Pune, March 05, 2025 (GLOBE NEWSWIRE) -- Utility Locator Market Size Analysis:

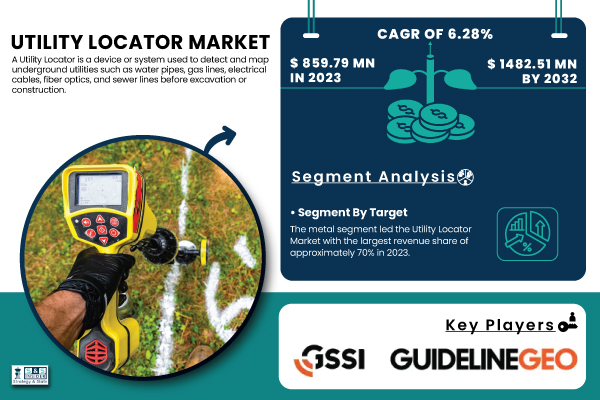

“The Utility Locator Market size was USD 859.79 Million in 2023 and is expected to reach USD 1482.51 Million by 2032, growing at a CAGR of 6.28% over the forecast period of 2024-2032.”

Get a Sample Report of Utility Locator Market@ https://www.snsinsider.com/sample-request/5867

Major Players Analysis Listed in this Report are:

- 3M (Scotchlok Connectors, 3M Dynatel Locator)

- Emerson Electric Co. (Rosemount Tank Gauging, Micro Motion Coriolis Flow Meters)

- Geophysical Survey Systems, Inc. (Radar System, GPR Utility Locator)

- Geotech (GPR System, Utility Locator)

- Guideline Geo (Seismo, Geode GPR)

- Leica Geosystems AG (Leica DSX, Leica DD250 Locator)

- MultiVIEW (Advanced GPR, Utility Survey Solutions)

- Radiodetection Ltd. (RD7100 Locator, RD8100 Locator)

- The Charles Machine Works, Inc. (Ditch Witch JT5, Ditch Witch 2720)

- USIC, LLC (Locator Equipment, Utility Mapping Solutions)

- Detection Services (GPR Utility Locator, Utility Mapping Services)

- Ground Penetrating Radar Systems (Utility Locator, Ground Radar)

- Maverick Inspection (Pipeline Inspection, Utility Mapping Services)

- McLaughlin (Utility Locators, Ground Penetrating Radar Systems)

- On Target Utility Services (Utility Locators, Utility Mapping)

- Pipehorn (Locator Systems, GPR Systems)

- Ridge Tool Company (Ridgid SeekTech, Ridgid Locator)

- Vivax-Metrotech (VLoc3-Pro Locator, VLoc3-CAM Locator)

- RHD Services (Utility Locators, Inspection Systems)

- One Vision Utility Services (Utility Location, Mapping Solutions)

- Utilities Plus (Utility Detection Services, Utility Locating Solutions)

Utility Locator Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 859.79 Million |

| Market Size by 2032 | USD 1482.51 Billion |

| CAGR | CAGR of 6.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • Urbanization and Infrastructure Development Drive Growing Demand for Accurate Utility Locating Solutions |

Do you have any specific queries or need any customization research on Utility Locator Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/5867

Utility Locator Market Thrives Amid Urbanization and Technological Advancements, Driven by AI, IoT, and Smart Infrastructure Projects

The utility locator market is growing based on increasing urbanization, infrastructural development, and growing deployment of sophisticated detection technologies. Increases in telecommunication infrastructure and application of AI and IoT are providing greater accuracy and efficiency in the process of locating utilities. Implementation of regulatory policies mandating safe excavation practices promotes market growth while ensuring compliance and reducing damages. Challenges related to high equipment pricing and technology integration issues still linger. Despite all this, automation and digitalization in utility management and construction pose profitable opportunities. With increased investment in smart city initiatives and robust safety standards, the need for sophisticated utility detection solutions is also on the rise.

By Target, Metal Segment Dominates Utility Locator Market, While Non-Metallic Detection Sees Rapid Growth with Advanced Technologies

The metal segment led the Utility Locator Market with a revenue share of nearly 70% in 2023. The very high incidence of metal utilities like pipes, cables, and conduits in urban infrastructure has aided this leadership. Electromagnetic locators and ground-penetrating radar (GPR), which are conventional detection techniques, have an extremely high success rate in tracing metal utilities, thus perpetuating demand. The non-metallic segment is also expected to register the fastest CAGR of approximately 7.78% during 2024-2032. It is due to the growing demand for non-metallic materials including plastic and composite pipes, owing to their attributes such as durability and corrosion resistance. The increase in non-metallic utility installation has generated corresponding demand for detection technologies.

By Offering, Equipment Segment Dominates Utility Locator Market, While Services Experience Rapid Growth Amid Rising Infrastructure Complexity

The equipment segment accounted for the highest revenue share of 64% in 2023 as a result of the vital importance of sophisticated utility locator tools in underground detection. Equipment like electromagnetic locators, ground-penetrating radar, and acoustic sensors plays a crucial role in construction and maintenance projects to ensure precise utility mapping. The services segment will register a growth rate of 7.23% CAGR between 2024-2032, propelled by the growing need for professional utility detection services. As urbanization and infrastructure increase, industries are increasingly dependent on expert services to avoid risks and maintain regulatory compliance.

By Technique, Electromagnetic Field Technology Dominates Utility Locator Market, While Ground Penetrating Radar Sees Fastest Growth

The Electromagnetic Field (EMF) segment dominated the market with a 49% revenue share in 2023. It is owing to the accuracy of EMF locators to identify metallic utilities like pipes and cables with high accuracy. The Ground Penetrating Radar (GPR) segment will expand at the highest CAGR of 7.81% during 2024-2032. GPR's increased depth penetration and accuracy in identifying both metallic and non-metallic utilities are forcing its implementation within different sectors.

By Vertical, the Telecommunication Sector Dominates the Utility Locator Market, While the Water and Sewage Segment Grows Rapidly with Infrastructure Modernization

Telecommunication was the sector with the largest revenue share of 30% in 2023. Growth in fiber-optic network installation and the deployment of telecommunication infrastructure has risen demand for utility detection. Growth in the Water and Sewage segment is forecasted to take place at a highest CAGR of 9.07% between 2024-2032. In this sector, increasing emphasis on water conservation coupled with the aging sewage system upgrading is driving growth in advanced utility locators.

Utility Locator Market Segmentation:

By Technique

- Electromagnetic Field

- Ground Penetrating Radar

- Others

By Offering

- Equipment

- Services

By Target

- Metallic

- Non-metallic

By Vertical

- Oil & Gas

- Electricity

- Transportation

- Water and Sewage

- Telecommunication

- Others

North America Dominates Utility Locator Market, While Asia Pacific Emerges as Fastest-Growing Region with Infrastructure Boom

North America led the Utility Locator Market with a revenue market share of around 37% in 2023. The region's large infrastructure projects, stringent safety regulations, and strong adoption of advanced utility detection technologies are some of the factors driving its market leadership. The concentration of major industry players and ongoing investments in smart infrastructure further reinforce North America's leadership. Asia Pacific is expected to grow the fastest, with a projected 8.03% CAGR during 2024-2032. Increasing urbanization, infrastructure growth, and higher investment in utility management are fueling demand for utility locators in developing economies. China and India are leading the adoption of next-generation detection technology, which further fuels regional market growth.

Buy an Enterprise-User PDF of Utility Locator Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/5867

Recent Developments

- September 2024: 3M announced the production and sale of over 300 million friction shims worldwide, marking a significant milestone. These shims play a vital role in various industries, including automotive and aerospace.

- July 2024: Emerson introduced its Ovation 4.0 Automation Platform, integrating generative artificial intelligence (GenAI) to enhance data analysis and decision-making in power and water operations, improving utility locator functionalities.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Utility Locator Market Segmentation, By Technique

8. Utility Locator Market Segmentation, By Offering

9. Utility Locator Market Segmentation, By Target

10. Utility Locator Market Segmentation, By Vertical

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Utility Locator Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/utility-locator-market-5867

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.