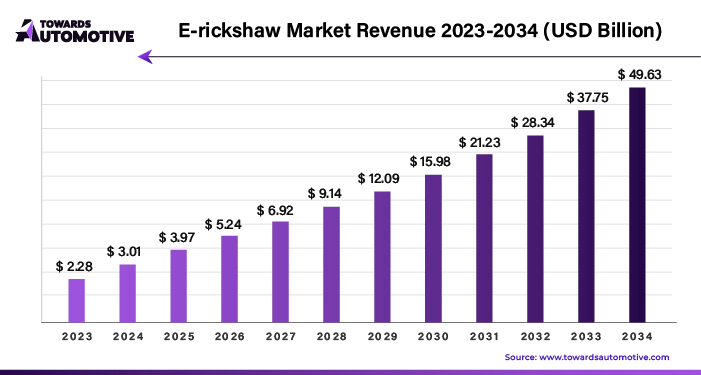

Ottawa, Sept. 11, 2024 (GLOBE NEWSWIRE) -- The global E-rickshaw market size is predicted to grow from USD 2.28 billion in 2023 to approximately USD 37.75 billion by 2033. Sales are projected to rise at a healthy CAGR of 32.02% between 2024 and 2034, a study published by Towards Automotive a sister firm of Precedence Statistics.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1327

Major Key Insights of the E-rickshaw Market:

- Asia Pacific dominated the E-rickshaw market in 2023.

- Europe is expected to grow at a significant rate in the market during the forecast period.

- By vehicle type, passenger cars segment dominated the market with the largest share in 2023.

- By battery capacity, 101 Ah segment is expected to grow at significant rate during the forecast period.

- By motor power, 1,000 to 1,500 W the segment dominated the market with the largest share in 2023.

The Rapid Growth of the E-Rickshaw Market: Trends, Opportunities, and Challenges

The e-rickshaw market is booming as car manufacturers dive into this space with new and innovative models. This growth is being boosted by government-led infrastructure projects that are enhancing the accessibility and upkeep of electric three-wheelers.

Electric vehicle (EV) makers are teaming up with public and government authorities to speed up the adoption of e-rickshaws. These collaborations are aimed at expanding charging infrastructure and pushing for supportive policies that promote electric vehicles.

Smart city projects offer a significant opportunity for e-rickshaws. These initiatives are focused on improving urban mobility, creating a perfect setting for integrating e-rickshaws into public transport systems.

The local production of electric auto-rickshaws with lithium-ion batteries is attracting consumer interest. Manufacturers are also offering buyback schemes, giving discounts on new lithium-ion battery e-rickshaws when customers trade in their old lead-acid battery models, ensuring proper disposal.

However, the e-rickshaw sector faces some hurdles. The lack of standardized quality, safety, and performance can result in a rise in low-quality e-rickshaws. Additionally, many essential components are still imported, leading to logistical and cost challenges for manufacturers.

To address these issues, leading companies are working on developing affordable three-wheeled EVs with advanced technology. This approach aims to offer consumers a blend of cost-effectiveness and cutting-edge features, making e-rickshaws an appealing choice in the fast-evolving market.

Get the latest insights on automotive industry segmentation with our Annual Membership: Get a Subscription

Transforming Tourism and Connectivity with E-Rickshaws: A New Era of Efficiency and Profitability

E-Rickshaws: A Green Choice for Tourism

E-rickshaws are becoming a popular option for tourists due to their eco-friendly design, which produces zero tailpipe emissions. This makes them ideal for destinations that focus on environmental preservation. Their small size lets them navigate narrow streets and hidden alleyways, giving tourists access to charming, less-traveled spots that larger vehicles can’t reach. E-rickshaws offer an affordable and flexible way to explore, though their limited range can be a drawback for longer journeys.

Revolutionizing Last-Mile Connectivity

In many developing countries and congested urban areas, traditional transport systems like buses and subways often miss the mark for last-mile connectivity. E-rickshaws are stepping in to fill this gap. Their compact design allows them to reach areas that conventional transport can't access. They provide a cost-effective and versatile solution for getting around, offering door-to-door service and improving mobility for residents.

For example, in July 2024, Lohia Auto, an Indian electric vehicle manufacturer, announced several new electric three-wheeler (E3W) models, expanding their offerings in the Indian market.

Increasing E-Rickshaw Profitability with Battery Swapping

Battery-swapping technology is revolutionizing the e-rickshaw industry. Traditionally, charging an e-rickshaw’s battery takes several hours, leading to downtime. With battery swapping, drivers can quickly exchange a depleted battery for a fully charged one, significantly reducing wait times and boosting operational efficiency. This innovation not only extends the e-rickshaw’s range but also allows drivers to cover longer routes and complete more trips without prolonged breaks.

Battery-swapping stations, which use standardized batteries, streamline the process by handling compatibility and maintenance issues. This infrastructure reduces the need for personal charging stations and lessens dependence on public charging points, ultimately cutting overall charging costs for drivers.

AI Integration Boosts Growth in the Electric Auto-Rickshaw Market

AI integration is set to revolutionize the electric auto-rickshaw market by significantly enhancing operational efficiency and customer experience. By incorporating advanced AI technologies, manufacturers can optimize route planning and improve energy management, leading to increased vehicle efficiency and reduced operational costs. AI-driven systems enable real-time data analysis, allowing for predictive maintenance and timely repairs, which minimizes downtime and enhances vehicle longevity.

Moreover, AI enhances safety features through advanced driver assistance systems (ADAS) that offer collision avoidance, lane-keeping assistance, and real-time traffic updates. These features not only improve safety but also boost consumer confidence and attract more buyers. Additionally, AI-powered customer service solutions, such as chatbots and personalized recommendations, offer a better user experience and streamline customer interactions.

AI integration also supports market expansion by enabling the development of smarter and more connected e-rickshaws. This advancement meets the growing demand for eco-friendly and efficient transportation options, driving market growth. As a result, AI is poised to play a crucial role in shaping the future of the electric auto-rickshaw market, fostering innovation and sustainability.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Understanding the Supply Chain Dynamics in the E-Rickshaw Market

The supply chain in the e-rickshaw market operates through a series of interconnected stages, each vital for ensuring the efficient production and distribution of electric rickshaws. It begins with the procurement of raw materials such as batteries, electric motors, and chassis components from suppliers. These materials are then delivered to manufacturing units where they are assembled into finished e-rickshaws.

Manufacturers rely on a network of suppliers for quality components, and they coordinate with logistics providers to ensure timely delivery. Once assembled, e-rickshaws are distributed to dealers and showrooms through a well-organized distribution network. The final stage involves the delivery of the e-rickshaws to end-users, often through direct sales or rental services.

Effective supply chain management in the e-rickshaw market requires careful coordination among suppliers, manufacturers, distributors, and dealers. By maintaining robust communication and leveraging technology for inventory and logistics management, the industry can address challenges such as supply shortages and demand fluctuations. This streamlined approach ensures that e-rickshaws are readily available to meet growing consumer demand and contribute to the market's expansion.

Key Components and Company Contributions to the E-Rickshaw Market Ecosystem

The E-rickshaw market is driven by several critical components and the contributions of various companies. At its core, an E-rickshaw comprises the battery, electric motor, controller, and chassis. The battery, usually lithium-ion or lead-acid, provides the power necessary for operation, while the electric motor converts this power into movement. The controller regulates the flow of electricity, ensuring smooth acceleration and braking. The chassis supports the entire structure, ensuring durability and safety.

Companies play a vital role in this ecosystem by specializing in different components and services. Battery manufacturers like Exide and Amara Raja focus on developing high-efficiency, long-lasting batteries. Electric motor producers such as Bosch and Siemens provide advanced motors that enhance performance and reliability. Controller and electronic component suppliers, including companies like Texas Instruments and Infineon, offer sophisticated control systems that optimize the driving experience. Additionally, chassis and frame manufacturers contribute by designing robust and lightweight structures that enhance the E-rickshaw’s efficiency and safety. Each company's innovations and expertise collectively push the market forward, driving growth and technological advancement in the E-rickshaw sector.

The Economic and Environmental Impact of E-Rickshaws on Urban Mobility in India

India's cities are booming, playing a key role in the nation's economic growth. As urban areas expand, there's an increasing need for sustainable development. One significant shift towards this goal is the rise of electric vehicles, especially in the auto-rickshaw sector. This transition to electric mobility is crucial for a more eco-friendly urban future.

The Evolution of Auto-Rickshaws

Auto-rickshaws have been a staple of urban transportation in India since the late 1950s, providing essential connectivity for many. With over 7 million such vehicles operating, they cater to a wide range of people. Technological progress over the years, including a shift to compressed natural gas (CNG), has improved efficiency and reduced emissions. Now, the spotlight is on electric auto-rickshaws, marking a big step towards greener urban transport.

A Growing Trend

E-rickshaws are gaining momentum in India. Data from 2023 shows that Uttar Pradesh leads with 403,411 registered e-rickshaws, followed by Delhi with 117,885 and Bihar with 108,669. Delhi has the highest density of e-rickshaws per million people. According to Down to Earth, e-rickshaws now account for 83% of the Indian electric vehicle market, with an estimated 925,000 units expected to be sold by the end of 2024.

Economic Benefits of E-Rickshaws

E-rickshaws offer several economic advantages. They are much cheaper to buy than traditional auto-rickshaws, costing between Rs 60,000 and Rs 110,000 compared to Rs 150,000 to Rs 300,000 for their internal combustion engine (ICE) counterparts. The running cost per kilometer is also significantly lower at Rs 0.40, compared to Rs 2.10 to Rs 2.30 for ICE rickshaws. E-rickshaws also have lower maintenance costs, making them more appealing to drivers. Additionally, they provide job opportunities for former cycle-rickshaw drivers, helping to sustain their livelihoods.

Environmental Benefits of E-Rickshaws

E-rickshaws are crucial for reducing air and noise pollution, addressing environmental sustainability. Replacing CNG auto-rickshaws with e-rickshaws could cut CO2 emissions by 1,036.6 tonnes daily, or 378,357 tonnes annually. This shift supports India’s efforts to lower greenhouse gas emissions and improve urban air quality.

Key Metrics

- Number of Registered E-Rickshaws:

- Uttar Pradesh: 403,411

- Delhi: 117,885

- Bihar: 108,669

- E-Rickshaw Market Share: 83% of Indian electric vehicle market

- Expected Sales by End of 2024: 925,000 units

- Initial Cost of E-Rickshaw: Rs 60,000 - Rs 110,000

- Initial Cost of ICE Auto-Rickshaw: Rs 150,000 - Rs 300,000

- Running Cost per Kilometer (E-Rickshaw): Rs 0.40

- Running Cost per Kilometer (ICE): Rs 2.10 - Rs 2.30

- Daily CO2 Emissions Reduction: 1,036.6 tonnes

- Annual CO2 Emissions Reduction: 378,357 tonnes

Market Concentration in the Electric Tuk-Tuk Sector

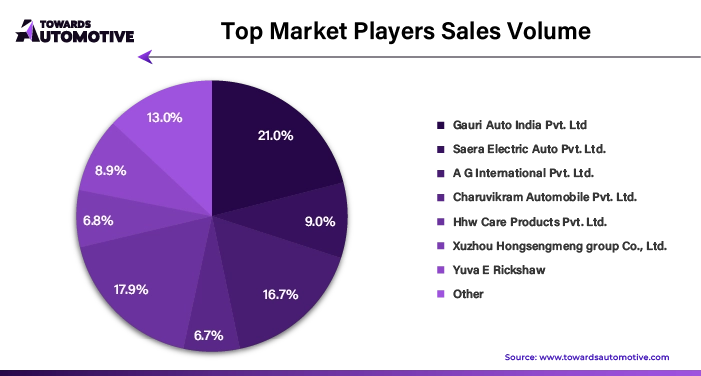

The electric tuk-tuk sector is a dynamic market with a range of players contributing to its growth. At the top, Tier 1 companies dominate the landscape, holding around 50% of the global market share. Leading these giants are Mahindra Electric Mobility Limited, formerly Mahindra Reva Electricals, which is known for its innovative electric rickshaws and strategic partnerships; Saera Electric Auto Pvt. Ltd., which focuses on enhancing the functionality and performance of its electric vehicles; and Telco E-Vehicles Pvt. Ltd., known for its cutting-edge electric rickshaw models.

In the mid-tier, Tier 2 companies make up about 35% of the market share. These players, such as How Care Products Pvt. Ltd., Charuvikram Automobiles Pvt. Ltd., and Xuzhou Hongsengmeng Group Co., Ltd., are significant but not as dominant as the Tier 1 leaders. Notable mentions include Tianjin Xingangyun Technology Co., Ltd., which has a broad network across various regions and specializes in electric tricycles and parts, and Anhui Zhengmin Vehicle Industry Co., Ltd., recognized for its high-quality production standards.

Tier 3 companies, which include smaller or local players, hold about 15% of the market share. These companies often focus on niche markets and specialized products. Among them are Gauri Auto India Pvt. Ltd., which offers a range of e-scooters and e-auto rickshaws with advanced features, and Yuva E Rickshaw, which also contributes to this tier.

Country-Wise Insights into the Electric Auto-Rickshaw Market (2024-2034)

The electric auto-rickshaw market is poised for substantial growth over the next decade, with key countries leading the charge in different regions. This section delves into the dominant players in the electric rickshaw industry, highlighting anticipated market share, sales trends, and future opportunities. Understanding these dynamics is crucial for companies aiming to target key regions for investment and strategic planning.

India: A Hub for Electric Auto-Rickshaws

India is set to remain a major player in the electric auto-rickshaw sector due to several factors. The country’s increasing urbanization and demand for affordable, eco-friendly transport solutions are driving the adoption of electric rickshaws. Government initiatives, including subsidies and regulatory support, are further boosting the market. Rising fuel prices make electric rickshaws a more cost-effective option compared to traditional petrol-powered models. India’s strong automotive industry and low labor costs also support this growth. Companies like Mahindra are capitalizing on this trend, with new models like the Treo Plus, which boasts a metal body and attractive pricing, making it more accessible to consumers. Mahindra’s Treo series has already made a significant impact, with over 50,000 units sold and a substantial reduction in CO2 emissions.

China: Leading with Manufacturing Excellence

China is emerging as a dominant force in the electric auto-rickshaw market in the Asia-Pacific region. The country’s robust manufacturing infrastructure and advanced technology position it well for large-scale production. China’s significant investments in EV technology, including battery and motor advancements, play a crucial role. Government support for clean transportation further enhances the market’s growth prospects. Chinese companies like LOBO EV Technologies are at the forefront, introducing innovations such as solar-powered e-trikes and delivery e-bikes, catering to the growing demand in sectors like food delivery.

Spain: Tourism Drives E-Rickshaw Adoption

Spain is seeing increased use of electric rickshaws, primarily driven by the tourism sector. The country’s advancements in e-rickshaw technology and lower battery prices have made these vehicles more affordable. Their compact size and eco-friendly nature make them ideal for tourist areas and restricted zones, fueling their popularity for rentals and guided tours.

France and Italy: Emerging Markets with Promising Growth

France and Italy are also witnessing growth in the electric auto-rickshaw market. France benefits from technological advancements and supportive government policies aimed at reducing emissions. In Italy, growing awareness of sustainable transport and the integration of electric rickshaws into urban mobility plans are driving market expansion.

Leading Segments in the Battery Rickshaw Industry: Trends and Insights

This section highlights the prominent segments within the battery rickshaw industry, offering valuable insights into the anticipated growth rates. This information will assist businesses in identifying leading sectors and making informed investment decisions.

Dominance of Passenger Carriers in Vehicle Types

| Segment | Passenger Carriers (Vehicle Type) | |

| Market Share (2024) | 64% | |

Passenger carriers are set to dominate the battery rickshaw market with a significant value share of 64.0% in 2024. This segment's growth is driven by the increasing consumer preference for economical and efficient travel options for short-distance trips. E-passenger carriers, also known as electric three-wheelers, are particularly appealing due to their affordability in maintenance and operation compared to traditional fuel-powered vehicles.

Manufacturers are responding to this demand by offering a diverse range of passenger carrier models, catering to various passenger capacities and comfort levels. The low operational costs and high earning potential of e-passenger carriers compared to cargo variants are notable advantages. Consequently, there is a growing trend among manufacturers to invest in the design and development of cost-effective, efficient e-three-wheelers, which benefits companies, consumers, and passengers alike.

Popularity of 1,000 to 1,500 W Motor Power

| Segment | 1,000 to 1,500 W (Motor Power) | |

| Market Share (2024) | 58% | |

Electric rickshaws with motor power ranging between 1,000 and 1,500 W are emerging as the preferred choice within the industry, capturing a substantial market share of 58.0% in 2024. This power range strikes a balance between performance and battery consumption, offering the advantage of long-range travel on a single charge.

Motor powers in this range provide good performance while adhering to regulatory limits imposed in various regions. Although higher-powered motors can deliver faster speeds, they also raise safety concerns due to increased risks. Therefore, electric rickshaws with moderate power prioritize safety and comply with urban speed limits, making them a suitable option for many developing countries.

The 1,000 to 1,500 W motor power range ensures a blend of efficiency, performance, affordability, and safety. These features make it the most appropriate choice for the majority of the electric auto-rickshaw sector, aligning with both consumer needs and regulatory requirements.

Competitive Landscape

As the electric rickshaw sector continues to expand, competition among manufacturers is intensifying. Companies are focusing on producing cost-effective models to attract price-sensitive consumers, particularly in developing countries. This shift is driven by the ongoing growth of the sector, which demands both affordability and innovation.

To stay ahead in this competitive market, manufacturers are investing in new technological advancements. Key features that are expected to provide a competitive edge include extended battery ranges, efficient e-rickshaw battery swapping infrastructure, and the integration of advanced technologies such as GPS tracking, infotainment systems, and digital payment options. These innovations are likely to boost sales and appeal to tech-savvy consumers.

However, increased competition is also exerting pricing pressure, leading to lower product prices. While this is beneficial for consumers, it poses challenges for manufacturers, potentially squeezing profit margins. The competitive landscape is fostering industry consolidation, with leading players expected to dominate as less competitive companies struggle to keep up.

Recent Developments

- In May 2024, Rajiv Bajaj, Managing Director of Bajaj Auto, announced plans to launch an affordable electric three-wheeler. This move aims to make electric rickshaws more accessible to a broader audience.

- Piaggio introduced a Battery Subscription Model in May 2024, which aims to make electric three-wheeler ownership more economical by removing the initial battery cost barrier.

- Tata Motors unveiled the TATA Ace EV 1000 mini truck in May 2024, designed for last-mile mobility. This model features the advanced EVOGEN powertrain and comes with a seven-year battery warranty, underscoring Tata Motors' commitment to innovation and reliability.

These developments reflect a rapidly evolving market where technological advancements and competitive strategies are reshaping the landscape of electric rickshaws.

Browse More Insights of Towards Automotive:

- In 2022, the global market for e-bike motors was valued at USD 4.98 billion and is projected to grow to USD 16.14 billion by 2032, reflecting a strong CAGR of 13.96%.

- The automotive e-tailing market was valued at USD 56.98 billion in 2022 and is anticipated to reach USD 121.22 billion by 2032, with a CAGR of 8.44% over the forecast period.

- The global electric vehicle reducer market was valued at USD 2.505 billion in 2024 and is expected to expand to approximately USD 25.33 billion by 2034, growing at a CAGR of 26.69% from 2024 to 2034.

- The global electric vehicle insulation market was valued at USD 7.48 billion in 2024 and is projected to reach around USD 43.02 billion by 2034, with a CAGR of 21.74% during the same period.

- The global electric vehicle battery housing market was valued at USD 2.02 billion in 2024 and is expected to grow to approximately USD 31.27 billion by 2034, showing a CAGR of 31.84% from 2024 to 2034.

- The global electric utility vehicles market was valued at USD 10.63 billion in 2024 and is projected to be worth USD 44.73 billion by 2034, expanding at a CAGR of 15.45% over the forecast period.

- The global electric commercial vehicle MRO market was valued at USD 0.79 billion in 2024 and is expected to reach USD 6.73 billion by 2034, growing at a CAGR of 23.85% from 2024 to 2034.

- The global electric scooters market was valued at USD 11.44 billion in 2024 and is forecasted to grow to USD 28.34 billion by 2034, with a CAGR of 9.15% over the forecast period.

- The global electric vehicle fluid market was valued at USD 1.65 billion in 2024 and is projected to reach USD 25.84 billion by 2034, expanding at a CAGR of 31.80% from 2024 to 2034.

- The global electric kick scooter market was valued at USD 3.06 billion in 2024 and is expected to grow to USD 8.68 billion by 2034, showing a CAGR of 11.60% during the forecast period.

Top Companies in E-rickshaw Market

- How Care Products Pvt. Ltd.

- Charuvikram Automobiles Pvt. Ltd.

- A G International Pvt. Ltd.

- Saera Electric Auto Pvt. Ltd.

- Gauri Auto India Pvt. Ltd.

- Yuva E Rickshaw

- Xuzhou Hongsengmeng Group Co., Ltd.

- Wuxi Weiyun Motor Co. Ltd.

- Wuxi Berang International Trading Co., Ltd.

- Udaan E Rickshaw

- Goenka Electric Motor Vehicles Pvt. Ltd.

- Mini Metro EV LLP

- Aditya Automobile

- Dilli Electric Auto Pvt. Ltd

Market Segments

By Vehicle Type

- Passenger carriers

- Load carriers

By Battery Capacity

- 101 Ah

- <101 Ah

By Motor Power

- Up to 1,000 W

- 1,000 to 1,500 W

- More than 1,500 W

By End-user

- Original equipment manufacturers

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Key Points of Table of Contents

- Executive Summary

- Market Segmentation

- Leading E-Rickshaw Brands

- Market Dynamics

- Regional Analysis

- Competitive Landscape

- Cross Segment Analysis

- Go-to-Market Strategies

- Integration of AI in E-Rickshaw Market

- Production and Consumption Data

- Opportunity Assessment

- Case Studies and Examples

- Future Prospects and Innovations

- Consumer Insights and Trends

- Technological Advancements

- Regulatory and Policy Framework

- Future Outlook and Projections

- Appendices

View Full in-depth TOC on E-rickshaw Market @ https://www.towardsautomotive.com/table-of-content/e-rickshaw-market-sizing

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1327

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing automotive world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive