New York, Sept. 17, 2024 (GLOBE NEWSWIRE) -- Overview

The Used Cars Market size is expected to reach USD 1.8 trillion by 2024 and is further anticipated to reach USD 3.4 trillion by 2033 according to Dimension Market Research. The market is anticipated to register a CAGR of 7.3% from 2024 to 2033.

A used car, or secondhand vehicle, has had one or more previous owners and is sold through multiple channels like franchise stores, certified dealers, private parties, and rental companies. The market can be unorganized in some regions, like cross-border sales from high-income to low-income countries. Also, pricing models include private-party, dealer trade-in, and dealer prices, with changes in regulations across regions requiring compliance.

Make informed decisions with our complimentary PDF sample report, providing a detailed overview of market trends, drivers, and challenges. Seize your competitive advantage now! https://dimensionmarketresearch.com/report/used-cars-market/request-sample/

The US Overview

The Used Cars Market in the US is projected to reach USD 0.6 trillion in 2024 at a compound annual growth rate of 7.3% over its forecast period.

The US used car market is expected to show growth with a rise in online sales platforms, increasing demand for certified pre-owned and eco-friendly vehicles, and a focus on affordability. However, challenges like higher interest rates affect financing costs and concerns about maintenance expenses for older cars may deter some buyers.

Important Insights

- The Used Cars Market is expected to grow by USD 1.5 trillion by 2033 from 2025 with a CAGR of 7.3%.

- The SUV segment is set to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- The conventional vehicle segment is anticipated to lead the Used Cars market in 2024.

- The franchised dealer segment is anticipated to get the biggest revenue share in 2024 in the Used Cars market.

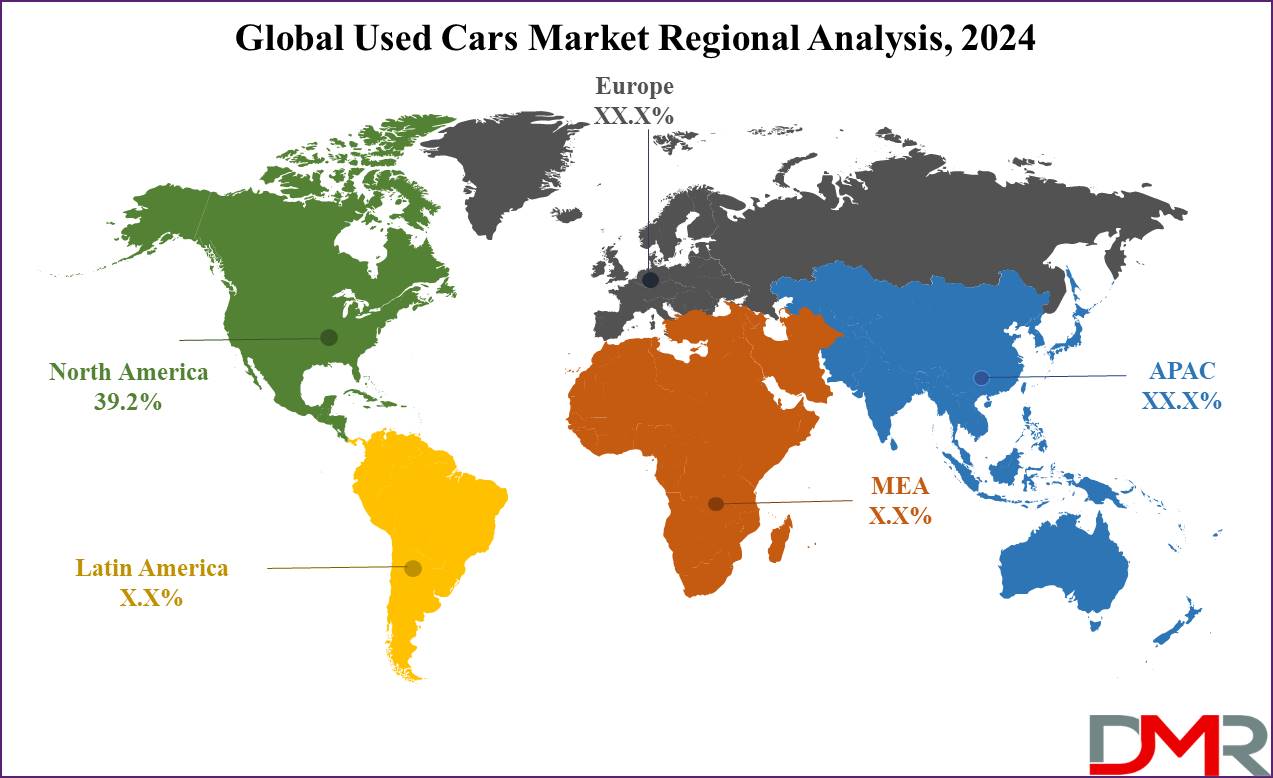

- North America is predicted to have a 39.2% share of revenue share in the Global Remote Sensing Technology Market in 2024.

Global Used Cars Market: Trends

- Rising Prices: Limited supply and high demand, mostly post-pandemic, have driven up prices in the used car market.

- Shift to Online Sales: High consumer preference for online buying has led to the growth of digital platforms & contactless transactions in the used car market.

- The popularity of SUVs and trucks: The increase in consumer preference for larger vehicles like SUVs and trucks is reflected in the used car market, driving higher demand for these models.

- Increased Focus on Sustainability: Increasing awareness of environmental impact is pushing interest in used electric & hybrid vehicles, aligning with global sustainability goals.

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today at https://dimensionmarketresearch.com/report/used-cars-market/download-reports-excerpt/

Used Cars Market: Competitive Landscape

The used car market features traditional dealerships, online platforms, and private sellers competing for market share. Digital platforms boost convenience & transparency, prompting traditional dealers to improve their online presence and offer services like certified pre-owned programs. Intense price competition drives a focus on quality, trust, and financing, while consolidation increases.

Some of the major players in the market include eBay Inc, TrueCar Inc, Alibaba Group Holding Ltd, AutoNation, Lithia Motor Inc, Cars24, Mahindra First Choice, and more.

Some of the prominent market players:

- eBay Inc

- TrueCar Inc

- Alibaba Group Holding Ltd

- AutoNation

- Lithia Motor Inc

- Cars24

- Mahindra First Choice

- Arnold Clark Automobiles Ltd

- Cox Automotive Ltd

- CarMax Enterprise Service

- Other Key Players

Used Cars Market Scope

| Market Size (2024) | USD 1.8 Tn |

| Forecast Value (2033) | USD 3.4 Tn |

| CAGR (2024-2033) | 7.3 % |

| The US Market Size (2024) | USD 0.6 Tn |

| Leading Region in terms of Revenue Share | North America |

| Percentage of Revenue Share by Leading Region | 39.2% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2025 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Vehicle Type, By Fuel Type, By Size, By Vendor Type, By Sales Channel |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Regional Analysis

North America is expected to lead the used car market in 2024, holding the largest revenue share of 39.2%. The region's varied vehicle selection, catering to various preferences & budgets, attracts a large customer base, solidifying its dominant market position. A strong market infrastructure & strong consumer demand further support North America's leadership. Further, the Asia Pacific region is expected to see the fastest growth, driven by higher demand in China, India, and other emerging markets, where technological development and organized trading services are enhancing the used car buying experience.

Drive Your Business Growth Strategy: Purchase the Report for Key Insights - Get It Now! https://dimensionmarketresearch.com/checkout/used-cars-market/

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Segment Analysis

Franchised dealers are expected to dominate the used car market in 2024, driven by their variety of vehicle selection, certified pre-owned options, immediate delivery, and strong brand trust. Key trends like expanding online infrastructure, competitive pricing, thorough product testing, and improved post-sale services. Independent dealers, providing vehicles from various brands, also play a significant role, benefiting from easy financing, lower prices, and less documentation. Their flexibility and personalized service make them a viable choice for budget-conscious buyers in a competitive market.

Used Cars Market Segmentation

By Vehicle Type

- Conventional

- Hybrid

- Electric

By Fuel Type

- Gasoline

- Diesel

- Others

By Size

- Compact

- Mid-sized

- SUV

By Vendor Type

- Organized

- Unorganized

By Sales Channel

- Franchised Dealers

- Independent Dealers

- Others

Unlock Business Opportunities with Our Sample Report - Get Yours Now! https://dimensionmarketresearch.com/report/used-cars-market/request-sample/

Global Used Cars Market: Driver

- Rising Demand for Affordable Transportation: Economic challenges & high new car prices drive consumers toward more affordable used cars.

- Increased Vehicle Durability: Better vehicle quality & longevity make used cars a more attractive option for buyers.

- Digital Platforms & Online Marketplaces: The expansion of online platforms encourages easier access to a variety of used vehicles, enhancing market efficiency.

- Financing Options & Low Interest Rates: More flexible financing options and low-interest rates make used cars more accessible to a larger pool of buyers.

Global Used Cars Market: Restraints

- Depreciation Concerns: The rapid depreciation of used vehicles can impact buyers, mainly those looking for long-term value.

- Limited Warranty & Reliability Issues: Concerns over potential repairs and a lack of warranties make some consumers hesitant to purchase used cars.

- Market Fragmentation: High variability in vehicle quality & pricing across different sellers can create trust issues & complicate the buying process.

- Regulatory & Compliance Challenges: Changing regulations and standards for used vehicles across regions can impact cross-border transactions and market expansion.

Global Used Cars Market: Opportunities

- Expansion into Emerging Markets: The growing demand for affordable vehicles in emerging economies provides significant growth opportunities for the used car market.

- Integration of AI & Data Analytics: Using AI and data analytics for pricing, vehicle history tracking, and customer targeting can improve market efficiency and consumer trust.

- Certified Pre-Owned Programs: Growth in certified pre-owned programs by manufacturers and dealers can boost consumer confidence & increase sales.

- Electric Vehicle (EV) Resale Market: As EV adoption grows, the resale market for used electric vehicles provides new growth opportunities for the used car market.

Recent Developments in the Used Cars Market

- July 2024: Volkswagen Passenger Cars India released the beginning of its Autofest Mega Exchange Carnival 2024 which provides customers a chance to enhance to a new Volkswagen car with exciting benefits & deals available during July 2024.

- June 2024: Autotech Company CARS24 emerged in the multi-brand car repair and maintenance services sector, which follows the company’s growth into financial services for funding used cars and expanding into Tier III cities and over 40 other cities.

- March 2024: Audi expanded its retail footprint in India by launching a new pre-owned car facility, Audi Approved: plus, in Guwahati, Assam. Situated at Balughat, Jayanagar, Tripura Road, which marks the 26th Audi Approved: plus facility in India and the largest luxury used car showroom in the Northeast, boasting a 10-car display.

- November 2023: Amazon launched digital showrooms on its site for shoppers to research and compare vehicles, but not purchase them directly through Amazon. Consumers can also buy car products, like replacement parts, through its site.

Browse More Related Reports

The Electric Vehicle Sensor Market is forecasted to reach USD 16.0 billion by 2024 and is expected to expand at a compound annual growth rate (CAGR) of 15.7% over the following years, reaching a market value of USD 59.4 billion by 2033.

The Automotive Chip Market is anticipated to achieve a value of USD 59.3 billion in 2024, with a projected CAGR of 11.1% through 2033, reaching a total market worth of USD 153.0 billion.

The Automotive Plastic Compounding Market, valued at USD 3,372.0 million in 2023, is expected to grow steadily at a CAGR of 6.0%, reaching a market value of USD 6,063.1 million by 2033.

The Automotive Parts Packaging Market, which was valued at USD 9.9 billion in 2023, is projected to grow at a CAGR of 4.7%, reaching a market value of USD 14.9 billion by 2033.

The Digital Railways Market is expected to grow from USD 69.8 billion in 2023 to USD 165.4 billion by 2032, with an anticipated CAGR of 10.1% over the forecast period.

The Electrified Roads Market is forecasted to reach USD 98.8 billion in 2023 and is projected to grow at a CAGR of 10.2%, reaching a value of USD 236.2 billion by 2032.

The CNG Powertrain Market is expected to attain a market value of USD 102.2 billion in 2023, with robust growth projected at a CAGR of 18.0%, reaching USD 455.0 billion by 2032.

The Automotive Wrap Films Market is projected to be valued at USD 7.4 billion in 2023 and is expected to experience rapid growth at a CAGR of 23.2% over the forecast period (2023-2032).

About Dimension Market Research (DMR)

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world. We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.