Austin, Sept. 12, 2024 (GLOBE NEWSWIRE) -- Digital Twin Market Size Analysis:

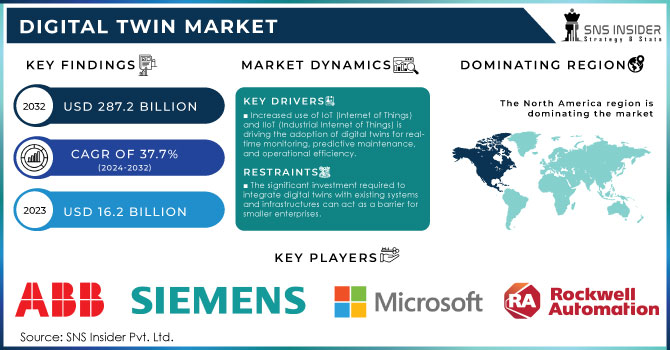

“According to SNS Insider, the Digital Twins Market Size was valued at USD 16.2 billion in 2023 and is expected to reach USD 287.2 billion by 2032, with a CAGR of 37.7% over the forecasting period 2024-2032.”

Market Analysis

Increasing Focus on Smart Infrastructure and Predictive Maintenance

The U.S. Department of Energy published that federal spending on smart infrastructure has risen by 35% in 2023. The European Commission has also dedicated €1.2 billion to projects that apply digital twins to integrate and improve the management and sustainability of urban infrastructure. This substantial governmental support has positioned digital twin technology as essential for the efficient functioning of cities and infrastructure. The technology’s ability to replicate real-world conditions in a virtual space enables the anticipation of maintenance issues before they arise, reducing downtime and cutting costs. For example, the U.S. Department of Transportation employed digital twin systems to enhance predictive maintenance measures of its bridges, tunnels, and highways, potentially preventing failures and improving long-term structural integrity. This focus on infrastructure and transportation aligns with global initiatives toward smarter, more resilient cities.

Generative AI significantly enhances digital twin technology by autonomously creating new content, models, and designs. It improves structures' performance and efficiency and boosts innovation through optimized product design. Generative AI also strengthens simulation capabilities by generating varied scenarios for comprehensive analysis of asset behavior under different conditions, aiding risk assessment and decision-making. Additionally, it speeds up the creation of digital replicas by learning from existing data, reducing model development time. Furthermore, by analyzing historical data, generative AI can identify anomalies and patterns, thereby improving predictive maintenance and helping prevent potential issues before they occur.

Get a Sample Report of Digital Twin Market @ https://www.snsinsider.com/sample-request/2760

Major Players Analysis Listed in this Report are:

- ABB Group (ABB Ability™ Digital Twin, ABB Ability™ Remote Condition Monitoring)

- Amazon Web Services, Inc. (AWS IoT TwinMaker, AWS IoT SiteWise)

- ANSYS, Inc. (ANSYS Twin Builder, ANSYS Discovery Live)

- Autodesk Inc. (Autodesk Revit, Autodesk BIM 360)

- Oracle Corporation (Oracle IoT Cloud, Oracle Digital Twin Hub)

- Accenture plc (Accenture Digital Twin Services, Accenture myConcerto)

- Hitachi Ltd. (Hitachi Lumada Digital Twin, Hitachi Smart Manufacturing)

- AVEVA Group plc (AVEVA Predictive Analytics, AVEVA Asset Performance Management)

- Capgemini (Capgemini Digital Twin Solutions, Capgemini IoT Solutions, Capgemini Digital Manufacturing)

- Bentley Systems Inc. (Bentley iTwin, Bentley OpenBuildings Designer)

- Dassault Systèmes (3DEXPERIENCE® Platform, CATIA Digital Twin)

- General Electric (GE Digital Twin, Predix Platform)

- Hexagon AB (Hexagon Digital Twin Solutions, Intergraph Smart 3D)

- IBM Corporation (IBM) (IBM Maximo, IBM Watson IoT)

- Microsoft Corp. (Microsoft Azure Digital Twins, Microsoft IoT Central)

- PTC Inc. (PTC ThingWorx, PTC Vuforia)

- Robert Bosch (Bosch IoT Suite, Bosch Digital Twin Solutions)

- Rockwell Automation Inc. (Rockwell FactoryTalk, Rockwell Automation Digital Twin)

- SAP SE (SAP Digital Twin, SAP Leonardo IoT)

- Siemens AG

Digital Twin Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 16.2 Bn |

| Market Size by 2032 | USD 287.2 Bn |

| CAGR | CAGR of 37.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Increased use of IoT (Internet of Things) and IIoT (Industrial Internet of Things) is driving the adoption of digital twins for real-time monitoring, predictive maintenance, and operational efficiency. • The need to reduce operational downtime and maintenance costs has spurred the use of digital twins to predict equipment failures and improve asset utilization. |

Do you have any specific queries or need any customization research on Digital Twin Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/2760

Segment Analysis

Predictive maintenance application segment accounted for the largest revenue share in 2023, with government programs supporting its growth. In the U.S., predictive maintenance initiatives in the manufacturing and infrastructure sectors, supported by the National Institute of Standards and Technology, are driving widespread digital twin adoption. The application process relies on real-time data from sensors to predict and prevent equipment failure, critical in high-stakes industries such as aviation, healthcare, and utilities. Meanwhile, the U.K. government invested £300 million in predictive maintenance technologies targeting the optimal use of public sector assets, such as railways and power grids. This technology is invaluable in reducing equipment downtime, resulting in increased operational efficiency with significant cost savings across multiple industries. Digital twin technology is helping minimize equipment downtime, resulting in increased operational efficiency and significant cost savings for industries

Automotive and Transport End-User Segment Accounted for the Largest Revenue Share in 2023, with automakers increasingly adopting this technology for vehicle simulation, testing, and predictive analytics. The U.S. Department of Energy’s Office of Vehicle Technologies funded projects exploring applications of digital twins in developing autonomous vehicles with over $200 million in 2023. The automotive sector’s adoption of big data and Internet of Things technologies has accelerated, resulting in significant safety improvements, cost reduction, and improved operational efficiency, particularly for electric vehicle manufacturers. For example, Tesla leverages a product digital twin to facilitate the remote troubleshooting and debugging of its cars. The telecommunications segment is growing with significant growth rate because of increased demand for network reliability and service, with the Indian Ministry of Telecommunications being a notable example. India has been at the forefront of 5G development, with a focus on digital twin systems for planning and optimization supporting the telecoms industry through enhanced service performance and reduced operational risk.

Digital Twin Market Segmentation:

By Solution

- Component

- Process

- System

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Deployment

- Cloud

- On-premise

By Application

- Product Design & Development

- Predictive Maintenance

- Business Optimization

- Others

By End-use

- Manufacturing

- Agriculture

- Automotive & Transport

- Energy & Utilities

- Healthcare & Life Sciences

- Residential & Commercial

- Retail & Consumer Goods

- Aerospace

- Telecommunication

- Others

North America led the digital twin market in 2023 and accounted for 33% revenue share

North America region’s dominance is driven by significant investments by governments and their innovation initiatives. Federal agencies of the government in the USA, such as the department of defence and military, have adopted a digital twin model deployed in logistics, defence, and various other sectors in manufacturing. Additionally, in 2023, to improve smart city infrastructures, the Canadian government invested $300 million, thereby accelerating the usage of digital twin technology in urban development make changes. North America’s investments and focus on innovating and integrating digital technologies in the public and private sector has ensured its dominance in the digital twin market. In addition, U.S. government initiatives such the Advanced Manufacturing National Program Office decision to adopt digital twin solutions in manufacturing are seen as standards for operational excellence and innovation industries.

Latest News in the Digital Twin Market

- During August 2024, Siemens launched a new digital twin platform in the cloud. The target audience is predictive maintenance, and the purpose is the large-scale industrial equipment. Backed by funding from the European government, this activity enhances performance monitoring and preventive action.

- In addition, Microsoft announced an artificial intelligence digital twin added to the Azure platform in June 2024. U.S. federal agencies also participate to streamline infrastructure management through a model’s complex systems at the user and scenario level.

- In June 2023, Helixx, a U.K.-based technology company, began its partnership with Siemens. The company invited Helixx as a new user because it plans to support the development of commercial manufacturing hubs of electric vehicles using Siemens’ digital twin software, “Xcelerator.”

Buy an Enterprise-User PDF of Digital Twin Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/2760

Key Takeaways

- This report highlights how government investments are propelling digital twin adoption, especially in predictive maintenance and transportation

- It provides insights into the largest revenue-generating segments, including automotive and transport, and the growing telecommunications sector.

- The report details North America’s leadership resulting as a consequence of considerable government’s backed innovation and investment.

- The report provides the latest developments taken by key players such as Siemens and Microsoft.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Digital Twin Market Segmentation, By Solution

8. Digital Twin Market Segmentation, By Enterprise Size

9. Digital Twin Market Segmentation, By Deployment

10. Digital Twin Market Segmentation, By Application

11. Digital Twin Market Segmentation, By End-use

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of Digital Twin Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/digital-twin-market-2760

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.