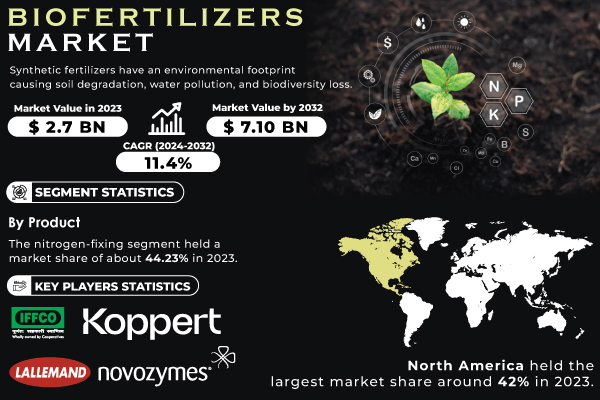

Austin, Oct. 14, 2024 (GLOBE NEWSWIRE) -- “The SNS Insider report indicates that The Biofertilizers Market is poised to witness substantial growth, projected to reach USD 7.10 Billion by 2032, growing at a compound annual growth rate of 11.4% from 2024 to 2032.”

Trends Impacting the Biofertilizers Market

One of the key drivers of growth in the biofertilizers market is the world trend of promoting sustainable agriculture. Thus, the increasing awareness of the issues caused by chemical fertilizers among the population motivates such customers to choose biofertilizers instead, as they are natural substances that help soil to become more fertile and plants to grow. At present, the biofertilizers market increases as more and more farmers begin to use the product due to the numerous advantages it provides. The relevant trend is emphasized in statistics, which indicates that the area of organic agricultural land has significantly gotten higher, with more than 75 million hectares nowadays globally.

Request Sample Report of Biofertilizers Market 2024 @ https://www.snsinsider.com/sample-request/3666

Key Players :

Raw Key Manufacturers

- Indian Farmers Fertiliser Cooperative Ltd (IFFCO BIOTECH, Nano Urea)

- CBF China Biofertilizers (Bio-NPK, Organic Fertilizers)

- Koppert Biological Systems Inc. (Mycorrhiza, Nematode Control)

- Kiwa Bio-Tech Products Group Corp (Eco-Grow Biofertilizer, Kiwa Biofertilizer)

- T. Stanes and Company Ltd (RhizoPlus, NitroPlus)

- Symborg S.L. (BlueN, Symbioroots)

- Lallemand Inc. (Lalfix, LalGreen)

- Novozymes A/S (JumpStart, Zymate)

- Sigma Agri-Science, LLC (Sigma BioFix, Green Glo)

- Biomax (Biomax Phosphate Solubilizer, Biomax Humic Acid)

This implies that as organic farming becomes more and more popular, simultaneously, the biofertilizers sector is likely to grow. Moreover, considering the situation where a higher number of countries implement more severe laws concerning the environmental impact of chemical fertilizers to minimize their use, the farmers who have been using chemical fertilizers so far are likely to switch to alternative products.

Opportunities in the Biofertilizers Market

Emerging Markets and Technological Innovations

The rapid economic growth in emerging markets, particularly in the Asia-Pacific region, is creating significant opportunities for the biofertilizers market. In countries like India and China, the demand for sustainable farming practices is on the rise, driven by increasing investments aimed at improving agricultural efficiency and environmental health. With the population in these countries expected to continue growing, the pressure to meet food demand is mounting. This scenario is pushing farmers to consider biofertilizers as a viable solution to enhance crop yields while minimizing the ecological footprint.

As more farmers become aware of the benefits of biofertilizers, adoption rates are increasing. These products not only improve soil fertility and promote plant growth but also help reduce reliance on chemical fertilizers, which can harm the environment. A recent survey by the Indian Ministry of Agriculture indicated that the use of biofertilizers among farmers has seen a notable increase, with reports suggesting that about 30% of farmers in India now incorporate biofertilizers into their farming practices.

Key Segments:

By Product

- Nitrogen Fixing

- Phosphate Solubilizing

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Application

- Seed Treatment

- Soil treatment

If You Need Any Customization on Biofertilizers Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/3666

Which Region Held the Highest Market Share in the Biofertilizers Market?

In 2023, the North American region dominated the biofertilizers market and accounted for approximately 42% of the total market share. This dominance is primarily attributed to the region's strong emphasis on sustainable agricultural practices and a growing consumer preference for organic products. The increasing awareness of the environmental impacts associated with chemical fertilizers has led farmers and agricultural stakeholders to seek eco-friendly alternatives, such as biofertilizers, to enhance soil fertility and crop yields. In North America, the increasing awareness of environmental sustainability and the rising popularity of organic products are driving demand. The United States Department of Agriculture (USDA) has reported significant growth in organic farming, further bolstering the biofertilizers market. Meanwhile, Europe’s stringent regulations on chemical fertilizers and a growing emphasis on organic agriculture have contributed to the market's expansion.

Which Product Dominated the Biofertilizers Market in 2023?

The nitrogen-fixing segment held a market share of about 44.23% in 2023. This segment includes products that contain microorganisms capable of fixing atmospheric nitrogen, such as Rhizobium and Azotobacter. The demand for nitrogen-fixing biofertilizers is increasing due to their ability to enhance soil fertility and promote plant growth, particularly for legumes. Moreover, as awareness grows regarding the negative impacts of chemical fertilizers on soil health and the environment, farmers are increasingly turning to nitrogen-fixing biofertilizers as a reliable alternative. By enriching the soil and promoting healthier plant development, these biofertilizers contribute to higher crop yields and improved agricultural sustainability, making them an essential component of modern farming strategies.

Buy Full Research Report on Biofertilizers Market 2024-2032 @ https://www.snsinsider.com/checkout/3666

Which Crop Type Segment Dominated the Biofertilizers Market in 2023?

The cereals and grains segment held the largest market share around 40% in 2023. The demand for biofertilizers in this segment is driven by the need to enhance the yield and quality of staple crops like rice, wheat, and maize. Farmers are increasingly adopting biofertilizers to improve soil health and reduce dependency on chemical fertilizers. A significant government statistic that underscores this demand is provided by the Food and Agriculture Organization (FAO) of the United Nations, which projected that global cereal production would reach approximately 3 billion metric tons in 2023, reflecting an increase from 2.7 billion metric tons in 2019. This upward trend in production indicates a growing need to satisfy the rising consumption levels driven by both population growth and dietary shifts.

Recent Developments

- In 2023, Nutrien Ltd. announced its acquisition of a leading biofertilizer company to expand its product offerings and strengthen its position in the sustainable agriculture market. This strategic move aims to enhance Nutrien’s capabilities in delivering eco-friendly solutions to farmers.

- In 2023, Biomax Technologies introduced a novel biofertilizer product formulated for specific crops, highlighting the company’s commitment to sustainability and addressing the increasing demand for tailored solutions in the biofertilizers market.

Conclusion

The biofertilizers market is on the verge of robust growth, driven by the increasing need for sustainable agricultural practices and the rising demand for organic farming solutions. Companies that prioritize product innovation, sustainability, and expansion into emerging markets are well-positioned to capitalize on the significant opportunities within this market. With ongoing developments in technology and growing consumer awareness, the biofertilizers market is expected to thrive in the coming years.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Biofertilizers Market Segmentation, by Product

8. Biofertilizers Market Segmentation, by Crop Type

9. Biofertilizers Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Biofertilizers Market Report 2024-2032 @ https://www.snsinsider.com/reports/biofertilizers-market-3666

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain