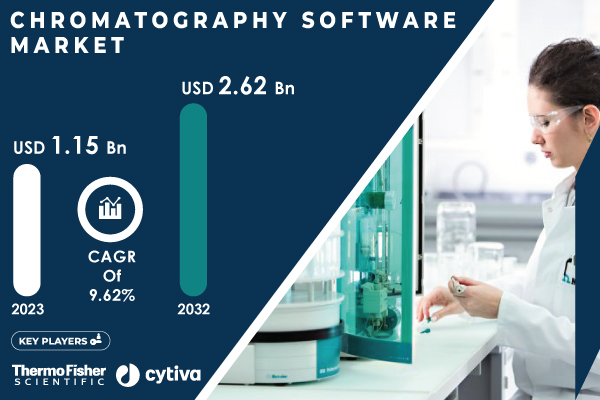

Austin, Dec. 03, 2024 (GLOBE NEWSWIRE) -- The Chromatography Software Market was valued at USD 1.15 billion in 2023 and is expected to reach USD 2.62 billion by 2032, growing at a CAGR of 9.62% over the forecast period 2024-2032. The growth is primarily attributed to increasing demand for advanced analytical solutions in industries such as pharmaceuticals, biotechnology, and environmental testing.

The surge in demand for efficient, high-precision analytical solutions boosts market growth.

Market Overview

The chromatography software market is growing rapidly with the increasing demand for advanced technologies in research and industrial applications. Chromatography is a technique used for the separation of mixtures, and with increasing regulatory demands and technological advancements, the need for reliable and efficient software solutions has increased. The market for chromatography software is driven by industries requiring high-precision testing such as pharmaceuticals, biotechnology, environmental monitoring, and food testing. Laboratories and research institutions adapt such software solutions to follow proper work management and accurate data analysis, thereby ensuring good quality outputs and conformity with regulations.

The supply and demand dynamics have shifted toward the implementation of software solutions that interface well with laboratory instruments. Research data complexity and the drive toward digitization in laboratories make chromatography software a vital element of laboratory operations. This market is characterized by the trend toward cloud-based solutions that provide greater flexibility, scalability, and real-time sharing of data across global teams. In addition, the pharmaceutical drugs segment is booming due to constant demand from the pharmaceutical industries, which rely on chromatography in drug development and quality control.

Download PDF Sample of Chromatography Software Market @ https://www.snsinsider.com/sample-request/2446

Key Companies:

- Bruker Corporation

- Shimizu Corporation

- Thermo Fisher Scientific Inc.

- Hitachi High-Technologies

- Cytiva

- Gilson Inc.

- Restek Corporation

- Jasco

- Scion Instruments

- Waters Corporation

- Axel Semrau GmbH & Co. KG

- Agilent Technologies Inc.

- DataApex

- KNAUER

- Shimadzu Corporation

Chromatography Software Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.15 Billion |

| Market Size by 2032 | USD 2.62 Billion |

| CAGR | CAGR of 9.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Standalone, Integrated) • By Deployment Type (On-premise, Web & Cloud-based) • By Application (Pharmaceutical Industry, Forensic Testing, Environmental Testing, Food Industry) |

| Key Drivers | • Cloud Adoption, AI Integration, and Regulatory Demands |

If You Need Any Customization on Chromatography Software Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/2446

Segment Analysis

By Device Type

In 2023, standalone chromatography software devices accounted for the largest share, holding over 57.0% of the market. This segment’s dominance can be attributed to its flexibility and lower upfront investment compared to integrated solutions. Standalone devices are ideal for small to medium-sized laboratories requiring dedicated systems for specific chromatography applications. The simplicity of installation and ease of operation have made these systems the preferred choice for many laboratories worldwide.

The integrated chromatography software devices segment, however, is the fastest-growing and is expected to witness rapid growth due to the increasing demand for all-in-one systems. Integrated solutions combine both hardware and software, offering a streamlined approach to chromatography applications. Industries such as pharmaceuticals, environmental testing, and food safety are driving the adoption of integrated devices due to the need for higher throughput, greater efficiency, and reduced human error. The seamless integration of hardware and software into a single solution allows organizations to improve workflow efficiency, which is especially critical in large-scale operations.

By Deployment Type

In 2023, on-premise deployment solutions led the chromatography software market, accounting for approximately 60.0% of the total market share. This preference is driven by the need for higher data security and control, particularly in industries such as pharmaceuticals, where regulatory compliance and data confidentiality are critical. On-premise solutions offer greater customization, making them a suitable option for organizations with stringent data management protocols.

On the other hand, web and cloud-based chromatography software is experiencing the fastest growth due to the increasing demand for scalable, flexible, and cost-effective solutions. The shift to cloud solutions enables remote access to critical data, fostering collaboration among global teams, and minimizing IT infrastructure costs. Furthermore, the ability to scale the software with ease has made cloud-based solutions an attractive option for research teams working on large-scale projects across various locations.

By Application

The pharmaceutical industry dominated the chromatography software market in 2023, holding approximately 43.0% of the market share. Chromatography software plays a crucial role in ensuring quality control, regulatory compliance, and precision in drug development processes. The increasing complexity of drug formulations and the need for high-precision analysis continue to drive the demand for chromatography software in pharmaceutical applications.

The environmental testing sector, however, is poised to experience the fastest growth over the forecast period. The heightened focus on sustainability, environmental safety, and climate change is driving demand for chromatography solutions in environmental monitoring. As governments and regulatory bodies implement stricter environmental standards, the need for chromatography software to test and detect pollutants, toxins, and contaminants in water, air, and soil has surged. The sector's growth is further supported by innovations in chromatography techniques that enable more efficient and accurate environmental testing.

Buy Full Research Report on Chromatography Software Market 2024-2032 @ https://www.snsinsider.com/checkout/2446

Recent Developments in the Chromatography Software Market

- April 2024: Waters Corporation launches the Alliance iS Bio HPLC System to enhance efficiency and reduce errors in biopharma QC labs.

- February 2024: Thermo Fisher Scientific launched the Dionex Inuvion Ion Chromatography (IC) system, a versatile and user-friendly instrument for ion analysis. It supports a wide array of analytical needs, including the determination of small and ionic polar compounds.

- January 2022: Waters Corporation expanded the roll-out of its Empower Chromatography Data Software (CDS) across five field science laboratories in the U.S. FDA's medical product testing labs, further complementing its portfolio of chromatography data systems.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, 2023

5.2 User Demographics, By User Type and Roles, 2023

5.3 Feature Analysis, by Feature Type

5.4 Cost Analysis, by Software

5.5 Integration Capabilities

5.6 Regulatory Compliance, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.4 Strategic Initiatives

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Chromatography Software Market Segmentation, by Device Type

7.1 Chapter Overview

7.2 Standalone

7.3 Integrated

8. Chromatography Software Market Segmentation, by Deployment Type

8.1 Chapter Overview

8.2 On-premise

8.3 Web & Cloud-based

9. Chromatography Software Market Segmentation, by Application

9.1 Chapter Overview

9.2 Pharmaceutical Industry

9.3 Forensic Testing

9.4 Environmental Testing

9.5 Food Industry

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/2446

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.