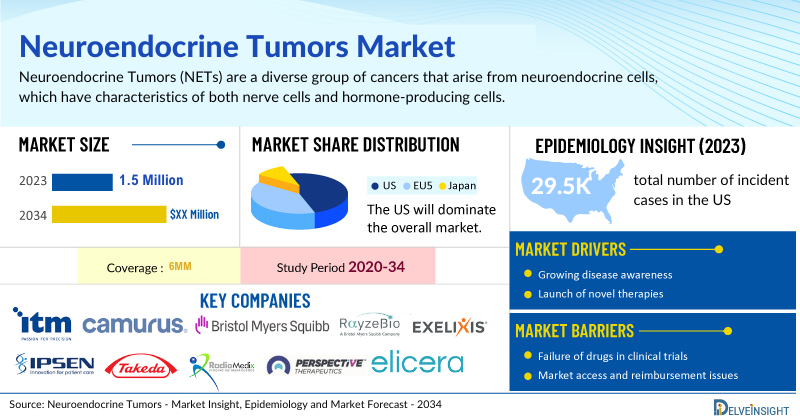

New York, USA, Nov. 25, 2024 (GLOBE NEWSWIRE) -- Neuroendocrine Tumors Market to Showcase Rapid Growth During the Study Period (2020–2034), at a CAGR of 5.1%| DelveInsight

The launch of upcoming therapies such as ITM-11, CAM2029, RYZ101, CABOMETYX, ALPHAMEDIX, and others in the forecast period, rising incident population due to an increased number of endoscopic and radio-imaging studies, increasing research activities are driving neuroendocrine tumor market size. Companies such as Novartis, ITM Solucin GMBH, Camurus, Bristol Myers Squibb, Rayzebio, Exelixis, Ipsen, Takeda, and others are competing fiercely to capture the largest market sizes.

DelveInsight’s latest Neuroendocrine Tumors Market Insights report includes a comprehensive understanding of current treatment practices, emerging neuroendocrine tumor drugs, market share of individual therapies, and current and forecasted neuroendocrine tumors market size from 2020 to 2034, segmented into 6MM [the United States, the EU4 (Germany, France, Italy, and Spain), and the United Kingdom].

Key Takeaways from the Neuroendocrine Tumors Market Report

- According to DelveInsight’s analysis, the market size of neuroendocrine tumors in the US was USD 1.5 billion in 2023.

- In 2023, Somatostatin analogs (SSAs) captured the highest market size of approximately USD 700 million in the US, followed by LUTATHERA. However, by 2034, radioligand treatments including approved beta emitter-radioligand therapy [LUTATHERA], and most anticipated alpha emitter-based therapies are expected to drive the overall NETs market size.

- The total number of incident cases of NETs in the US was nearly 29,500 cases in 2023 and is projected to increase by 2034.

- Prominent emerging companies working in the domain of neuroendocrine tumors, including ITM Solucin GMBH, Camurus, Bristol Myers Squibb, Rayzebio, Exelixis, Ipsen, Takeda, Radiomedix, Orano Med, Perspective Therapeutics, Elicera Therapeutics, Chimerix, Enterome, Teclison, and others, are actively working on innovative neuroendocrine tumor drugs. These novel neuroendocrine tumor therapies are anticipated to enter the neuroendocrine tumors market in the forecast period and are expected to change the market.

- Some of the key emerging neuroendocrine tumor treatments include ITM-11 (N.C.A. 177LU-EDOTREOTIDE), CAM2029, RYZ101 (ACTINIUM-225 DOTATATE), CABOMETYX (Cabozantinib), ALPHAMEDIX (212PB-DOTAMTATE), [212PB] VMT--NET, ELC-100 (ADVINCE), ONC201, EO2401 + NIVOLUMAB, TIRAPAZAMINE (TEC-001), and others.

- As the field of radioligand therapy evolves, there is an exciting shift towards alpha-emitting radioisotopes. At present, only beta-emitting radioisotopes are currently approved, companies are now focusing on developing alpha-emitters.

- In August 2024, Exelixis announced that its supplemental New Drug Application (sNDA) for CABOMETYX has been accepted in the US for: 1) the treatment of adults with previously treated, locally advanced/unresectable or metastatic, well- or moderately differentiated pancreatic neuroendocrine tumors (pNET), and 2) the treatment of adults with previously treated, locally advanced/unresectable or metastatic, well- or moderately differentiated extra-pancreatic NET (epNET). The US Food and Drug Administration (FDA) assigned a standard review with a Prescription Drug User Fee Act (PDUFA) target action date of April 3, 2025.

- In July 2024, Curium announced that it had submitted its 505(b)(2) NDA for Lutetium Lu 177 Dotatate Injection for the treatment of somatostatin receptor-positive (SSTR+) GEP-NETS.

- In April 2024, Novartis announced that the US FDA approved LUTATHERA for the treatment of pediatric patients 12 years and older with SSTR+ GEP-NETs, including foregut, midgut, and hindgut NETs.

Discover which therapies are expected to grab the NETs market share @ Neuroendocrine Tumors Market Report

Neuroendocrine Tumors Overview

Neuroendocrine Tumors (NETs) are a diverse group of cancers that arise from neuroendocrine cells, which have characteristics of both nerve cells and hormone-producing cells. These tumors can develop anywhere in the body but are most commonly found in the gastrointestinal tract, pancreas, and lungs. The exact causes of neuroendocrine tumors are not fully understood, but certain factors may increase risk, including genetic syndromes like multiple endocrine neoplasia type 1 (MEN1), Von Hippel-Lindau disease, and neurofibromatosis. Other potential contributors include chronic inflammatory conditions, smoking, and exposure to certain chemicals.

Symptoms of NETs can vary widely depending on the tumor's location and whether it secretes hormones. Some tumors may be asymptomatic for a long time. Common symptoms include abdominal pain, diarrhea, flushing of the skin, unexplained weight loss, and in cases of hormone-secreting tumors, symptoms related to excess hormones, such as changes in blood sugar levels or high blood pressure.

Diagnosing NETs typically involves a combination of blood and urine tests to detect hormone levels, imaging studies like CT, MRI, or PET scans, and biopsies to analyze tumor tissue. Specialized tests like chromogranin A (CgA) blood tests or somatostatin receptor scintigraphy (Octreoscan) may also be used to identify neuroendocrine activity and locate tumors.

Neuroendocrine Tumors Epidemiology Segmentation

The neuroendocrine tumors epidemiology section provides insights into the historical and current neuroendocrine tumors patient pool and forecasted trends for the 6MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The neuroendocrine tumors market report proffers epidemiological analysis for the study period 2020–2034 in the 6MM segmented into:

- Total Incident Cases of NET

- Cases of NETs by Grade

- Stage-specific Cases of NET

- Cases of NETs by Site

- Cases of NETs by Functional Status

Download the report to understand which factors are driving NETs epidemiology trends @ Neuroendocrine Tumors Epidemiological Insights

Neuroendocrine Tumors Treatment Market

Surgery is generally considered a first-line treatment for localized NETs. The frontline treatment for metastatic disease is somatostatin analogs, and currently, two agents are FDA-approved: SANDOSTATIN (octreotide acetate) and SOMATULINE DEPOT (lanreotide). Both somatostatin analogs provide symptomatic relief in 50% to 70% of patients and biochemical responses in 40% to 60% of patients.

Traditionally, mTOR inhibitor – everolimus or sunitinib – was acknowledged as a second-line agent, but with the recent approval of PRRT (peptide receptor radionuclide therapy), the choice of second-line therapy is debatable.

While GEP-NETs in children and adolescents are rare, the impact can be devastating. Advanced Accelerator Applications (AAA)/Novartis’s LUTATHERA is now the very first therapy approved specifically for use in pediatric patients with GEP-NETs. offering new hope to young patients living with this rare cancer.

In January 2018, the FDA approved LUTATHERA, a radiolabeled somatostatin analog for the treatment of GEP-NETs. In April 2024, Novartis announced that the US FDA approved LUTATHERA for the treatment of pediatric patients 12 years and older with SSTR+ GEP-NETs, including foregut, midgut, and hindgut NETs. LUTATHERA is also approved in Europe for unresectable or metastatic, progressive, well-differentiated (G1 and G2), SSTR-positive GEP-NETs in adults, and in Japan for SSTR-positive NETs.

All available therapies for NETs, whether monotherapy or combination, are currently leveraged to treat this complex, diverse population of patients, yet no treatment has maintained progression-free survival (PFS) indefinitely.

At present, the NETs market is dominated by SSAs, however, by 2034, radioligand therapies are projected to capture the highest market share, reflecting a paradigm shift driven by their enhanced efficacy and the growing adoption of targeted treatment approaches. While LUTATHERA has primarily been used as a second-line treatment, there is a growing interest in expanding its use to first-line settings for medium- and high-risk NETs. This trend underscores the rising prominence of radioligand therapies in redefining treatment standards in the NETs space.

Learn more about the market of NETs @ Neuroendocrine Tumors Treatment

Neuroendocrine Tumors Emerging Drugs and Companies

Some of the drugs in the pipeline include ITM-11 (ITM Isotope Technologies Munich), CABOMETYX (Exelixis/Ipsen/Takeda), CAM2029 (Camurus), AlphaMedix (Radiomedix/Orano Med), VMT--NET (Perspective Therapeutics), and others.

CABOMETYX (cabozantinib) is a small-molecule inhibitor targeting several receptor tyrosine kinases, such as VEGFRs, MET, RET, and the TAM family (TYRO3, MER, AXL). In August 2024, the FDA accepted a supplemental New Drug Application (sNDA) for cabozantinib to treat patients with advanced pancreatic neuroendocrine tumors (pNET) and extra-pancreatic neuroendocrine tumors (epNET) who have previously undergone treatment.

The FDA set a PDUFA target date of April 3, 2025, for review and granted orphan drug designation for pNET. This application is supported by data from the Phase III CABINET trial, which studied CABOMETYX in these patient populations.

ITM-11 (177Lu-edotreotide), developed by ITM Isotope Technologies Munich, is a novel Targeted Radionuclide Therapy that combines two components: Edotreotide (DOTATOC), an octreotide-based somatostatin analog, and EndolucinBeta (n.c.a. lutetium-177 chloride), a low-energy beta-emitting synthetic radioisotope.

It is currently under investigation in two Phase III clinical trials: COMPETE (NCT03049189) and COMPOSE (NCT04919226). COMPETE focuses on assessing ITM-11 for treating Grade 1 and Grade 2 GEP-NETs, while COMPOSE investigates its use in patients with well-differentiated high Grade 2 and Grade 3 GEP-NETs. ITM-11 was granted orphan designation for GEP-NET treatment based on Phase II data showing significant improvement in PFS.

The other pipeline therapies for neuroendocrine tumors include

- RYZ101 (ACTINIUM-225 DOTATATE): BRISTOL MYERS SQUIBB/RAYZEBIO

- CAM2029: Camurus

- ALPHAMEDIX (212PB-DOTAMTATE): RADIOMEDIX/ORANO MED

- [212PB] VMT-α-NET: PERSPECTIVE THERAPEUTICS

- ELC-100 (ADVINCE): ELICERA THERAPEUTICS

- ONC201: CHIMERIX

- EO2401 + NIVOLUMAB: ENTEROME

- TIRAPAZAMINE (TEC-001): TECLISON

It is more important than ever to ensure and understand supply chain and manufacturing issues of radiopharmaceuticals to stay at the forefront of radiopharmaceutical innovation, especially since a number of companies are investigating radiopharmaceuticals. Emerging key players should make sure that their product, supply, and production capabilities are adequate, and they should be prepared to meet the challenge of offering new therapeutic approaches to cancer patients who otherwise have limited options. In June 2024, BMS-RayzeBio was forced to pause a phase III trial due to an actinium shortage.

Oncolytic virotherapy holds promise for cancer treatment. Oncolytic virotherapies like ELC100 (Elicera Therapeutics) and SVV-001 (Seneca therapeutics) are also being investigated for the treatment of NETs in early clinical trials.

The anticipated launch of these emerging therapies are poised to transform the neuroendocrine tumors market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the neuroendocrine tumors market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about NETs clinical trials, visit @ Neuroendocrine Tumors Treatment Drugs

Neuroendocrine Tumors Market Dynamics

The neuroendocrine tumors market dynamics are anticipated to change in the coming years. NETs are often diagnosed at an early stage due to the hormonal symptoms they produce, allowing for timely intervention and better outcomes, and with advancements like LUTATHERA being the first therapy specifically approved for pediatric patients with GEP-NETs, along with continued research in targeted therapies such as somatostatin analogs and molecular inhibitors, there are growing opportunities for more effective and personalized treatments; participation in clinical trials can further drive the discovery of new treatment modalities and improve patient outcomes.

Furthermore, many potential therapies are being investigated for the treatment of NETs, and it is safe to predict that the treatment space will significantly impact the NETs market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the NETs market in the 6MM.

However, several factors may impede the growth of the neuroendocrine tumors market. Since most of the NET cases comprise GEP-NETs, the lack of awareness among healthcare professionals and the general public often leads to delayed diagnosis and treatment. GEP-NETs are a heterogeneous group of tumors with diverse clinical presentations, making it difficult to develop standardized treatment protocols. Additionally, challenges in research and development, such as limited funding and resources, hinder advancements in the field, while the complexity of diagnosing GEP-NETs increases the risk of misdiagnosis or delayed diagnosis, resulting in suboptimal treatment outcomes.

Moreover, neuroendocrine tumor treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the NETs market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists.

| Neuroendocrine Tumors Report Metrics | Details |

| Study Period | 2020–2034 |

| Neuroendocrine Tumors Report Coverage | 6MM [The United States, the EU-4 (Germany, France, Italy, and Spain), and the United Kingdom] |

| Neuroendocrine Tumors Market Size in the US in 2023 | USD 1.5 Billion |

| Key Neuroendocrine Tumors Companies | Novartis, Merck, Pfizer, ITM Solucin GMBH, Camurus, Bristol Myers Squibb, Rayzebio, Exelixis, Ipsen, Takeda, Radiomedix, Orano Med, Perspective Therapeutics, Elicera Therapeutics, Chimerix, Enterome, Teclison, and others |

| Key Neuroendocrine Tumors Therapies | WELIREG, LUTATHERA, SOMATULINE DEPOT, AFINITOR, SUTENT, SANDOSTATIN LAR DEPOT, SANDOSTATIN, ITM-11 (N.C.A. 177LU-EDOTREOTIDE), CAM2029, RYZ101 (ACTINIUM-225 DOTATATE), CABOMETYX (CABOZANTINIB), ALPHAMEDIX (212PB-DOTAMTATE), [212PB] VMT--NET, ELC-100 (ADVINCE), ONC201, EO2401 + NIVOLUMAB, TIRAPAZAMINE (TEC-001), and others |

Scope of the Neuroendocrine Tumors Market Report

- Neuroendocrine Tumors Therapeutic Assessment: Neuroendocrine Tumors current marketed and emerging therapies

- Neuroendocrine Tumors Market Dynamics: Conjoint Analysis of Emerging Neuroendocrine Tumors Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Neuroendocrine Tumors Market Access and Reimbursement

Discover more about neuroendocrine tumor drugs in development @ Neuroendocrine Tumors Clinical Trials

Table of Contents

| 1 | KEY INSIGHTS |

| 2 | REPORT INTRODUCTION |

| 3 | EXECUTIVE SUMMARY |

| 4 | NETS MARKET OVERVIEW AT A GLANCE |

| 4.1 | MARKET SHARE DISTRIBUTION (%) BY THERAPIES IN 2020 IN THE US |

| 4.2 | MARKET SHARE DISTRIBUTION (%) BY THERAPIES IN 2034 IN THE US |

| 4.3 | MARKET SHARE DISTRIBUTION (%) BY LINES OF THERAPIES IN 2020 IN THE US |

| 4.4 | MARKET SHARE DISTRIBUTION (%) BY LINES OF THERAPIES IN 2034 IN THE US |

| 5 | KEY EVENTS |

| 6 | EPIDEMIOLOGY AND MARKET METHODOLOGY |

| 7 | DISEASE BACKGROUND AND OVERVIEW |

| 7.1 | INTRODUCTION |

| 7.2 | SIGNS AND SYMPTOMS |

| 7.3 | CLASSIFICATION |

| 7.4 | RISK FACTORS |

| 7.5 | DIAGNOSIS |

| 7.6 | DIAGNOSTIC BIOMARKERS |

| 7.7 | DIFFERENTIAL DIAGNOSIS |

| 7.8 | STAGING |

| 8 | TREATMENT OF NETS |

| 8.1 | TREATMENT ALGORITHM |

| 8.2 | TREATMENT GUIDELINES |

| 8.2.1 | National Comprehensive Cancer Network (NCCN) Guidelines, 2024 |

| 8.2.1.1 | NCCN Guidelines Version 2.2024 Neuroendocrine Tumors (NETs) of the Gastrointestinal Tract (Well-Differentiated Grade 1/2), Lung, and Thymus |

| 8.2.1.2 | NCCN Guidelines Version 2.2024 Well-Differentiated, Grade 3 NETs |

| 8.2.1.3 | NCCN Guidelines Version 2.2024 NETs of the Pancreas (Well-differentiated Grade 1/2) |

| 8.2.2 | European Neuroendocrine Tumor Society (ENETS) 2023 Guidance Paper for Gastroduodenal NETs G1–G3 |

| 8.2.3 | European Society for Medical Oncology, 2020 |

| 9 | EPIDEMIOLOGY AND PATIENT POPULATION |

| 9.1 | KEY FINDINGS |

| 9.2 | ASSUMPTIONS AND RATIONALE |

| 9.3 | THE UNITED STATES |

| 9.3.1 | Total Incident Cases of NETs in the United States |

| 9.3.2 | Grade-specific Cases of NETs in the United States |

| 9.3.3 | Stage-specific Cases of NETs in the United States |

| 9.3.4 | Site-specific Cases of NETs in the United States |

| 9.3.5 | Cases of NETs by Functional Status in the United States |

| 9.4 | EU4 AND THE UK |

| 9.4.1 | Total Incident Cases of NETs in EU4 and the UK |

| 9.4.2 | Grade-specific Cases of NETs in EU4 and the UK |

| 9.4.3 | Stage-specific Cases of NETs in EU4 and the UK |

| 9.4.4 | Site-specific Cases of NETs in EU4 and the UK |

| 9.4.5 | Cases of NETs by Functional Status in EU4 and the UK |

| 10 | PATIENT JOURNEY |

| 11 | MARKETED DRUGS |

| 11.1 | KEY COMPETITORS |

| 11.2 | WELIREG (BELZUTIFAN/MK-6482): MERCK |

| 11.2.1 | Product Description |

| 11.2.2 | Regulatory Milestones |

| 11.2.3 | Other Developmental Activities |

| 11.2.4 | Current Pipeline Activity |

| 11.2.4.1 | Clinical Trials Information |

| 11.2.5 | Safety and Efficacy |

| 11.3 | LUTATHERA (LUTETIUM LU 177 DOTATATE): NOVARTIS |

| 11.3.1 | Product Description |

| 11.3.2 | Regulatory Milestones |

| 11.3.3 | Other Developmental Activities |

| 11.3.4 | Current Pipeline Activity |

| 11.3.4.1 | Clinical Trials Information |

| 11.3.5 | Safety and Efficacy |

| 11.4 | SUTENT (SUNITINIB MALATE): PFIZER |

| 11.4.1 | Product Description |

| 11.4.2 | Regulatory Milestone |

| 11.4.3 | Safety and Efficacy |

| 11.5 | AFINITOR (EVEROLIMUS): NOVARTIS |

| 11.5.1 | Product Description |

| 11.5.2 | Regulatory Milestones |

| 11.5.3 | Safety and Efficacy |

| 11.6 | SOMATULINE DEPOT (LANREOTIDE): IPSEN BIOPHARMACEUTICALS |

| 11.6.1 | Product Description |

| 11.6.2 | Regulatory Milestones |

| 11.6.3 | Other Developmental Activities |

| 11.6.4 | Safety and Efficacy |

| 11.7 | DEMSER (METYROSINE): BAUSCH HEALTH AND ONO PHARMACEUTICAL |

| 11.7.1 | Product Description |

| 11.7.2 | Regulatory Milestones |

| 11.7.3 | Other Developmental Activities |

| 11.7.4 | Safety and Efficacy |

| 11.8 | AZEDRA (IOBENGUANE I 131; RAIATT MIBG-I 131 INJECTION): PROGENICS PHARMACEUTICALS /LANTHEUS HOLDINGS AND FUJIFILM TOYAMA CHEMICAL |

| 11.8.1 | Product Description |

| 11.8.2 | Regulatory Milestones |

| 11.8.3 | Other Developmental Activities |

| 11.8.4 | Safety and Efficacy |

| 12 | EMERGING DRUGS |

| 12.1 | KEY COMPETITORS |

| 12.2 | ITM-11 (N.C.A. 177LU-EDOTREOTIDE): ITM SOLUCIN GMBH |

| 12.2.1 | Product Description |

| 12.2.2 | Other Developmental Activities |

| 12.2.3 | Clinical Development |

| 12.2.3.1 | Clinical Trial Information |

| 12.2.4 | Safety and Efficacy |

| 12.3 | CAM2029: CAMURUS |

| 12.4 | RYZ101 (ACTINIUM-225 DOTATATE): BRISTOL MYERS SQUIBB/RAYZEBIO |

| 12.5 | CABOMETYX (CABOZANTINIB): EXELIXIS/IPSEN/TAKEDA |

| 12.6 | ALPHAMEDIX (212PB-DOTAMTATE): RADIOMEDIX/ORANO MED |

| 12.7 | [212PB] VMT-Α-NET: PERSPECTIVE THERAPEUTICS |

| 12.8 | ELC-100 (ADVINCE): ELICERA THERAPEUTICS |

| 12.9 | ONC201: CHIMERIX |

| 12.10. | EO2401 + NIVOLUMAB: ENTEROME |

| 12.11 | TIRAPAZAMINE (TEC-001): TECLISON |

| 13 | NETS: MARKET ANALYSIS |

| 13.1 | KEY FINDINGS |

| 13.2 | MARKET OUTLOOK |

| 13.3 | CONJOINT ANALYSIS |

| 13.1 | KEY MARKET FORECAST ASSUMPTIONS |

| 13.2 | UNITED STATES MARKET SIZE |

| 13.2.1 | Total Market Size of NETs in the United States |

| 13.2.2 | Market Size of NETs by Therapies in the United States |

| 13.3 | EU4 AND THE UK MARKET SIZE |

| 13.3.1 | Total Market Size of NETs in EU4 and the UK |

| 13.3.2 | Market Size of NETs by Therapies in EU4 and the UK |

| 14 | NETs Market UNMET NEEDS |

| 15 | NETs Market SWOT ANALYSIS |

| 16 | NETs Market KOL VIEWS |

| 17 | MARKET ACCESS AND REIMBURSEMENT |

| 17.1 | UNITED STATES |

| 17.1.1 | Centre for Medicare and Medicaid Services (CMS) |

| 17.2 | EU4 AND THE UK |

| 17.2.1 | Germany |

| 17.2.2 | France |

| 17.2.3 | Italy |

| 17.2.4 | Spain |

| 17.2.5 | United Kingdom |

| 17.3 | MARKET ACCESS AND REIMBURSEMENT OF NETS |

| 18 | APPENDIX |

| 18.1 | BIBLIOGRAPHY |

| 18.2 | REPORT METHODOLOGY |

| 19 | DELVEINSIGHT CAPABILITIES |

| 20 | DISCLAIMER |

| 21 | ABOUT DELVEINSIGHT |

Related Reports

Neuroendocrine Tumors Epidemiology Forecast

Neuroendocrine Tumors Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted NETs epidemiology in the 7MM, i.e., the United States, EU4 (Germany, France, Italy, Spain) and the United Kingdom, and Japan.

Neuroendocrine Tumors Pipeline

Neuroendocrine Tumors Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key NETs companies, including RayzeBio, Inc., Seneca Therapeutics, Vyriad, Inc., ADC Therapeutics, Eli Lilly and Company, Biotheus Inc., ImmunityBio, Inc., Chimerix, Merck Sharp & Dohme, Oryzon Genomics S.A., CSPC ZhongQi Pharmaceutical Technology, TaiRx, Inc., Betta Pharmaceuticals, Pfizer, NanOlogy LLC, Cardiff Oncology, Luye Pharma Group, Philogen, Hoffmann-La Roche, Regeneron Pharmaceuticals, among others.

Gastroenteropancreatic Neuroendocrine Tumors Market

Gastroenteropancreatic Neuroendocrine Tumors Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key GEP-NET companies including Novartis, Ipsen Biopharmaceuticals, Pfizer, ITM Isotopen Technologien Muenchen, Camurus AB, Hutchison Medipharma Limited, Bristol-Myers Squibb, Eisai Limite, Experior S.L., Tarveda Therapeutics, Roche Pharma A, Exelixis, Merck Sharp & Dohme Corp, Recordati Inc, Eli Lilly and Company, Genentech, Inc., Aveo Oncology Pharmaceuticals, Radiomedix, Orano Med, PharmaMar, Bayer, Trio Medicines, among others.

Gastroenteropancreatic Neuroendocrine Tumors Pipeline

Gastroenteropancreatic Neuroendocrine Tumors Pipeline Insight – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key GEP-NET companies, including Ascletis, Genexine, PharmAbcine, VAXIMM AG, WPD Pharmaceuticals, Accendatech USA Inc., Midatech Ltd, MediciNova, Kadmon Corporation, LLC, Istari Oncology, Inc., Bristol-Myers Squibb, Novartis, Jiangsu Hengrui Medicine, Peloton Therapeutics, Inc., Karyopharm Therapeutics, VBL Therapeutics, Nerviano Medical Sciences, Acerta Pharma BV, Basilea Pharmaceutica, DNAtrix, Inc., NanoPharmaceuticals LLC, Erasca, Inc., Oblato, Inc., OX2 Therapeutics, Crimson Biopharm Inc., Merck Sharp & Dohme LLC, Transgene, CANbridge Life Sciences Ltd., Eli Lilly and Company, Arcus Biosciences, Inc., Incyte Corporation, BerGenBio ASA, Istari Oncology, Inc., Chimerix, among others.

Pancreatic Neuroendocrine Tumors Market

Pancreatic Neuroendocrine Tumors Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key PNET companies including Novartis Pharmaceuticals, Pfizer, Keyrus Biopharma, Merck Sharp & Dohme LLC, Pfizer, Apices Soluciones S.L., Pharmacyclics LLC, Ipsen, among others.

Oncology Conference Coverage Services

DelveInsight’s Oncology Conference Coverage Services offer a thorough analysis of outcomes from major events like ASCO, ESMO, ASH, AACR, ASTRO, SOHO, SITC, the European CAR T-cell Meeting, and IASLC. This detailed examination provides businesses with essential insights for competitive intelligence and market trend forecasting, supporting the formulation of future strategies.

Other Business Consulting Services

Healthcare Competitive Intelligence

Healthcare Portfolio Management

Case Study

Learn how the engagement with respected KOLs bolstered the client's reputation as a leader in the pharma industry at KOL Profiling

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter