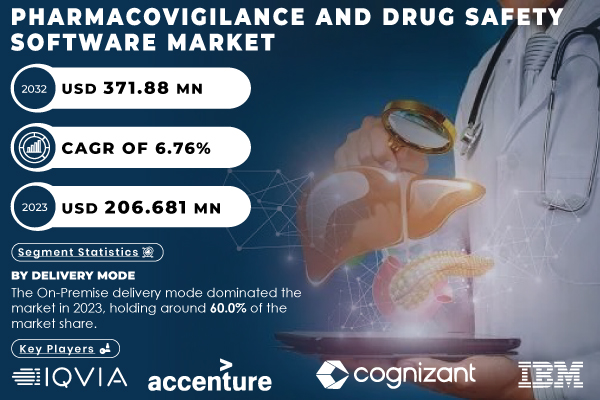

Austin, United States, Nov. 25, 2024 (GLOBE NEWSWIRE) -- “According to SNS Insider, The Pharmacovigilance and Drug Safety Software Market, is projected to grow from USD 206.68 million in 2023 to USD 371.88 million by 2032, at a CAGR of 6.76% over the forecast period from 2024 to 2032.”

Key Market Drivers

The increasing demand for drug safety monitoring, fueled by a surge in global pharmaceutical drug approvals and the need to comply with stringent regulatory requirements, is driving this market's growth. Furthermore, the integration of advanced technologies, such as artificial intelligence (AI), machine learning (ML), and cloud-based solutions, is expected to play a pivotal role in enhancing pharmacovigilance processes.

The market's growth is attributed to the rising number of drug approvals, increasing adverse drug reactions (ADR) reporting, and the growing need for effective drug safety monitoring systems. With pharmaceutical companies under constant scrutiny from regulatory bodies like the FDA and EMA, there is an increasing need for robust pharmacovigilance systems. The adoption of AI and ML technologies is also accelerating the demand for smarter and more efficient drug safety solutions, enabling faster data analysis and early detection of potential drug risks.

Get a Sample Report of Pharmacovigilance and Drug Safety Software Market@ https://www.snsinsider.com/sample-request/2379

Market Overview

Pharmacovigilance and drug safety software plays a crucial role in monitoring and assessing the safety of drugs, ensuring that any potential adverse reactions or side effects are detected and managed promptly. The software helps pharmaceutical companies, biotech firms, and regulatory bodies ensure drug safety, improve clinical trials, and maintain compliance with global regulations. The growing focus on patient safety and regulatory compliance, combined with the increasing volume of data from clinical trials and post-market surveillance, is driving demand for these software solutions.

The global market for pharmacovigilance and drug safety software is characterized by rapid advancements in technology. The incorporation of AI and big data analytics allows pharmaceutical companies to streamline data collection, signal detection, and risk assessment processes. Additionally, regulatory requirements surrounding ADR reporting and post-market surveillance are becoming more stringent, creating a strong demand for software that can help automate and improve compliance.

Key Pharmacovigilance and Drug Safety Software Companies Profiled:

- IQVIA

- Accenture

- Cognizant

- Laboratory Corporation of America Holdings (LabCorp)

- IBM

- ArisGlobal

- ICON Plc.

- Capgemini

- Oracle

- Parexel International Corporation

- ArisEurope

- Syneos Health

- Genpact

- Max Application

Pharmacovigilance and Drug Safety Software Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 206.68 million |

| Market Size by 2032 | US$ 371.88 million |

| CAGR | CAGR of 6.76% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Need any customization research on Pharmacovigilance and Drug Safety Software Market, Enquire Now@ https://www.snsinsider.com/enquiry/2379

Segmentation Insights

- By Functionality:

Case Data Collection and Management was the dominant segment, accounting for approximately 45.0% of the market share in 2023. This segment is critical for the efficient and accurate management of adverse drug reactions (ADR) and safety reports, essential for regulatory compliance. With pharmaceutical companies experiencing an increase in drug approvals, the demand for solutions that streamline the collection and management of ADR reports is on the rise. This functionality remains key in ensuring that pharmacovigilance processes are effective and timely.

The Signal Detection and Other Safety Risk Assessment segment is the fastest-growing, fueled by advancements in AI and machine learning technologies. The demand for real-time data analysis and early detection of potential drug risks is propelling this segment, projected to grow at a CAGR of 14% in the coming years. These technologies enhance the accuracy of safety signal detection, enabling pharmaceutical companies to proactively identify and address drug safety issues.

- By Delivery Mode:

In 2023, the On-Premise delivery mode led the market with a 60.0% share. On-premise solutions provide greater control over sensitive data, a crucial factor for compliance with stringent regulatory standards in pharmacovigilance. Companies in the pharmaceutical and biotech sectors prefer on-premise solutions for enhanced security, customization, and data integration.

The On-Demand delivery model, however, is the fastest-growing segment, with a projected CAGR of 20%. The shift towards cloud-based solutions, which offer flexibility, scalability, and cost-effectiveness, is driving this growth. Smaller pharmaceutical companies and CROs are increasingly adopting on-demand solutions for real-time access to data and collaboration across global teams.

- By End-Use:

The Pharma & Biotech Companies segment held the largest share, comprising 55.0% of the market in 2023. These companies are the primary drivers of demand for pharmacovigilance software due to their direct involvement in drug development, approval, and monitoring. As regulatory scrutiny increases and the number of drug approvals rises, the need for robust pharmacovigilance systems becomes even more critical.

The Contract Research Organizations (CROs) segment is the fastest-growing, with a projected CAGR of 16%. CROs, which manage clinical trials and post-market surveillance for pharmaceutical companies, are increasingly adopting cloud-based, AI-powered pharmacovigilance solutions to handle large data volumes and ensure compliance across multiple clients.

Pharmacovigilance and Drug Safety Software Market Key Segments

By Functionality

- Case data collection and management

- Signal detection and other safety risk assessment

- Safety Metrics & Others

By Delivery Mode

- On-Premise

- On-Demand

By End-use

- Pharma & Biotech Companies

- CRO

- BPO

- Others

Request An Analyst Call@ https://www.snsinsider.com/request-analyst/2379

Regional Analysis

North America remained the dominant region in the pharmacovigilance and drug safety software market, driven by the strong presence of pharmaceutical and biotechnology companies, along with the region’s stringent regulatory environment. In 2023, North America accounted for a substantial share of the market. The U.S. market, in particular, is expected to witness consistent growth due to ongoing advancements in pharmacovigilance technologies and the adoption of AI, machine learning, and cloud-based solutions. Major companies such as IQVIA, Accenture, and Cognizant are actively expanding their presence in North America, providing comprehensive pharmacovigilance software solutions for drug safety monitoring.

Europe followed closely as a major market for pharmacovigilance software. The European region is witnessing rapid growth due to the increasing number of regulatory requirements for drug safety and ADR reporting. European pharmaceutical companies and regulatory bodies, including the European Medicines Agency (EMA), are investing in sophisticated pharmacovigilance solutions to ensure patient safety and regulatory compliance. The demand for AI-driven drug safety systems in Europe is expected to grow as advancements in technology enable more efficient data analysis and risk management.

Recent Developments

- IQVIA (November 2024): Announced a plan to cut pharmacovigilance costs by 50% while achieving over 99% accuracy using generative AI, significantly reducing human verification efforts and improving data quality.

- FDA (June 2024): The Center for Drug Evaluation and Research (CDER) introduced the Emerging Drug Safety Technology Meeting program. This initiative will focus on discussions about the role of AI in enhancing pharmacovigilance practices.

Buy a Single-User PDF of Pharmacovigilance and Drug Safety Software Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/2379

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.