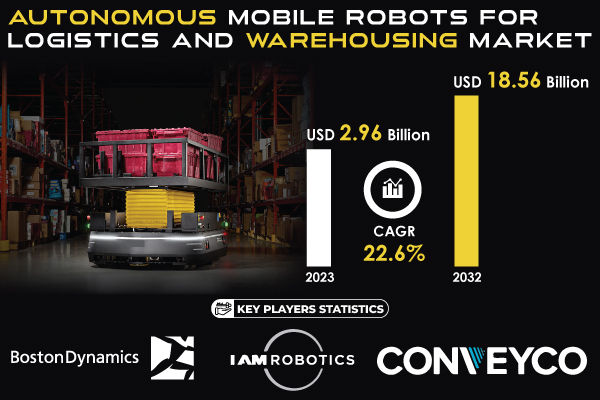

Pune, Sept. 26, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Autonomous Mobile Robots for Logistics and Warehousing Market size was valued at USD 2.96 billion in 2023 and is expected to grow to USD 18.56 billion by 2032 and grow at a CAGR of 22.6% over the forecast period of 2024-2032.”

Surge in Autonomous Mobile Robots for Logistics and Warehousing Market

The Autonomous Mobile Robots (AMR) market for logistics and warehousing is rapidly expanding, primarily due to the growing need for automation in supply chains. These self-navigating robots streamline tasks like picking, sorting, and inventory management, leading to enhanced operational efficiency and reduced labor costs. The surge in e-commerce demands quicker, more accurate fulfillment, while advancements in AI and sensor technology allow AMRs to function autonomously in dynamic environments, helping logistics companies tackle labor shortages and meet rising consumer expectations.

Download PDF Sample of Autonomous Mobile Robots for Logistics and Warehousing Market @ https://www.snsinsider.com/sample-request/4148

Key Players

- IAM Robotics (Swift and Locus)

- Geekplus Technology Co., Ltd. (GPlus and GTP Series)

- Clearpath Robotics Inc. (Husky and Otto)

- Boston Dynamics (Stretch and Handle)

- Conveyo Technologies (Conveyo AMR and Mobile Robot Systems)

- KUKA AG (KMP 1500 and KMP 600)

- Fortna Inc. (FortnaFlex and FortnaOS)

- Locus Robotics (LocusBot and Locus 2)

- Teradyne Inc. (MiR600 and MiR200)

- OMRON Corporation (LD Series and HD-1500)

- Fetch Robotics (Freight Series and RoboShelf)

- GreyOrange (Butler and GreyMatter)

- InVia Robotics (InVia Fetch and InVia Logic)

- 6 River Systems (Chucks and Collaborative Robots)

- Savioke (Relay and TUG)

- Robotnik Automation (RB-KAIROS and RB-1 Base)

- DHL Supply Chain (DHL Robotics Solutions and Automated Guided Vehicles)

- SoftBank Robotics (Pepper and Whiz)

- Adept Technology (Adept Mobile Robot and Adept Lynx)

- Seegrid (Seegrid GT10 and Seegrid Palion)

- Others

Autonomous Mobile Robots for Logistics and Warehousing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.96 Billion |

| Market Size by 2032 | USD 18.56 Billion |

| CAGR | CAGR of 22.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Autonomous Mobile Picking Robots, Automated Forklifts, Autonomous Inventory Robots, Aerial Inventory Robots) • By Applications (Retail & eCommerce, Healthcare & Pharmaceuticals, Food & Beverages, Consumer Electronics, Automotive, Others) |

| Key Drivers | • Primary factors propelling the expansion of Autonomous Mobile Robots (AMRs) in the warehouse and logistics sector. • Increasing need for automation in logistics and warehousing Autonomous Mobile Robots in focus. |

If You Need Any Customization on Autonomous Mobile Robots for Logistics and Warehousing Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/4148

Transforming Warehouse Efficiency: The Rise of Autonomous Mobile Robots

The Autonomous Mobile Robots (AMR) market for logistics is on the brink of significant growth, fueled by ongoing labor shortages and the demand for enhanced operational efficiency. Despite only 8% of U.S. warehouses currently utilizing AMRs, this is rapidly changing as e-commerce operators expand their capacities and seek solutions to overcome workforce constraints. AMRs automate repetitive tasks, improving productivity while alleviating employee strain and fostering job satisfaction. With double-digit growth projected for the sector, the integration of AMRs is reshaping warehouse operations, ensuring sustainable productivity without exhausting the workforce, thereby redefining logistics in the e-commerce landscape.

The Dual Dominance of Automated Forklifts and Retail & E-Commerce in the AMR Logistics Market

By Type,

In the Autonomous Mobile Robots (AMR) market for logistics and warehousing, Automated Forklifts dominated with a 40% revenue share in 2023, driven by the need for efficient material handling. Their automation enhances speed, precision, and labor optimization. Innovations from companies like Toyota Industries with AutonoMate and KION Group’s Linde Robotics, alongside Jungheinrich’s ECR series, showcase advancements in safety and productivity, while IoT and machine learning integration further elevate their significance in modern logistics.

By Application,

In the Autonomous Mobile Robots (AMR) market for logistics and warehousing, the Retail & eCommerce sector led with a 36% revenue share in 2023, fueled by the rapid growth of online shopping. Retailers are increasingly adopting AMRs to enhance order fulfillment, inventory management, and reduce costs. Notable developments include Amazon Robotics' new mobile fulfillment robots that optimize picking alongside human workers, GreyOrange's AI-driven Butler system for dynamic inventory management, and Fetch Robotics' Freight series for automating material handling. As demand for faster deliveries rises, investments in AMRs within this sector are expected to grow significantly.

Regional Dynamics in the Autonomous Mobile Robots (AMR) Market for Logistics and Warehousing: North America and Asia-Pacific in 2023.

In 2023, North America led the Autonomous Mobile Robots (AMR) market for logistics and warehousing, securing a notable 36% revenue share. This leadership is driven by a thriving e-commerce sector, significant investments in automation, and a focus on operational efficiency. Key product launches include Amazon Robotics' Kiva robots, Vecna Robotics' material handling AMR, and Locus Robotics' upgraded systems that enhance human-robot collaboration. As demand for rapid deliveries increases, North America's commitment to innovation solidifies its position as a frontrunner in the AMR logistics landscape.

In 2023, the Asia-Pacific region emerged as the second fastest-growing market for Autonomous Mobile Robots (AMR) in logistics and warehousing, fueled by rapid industrialization, urbanization, and a thriving e-commerce sector. Leading countries like China, Japan, and Australia are adopting AMR technologies to enhance efficiency and meet dynamic supply chain demands. Notable developments include Fanuc's launch of AMRs with advanced navigation and high payload capacities, GreyOrange's introduction of the AI-driven Butler system in India for improved inventory management, and Omron's LD Series mobile robots in Australia, aimed at optimizing material handling. This focus on automation positions Asia-Pacific as a key player in the global AMR landscape.

Buy Full Research Report on Autonomous Mobile Robots for Logistics and Warehousing Market 2024-2032 @ https://www.snsinsider.com/checkout/4148

Recent Development

- On June 4, 2024, Locus Robotics was awarded the 2024 Fortress Cybersecurity Award in the Compliance category, recognizing its commitment to adhering to the highest cybersecurity standards and safeguarding customer data.

- Dusseldorf, July 3, 2024 – Geekplus, the global leader in mobile robot and smart logistics solutions, has collaborated with Körber to deploy more than 20 autonomous mobile robots for the wine distributor Hawesko Group. The project brings warehouse automation to the company’s Tornech, Germany, facility, where in-house logistics service provider IWL handles 20 million bottles of wine and champagne annually.

- On August 26, 2024, Boston Dynamics launched its second commercial product for autonomous warehouse robotics, focused on managing physically demanding tasks to improve efficiency and safety in logistics operations.

Key Takeaways

- The report provides comprehensive insights into the Autonomous Mobile Robots for Logistics and Warehousing Market, enabling businesses to understand industry trends and competitive dynamics.

- It highlights recent developments, market size data, segment analysis, and revenue forecasts, offering valuable intelligence for strategic decision-making.

- The analysis supports companies in identifying technological innovations and emerging trends essential for gaining a competitive edge in the evolving landscape of logistics automation.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Adoption Rates (2023)

5.2 Usage and Deployment Trends (2023), by Region

5.3 AMR Unit Volume, by Region (2020-2032)

5.4 Investment in Automation, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Autonomous Mobile Robots for Logistics and Warehousing Market Segmentation, by Type

7.1 Chapter Overview

7.2 Autonomous Mobile Picking Robots

7.3 Automated Forklifts

7.4 Autonomous Inventory Robots

7.5 Aerial Inventory Robots

8. Autonomous Mobile Robots for Logistics and Warehousing Market Segmentation, by Application

8.1 Chapter Overview

8.2Retail & eCommerce

8.3 Healthcare & Pharmaceuticals

8.4 Food & Beverages

8.5 Consumer Electronics

8.6 Automotive

8.7 Others

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Description of Autonomous Mobile Robots for Logistics and Warehousing Market Report 2024-2032 @ https://www.snsinsider.com/reports/autonomous-mobile-robots-for-logistics-and-warehousing-market-4148

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.