Pune, Oct. 03, 2024 (GLOBE NEWSWIRE) -- BFSI Security Market Size & Growth Analysis:

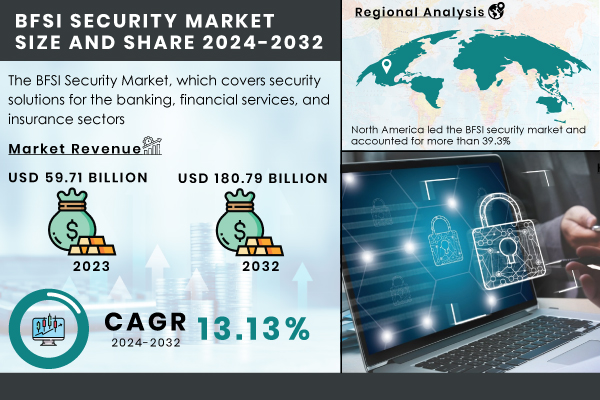

“According to SNS Insider Research, The BFSI security Market size was valued at USD 59.71 billion in 2023 and is projected to grow to USD 180.79 billion by 2032, reflecting a compound annual growth rate (CAGR) of 13.13% over the forecast period from 2024 to 2032.”

The BFSI sector has been undergoing a significant digital revolution as it relies more on Internet banking, digital transactions, and mobile banking. Such changes are convenient, but there are certain challenges as they pose an elevated risk of cybercrime. Hence, the demand for cybersecurity is growing. The rising number of online fraud, phishing attacks, and data breaches has made financial institutions more inclined to invest in more sophisticated security measures to protect their data also their clients' information and build trust. At the same time, the BFSI sector offers substantial growth opportunities in the security market. For instance, 2023 marked a significant surge in data breaches and fraud incidents, with a 14% increase in data breaches reported by September, which affected more than 66 million people in the United States, totaling 733 incidents. Similarly, phishing and extortion tactics remain prevalent, largely because the BFSI sector is particularly vulnerable to data breaches, presenting cybercriminals with ample opportunities to profit from stolen data. Furthermore, the level of fraud losses exceeded more than $10 billion, which is also 14% more than in 2022, largely driven by online scams. In this regard, all financial institutions are currently investing vast amounts of money in new advanced financial security solutions to protect data, comply with legal requirements, and increase the trust of their clients.

At present, the most notable trend includes the introduction of advanced technologies like artificial intelligence and machine learning. These innovations have the potential to revolutionize the capability of companies to detect and respond to threats. By processing vast amounts of data in real-time mode, the systems can assist institutions in identifying threats and acting accordingly.

Get a Sample Report of BFSI Security Market@ https://www.snsinsider.com/sample-request/3252

Major Players Analysis Listed in this Report are:

- IBM

- Cisco Systems, Inc

- Palo Alto Networks

- McAfee

- Symantec (Broadcom)

- Check Point Software Technologies

- Trend Micro

- Fortinet

- RSA Security

- FireEye (Trellix)

- CrowdStrike

- NortonLifeLock

- Splunk

- Gemalto (Thales)

- Zscaler

- Akamai Technologies

- F5 Networks

- Forcepoint

- Bitdefender

- CyberArk & Other Players

Another trend that is likely to strengthen data protection measures in the given sector is the implementation of biometric and multi-factor authentication systems. Furthermore, the services of specialized third parties are gaining popularity. Managed security services attract interest as they allow organizations to boost their security levels without owning a specialized team of cybersecurity experts and bearing relevant expenses. These trends are bound to fuel the growth of the BFSI security market.

BFSI Security Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 59.71 Bn |

| Market Size by 2032 | US$ 180.79 Bn |

| CAGR | CAGR of 13.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Do you have any specific queries or need any customization research on BFSI Security Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3252

Segmentation Analysis

By End-Use

In 2023, the banking sector accounted for the largest share of 41.3% of market revenue. This sector manages vast financial assets and sensitive customer data, making it a prime target for cybercriminals and fraudsters. According to the 2023 IBM 'Cost of a Data Breach' report, organizations worldwide incur an average cost of $4.45 million for each data breach. The banking sector faces increased risks from both IT infrastructure attacks and physical security breaches. Consequently, financial institutions are significantly investing in security measures such as surveillance systems, incident response planning, threat detection, and employee training, which contribute to their considerable market share.

The financial services market is anticipated to exhibit the highest growth rate of 14.6% during the forecast period. This rapid expansion is mainly due to the increasing connectivity within digital channels and IT-based services. While such progress improves convenience for customers, it also exposes them to new types of vulnerabilities derived from cyber threats. Criminals frequently resort to such tactics as phishing, fraudulent emails, and misleading phone calls to obtain sensitive customer data that would allow them to take over their accounts. For example, Truecaller research discovered that almost 70 million Americans lost as much as $40 billion to fraudsters through phone calls in 2022. As a response, financial organizations will continue to invest in protective technologies intended to keep customer information secure and maintain their operational continuity, further fueling the market growth.

BFSI Security Market key Segmentation:

By Type

- Physical Security

- Access Control Systems

- Video Surveillance Systems

- Intrusion Detection & Prevention Systems

- Security Guard Services

- Information Security

- Network Security

- Endpoint Security

- Data Security

- Identity & Access Management (IAM)

- Security Information & Event Management (SIEM)

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By End-use

-

- Banking

- Insurance

- Financial Services

Regional Landscape

North America dominated the BFSI security market in 2023 and accounted for 39.3% of the total market. The region has the presence of some of the leading global financial institutions which cater to large financial data demand. North America, as a financial powerhouse, has huge wealth and financial liquidity. Its BFSI sector has always been a soft target of cyberattacks. This, in turn, made such institutions quickly adopt security types of equipment.

The U.S. financial service sector is currently facing multiple financial threats, from credit card fraud and account hacking to data breaches and online banking scams. The first key point is that the U.S. financial system is particularly susceptible to state-sponsored cyber-attacks that are typically more complicated and widespread and necessitate serious financial investment into protection. To address these issues, multiple U.S. regulatory bodies, including Congress, have adopted numerous laws. For example, the Sarbanes-Oxley Act of 2002, the Bank Secrecy Act, and the Gramm-Leach-Bliley Act were all implemented to provide a more secure financial services environment.

Recent Developments

- In July 2024, Check Point Software Technologies Ltd. and Logix InfoSecurity Pvt Ltd announced a Managed Security Service Provider agreement aimed at enhancing email security technology solutions. This partnership is anticipated to combat advanced threats such as email phishing, account hacking, and malware scams across critical sectors, including BFSI.

- In May 2024, IBM Corporation and Palo Alto Networks revealed their collaboration to deliver AI-powered cybersecurity solutions to their clients. This strategic alliance is expected to address the rising instances of cyber threats affecting various industries, particularly the BFSI sector.

Access Complete Research Report Details of BFSI Security Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/bfsi-security-market-3252

Here's a table highlighting the benefits and impact of managed security services (MSS) on the BFSI sector:

| Aspect | Details |

| Cost Efficiency | Organizations reduce expenses by outsourcing rather than maintaining a specialized in-house cybersecurity team. |

| Access to Expertise | MSS providers bring specialized knowledge, offering advanced threat detection and mitigation techniques that would be costly to develop internally. |

| 24/7 Monitoring | Continuous monitoring by MSS providers helps in early detection and quicker response to cyber threats, improving overall security posture. |

| Scalability | MSS allows financial institutions to scale their security measures easily, adapting to evolving risks without major investments in infrastructure. |

| Regulatory Compliance | MSS providers help BFSI institutions stay compliant with changing regulations by offering updated security practices and necessary documentation. |

| Focus on Core Activities | Outsourcing security management allows BFSI organizations to focus on core activities, such as customer service and financial operations, without being bogged down by security concerns. |

| Threat Intelligence | MSS providers offer timely and updated threat intelligence, enhancing proactive defenses against potential attacks. |

| Market Growth Impact | The convenience and advantages of MSS are driving investments in BFSI security, thus contributing significantly to the market's growth. |

This table summarizes how managed security services help financial institutions enhance security, reduce costs, and ensure compliance, fueling the growth of the BFSI security market.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. BFSI Security Market Segmentation, By Type

8. BFSI Security Market Segmentation, By Enterprise Size

9. BFSI Security Market Segmentation, By End-Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Buy a Single-User PDF of BFSI Security Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3252

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.