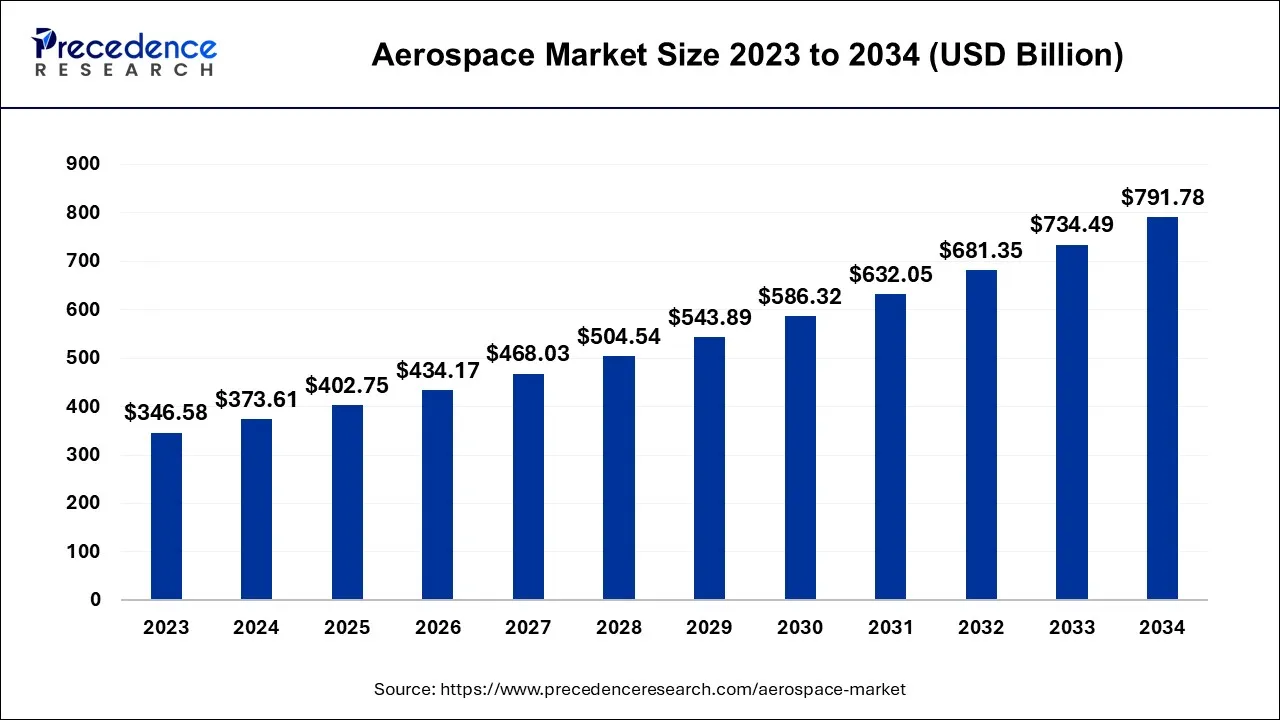

Ottawa, Oct. 04, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global aerospace market size is expected to reach around USD 734.49 billion by 2033, increasing from USD 373.61 billion in 2024. The aerospace market is driven by the increasing air traffic and the rising air travel demand. The aerospace industry involves manufacturing a wide variety of aircraft and spacecraft, such as helicopters, gliders, passenger and military aircraft, satellites, launch vehicles, and other related products.

Get Report Sample Pages@ https://www.precedenceresearch.com/sample/3457

The aerospace market witnessed significant growth over the years and is anticipated to grow rapidly soon due to the increasing military and defense spending and the rising advancements in aviation technology, such as propulsion systems, advanced materials, satellite communication, and space exploration programs. The growing curiosity about exploring outer space encourages market players to invest in R&D programs.

According to the Aerospace, Security and Defence Industries Association of Europe, the collective research and development (R&D) expenditure in the aeronautics and defense sectors reached about €23.2bn in 2022, up 18.5% as compared to the previous year.

| RD Investment | 2022 | |

| Defense Aeronautics | 56 | % |

| Civil Aeronautics | 44 | % |

Key Insights

- North America has generated highest revenue share of 46% in 2023.

- By Type, the commercial aircraft segment has captured revenue share of 43.5% in 2023.

- By Type, the aerospace support segment is growing at a CAGR of 8.5% from 2024 to 2034.

- By Size, the narrow body segment has captured revenue share of 78.2% in 2023.

- By End-user, the private sector segment has generated revenue share of 65.4% in 2023.

- By Operation, the manual aircraft segment has accounted revenue share of 68.5% in 2023.

Request here to Buy This Premium Report@ https://www.precedenceresearch.com/checkout/3457

Major companies' share report

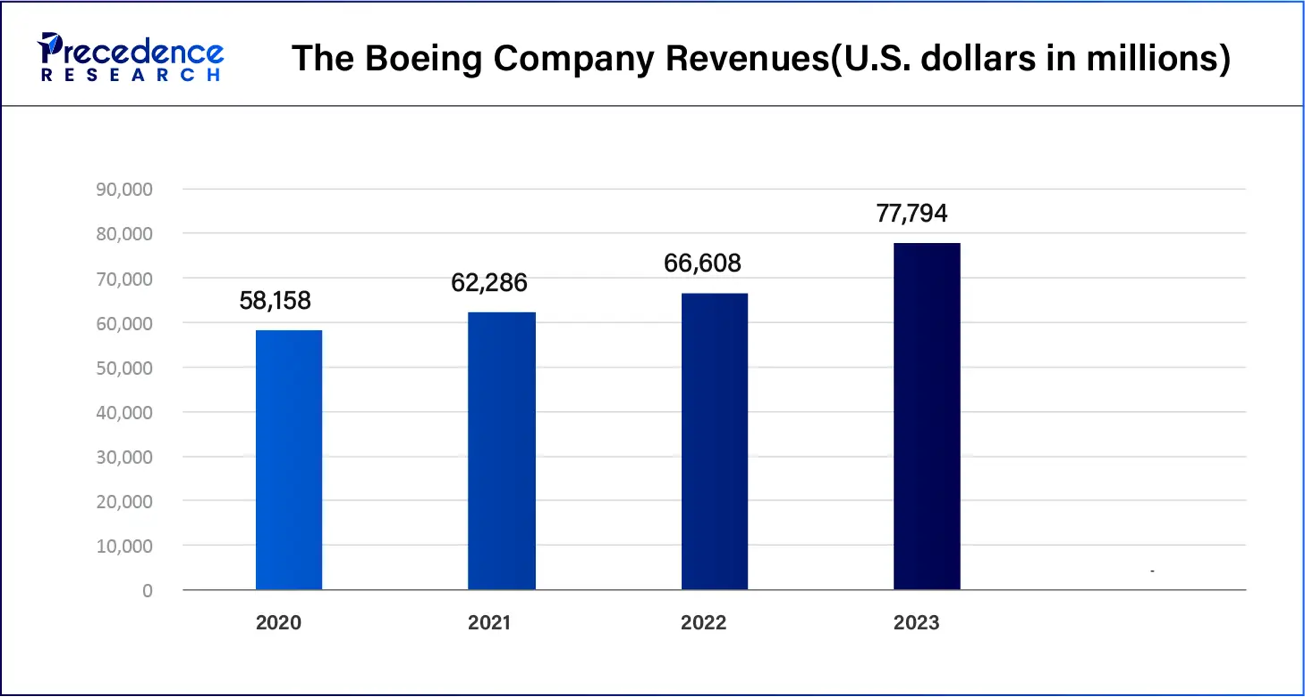

Boeing Company

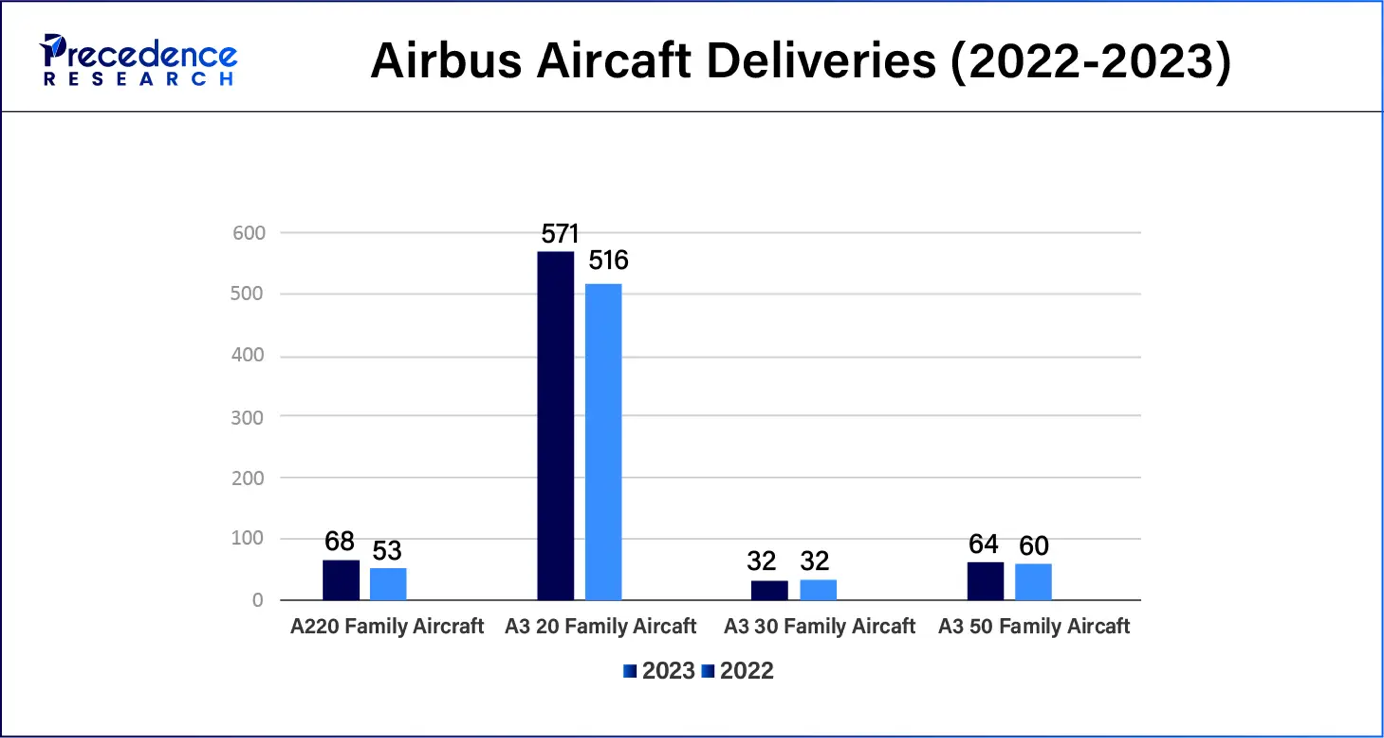

Airbus

In 2023, Airbus delivered about 735 commercial aircraft to 87 customers across the globe, indicating strong recovery as compared to 2022.

Full aircraft fleet deliveries for 2023

Aerospace Market Data and Statistics

- According to the General Aviation Manufacturers Association (GAMA), as compared to 2022, the general aviation shipments saw an immense boost. In 2023, the preliminary aircraft deliveries were valued at $28.3 billion, which is an approximate increase of 3.3% from 2022.

- Whereas the piston helicopter deliveries saw a boost where 209 units were sold. The total value of helicopter deliveries became $4.9 billion in 2023.

- In 2023, Airbus delivered 735 commercial aircraft to 87 consumers across the globe. The company has witnessed 2,319 gross orders of A320 and A350 Family aircraft in 2023.

- There were 1,509 aircraft engine parts manufacturing businesses in the United States as of 2023, which is a direct increase of 2.8% from year 2022.

- U.S. aerospace manufacturing jobs increased by 5% in 2022, reaching approximately 514,000 employees.

- Commercial aircraft deliveries by Boeing contributed $66 billion to revenues.

- $18 billion was spent globally on aerospace research and development in 2022, with 50% allocated to sustainability and decarbonization efforts.

- Total global military aircraft sales amounted to approximately $45 billion in 2022.

- Sales of business jets hit 720 units worldwide, marking a 10% year-on-year increase.

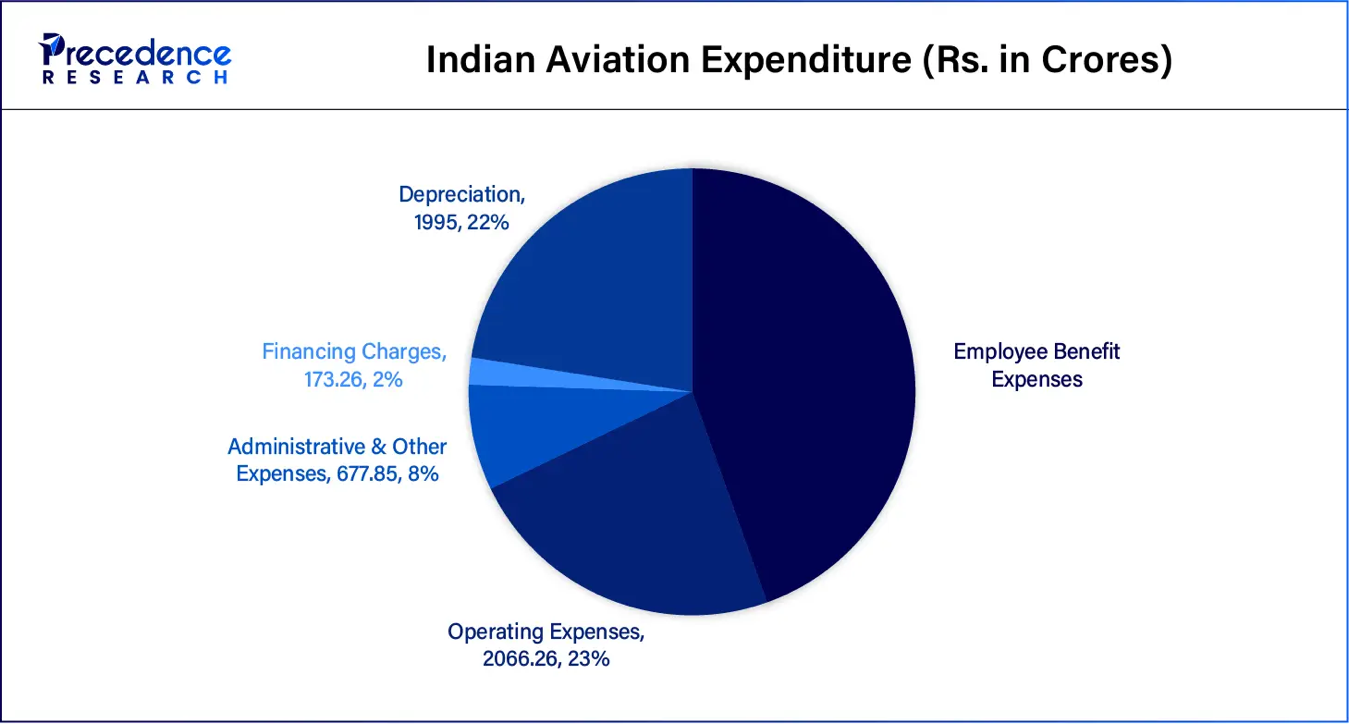

- The growing air traffic in India has set a demand of 816 new aircraft. To cater this demand, Indian aircraft operators have placed orders with major international players such as Bombardier and Airbus. The total spending on these planes is of $100 billion.

North America dominated the aerospace market

- North America dominated the market in 2023 due to the presence of many key players, including General Dynamics, Raytheon Technologies, Boeing, Lockheed Martin, and Honeywell.

- The growing need for sophisticated airplanes, including drones and satellites, and the rapid expansion of the aerospace sector further drove the market. Moreover, the increasing expenditure on aerospace R&D projects to facilitate technical advancements contributed to the growth of the market.

Asia Pacific Aerospace Market Insights

- The market in Asia Pacific is expected to expand at the fastest growth rate in the coming years. The market growth is mainly attributed to the increasing demand for air travel from China and India.

- Moreover, the increasing government investments in defense and aerospace sector to improve existing fleet capabilities are projected to boost the market in the region.

Report Highlights

Type Insights

The commercial aircraft segment dominated the market in 2023. Significant advancements have been made in commercial aviation by cutting unprofitable routes, decreasing operation expenses, and phasing out old planes that consume lots of fuel. This has resulted in cheap airfares, making air travel accessible while ensuring maximum profit margins for airline companies. Major advantages like on-demand schedules, in-flight communication, confidentiality, and safety features are key attributes of commercial aviation. Additionally, the increasing delivery of commercial aircraft contributed to the segmental growth.

- For instance, in 2023, Boeing delivered 67 commercial jets and Airbus delivered 112 units.

| Air Passengers | 2023 | |

| International | 58 | % |

| Domestics | 42 | % |

The aerospace support segment is anticipated to witness the fastest growth during the forecast period. Aerospace support is a digital solution that integrates various advanced technologies and collaborative frameworks to offer various services, such as documentation management, maintenance, logistics, repair, training, and consultancy. The feature set allows the system to perform real-time data analytics, customization, scalability, and collaborative decision-making.

Size Insights

The narrow body segment dominated the market in 2023. Aviation industry has been considerably influenced by narrow body aircraft, which affected airline strategies, route planning, and passenger experiences. For the short to medium-haul routes, they provide cost-effective options and flexibility, thereby increasing operational efficiency of aviation. In addition to this, narrow body aircraft can access several airports, including those with shorter runways.

- IBA's ISTAT-certified experts revealed that the base values of new narrow-body aircraft increased between 1.1% and 1.6% from 2022 to 2023.

The wide body segment is projected to expand rapidly during the forecast period. Advantages associated with wide body aircraft include the ability to carry many passengers, more comfort, and greater flexibility with regards to the carriage of goods. These aircraft are suitable for busy airways. Also, their spacious design makes them suitable for better in-flight entertainment systems as well as long haul flights, thus enhancing the airline’s profitability.

- In August 2024, Israel Aerospace Industries is in talks with Hindustan Aeronautics Ltd and IndiGo and Air India to establish a passenger-to-freighter facility for wide body aircraft in India.

End User Insights

The private sector segment dominated the market in 2023. Private airlines offer on-demand travel services, attracting more travelers. Private aircraft have comfortable chairs, large cabins, and lavish facilities. Long security queues and check-in processes are also bypassed by private airlines, thus saving time. Consequently, they fly from shorter airstrips, reducing the need for ground transportation. Moreover, enhanced security associated with private airlines contributed to the segment’s growth.

- In August 2024, Jetvia, one of the best Southwest jet charter companies, launched a fractional ownership financing scheme to make private aviation more accessible by reducing financial barriers for many more potential clients, with a deposit of only 25% and an interest rate of 5%.

- In April 2024, BarkBox introduced an ultra-luxury private jet air carrier for people and pets, starting at $6,000, and providing a private chef and dog Champagne.

The government sector segment is anticipated to grow at the fastest rate during the forecast period, owing to the increasing investments by governments in the aerospace sector for improving existing fleets. Government aircraft are used for facility management and security provision and contribute to economic growth while saving on direct travel expenses. In addition to this, these planes play an important role in emergency evacuations and providing healthcare services in rural areas.

- In February 2024, the Civil Aviation Ministry planned to introduce eight new flight routes for Ayodhya following the Ram Temple ceremony, which has become a popular Indian destination.

Operation Insights

The autonomous aircraft segment is expected to expand at the fastest growth rate during the forecast period. Autonomous flight technology enhances safety and efficiency in aerospace operations. Autonomous technology reduces human errors, leading to safe flight, minimizing maintenance, and reducing operational costs.

- In August 2024, during the U.S. Air Force's 'Agile Flag 24-3' exercise, Joby Aviation showcased autonomous airborne logistics operations using a Cessna 208B Grand Caravan

Aerospace Market Dynamics

Driver

Rising living standards

Rising GDP and living standards caused a significant increase in air travel, as people frequently travel for both business and leisure. Air traffic in rapidly emerging economies with better living standards is growing faster as people are willing to spend more money on travel. Moreover, globalization has also encouraged people to travel abroad, thereby propelling the market.

Restraint

Security and safety

The aerospace market faces challenges in safety and security concerns. Recent events related to commercial flights demonstrate the need for elevated security across engines, aerostructures, avionics systems, and design, testing, manufacturing, and operational processes. Engineering companies must carry out enhanced inspection services and more rigorous testing programs, along with an increased emphasis on quality assurance at every stage.

Opportunity

Emergence and adoption of new technology

In the aerospace market, cleantech involves novel approaches that help minimize carbon footprints, enhance use of green energy sources, and improve effectiveness. The rising adoption of clean combustion fuels and new materials for aircraft construction propel the market. Moreover, the increasing focus on electrification, R&D, and commercialization of hydrogen techniques contribute to the growth of the market.

- In October 2023, Ameresco, a cleantech integrator, partnered with Schaeffler Aerospace Canada to launch a large-scale energy efficiency project focusing on cooling, heating, and air quality solutions.

Recent developments

- In August 2024, Tech Mahindra partnered with Marshall Group, a specialist in aerospace and defense engineering services, to offer new technology to the aviation industry.

- In August 2024, Aerolloy Technologies Limited, a subsidiary of PTC Industries Limited, acquired a hot rolling mill for manufacturing titanium alloy plates and sheets for aerospace and defense applications.

Related Reports

Autonomous Aircraft Market - The global market for autonomous aircraft was valued at USD 8.10 billion in 2023 and is projected to grow to approximately USD 50.15 billion by 2033, with a compound annual growth rate (CAGR) of 20% from 2024 to 2033.

Electric Aircraft Market - The global electric aircraft market was valued at USD 7.91 billion in 2022 and is anticipated to reach USD 50.86 billion by 2032, experiencing a significant compound annual growth rate (CAGR) of 20.6% from 2023 to 2032.

eVTOL Aircraft Market - The global eVTOL aircraft market was valued at USD 11.15 billion in 2022 and is projected to reach approximately USD 35.79 billion by 2032, with a compound annual growth rate (CAGR) of 12.37% during the forecast period from 2023 to 2032.

eCTOL Aircraft Market - The global eCTOL aircraft market was valued at USD 2.61 billion in 2024 and is projected to grow to approximately USD 127.26 billion by 2034, with a compound annual growth rate (CAGR) of 47.5% from 2024 to 2034.

Connected Aircraft Market - The global connected aircraft market is expected to be valued at USD 5.71 billion in 2024 and is projected to reach approximately USD 50.59 billion by 2034, with a compound annual growth rate (CAGR) of 24.4% during the period from 2024 to 2034.

Aerospace Market Players

- Boeing Company

- Airbus SE

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Safran S.A.

- General Dynamics Corporation

- Leonardo S.p.A.

- BAE Systems plc

- Honeywell International Inc.

- Thales Group

- Rolls-Royce Holdings plc

- General Electric Company

- United Technologies Corporation

Segments Covered in the Report

By Type

- Commercial Aircraft

- Aircraft Maintenance

- Repair and Overhauling Services

- Aerospace Support

- Auxiliary Equipment

By Size

- Narrow Body

- Wide Body

By End User

- Private Sector

- Government Sector

By Operation

- Manual Aircraft

- Autonomous Aircraft

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Request here to Buy This Premium Report@ https://www.precedenceresearch.com/checkout/3457

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

https://www.towardsevsolutions.com/

https://www.towardsdental.com/

For Latest Update Follow Us: