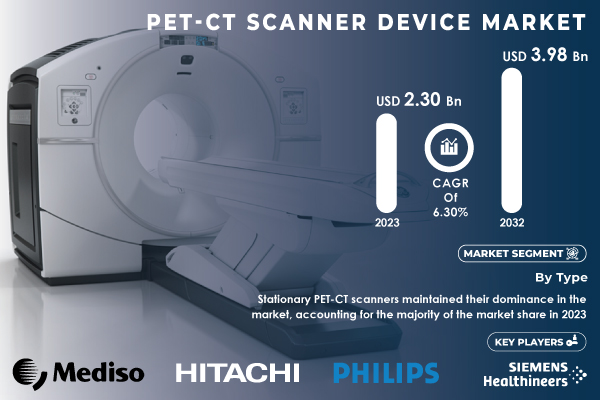

Austin, Nov. 21, 2024 (GLOBE NEWSWIRE) -- The PET-CT Scanner Device Market was valued at USD 2.30 billion in 2023 and is projected to reach USD 3.98 billion by 2032, growing at a CAGR of 6.30% during the forecast period of 2024-2032. The market is witnessing growth due to the increasing demand for early diagnosis of various medical conditions, particularly cancer, and the continual improvements in imaging technology that enhance the precision and efficiency of PET-CT scanners.

Market Overview

The PET-CT scanner market has witnessed tremendous growth in the recent past, and the trend is expected to continue with technological innovations, population aging, and increasing diseases such as cancer, neurological disorders, and cardiovascular diseases. The combination of PET with CT in one device offers high-resolution imaging with early detection and precise monitoring of disease progression.

The demand for PET-CT scanners is also driven by the requirement for more effective tools that help in disease prognosis, such as cancer, in which early diagnosis holds paramount importance for the treatment. The adoption of PET-CT scanners by hospitals, diagnostic centers, and research institutions also contributes to the growth of the market since these machines use non-invasive imaging. Further driving the market are new developments in imaging technologies like higher resolution, faster scanning times, and integration with AI for better analysis of images. The move towards less invasive diagnostic techniques also pushes the demand for more PET-CT scanners in different applications: oncology, cardiology, and neurology.

Download PDF Sample of PET-CT Scanner Device Market @ https://www.snsinsider.com/sample-request/4147

Prominent Players:

- General Electric Co. - Discovery PET/CT Series (e.g., Discovery MI, Discovery 690)

- Siemens Healthineers - Biograph mCT, Biograph Vision

- Koninklijke Philips N.V. - Ingenuity TF PET-CT, PET/CT Vereos

- Canon Medical Systems - Celesteion PET-CT Scanner

- Hitachi, Ltd. - PET-CT System: Scintillator-based and Digital PET-CT

- Mediso Ltd. - NanoPET/CT (Preclinical PET-CT system)

- PerkinElmer, Inc. - Triumphant PET/CT

- Toshiba Corporation - Aquilion ONE PET/CT

- Bruker Corporation - Quadra PET-CT

- Neusoft Medical Systems - Neusoft PET-CT Scanner

- Yangzhou Kindsway Biotech Co. Ltd. - KDW-PET/CT

- Shimadzu Corporation - NexCore PET/CT

- United Imaging - uMI 550 PET/CT

- Positron Corporation - NovoPET PET/CT Scanner

- MIE (Medical Imaging Electronics) - MIE PET-CT

- Basda - BD-PET/CT

- MinFound Medical Systems - MinFound PET-CT System

- Radimage Technologies Pvt. Ltd. - RadPET-CT

- Edge Medical Solutions Pvt. Ltd. - EdgePET-CT

- GS Medical Imaging Private Limited - GS PET-CT

PET-CT Scanner Device Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.30 Billion |

| Market Size by 2032 | USD 3.98 Billion |

| CAGR | CAGR of 6.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Stationary Scanners, Portable Scanners/Mobile Scanners) • By Service Provider (Hospitals, Diagnostic Centers, Research Institutes) • By Application (Oncology, Neurology, Cardiology, Others) • By Slice Count (Low Slice Scanner (<64 Slices), Medium Slice Scanner (64 Slices), High Slice Scanner (>64 Slices)) • By Isotope/Detector Type (Fluorodeoxyglucose (FDG), 62Cu ATSM, 18 F Sodium Fluoride, FMISO, Gallium, Thallium, Others) |

| Key Drivers | • Advancing Precision Medicine with the Growing Impact of PET-CT Scanners |

If You Need Any Customization on PET-CT Scanner Device Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/4147

Segment Analysis

By Type: Stationary PET-CT Scanners Dominated, Mobile Scanners Show Rapid Growth

Stationary PET-CT scanners dominated the market in 2023, holding a substantial share of approximately 70.0%. These systems are widely preferred due to their stability, high throughput, and excellent imaging quality. They are commonly found in hospitals and diagnostic centers where frequent and high-quality imaging is required for complex diagnostic procedures in oncology, neurology, and cardiology.

The portable/mobile PET-CT scanners, growing at a CAGR of 10%, are emerging as a fast-growing segment. The increasing demand for on-site diagnostics in remote areas and emergency settings, where installation of stationary systems is not feasible, is driving the adoption of portable scanners. These mobile scanners are becoming crucial for emergency medical services and outpatient care.

By Service Provider: Hospitals Led, Diagnostic Centers Growing Rapidly

In 2023, hospitals accounted for the largest share of the PET-CT market, holding approximately 65.0%. Hospitals continue to dominate the market as they offer a wide range of services, including oncology, cardiology, and neurology departments, where PET-CT imaging plays a vital role in accurate diagnosis and treatment planning.

Diagnostic centers, which grew at a significant rate of 9%, are emerging as a key player in the market due to their focus on advanced imaging technologies and cost-effective services. The shift toward outpatient services and the growing demand for quick and efficient diagnostic solutions are propelling the growth of diagnostic centers.

By Application: Oncology Led, Neurology Surges in Demand

Oncology remained the dominant application for PET-CT scanners, accounting for approximately 55.0% of the market share in 2023. The ability of PET-CT scanners to detect cancer at its early stages, along with their role in staging, treatment planning, and monitoring, makes them essential in oncology. As the global cancer burden continues to rise, the demand for PET-CT imaging in oncology is expected to grow substantially.

Neurology is the fastest-growing application segment, growing at a CAGR of 10%. The rising prevalence of neurological disorders, such as Alzheimer's disease, Parkinson's disease, and epilepsy, along with advances in imaging technology, are driving the increased use of PET-CT scanners in neurology. PET-CT scanners' ability to detect metabolic changes in the brain offers better diagnostic accuracy, which is fueling growth in this segment.

Regional Analysis

North America held the largest market share in 2023, with the United States leading the charge. The region's dominance is attributed to the high healthcare expenditure, the presence of advanced medical infrastructure, and the increasing demand for early-stage cancer detection. The U.S. is home to several major healthcare providers and research institutions that contribute to the widespread use of PET-CT scanners. Additionally, the region benefits from continuous innovations in medical imaging technologies, including the integration of AI and machine learning with PET-CT devices.

The demand for PET-CT scanners in North America is expected to continue growing due to the rising prevalence of chronic diseases, the aging population, and the focus on precision medicine. Moreover, the region sees high adoption rates of both stationary and mobile PET-CT scanners, owing to the need for quick diagnostics in hospitals, clinics, and emergency settings.

The Asia-Pacific region is the fastest-growing market for PET-CT scanners, driven by increasing healthcare investments, growing demand for advanced imaging technologies, and the rising prevalence of cancer and neurological diseases. China and India are key contributors to this growth due to their large population, improved healthcare infrastructure, and increasing awareness of the benefits of advanced diagnostic technologies.

The Asia-Pacific market is also experiencing a rise in the number of diagnostic centers offering affordable imaging services. These centers are becoming increasingly popular in countries like India, where the healthcare system is undergoing significant transformation. The region is expected to witness accelerated adoption of both stationary and mobile PET-CT scanners in the coming years.

Buy Full Research Report on PET-CT Scanner Device Market 2024-2032 @ https://www.snsinsider.com/checkout/4147

Recent Developments

- November 2024: Philips received FDA 510(k) clearance for its Spectral CT 7500 RT, a new detector-based spectral CT radiotherapy solution, designed to enhance radiotherapy precision.

- June 2024: The IRCCS in Bologna unveiled the world’s first Total-Body PET/CT scanner, the uEXPLORER system, co-developed by UC Davis and United Imaging Healthcare, marking a breakthrough in oncology imaging.

These recent innovations are driving ongoing improvements in diagnostic imaging, making PET-CT scanners more efficient, accessible, and capable of meeting the growing demand for precise medical diagnoses across various applications.

Table of Contents – Major Key Points

1. Introduction

- Market Definition

- Scope (Inclusion and Exclusions)

- Research Assumptions

2. Executive Summary

- Market Overview

- Regional Synopsis

- Competitive Summary

3. Research Methodology

- Top-Down Approach

- Bottom-up Approach

- Data Validation

- Primary Interviews

4. Market Dynamics Impact Analysis

- Market Driving Factors Analysis

- PESTLE Analysis

- Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

- Incidence and Prevalence (2023)

- Prescription Trends (2023), by Region

- Device Volume, by Region (2020-2032)

- Healthcare Spending, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

- List of Major Companies, By Region

- Market Share Analysis, By Region

- Product Benchmarking

- Strategic Initiatives

- Technological Advancements

- Market Positioning and Branding

7. PET-CT Scanner Device Market Segmentation, by Type

8. PET-CT Scanner Device Market Segmentation, By Service Provider

9. PET-CT Scanner Device Market Segmentation, By Application

10. PET-CT Scanner Device Market Segmentation, By Slice Count

11. PET-CT Scanner Device Market Segmentation, By Isotope/Detector Type

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/4147

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.