United Kingdom, London, Dec. 02, 2024 (GLOBE NEWSWIRE) -- Fintech blockchain, critical to financial technology, serves as a decentralized and distributed ledger that ensures cozy, transparent, and immutable transactions. In the fintech zone, blockchain complements core offerings which include fee processing, lending, and asset management with the aid of decreasing fraud, accelerating transaction times, and lowering expenses. Enabling direct peer-to-peer transactions for items and offerings appreciably improves the performance of monetary operations. Additionally, it is revolutionizing traditional monetary fashions by promoting inclusivity and operational performance.

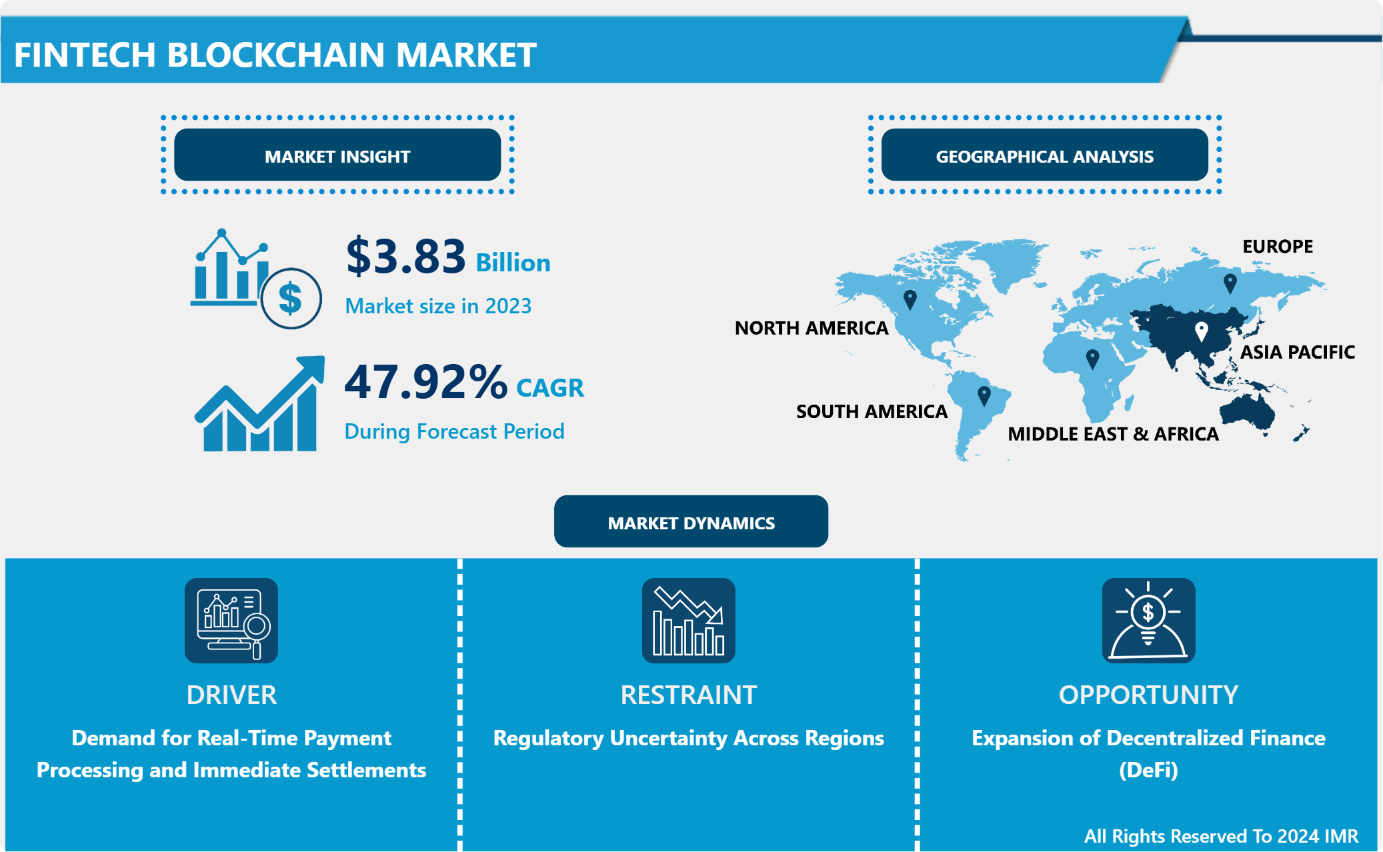

Introspective Market Research is excited to unveil its latest report, "Fintech Blockchain Market" This in-depth analysis shows that the global Fintech Blockchain market, valued at USD 3.83 billion in 2023, is poised for substantial growth, expected to hit USD 129.73 billion by 2032. This growth trajectory aligns with a strong CAGR of 47.92% during the forecast period from 2024 to 2032.

The Fintech Blockchain market has emerged as one of the maximum promising sectors in monetary offerings, pushed with the aid of blockchain's middle benefits, which include decentralization, transparency, sturdy security, and high transaction speeds. As a distributed ledger generation, blockchain allows users to transact without delay, bypassing intermediaries, thereby lowering charges, minimizing transaction volumes, and shortening processing times. Its integration into fintech has revolutionized traditional monetary systems, unlocking new possibilities using enhancing performance and security in monetary transactions.

The market's growth is fuelled by using the call for quicker, greater comfy, and price-powerful pass-border transactions. Conventional economic structures often suffer from gradual approaches, excessive expenses, and delays, in particular in international payments. The blockchain era addresses those problems with capabilities like actual-time settlements and the elimination of intermediaries. The growing adoption of digital currencies and cryptocurrencies by monetary institutions has in addition expanded blockchain’s use in fintech. Blockchain, underpinned using cryptographic principles, operates independently of centralized fiat authorities, permitting borderless bills and monetary inclusion for unbanked populations in growing areas.

The deployment of clever contracts has appreciably more advantageous financial strategies via automating and securing transactions, reducing credit fraud, and removing the need for intermediaries. Smart contracts are self-executing software program packages that enforce contractual terms embedded within their code. This innovation has extensive implications for regions like lending, coverage, and funding, streamlining operations, and reducing struggle.

Additionally, partnerships between fintech start-ups and set-up monetary institutions are driving market growth. Start-ups carry innovation and agility, while traditional establishments offer funding, scale, and regulatory knowledge. This collaboration is fostering the development of novel blockchain answers tailored to the evolving wishes of the monetary region. The active participation of mission capital companies and extended research and improvement efforts are in addition propelling the market forward.

Download Sample 250 Pages of Fintech Blockchain Market Report@ https://introspectivemarketresearch.com/request/17115

Demand for Real-Time Payment Processing and Immediate Settlements: Enabling Faster, More Efficient Transactions Without Intermediaries

The demand for actual-time price processing and on-the-spot settlements has emerged as a first-rate driving force within the boom of the Fintech Blockchain market. Traditional charge structures, especially in move-border transactions, often involve multiple intermediaries consisting of banks, price processors, and clearinghouses which can result in delays, excessive prices, and inefficient procedures. These obstacles create good-sized demanding situations for companies and people, especially within the context of rapid-paced global trade. Blockchain technology offers an answer by way of allowing transactions to arise without delay between parties without the need for intermediaries, appreciably decreasing processing instances and costs.

One of the key benefits of blockchain in real-time price processing is its capability to facilitate instantaneous settlements. In conventional economic systems, transactions can take several days to settle, particularly when they go over borders. This postponement can impact coin drift, growth the risk of fraud, and create possibilities for market inefficiencies. By evaluation, blockchain permits nearly on-the-spot settlement of transactions, permitting both companies and purchasers to access funds in real time, 24/7. This is specifically essential in industries inclusive of e-trade, remittances, and international alternate, wherein time-sensitive transactions are the norm.

Blockchain’s decentralized nature complements safety, making sure that transactions are recorded transparently and immutably, which appreciably reduces the risk of fraud and errors. The accelerated confidence in the security of blockchain transactions is riding both institutional and customer adoption, similarly fueling the demand for real-time charge solutions. As monetary institutions, fintech businesses, or even governments explore blockchain's capability, the growing need for actual-time bills is expected to continue using the adoption of the blockchain era, in the end reshaping how money moves globally.

Regulatory Uncertainty Across Regions: Hindered Adoption Due to Lack of Consistent Blockchain Regulations

One of the widespread restraints within the Fintech Blockchain market is the winning regulatory uncertainty across diverse areas. The creation and considerable adoption of blockchain technology in monetary services, while transformative, has outpaced the development of clear, regular, and harmonized regulations. As blockchain operates across borders, the lack of uniformity in regulatory frameworks among countries presents demanding situations for fintech agencies, establishments, or even governments in adopting and scaling blockchain-based totally solutions.

Regulatory uncertainty manifests in numerous methods. For instance, distinct international locations have of a kind stance on a way to deal with blockchain-based property, together with cryptocurrencies. Some countries have fully embraced blockchain and its applications, offering regulatory frameworks that promote innovation, at the same time as others have imposed strict policies, banned certain uses of blockchain, or continue to be silent on the matter altogether. In a few cases, regulators are nevertheless in the technique of defining clean guidelines, and there is regular confusion approximately how current legal guidelines practice blockchain-based answers.

The ambiguity in policies has the potential to postpone or even derail blockchain adoption. Financial establishments, which are normally conservative and hazard-averse, might also hesitate to put money into blockchain-primarily based structures because of worries about prison compliance and the possibility of destiny regulatory adjustments. The uncertainty surrounding problems which include information privatizes, anti-money laundering (AML) laws, and understand-your-patron (KYC) necessities in addition complicates the scenario, as agencies may be unsure approximately a way to comply with current and capability guidelines.

"Research made simple and affordable – Trusted Research Tailored just for you – IMR Knowledge Cluster"

https://www.imrknowledgecluster.com/

Expansion of Decentralized Finance (DeFi): Growing Adoption of Decentralized Platforms Offering Financial Services Without Intermediaries

The Expansion of decentralized finance (DeFi) presents a significant growth opportunity for the Fintech Blockchain market. DeFi leverages the blockchain era to create a financial environment that operates without intermediaries like banks, imparting offerings including lending, borrowing, buying and selling, and asset control at once to users. This decentralized technique complements accessibility, transparency, and performance, enabling individuals and organizations to manipulate their price range autonomously. As DeFi continues to benefit traction, particularly amongst tech-savvy users and crypto enthusiasts, its ability to disrupt traditional economic structures has opened avenues for blockchain adoption in fintech.

One of the key drivers of DeFi’s growth is its capability to provide monetary offerings to underserved and unbanked populations globally. By doing away with geographical and institutional barriers, DeFi structures permit people in growing areas to access loans, savings, and investment opportunities using the most effective smartphone and internet connection. Moreover, DeFi’s integration with clever contracts guarantees automatic and trust less transactions, lowering the danger of fraud and mistakes. The growing popularity of decentralized exchanges (DEXs) and liquidity pools in addition demonstrates the demand for peer-to-peer monetary offerings that empower users with full management over their property.

For agencies, DeFi gives cost savings and flexibility, as it removes the charges and delays related to traditional monetary intermediaries. Institutional interest in DeFi is also growing, with foremost monetary players exploring ways to incorporate decentralized structures into their operations. As regulatory frameworks around DeFi evolve and scalability issues are addressed, the sector is anticipated to mature, presenting big opportunities for blockchain generation providers to innovate and amplify their market presence.

Key Manufacturers

Market key players and organizations within a specific industry or market that significantly influence its dynamics. Identifying these key players is essential for understanding competitive positioning, market trends, and strategic opportunities.

- Ripple Labs Inc. (USA)

- Coinbase (USA)

- Binance (Cayman Islands)

- Bitmain Technologies Ltd. (China)

- Bitfury Group Limited (Netherlands)

- Circle Internet Financial Limited (USA)

- ConsenSys AG (USA)

- Gemini Trust Company LLC (USA)

- Ledger SAS (France)

- Kraken Digital Asset Exchange (USA), and Other Active Players

In October 2024, Thunes, the Smart Superhighway for moving money globally, announced a strategic collaboration with Circle, a global digital financial technology firm and the issuer of stablecoins USDC and EURC through its regulated entities, to accelerate innovation in stablecoin liquidity management. The alliance enabled members of Thunes’ Direct Global Network to fund and execute cross-border transactions using USDC, facilitating faster transfers in just seconds, seven days a week. The use of USDC settlements enhanced liquidity and reduced capital costs for Thunes’ members.

In August 2023, Coinbase announced its Canadian expansion with a series of new offerings, reinforcing its commitment to Canada as a priority Go Deep market. Through its partnership with Peoples Trust Company, part of Peoples Group, Coinbase began offering access to Interac e-Transfers® to 100% of Canadian Coinbase users, making it easier and more secure to move money in and out of their accounts. This move aimed to make cryptocurrencies more accessible to millions of Canadians.

Do you need any industry insights on Fintech Blockchain Market, Make an enquiry now >> https://introspectivemarketresearch.com/inquiry/17115

Key Segments of Market Report

By Application,

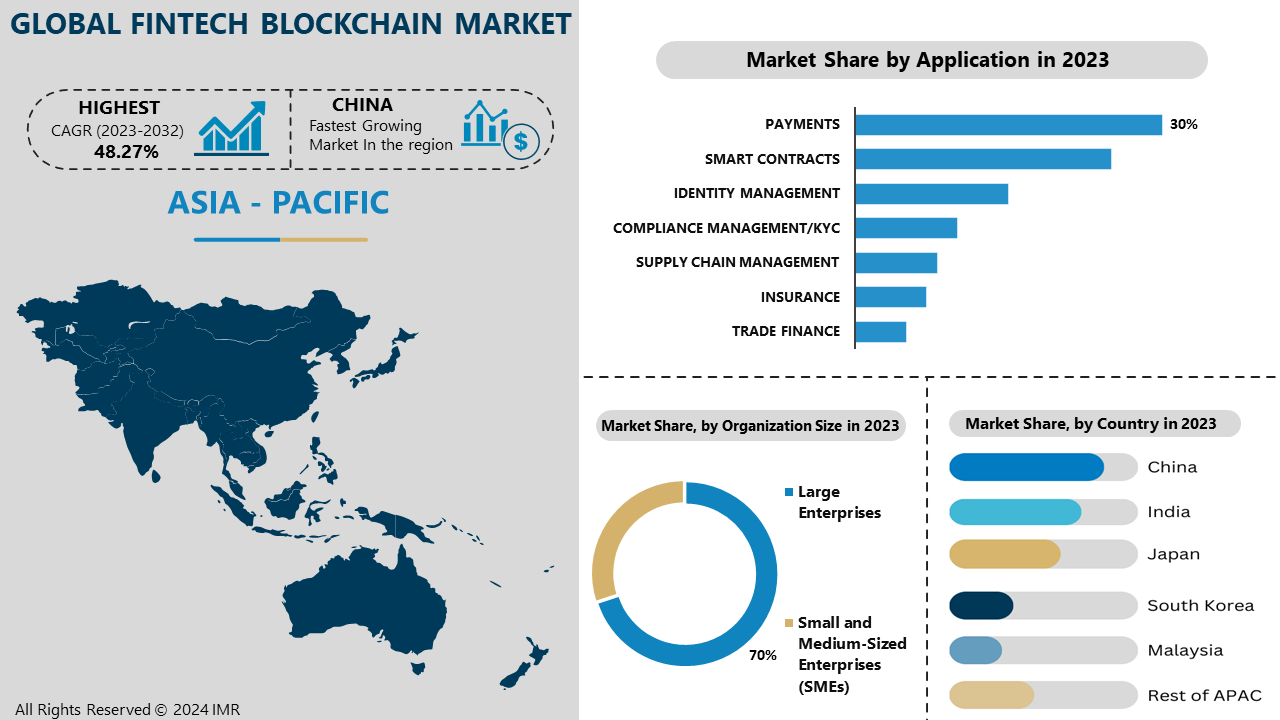

Smart Contracts are another realm closely tied to blockchain technology for applying automation in contracts so that they can be executed smoothly and independently, thus eliminating the role of an intermediate and increasing the overall trust in the various financial deals happening in an organization. Identity Management is also widely used where blockchain guarantees the trustworthy and irreversible confirmation of a subject’s identity, which is instrumental in combating fraudulent activities and protecting privacy. Blockchain helps in Compliance Management/KYC as the processes are transparent and once the data is written, it can’t be altered making the compliance and KYC procedures cheaper to implement.

Supply Chain Management of a product makes use of blockchain for improving the transparency, traceability, and real-time tracking and validation of products. Customers in insurance can also benefit from blockchain since it provides smart contracts to support the claims as well as providing risk appetites from an immutable ledger technology. Finally, through utilizing blockchain Trade Finance is transformed by providing better security and cutting the fraud risks, as well as optimizing the trade documentation and the processes of settlements. In summary, these applications depict how blockchain will revolutionize fintech through innovation, efficiency, and security.

By End-User,

Banking institutions are adopting the blockchain to permit cozy and quicker transactions as well as slice on costs and durations of clearing settlements. NBFS entities are presently thinking about using blockchain technology to beautify the general element of transactions among their counterparties. Currently, insurance corporations have centred on the following programs of blockchain; fraud detection, smart contracts, or even claims processing. Currently, blockchain is being applied in trade settlements of equities as well as regulatory compliances through the stock exchanges. Blockchain blessings funding firms in both factors of asset tokenization and trading inside the market.

Real property is considering blockchain for belongings sales, rents, and when conveying titles. Healthcare is adopting blockchain for record-maintaining and supply chain management for affected personal data. Consumer goods & retail industries are leveraging blockchain to music supply chains and combat counterfeits, & bills. At the governmental level, blockchain is being used for ID, voting, and growing the efficiency of public offerings. Other industries are also deploying blockchain for numerous emerging uses, accordingly, contributing to the marketplace growth for fintech blockchain.

By Region:

Asia Pacific is poised to dominate the Fintech Blockchain marketplace over the forecast period, driven by several compelling factors. The location boasts one of the most important and quickest-growing populations within the globe, which affords broader access to smartphones and the internet. This big get-right of entry creates a fertile floor for the implementation of fintech answers, especially the ones constructed on blockchain technology. Countries like China, India, and Singapore have taken the lead in integrating blockchain into their financial systems, with sturdy authorities guide that encourages the modernization of the economic area and adoption of innovative technology.

The place’s rapidly evolving regulatory landscape performs an enormous role in fostering blockchain adoption, as many governments are shifting in the direction of frameworks that promote blockchain-based totally fintech answers. As a result, monetary and generation companies in the Asia Pacific vicinity are increasingly exploring the use of blockchain in key regions which includes fee systems, smart contracts, and identification verification. These improvements not only help extra economic inclusion but additionally decorate the efficiency and protection of financial transactions. Given the high stage of presidency assistance, the growing technological skills of monetary institutions, and the expanding digital economy, Asia Pacific is set to remain one of the maximum rewarding and dynamic markets for fintech blockchain innovation in the future years. The mixture of those elements positions the region as a primary player inside the worldwide fintech blockchain ecosystem.

If you require any specific information that is not covered currently, we will provide the same as a part of the customization >> https://introspectivemarketresearch.com/custom-research/17115

Comprehensive Offerings:

- Historical Market Size and Competitive Analysis (2017–2023): Detailed assessment of market size and competitive landscape over the past years.

- Historical Pricing Trends and Regional Price Curve (2017–2023): Analysis of historical pricing data and price trends across different regions.

- Market Size, Share, and Forecast by Segment (2024–2032): Projections and detailed insights into market size, share, and future growth by segment.

- Market Dynamics: In-depth analysis of growth drivers, restraints, opportunities, and key trends, with a focus on regional variations.

- Market Trend Analysis: Evaluation of emerging trends that are shaping the market landscape.

- Import and Export Analysis: Examination of trade patterns and their impact on market dynamics.

- Market Segmentation: Comprehensive analysis of market segments and sub-segments, with a regional breakdown.

- Competitive Landscape: Strategic profiles of key players across regions, including competitive benchmarking.

- PESTLE Analysis: Evaluation of the market through Political, Economic, Social, Technological, Legal, and Environmental factors.

- PORTER’s Five Forces Analysis: Assessment of competitive forces influencing the market.

- Industry Value Chain Analysis: Examination of the value chain to identify key stages and contributors.

- Legal and Regulatory Environment by Region: Analysis of the legal landscape and its implications for business operations.

- Strategic Opportunities and SWOT Analysis: Identification of lucrative business opportunities, coupled with a SWOT analysis.

- Conclusion and Strategic Recommendations: Final insights and actionable recommendations for stakeholders.

Related Report Links:

Blockchain in Insurance Market: Global Blockchain In Insurance Market is projected at USD 431.45 Million in the year 2021 and is expected to reach USD 27,036.76 Million by 2028, with a CAGR of 80.6% over the analysis period.

Commerce Technology And Services Market: Commerce Technology And Services Market Size Was Valued at USD 68.54 Billion in 2023, and is Projected to Reach USD 382.24 Billion by 2032, Growing at a CAGR of 21.04% From 2024-2032.

Metaverse Market: Global Metaverse Market Size Was Valued at USD 66.22 Billion in 2023 and is Projected to Reach USD 1,319 Billion by 2032, Growing at a CAGR of 39.46% From 2024-2032.

Blockchain as a Service (BaaS) Market: Global Blockchain as a Service (BaaS) Market size is expected to grow from USD 4.23 Billion in 2023 to USD 30.4 Billion by 2032, at a CAGR of 24.5% during the forecast period (2024-2032).

Wealth Management Market: The Management Market Size Was Valued at USD 1,257.19 Billion in 2023 and is Projected to Reach USD 2,940.22 Billion by 2032, Growing at a CAGR of 9.90% From 2024-2032.

Digital Transformation Market: Digital Transformation Market Size Was Valued at USD 880.8 Billion in 2023, and is Projected to Reach USD 7954.2 Billion by 2032, Growing at a CAGR of 27.7% From 2024-2032.

Financial Service Software Market: Financial Service Software Market Size Was Valued at USD 142.89 Billion in 2023, and is Projected to Reach USD 318.90 Billion by 2032, Growing at a CAGR of 9.33% From 2024-2032.

Digital Finance Market: Digital Finance Market Size Was Valued at USD 4,726.20 Million in 2023, and is Projected to Reach USD 15,613.74 Million by 2032, Growing at a CAGR 14.20% From 2024-2032.

Financial App Market: Financial App Market Size Was Valued at USD 1.31 Billion in 2023, and is Projected to Reach USD 3.41 Billion by 2032, Growing at a CAGR of 11.2% From 2024-2032.

Blockchain Identity Management Market: Global Blockchain Identity Management Market Size was valued at USD 680 million in 2022 and is projected to reach USD 128220 million by 2030, growing at a CAGR of 92.5% from 2023 to 2030

About Us:

Introspective Market Research is a premier global market research firm, leveraging big data and advanced analytics to provide strategic insights and consulting solutions that empower clients to anticipate future market dynamics. Our team of experts at IMR enables businesses to gain a comprehensive understanding of historical and current market trends, offering a clear vision for future developments.

Our strong professional network with industry-leading companies grants us access to critical market data, ensuring the generation of precise research data tables and the highest level of accuracy in market forecasting. Under the leadership of CEO Mrs. Swati Kalagate, who fosters a culture of excellence, we are committed to delivering high-quality data and supporting our clients in achieving their business goals.

The insights in our reports are derived from primary interviews with key executives of top companies in the relevant sectors. Our robust secondary data collection process includes extensive online and offline research, coupled with in-depth discussions with knowledgeable industry professionals and analysts.

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736

Email: sales@introspectivemarketresearch.com

LinkedIn| Twitter| Facebook | Instagram

Ours Websites : https://introspectivemarketresearch.com | https://imrknowledgecluster.com/knowledge-cluster | https://imrtechsolutions.com | https://imrnewswire.com/ | https://marketnresearch.de |