Austin, March 14, 2025 (GLOBE NEWSWIRE) -- Electronic Design Automation (EDA) Market Size & Growth Insights:

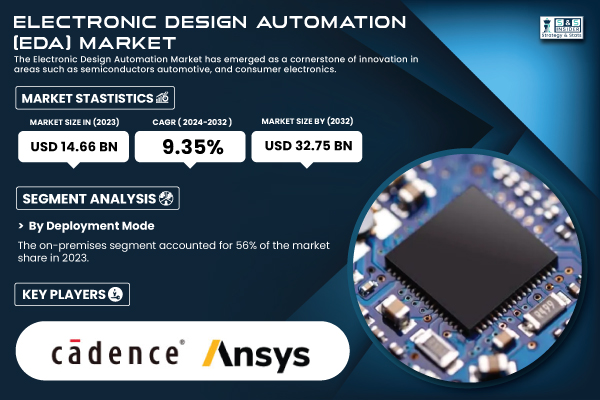

According to the SNS Insider Report, “The Electronic Design Automation (EDA) Market was valued at USD 14.66 billion in 2023 and is projected to reach USD 32.75 billion by 2032, growing at an impressive CAGR of 9.35% during 2024-2032.”

The market's expansion is driven by advancements in artificial intelligence, machine learning, and cloud-based design solutions, enabling semiconductor manufacturers to streamline production processes.

Get a Sample Report of Electronic Design Automation (EDA) Market @ https://www.snsinsider.com/sample-request/2102

Leading Market Players with their Product Listed in this Report are:

- Synopsys (Design Compiler, PrimeTime)

- Cadence Design Systems (Virtuoso, Allegro)

- Siemens EDA (Calibre, PADS)

- ANSYS (HFSS, RedHawk)

- Keysight Technologies (ADS, SystemVue)

- Zuken (CR-8000, E3.series)

- Altair Engineering (PollEx, HyperWorks)

- Autodesk (Fusion 360, Eagle)

- Altium (Altium Designer, CircuitStudio)

- Mentor Graphics (ModelSim, Questa)

- Silvaco (TCAD, SmartSpice)

- AWR Corporation (Microwave Office, Visual System Simulator)

- Magma Design Automation (Talc, Blast Fusion)

- Dassault Systèmes (3DEXPERIENCE, CATIA)

- National Instruments (Multisim, LabVIEW)

- ARM Holdings (Physical IP, CoreSight)

- Rambus (Design IP, Security IP)

- Xilinx (Vivado, ISE Design Suite)

- Intel (Quartus Prime, Pathfinder)

- Broadcom (IP Licensing, ASIC Design Services).

Electronic Design Automation (EDA) Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 14.66 Billion |

| Market Size by 2032 | USD 32.75 Billion |

| CAGR | CAGR of 9.35% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (IC Physical Design & Verification, Semiconductor IP, Computer-Aided Engineering (CAE), PCB & MCM, Services), • By Deployment Mode (Cloud-Based, On-Premises), • By Application (Memory Management Units, Microprocessors & Microcontrollers, Others), • By End User (Consumer Electronics Industry, Automotive, Healthcare) |

| Key Drivers | • AI and machine learning are revolutionizing the future of electronic design automation through innovation. • Worldwide investments in semiconductor production increase the need for electronic design automation tools. |

For A Detailed Briefing Sessions with Our Team of Analyst, Connect Now @ https://www.snsinsider.com/request-analyst/2102

Key Industry Segmentation

By Product: IC Physical Design & Verification Dominated, Semiconductor IP Fastest Growing

The IC Physical Design & Verification segment dominated the market and held the largest share of the market in 2023, owing to growing design complexity of semiconductor designs, especially at the advanced nodes such as 5nm, 3nm and next generation sub-2nm processes. Such tools should allow chip designers to perform analyses of power – performance – area trade-offs to deliver high efficiency.

The Semiconductor IP segment is estimated to experience the fastest CAGR between 2024 and 2032. System-on-Chip designs are the evolution of sweets like potato chips these days, where processing blocks can be developed frequently and taken in when developing chips to help save time and cash. This trend in adopting third-party IP, rather than designing from scratch, is coined by startups and mid-sized firms, is effectively driving growth for this segment.

By Deployment Mode: On-Premises Dominated, Cloud-Based Fastest Growing

In 2023, the On-Premises segment dominated the market and accounted for 56% of revenue share, owing to the demand for high computational power required in semiconductor manufacturing, the need for security, and regulatory requirements. The largest enterprises that have security or regulatory obligations to protect sensitive design data before Google goes too far prefer on-premises EDA. Full control over the source and destination of data, because getting the location of processing wrong could lead to a violation of intellectual property protection laws

The Cloud-Based segment is expected to witness the highest CAGR, due to features such as scalability, cost efficiency, and global collaboration. EDA-as-a-Service makes it possible for startups and smaller companies to interact with high-performance design tools without the need for significant, expensive infrastructure. Cloud-based EDA solutions are also more attractive for AI-driven semiconductor because they accelerate the design process with real-time collaboration among different teams working remotely.

By Application: Microprocessors & Microcontrollers Dominated, Memory Management Units Fastest Growing

Microprocessors & Microcontrollers segment has dominated the market, having a major portion of the processing unit in computing, consumer electronics & automotive applications. This segment is further propelled by the emerging trend of edge computing, AI-based chipset, and high-performance GPUs. The demand for sophisticated EDA verification and synthesis tools is high owing to disruptive innovation by players like Intel, AMD, and ARM in this space continually.

The MMUs segment is projected to register the fastest CAGR during the forecast period. Increasing demand for high-bandwidth memory, DRAM, and NAND flash solutions for AI accelerators, gaming consoles, and 5G devices are expected to drive the demand for MMUs and thus the highest CAGR. As workloads for AI/ML, cloud computing and next-gen smartphones go up, the need for efficient memory management becomes critical, driving memory chip optimization, and further propelling the adoption of EDA tools.

By End-User: Consumer Electronics Industry Dominated, Automotive Fastest Growing

In 2023, the Consumer Electronics Industry segment dominated the market and accounted for significant revenue share. The growth of smartphones, smartwatches, smart home devices, and AR/VR demand high-efficiency semiconductor designs. On the other hand, businesses including Apple, Samsung and Qualcomm are going all in on EDA solutions for chips of the future.

The Automotive segment is projected to be the fastest-growing by CAGR due to the rise of electric vehicles, autonomous driving technology, and connected car systems. As the demand for ADAS, EV powertrains, and in-car infotainment systems increases, the semiconductor components required for these applications are narrower in scope than traditional automotive chips, growing demand for EDA solutions among automotive semiconductor companies.

Buy a Single-User PDF of Electronic Design Automation (EDA) Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/2102

Key Regional Developments: North America dominates while Asia-Pacific registers fastest CAGR

In 2023, North America dominated the market and accounted for 32% of revenue share, owing to large semiconductor firms and increased research and development funding, and government initiatives. Moreover, the presence of Synopsys, Cadence, and Siemens EDA adds core strength to the market in the region. Market growth is also anticipated from the U.S. CHIPS Act and the enlarging ecosystem of AI-driven chip designs.

Asia-Pacific is expected to register the fastest CAGR during the forecast period, driven by semiconductor fabrication growth particularly in China, Taiwan, South Korea, and India. Next-gen semiconductor manufacturing investment by TSMC, Samsung, and SMIC is driving demand for EDA tools for chip design automation. Market growth in this region is further driven by the explosion of 5G infrastructure automotive electronics and IoT applications.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities

5.4 Usage Statistics, 2023

6. Competitive Landscape

7. Electronic Design Automation (EDA) Market, by Product

8. Electronic Design Automation (EDA) Market, by Deployment Mode

9. Electronic Design Automation (EDA) Market, by Application

10. Electronic Design Automation (EDA) Market, by End User

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Research Insights on Electronic Design Automation (EDA) Market Report Forecast @ https://www.snsinsider.com/reports/electronic-design-automation-market-2102

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.