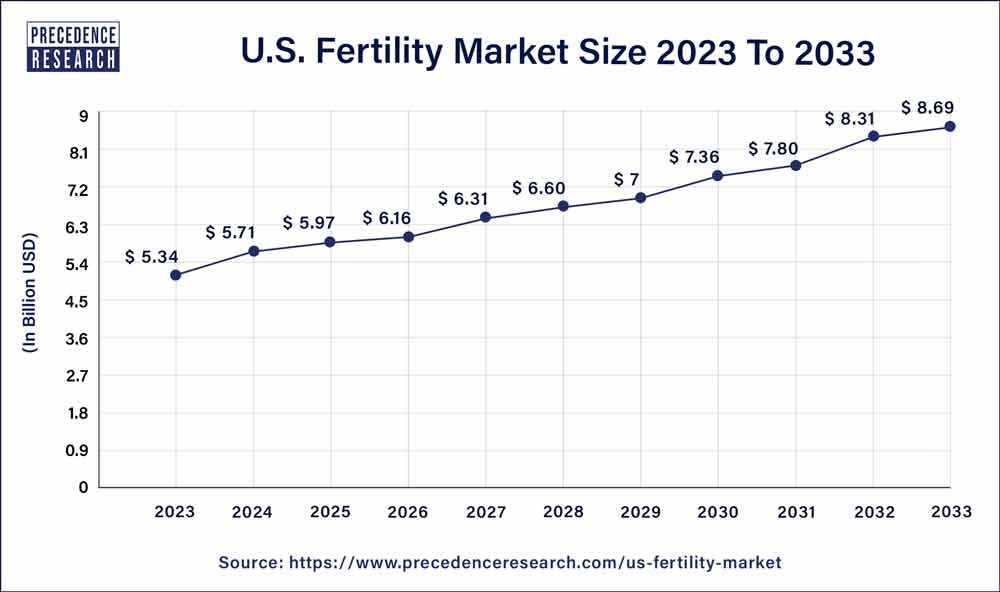

Ottawa, Sept. 06, 2024 (GLOBE NEWSWIRE) -- The U.S. fertility market size is predicted to increase from USD 5.34 billion in 2023 to approximately USD 8.69 billion by 2033. The market is expected to grow at a CAGR of 4.78% from 2024 to 2033, According to Precedence Research. The U.S. fertility market is driven by the increasing advancements in healthcare technologies and higher success rates of in vitro fertilization.

U.S. Fertility Market Overview:

Despite advances in healthcare solutions and technologies, infertility remains a key concern. The rising infertility rates due to changing lifestyle are projected to boost the market during the assessment years. According to the National Institute of Child Health and Human Development, about 9% of men and 11% of women of reproductive age in the US experience fertility problems.

Assisted reproductive technology, particularly in-vitro fertilization (IVF), boosts the growth of the market. Moreover, the rising research and development activities and emerging technologies are further boosting the efficiency of IVF treatment for infertility.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3751

U.S. Fertility Market Key Insights:

- By offering, the assisted reproductive technology segment dominated the U.S. fertility market in 2023.

- By end-user, the fertility clinics segment contributed the largest market share in 2023.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

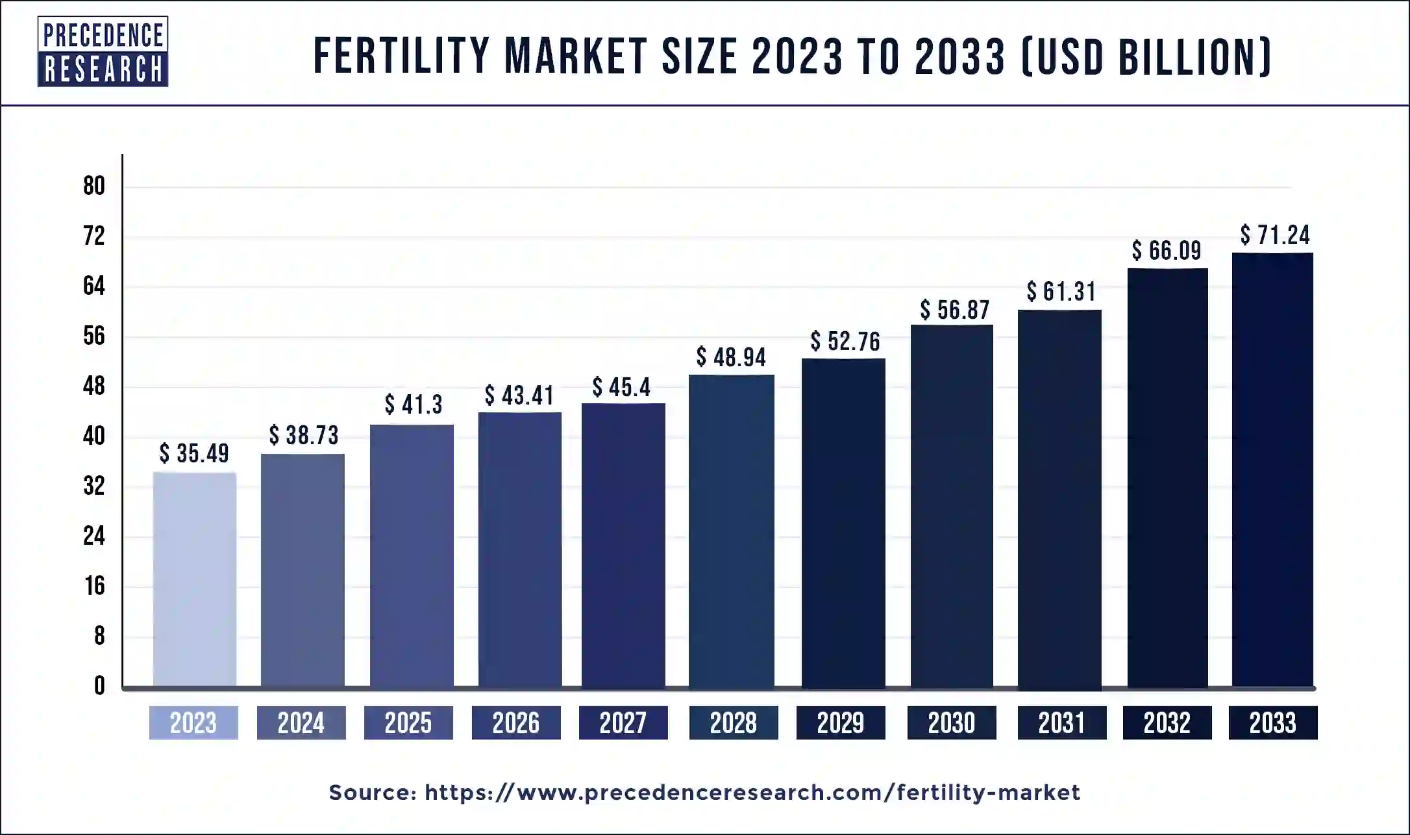

Global Fertility Market Size and Growth 2024 to 2034

The global fertility market size was USD 35.49 billion in 2023, calculated at USD 38.73 billion in 2024, and is expected to achieve USD 71.24 billion by 2033, registering a solid CAGR of 7.01% from 2024 to 2033.

Global Fertility Market (USD Million), By Offering, 2020 to 2023

| By Offering | 2020 | 2021 | 2022 | 2023 |

| Assisted Reproductive Technology | 23,646 | 25,946 | 28,522 | 31,310 |

| Fertility Drugs | 3,238 | 3,524 | 3,843 | 4,185 |

Immediate Delivery Available for Global Fertility Market | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1202

U.S. Fertility Market Segments Outlook:

Offering Outlook

The assisted reproductive technology segment dominated the U.S. fertility market in 2023. Assisted reproductive technology (ART) includes methods like in vitro fertilization (IVF), surrogacy, and fertility drugs that help increase the chances of pregnancy and reduce the risk of infections during the pre- and postnatal stages. Various types of ART include IVF, Gift, ZiFT, ICSI, IUI, surrogacy, and donor eggs. These help treat infertility. The rising adoption of ART contributed to the segmental growth.

- According to Centers for Disease Control and Prevention, in 2021, 86,146 out of 3,683,596 births in U.S. were convinced with the help of ART.

Number and outcomes of assisted reproductive technology procedures performed in 2021, by female patient’s reporting area of residence at the time of treatment in 50 US states, the District of Columbia, and Puerto Rico.

End-User Outlook

The fertility clinics segment led the U.S. fertility market in 2023 due to the countless benefits given by fertility clinics for infertility-afflicted people. These clinics provide a wide range of services, allowing patients to consult with fertility specialists in-depth. It further helps patients to identify the cause of infertility and offer personalized treatment options.

Clinics also encompass specialized onsite facilities for treatment and assistance from trained professionals. Some of the services provided by clinics include fertility testing, diagnosis, and treatments, including ovulation induction, surgical procedures, and assisted reproductive technologies such as IVF. Furthermore, clinics provide counseling on the emotional highs and lows of undergoing fertility treatment.

- According to the CDC, in 2021, around 238,126 patients had 413,776 cycles of ART at 453 reporting clinics in the U.S., leading to 112,088 clinical pregnancies, 91,906 live births (deliveries of one or more living infants), and 97,128 live-born infants.

Scope of U.S. Fertility Market

| Report Attribute | Key Statistics |

| Market Size in 2024 | USD 5.34 Billion |

| Market Size by 2033 | USD 8.69 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.78% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Offering and End User |

| Offering |

|

| End User |

|

U.S. Fertility Industry Report Content

Qualitative Analysis:

- Industry Overview

- Market Size

- Growth Prospects

- Industry Trends

- Market Drivers and Restraints

- Porter’s Analysis

- PESTEL Analysis

- Key Market Opportunities Prioritized

- Competitive Landscape

- Company Overview

- Financial Performance

- Product Benchmarking

- Latest Strategic Developments

Quantitative Analysis:

- Market size and forecast from 2024 to 2033

- Market estimates and forecast for offering segments up to 2033

- Country-wise market size and forecast for offering segments up to 2033

- Market estimates and forecast for end-user segments up to 2033

- Country-wise market size and forecast for end-user segments up to 2033

- Company financial performance

U.S. Fertility Market Dynamics:

Driver:

Rising infertility rates fueling the growth of the U.S. fertility market

Factors such as age-related diseases, lifestyle changes, hormonal changes, excessive smoking and drinking habits, delayed childbearing and sexually transmitted infections can cause infertility. Ovulation disorders are the most prevalent in women with endometriosis, structural abnormalities, autoimmune diseases like lupus, polycystic ovary syndrome (PCOS), and kidney disease.

Early symptoms of male infertility include problems with sperm shape, movement, or quantity. Veins that are enlarged in the scrotum also contribute to infertility in males. The increasing awareness about fertility treatment and the increasing rates of infertility drive the market.

- According to the World Health Organization (WHO), PCOS is the most common hormonal disorder in women of reproductive age.

Restraint:

High cost of treatment acts as a restraining factor

High cost associated with ARTs hamper the U.S. fertility market. IVF treatment costs vary due to factors such as geographical location, regulations, currency exchange rates, clinic packages, success rates, additional services, and the availability of healthcare infrastructure. Moreover, lack of insurance coverage for fertility treatments hamper the market.

Browse More Insights:

- Surrogacy Market: The global surrogacy market size is projected to be worth around USD 195.97 billion by 2034 from USD 21.85 billion in 2024, at a CAGR of 24.53% from 2024 to 2034.

- Artificial Blood Vessels Market: The global artificial blood vessels market size is projected to be worth around USD 3.75 billion by 2034 from USD 2.23 billion in 2024, at a CAGR of 5.33% from 2024 to 2034.

- Artificial Insemination Market: The global artificial insemination market size accounted for USD 2.97 billion in 2024 and is predicted to reach around USD 4.63 billion by 2034, growing at a CAGR of 4.54% from 2024 to 2034.

- Clinical Trials Market: The global clinical trials market size was valued at USD 57.37 billion in 2023 and is predicted to hit USD 90.59 bn by 2033 with a registered CAGR of 4.67% during the forecast period 2024 to 2033.

- Infertility Drugs Market: The global infertility drugs market size was valued at USD 3.71 billion in 2023 and is predicted to reach around USD 6.73 billion by 2033, growing at a CAGR of 6.13% from 2024 to 2033.

- Research Department Explosive (RDX) Market: The global research department explosive (RDX) market size accounted for USD 7.24 billion in 2024 and is predicted to reach around USD 10.09 billion by 2034, growing at a CAGR of 3% from 2024 to 2034.

- Psychiatry Clinics Market: The global psychiatry clinics market size was valued at USD 89.76 billion in 2023 and is anticipated to reach around USD 142.09 billion by 2033, growing at a CAGR of 4.70% from 2024 to 2033.

- Diagnostic Testing Market: The global diagnostic testing market size was valued at USD 210.55 billion in 2023 and is projected to surpass around USD 264.12 billion by 2033, registering a CAGR of 3% over the forecast period of 2024 to 2033.

Opportunity

Emerging technologies are propelling the market

Advancements in assisted reproductive technologies (ARTs), such as IVF, fertility testing, and diagnostics, have resulted in enhanced patient outcomes. Some sophisticated methods include AI-based in vitro fertilization (IVF), cryopreservation, time-lapse imaging, laser-assisted hatching (LAH), and intracytoplasmic sperm injection (ICSI).

Additionally, one latest method, preimplantation genetic testing, minimizes the chances of miscarriage while maximizing the chances of successful pregnancy by eliminating genetically misplaced embryos before transplantation.

- In May 2024, Gameto, a biotechnology company, raised US$ 33 million to develop fertility treatments that could shorten in vitro fertilization cycles and replace hormone injections.

- In December 2023, Orchid launched a genetic test in the U.S. that can spot genetic defects in embryos before an IVF pregnancy is initiated.

U.S. Fertility Market Top Companies

- Boston IVF Fertility Clinic

- Celmatix

- INVO Bioscience

- San Diego Fertility Center

- FUJIFILM IRVINE SCIENTIFIC

- Carolinas Fertility Institute

- Progyny Inc.

- Cook Medical

Recent News of the U.S. Fertility Market

- In July 2024, Mira, a US-based hormonal health company, launched an online clinic that provides personalized support from fertility specialists to people trying to conceive a pregnancy.

- In March 2024, Alife Health partnered up with Boston IVF to pilot the US's first AI tool for IVF medication optimization.

- In March 2023, the US Fertility and Ovation signed an definitive agreement to create the leading fertility platform in the U.S.

- In Feb 2024, Lupin, a leading pharmaceutical company, launched Ganirelix Acetate Injection in the US for women undergoing fertility treatment.

- In January 2024, IVI RMA acquired North American Operations of Eugin Group, consisting of the Boston IVF fertility network and Toronto-based TRIO, to provide evidence-based fertility solutions.

Segments Covered in the Report

By Offering

- Assisted Reproductive Technology

- IVF

- Artificial Insemination

- Surrogacy

- Others

- Fertility Drugs

- Gonadotropin

- Anti-estrogen

- Others

- Others

By End User

- Fertility Clinics

- Hospitals

- Clinical Research Institutes

Key Points of Table of Contents

Chapter 1. Introduction

Chapter 2. Research Methodology (Premium Insights)

Chapter 3. Executive Summary

Chapter 4. Market Variables and Scope

Chapter 5. COVID 19 Impact on U.S. Fertility Market

Chapter 6. Market Dynamics Analysis and Trends

Chapter 7. Competitive Landscape

Chapter 8. U.S. Fertility Market, By Offering

Chapter 9. U.S. Fertility Market, By End User

Chapter 10. U.S. Fertility Market, Countries Estimates and Trend Forecast

Chapter 11. Company Profiles

Chapter 12. Research Methodology

Chapter 13. Appendix

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3751

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us: