Austin, Nov. 05, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Outlook:

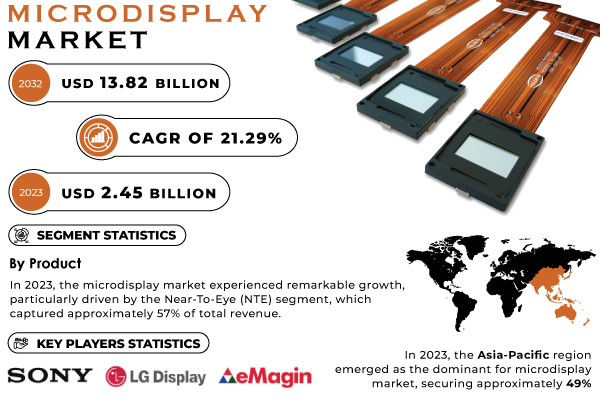

According to the S&S Insider, “The Microdisplay Market Size was valued at USD 2.45 Billion in 2023 and it is expected to reach USD 13.82 Billion by 2032 with a growing CAGR of 21.29% over the forecast period 2024-2032.”

Expanding AR/VR Integration and Advanced Display Technologies Propel Microdisplay Market Growth

A key driver for the Microdisplay Market is the widespread adoption of AR and VR devices across various sectors, such as gaming, healthcare, and retail. The technology enhances user experience by providing high-resolution visuals in compact form factors, essential for both consumer and professional applications. Furthermore, growing demand from the defense and automotive sectors for heads-up displays, which improve situational awareness and safety, is boosting the market. Increased investment in microdisplay innovation, particularly in OLED and LCOS technologies, also contributes to the development of brighter, more energy-efficient screens that offer superior.

Get a Sample Report of Microdisplay Market Forecast @ https://www.snsinsider.com/sample-request/4527

Leading Market Players with their Product Listed in this Report are:

- Sony Corporation (Micro OLED Displays, Head-Mounted Displays)

- LG Display (OLED Panels, Tandem OLED Displays)

- eMagin Corporation (OLED Microdisplay , Virtual Reality Headsets)

- Kopin Corporation (Microdisplay for AR/VR, Backplane Controllers)

- Himax Technologies (LCOS Microdisplay , Driver ICs)

- AU Optronics (LCD Panels, OLED Displays)

- Seiko Epson Corporation (Micro OLED Displays, Smart Glasses)

- Syndiant (LCOS Microdisplay , Pico Projectors)

- MicroVision (Laser Scanning Displays, AR Technology)

- Texas Instruments (Digital Light Processing (DLP) Chips)

- Panasonic Corporation (OLED Displays, Projectors)

- Universal Display Corporation (PHOLED Materials, OLED Technologies)

- Oculus VR (VR Headsets, Oculus Quest Series)

- Vuzix Corporation (Smart Glasses, AR Glasses)

- Google LLC (Google Glass, AR/VR Technologies)

- Apple Inc. (AR Glasses, VR Headsets)

- Samsung Electronics (QLED Displays, MicroLED Displays)

- Microchip Technology Inc. (Display Controllers, Microcontrollers for Displays)

- Nikon Corporation (Micro OLED Displays, Optical Instruments)

- Sharp Corporation (IGZO LCDs, OLED Panels)

Microdisplay Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.45 Billion |

| Market Size by 2032 | USD 13.82 Billion |

| CAGR | CAGR of 21.29% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Near-To-Eye, Projection, Others) • By Technology (Liquid Crystal Display (LCD), Organic Light-emitting Diode (OLED), Digital Light Processing (DLP), Liquid Crystal on Silicon (LCoS)) • By Application (Consumer Electronics, Military & Defense, Medical Applications, Industrial Systems, Automotive, Others) |

| Key Drivers | • Augmented Reality in Automotive Driving Demand for Microdisplay |

Do you Have any Specific Queries or Need any Customize Research on Microdisplay Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4527

Microdisplay Market Expansion Driven by Near-To-Eye (NTE) Innovations and LCD Dominance in High-Performance Applications

The microdisplay market’s growth in 2023 was propelled by the Near-To-Eye (NTE) segment, which led with 57% of revenue, largely thanks to advancements in AR/VR technology from industry giants like Meta and Sony. Products like Meta’s Quest 3 and Sony’s PlayStation VR2 with high-resolution OLED displays have enhanced the immersive gaming experience. Simultaneously, Liquid Crystal Displays (LCDs) captured 40% of market revenue due to their extensive use in consumer electronics and automotive applications. Market leaders Samsung, LG Display, and Sharp are driving LCD innovation, with developments in IPS and VA technologies catering to high-performance applications in gaming and professional sectors. With increasing consumer demand for advanced displays in AR/VR, both NTE technologies and LCD improvements continue to foster market growth through enhanced visuals, efficiency, and user experience. In 2023, the microdisplay market saw significant growth, led by the Near-To-Eye (NTE) segment, which accounted for 57% of total revenue. This was fueled by advancements and product launches in AR/VR from major players like Meta and Sony. Meta's Quest 3, featuring enhanced NTE microdisplay technology, and Sony's PlayStation VR2 with high-resolution OLED displays, boosted immersion and clarity in gaming. Additionally, MicroVision's new MicroLED displays bring greater brightness and energy efficiency to NTE applications. Rising consumer demand for AR glasses, especially in gaming and training, has spurred investment, with ongoing R&D expected to drive further innovations in this dynamic market.

In 2023, Liquid Crystal Displays (LCDs) dominated the microdisplay market, accounting for around 40% of total revenue due to their extensive use in consumer electronics, automotive displays, and wearables. LCDs offer high-quality images with vibrant colour reproduction and energy efficiency, making them ideal for diverse applications. Industry leaders like Samsung, LG Display, and Sharp continue to push LCD advancements, improving resolution and efficiency. LG Display, for example, has developed ultra-thin, lightweight LCDs tailored for smartphones and tablets. Specialized LCD technologies like IPS and VA have further enhanced viewing angles and contrast, gaining popularity in gaming and professional settings. As AR and VR applications expand, manufacturers are innovating LCDs to improve refresh rates and reduce latency.

Asia-Pacific's Dominance and North America's Rapid Growth in AR/VR and Consumer Electronics

In 2023, the Asia-Pacific region led the microdisplay market, capturing around 49% of global revenue due to rapid technological advancements and strong demand in consumer electronics. Industry giants like Sony, Samsung, and LG Display drive innovation in the region; Sony’s Crystal LED microdisplay targets immersive entertainment, while Samsung’s MicroLED technology enhances resolution and color accuracy. China, Japan, and India are experiencing robust growth in consumer electronics, spurring adoption of advanced microdisplays. Notable investments in AR/VR, such as Panasonic’s high-performance AR glasses, and automotive applications in ADAS and HUDs further position Asia-Pacific as a dominant force in the market.

Purchase Single User PDF of Microdisplay Market Report (33% Discount) @ https://www.snsinsider.com/checkout/4527

In 2023, North America emerged as the fastest-growing region in the microdisplay market, propelled by strong demand for advanced display technologies across diverse sectors. This growth stems largely from the widespread adoption of augmented reality (AR) and virtual reality (VR) in applications like head-mounted displays (HMDs) and automotive head-up displays (HUDs), driving the need for high-resolution, compact, and energy-efficient microdisplays. The U.S. and Canada are at the forefront, with notable investments in consumer electronics and key players such as eMagin Corporation and Kopin Corporation advancing microdisplay technology, especially for AR and VR applications. The expanding use of wearable devices and smart glasses further boosts market momentum as these products integrate microdisplays to enhance user experience. With continuous innovation and increasing consumer interest, North America is set for robust market growth.

Recent Development

- In June 2024, LG Display began mass production of the world’s first 13-inch Tandem OLED panel for laptops, enhancing OLED performance and reducing power consumption.

- In January 2024, Kopin Corporation and MICLEDI Microdisplay partnered to create high-brightness micro-LED displays for AR, combining MICLEDI’s CMOS manufacturing with Kopin's backplane expertise.

- In May 2024, VueReal launched its ColourFusion microDisplay, utilizing MicroSolid Printing for efficient full-color microLED displays in AR applications.

- In April 2024, Fraunhofer IPMS researchers improved transparency in OLED microdisplays to 45%, creating a lighter, high-resolution semi-transparent display for AR.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

7. Microdisplay Market Segmentation, by Product

9. Microdisplay Market Segmentation, by Technology

10. Microdisplay Market Segmentation, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access More Research Insights of Microdisplay Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/microdisplay-market-4527

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.