Pune, Nov. 07, 2024 (GLOBE NEWSWIRE) -- Security Orchestration, Automation, and Response (SOAR) Market Size Analysis:

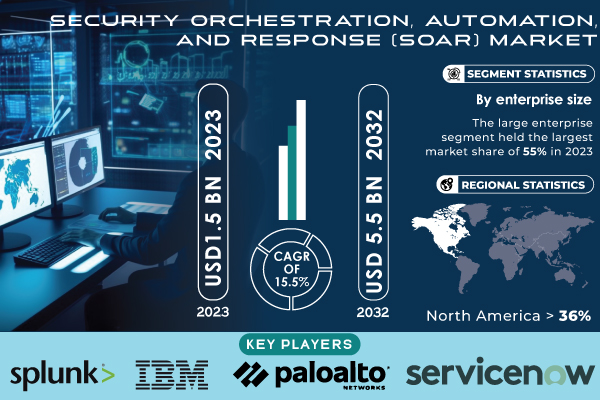

“According to the SNS insider report, in 2023, the SOAR market was valued at USD 1.5 billion, and it is projected to grow at a robust compound annual growth rate (CAGR) of 15.5%, reaching USD 5.5 billion by 2032.”

Key Trends Driving the SOAR Market Growth

The rise of cyber threats has led to increased adoption of Security Orchestration, Automation, and Response (SOAR) systems, particularly as they offer automated incident responses and efficiency in managing security events. In the United States, government support has been pivotal in encouraging SOAR deployment across sectors. For instance, the Biden administration's 2021 executive order on cybersecurity called for a zero-trust architecture in federal agencies, with SOAR technology as a key component for real-time threat detection and response. The Department of Defense (DOD) has integrated SOAR into its systems to strengthen data security, particularly given the challenges of staffing enough cybersecurity professionals in government roles. SOAR tools enable automation that helps mitigate personnel shortages by efficiently handling routine security tasks, freeing up analysts to focus on complex threats.

Data on cybersecurity incidents from agencies such as the FBI also highlights a significant need for SOAR solutions. In 2022 alone, the FBI’s Internet Crime Complaint Center received reports of over 800,000 cyber complaints, representing losses of more than $10 billion. SOAR solutions, by leveraging artificial intelligence and machine learning, help detect and respond to such threats proactively, thus helping reduce financial and operational risks for organizations across both private and public sectors.

Federal agencies are setting an example by adopting SOAR technology for enhanced automation and data-sharing capabilities, which has a ripple effect on private organizations that are also looking to improve their security posture. The SOAR market continues to grow as organizations prioritize more efficient, automated solutions to stay ahead of increasingly sophisticated cyberattacks.

Get a Sample Report of Security Orchestration, Automation, and Response (SOAR) Market@ https://www.snsinsider.com/sample-request/2249

Major Players Analysis Listed in this Report are:

- Splunk (Splunk Phantom, Splunk SOAR)

- IBM (IBM Resilient, IBM QRadar SOAR)

- Palo Alto Networks (Cortex XSOAR, Cortex XDR)

- ServiceNow (Security Operations, Incident Management)

- Rapid7 (InsightConnect, Rapid7 SOAR)

- Swimlane (Swimlane Platform, Swimlane SOAR)

- Fortinet (FortiSOAR, FortiEDR)

- McAfee (McAfee MVISION SOAR, McAfee Enterprise Security Manager)

- LogRhythm (LogRhythm SOAR, LogRhythm SIEM)

- Sumo Logic (Sumo Logic SOAR, Sumo Logic Cloud SIEM)

Security Orchestration, Automation, and Response (SOAR) Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.5 Billion |

| Market Size by 2032 | USD 5.5 Billion |

| CAGR | CAGR of 15.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • The growing sophistication and frequency of cyberattacks have heightened the need for advanced security solutions, prompting organizations to adopt SOAR platforms for effective threat detection and response. • AI and ML technologies enhance SOAR capabilities, enabling more efficient analysis of security incidents and automating routine tasks, which reduces response times. |

Do you have any specific queries or need any customization research on Security Orchestration, Automation, and Response (SOAR) Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/2249

Market Segment Analysis

By Enterprise Size

Large enterprises held a prominent position in the SOAR market, accounting for 55% of the market share in 2023. These organizations manage extensive digital infrastructures, making them prime targets for cyber-attacks. With numerous endpoints, users, and complex IT ecosystems, large enterprises benefit significantly from SOAR solutions to automate workflows, reduce manual workload, and enhance response times.

Small and medium-sized enterprises (SMEs) are also beginning to adopt SOAR systems as the cost and scalability of these solutions improve. As cybersecurity threats impact businesses of all sizes, SMEs are seeking affordable, efficient ways to strengthen their defenses, making SOAR solutions an attractive option.

By Application

Incident response dominated the SOAR market application segment in 2023 and held a market share of 38%. As cyber-attacks grow more frequent and sophisticated, effective incident response has become critical for businesses to minimize damage and resume operations swiftly. SOAR solutions streamline the incident response process by automating threat intelligence gathering, data correlation, and triaging of alerts, which enables quicker threat neutralization and minimizes operational disruption.

Other applications, such as threat intelligence and compliance, are also experiencing substantial growth as organizations aim to gain deeper insights into their security posture and comply with regulatory standards. SOAR solutions help these companies by centralizing threat data, offering real-time visibility, and facilitating compliance management.

By Vertical

The IT and telecommunications sector led the SOAR market by vertical, with a market share of 18.1% in 2023. As data-driven organizations, IT and telecommunications companies are responsible for safeguarding vast amounts of sensitive information. The complex nature of their networks and the critical need to ensure continuous service make SOAR solutions vital to this industry’s cybersecurity strategy.

The BFSI sector is another major adopter of SOAR technologies, as it is heavily regulated and highly susceptible to cyber threats. Banks and financial institutions are increasingly investing in SOAR solutions to meet regulatory requirements, protect customer data, and prevent financial losses from cyber incidents.

SOAR Market Segmentation:

By Component

- Solution

- Services

By Organization Size

- Small & Medium Enterprises

- Large Enterprises

By Deployment Mode

- Cloud

- On-Premises

By Application

- Threat Intelligence

- Network Forensics

- Incident Response

- Compliance

- Others

By Vertical

- BFSI

- IT & Telecom

- Retail & E-commerce

- Healthcare

- Manufacturing

- Government

- Education

- Others

Regional Analysis

North America is at the forefront due to its advanced technology infrastructure and high concentration of SOAR solution providers. In 2023, North America accounted for approximately 36% of the market share, driven by large-scale adoption among enterprises seeking to mitigate the escalating costs associated with data breaches. High-profile incidents and regulatory requirements, such as the GDPR and CCPA, have also contributed to SOAR adoption in this region.

The Asia-Pacific region is expected to see rapid growth over the forecast period, with a considerable CAGR from 2024 to 2032. Emerging economies such as India, China, and Japan are experiencing a rise in cybersecurity investments, spurred by the increasing frequency of cyber-attacks and the growing digitalization of industries. As organizations in the Asia-Pacific region adopt cloud technologies, IoT devices, and digital transformation initiatives, the demand for comprehensive SOAR solutions is on the rise to manage the increased cyber risks.

Buy an Enterprise-User PDF of SOAR Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/2249

Recent Developments in the SOAR Market

- In 2023, Palo Alto Networks expanded its SOAR capabilities through its Cortex XSOAR platform, integrating machine learning features for enhanced threat intelligence and faster response times. This move is set to improve the company’s position in the competitive SOAR landscape.

- Splunk Inc. entered into a strategic partnership with Amazon Web Services (AWS) in 2023 to provide a scalable SOAR solution for cloud-native environments. This collaboration aims to help organizations with hybrid and cloud-based infrastructures effectively manage security incidents.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Security Orchestration, Automation, and Response (SOAR) Market Segmentation, By Component

8. Security Orchestration, Automation, and Response (SOAR) Market Segmentation, By Organization Size

9. Security Orchestration, Automation, and Response (SOAR) Market Segmentation, By application

10. Security Orchestration, Automation, and Response (SOAR) Market Segmentation, By Deployment Mode

11. Security Orchestration, Automation, and Response (SOAR) Market Segmentation, By Vertical

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of SOAR Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/security-orchestration-automation-and-response-market-2249

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.